Financial Accounting > TEST BANKS > Solution Manual for Payroll Accounting 2020 30th Edition by Bieg. (All)

Solution Manual for Payroll Accounting 2020 30th Edition by Bieg.

Document Content and Description Below

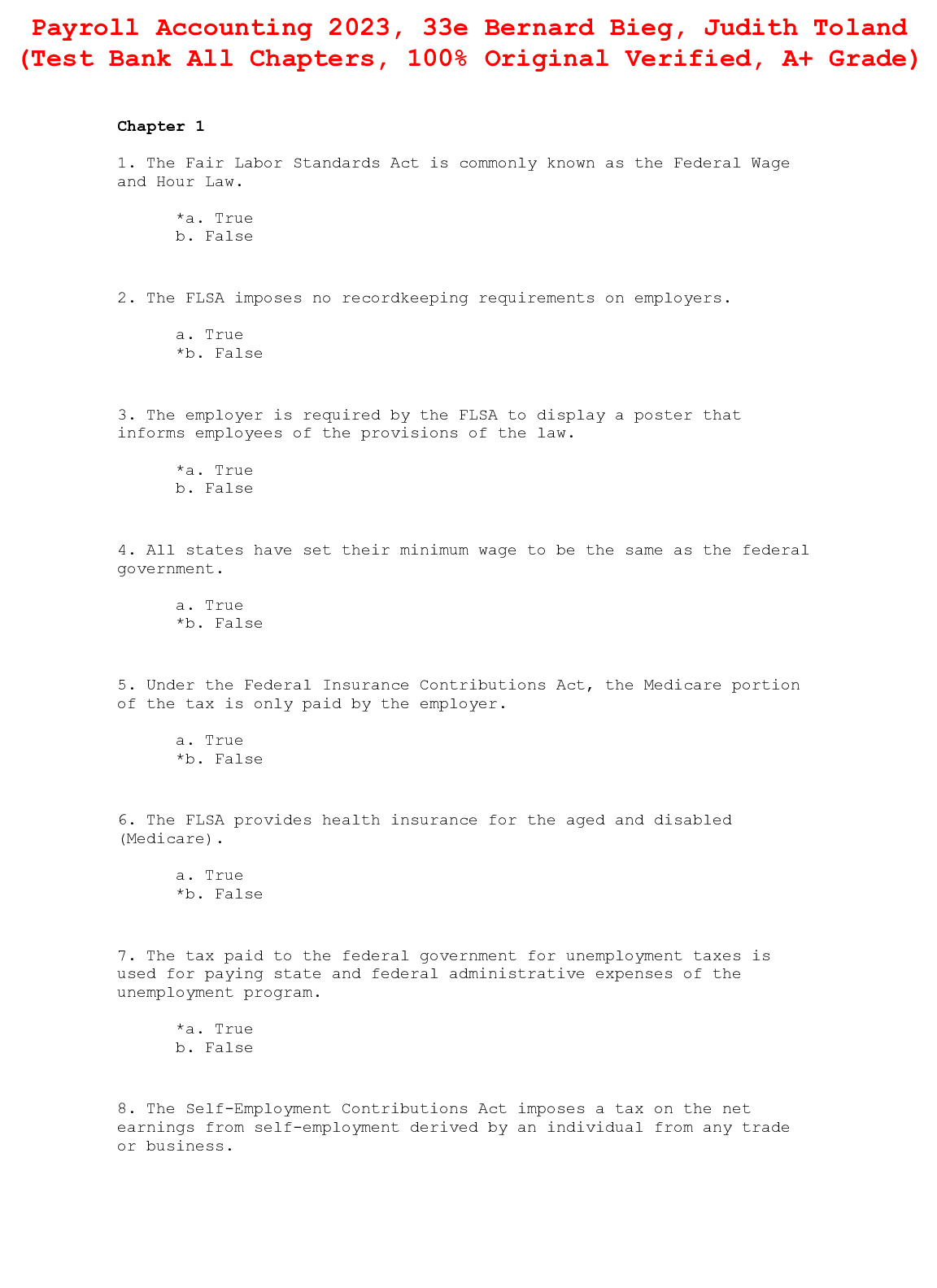

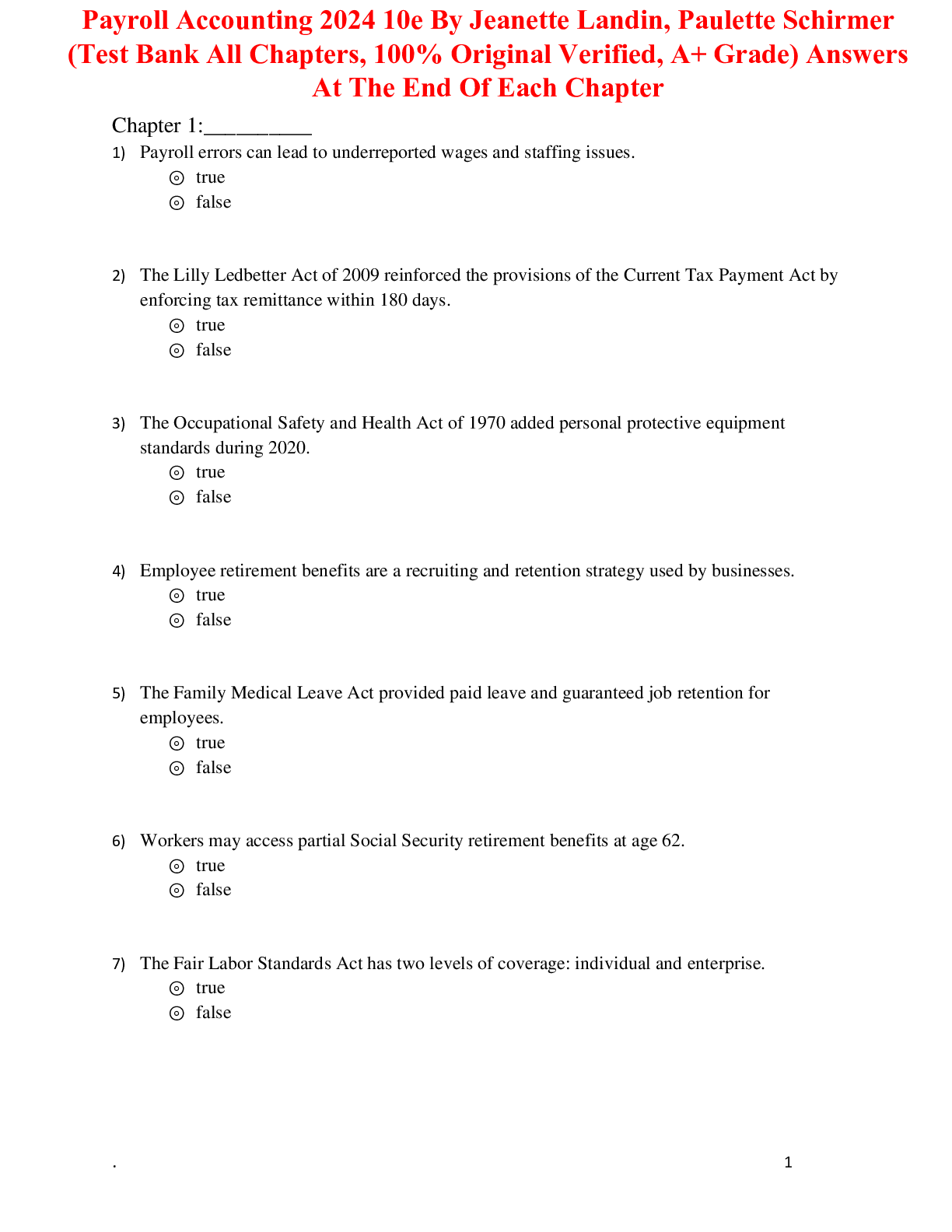

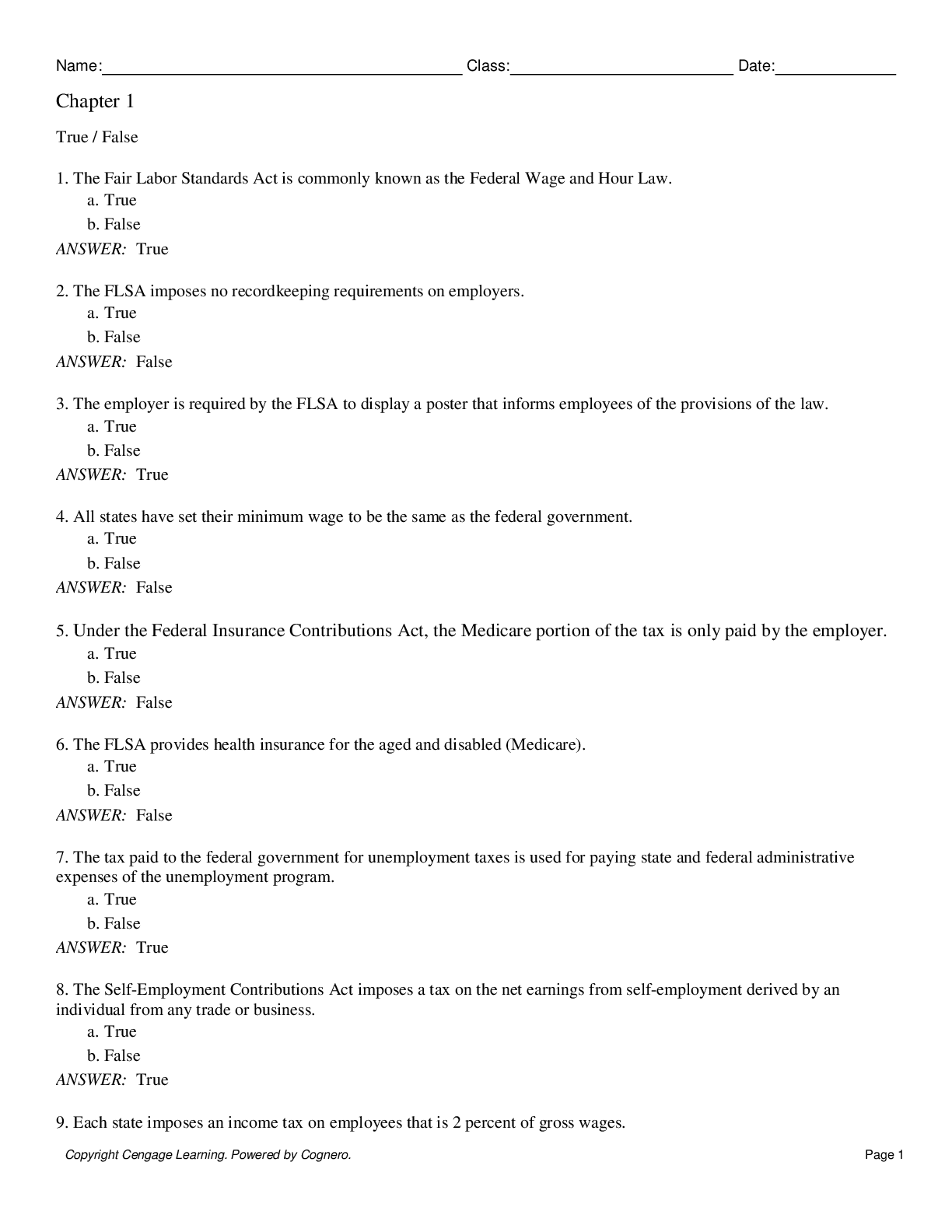

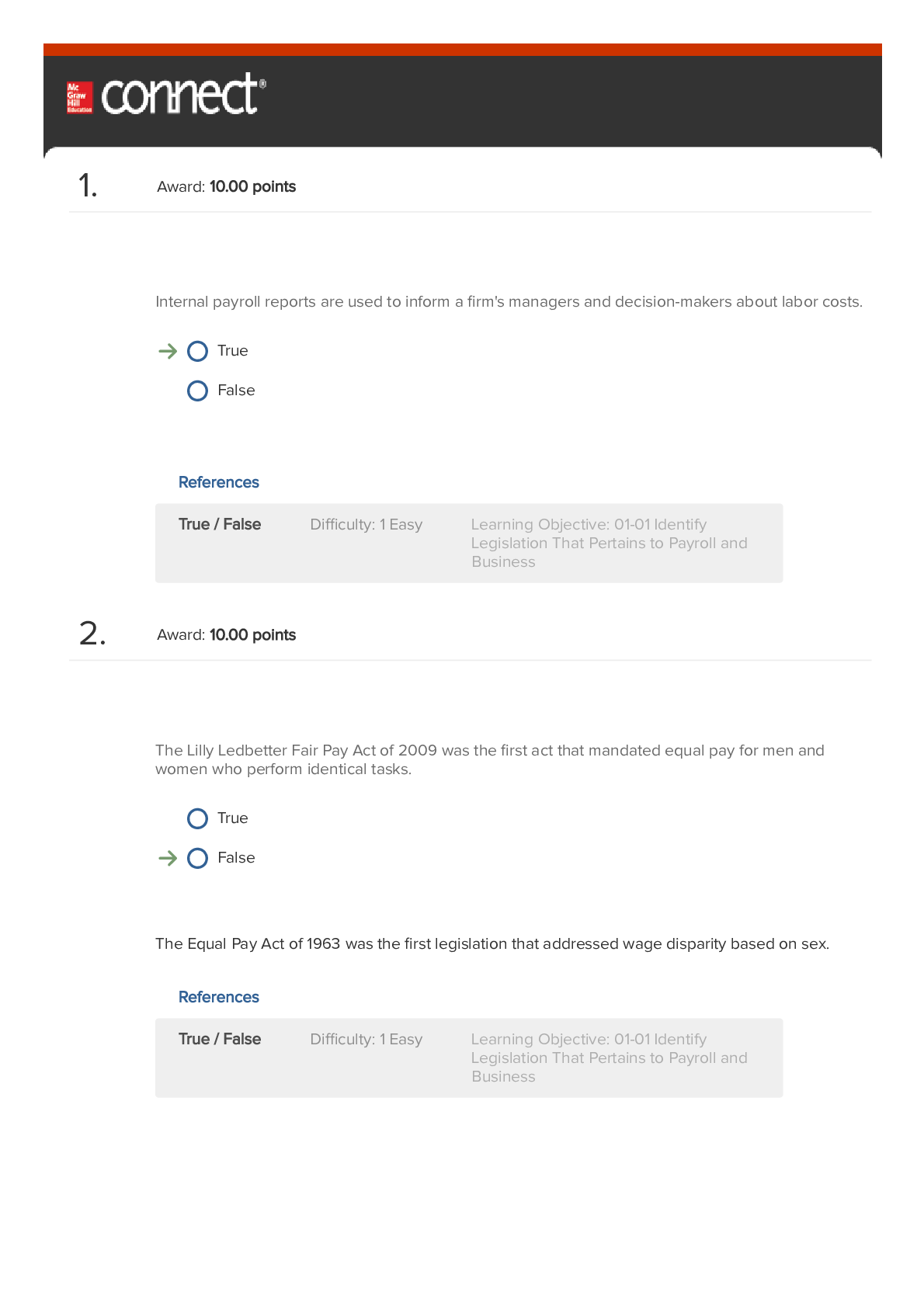

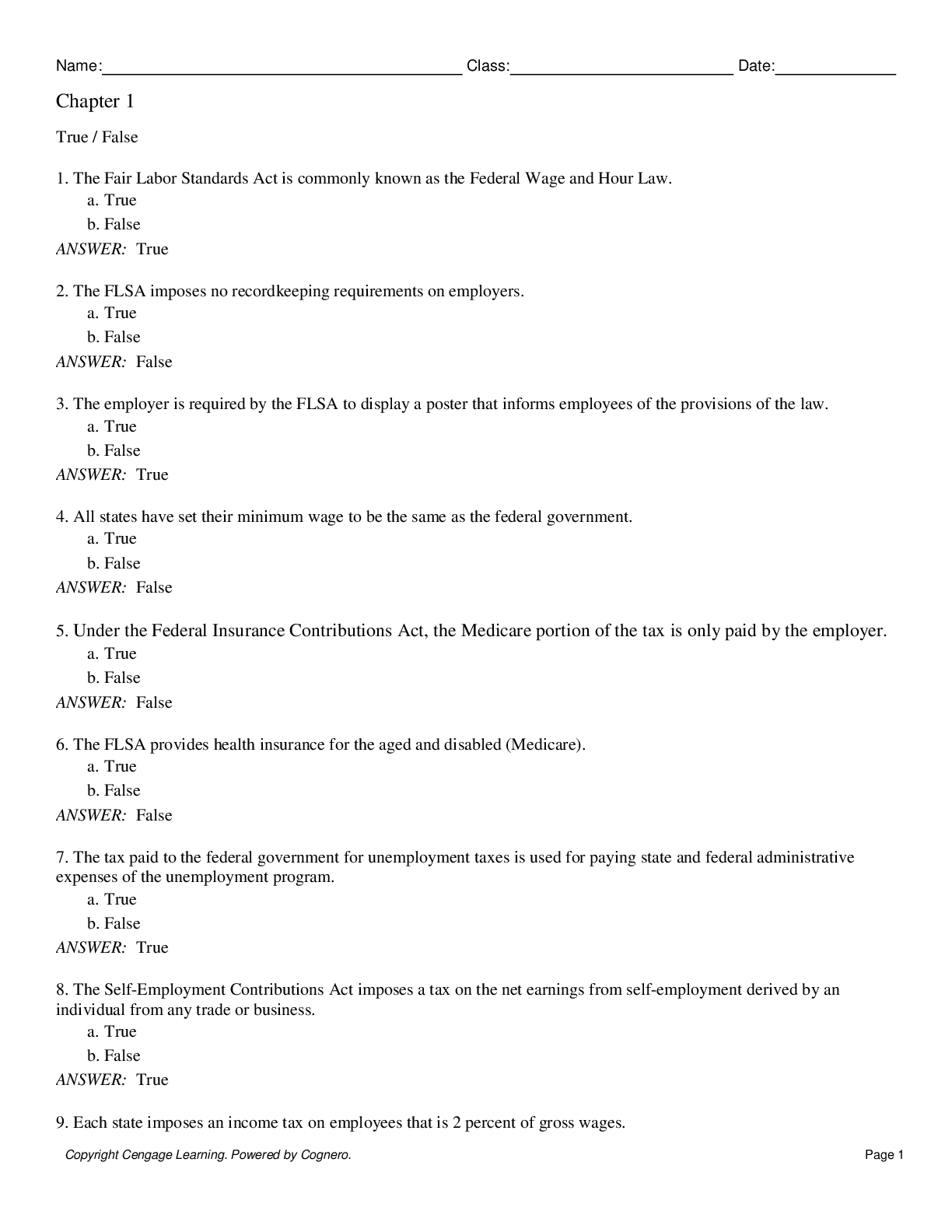

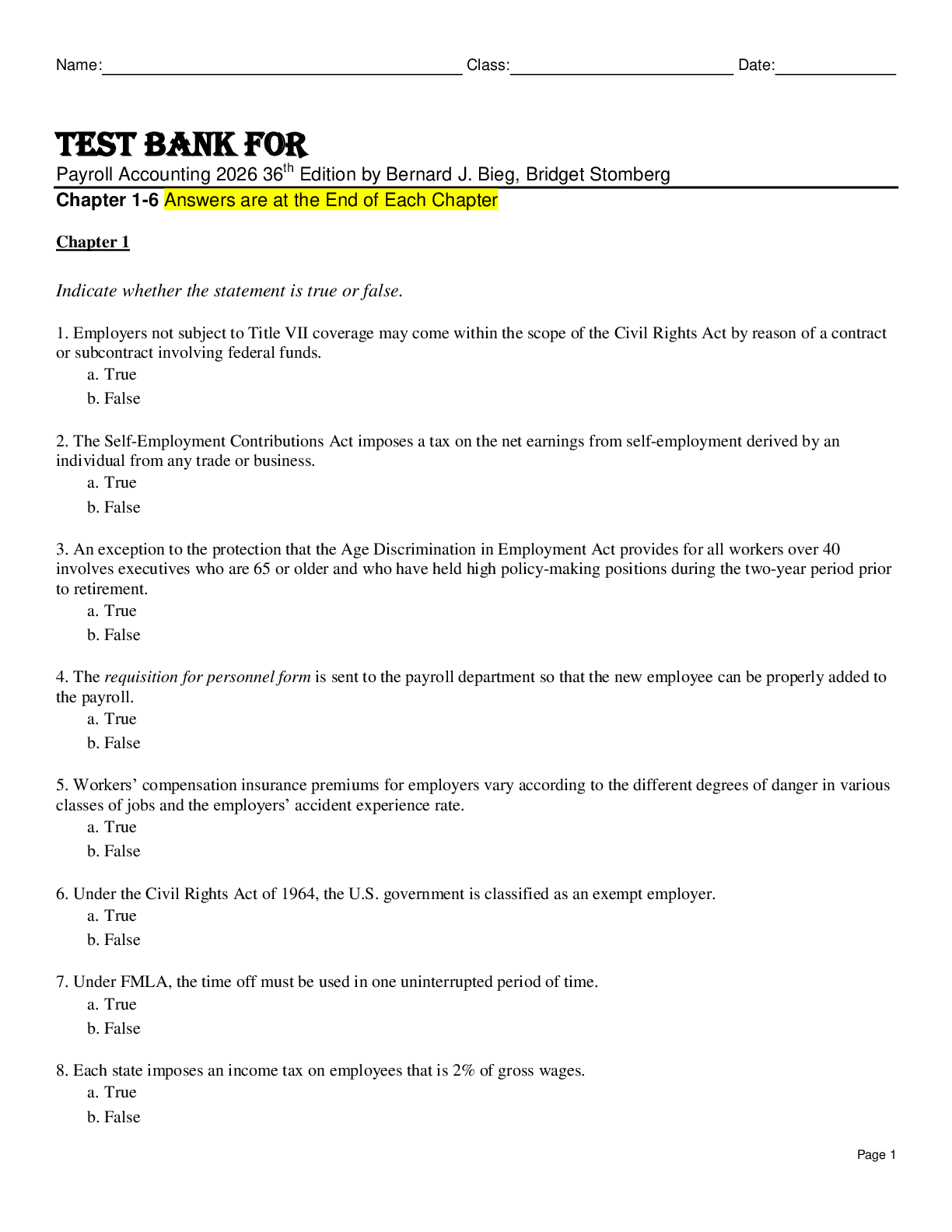

TABLE OF CONTENTS 1. The Need For Payroll And Personal Records. 2. Computing Wages and Salaries. 3. Social Security Taxes. 4. Income Tax Withholding. 5. Unemployment Compensation Taxes. 6. Analyzing a... nd Journalizing Payroll. TABLE OF CONTENTS 1. The Need For Payroll And Personal Records. 2. Computing Wages and Salaries. 3. Social Security Taxes. 4. Income Tax Withholding. 5. Unemployment Compensation Taxes. 6. Analyzing and Journalizing Payroll. TABLE OF CONTENTS 1. The Need For Payroll And Personal Records. 2. Computing Wages and Salaries. 3. Social Security Taxes. 4. Income Tax Withholding. 5. Unemployment Compensation Taxes. 6. Analyzing and Journalizing Payroll. [Show More]

Last updated: 2 years ago

Preview 1 out of 2 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$30.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Nov 18, 2021

Number of pages

2

Written in

Additional information

This document has been written for:

Uploaded

Nov 18, 2021

Downloads

0

Views

133