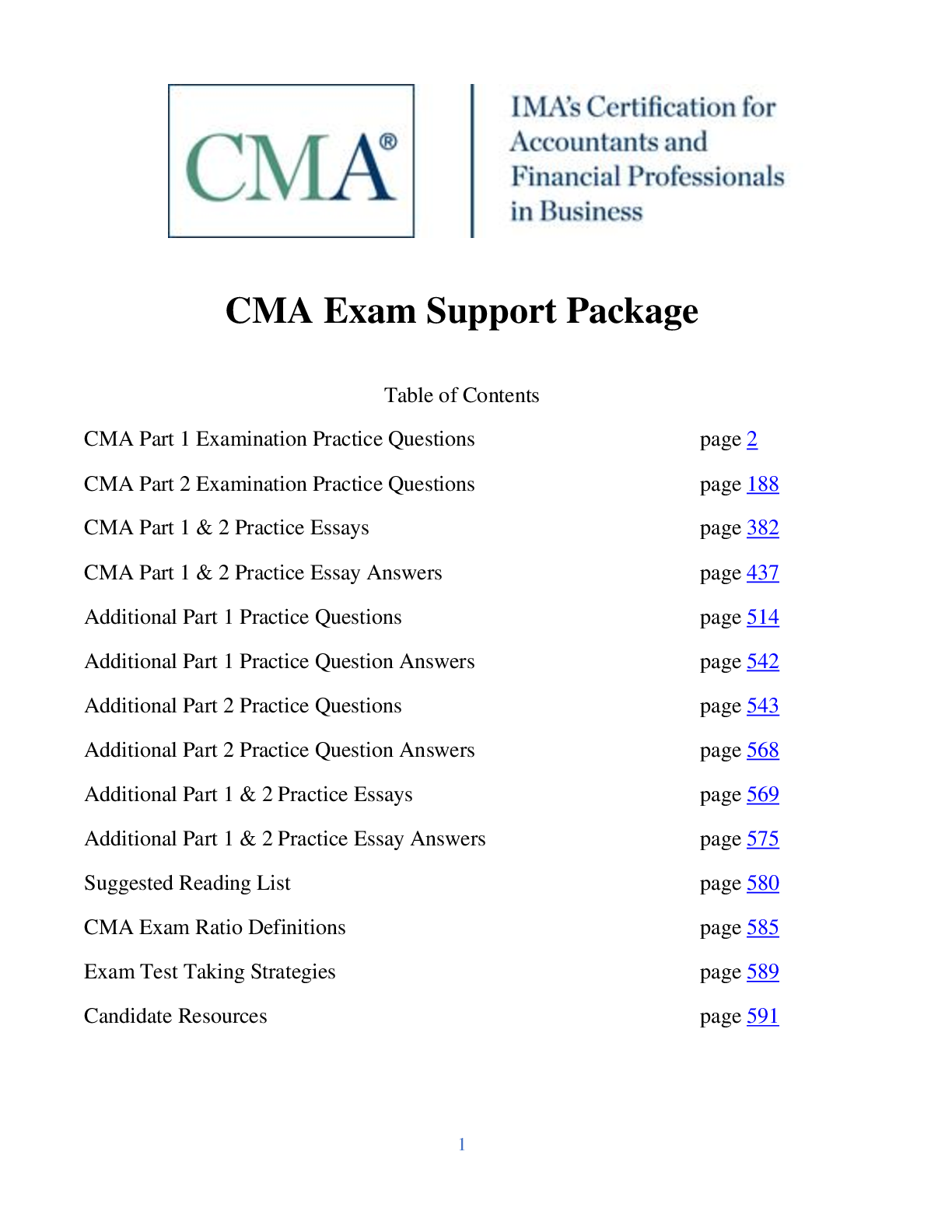

Financial Accounting > TEST BANKS > Certified Management Accountant (CMA), CMA 4 ALL SE/ Wiley Efficient Learning, / Wiley CMA Excel 202 (All)

Certified Management Accountant (CMA), CMA 4 ALL SE/ Wiley Efficient Learning, / Wiley CMA Excel 2021. Full Test Bank 3136 MCQ 2021 + Rationale. 526 Pages.

Document Content and Description Below

Rationale The firm's investments in new plant assets Potential shareholders are generally most interested in a firm's ability to increase its stock price and pay dividends. While investment in n... ew plant assets may give some information about a firm's growth potential, it does not provide the most useful information to potential shareholders because it does not involve dividends. Therefore, this is an incorrect answer. Rationale Changes in the firm's inventory balance A change in a firm's inventory balance is important information. However, potential shareholders are more interested in cash flow generated. Additionally, the change in inventory is better seen by looking at the balance sheet. Therefore, this is an incorrect answer. Rationale The firm's gains and losses from selling plant assets Gains and losses from selling plant assets is important information. However, potential shareholders are more interested in cash flow generated. Therefore, this is an incorrect answer. Rationale The firm's ability to pay dividends Potential shareholders are generally interested in a firm's ability to increase its stock price and pay dividends. The statement of cash flows provides information about cash generated (that can be used for future dividends) and cash used to pay dividends in the past. Therefore, this is the correct answer. The firm's ability to pay dividends Correct The firm's investments in new plant assets Your Answer Question 3 1.A.1.e tb.fin.inc.018_1805 LOS: 1.A.1.e Lesson Reference: Overview of Financial Statements and the Income Statement Difficulty: medium Bloom Code: 4 When using the indirect method, which statement provides the most accurate description of the relationship between accounts receivable and the operating activities section on the statement of cash flows? A decrease in accounts receivable results in a decrease in the operating activities section on the statement of cash flows. A decrease in accounts receivable results in no change in the operating activities section on the statement of cash flows. Rationale An increase in accounts receivable results in an increase in the operating activities section on the statement of cash flows. An increase in accounts receivable means that sales made on credit exceeded collections from customers. Since net income (the starting point of the operating activities section) uses cash sales and not cash collections, adding the increase in accounts receivable would result in “double counting” cash collections. Therefore, this is an incorrect answer. Rationale An increase in accounts receivable results in a decrease in the operating activities section on the statement of cash flows. An increase in accounts receivable means that sales made on credit exceeded collections from customers. Since net income (the starting point of the operating activities section) uses cash sales and not cash collections, the increase in accounts receivable must be subtracted when calculating cash flow from operating activities. Therefore, this is the correct answer. Rationale A decrease in accounts receivable results in a decrease in the operating activities section on the statement of cash flows. A decrease in accounts receivable means that collections from customers exceeded sales made on credit. Since net income (the starting point of the operating activities section) uses cash sales and not cash collections, the decrease in accounts receivable must be added when calculating cash flow from operating activities, not subtracted. Otherwise, cash flow from operating activities would be understated. Therefore, this is an incorrect answer. Rationale A decrease in accounts receivable results in no change in the operating activities section on the statement of cash flows. A decrease in accounts receivable means that collections from customers exceeded sales made on credit. Since net income (the starting point of the operating activities section) uses cash sales and not cash collections, the decrease in accounts receivable must be added when calculating cash flow from opeating activities. Otherwise, cash flow from operating activities would be understated. Therefore, this is an incorrect answer. [Show More]

Last updated: 3 years ago

Preview 1 out of 526 pages

, CMA 4 ALL SE, Wiley Efficient Learning, Wiley CMA Excel 2021.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$25.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jul 14, 2022

Number of pages

526

Written in

Additional information

This document has been written for:

Uploaded

Jul 14, 2022

Downloads

0

Views

56

.png)