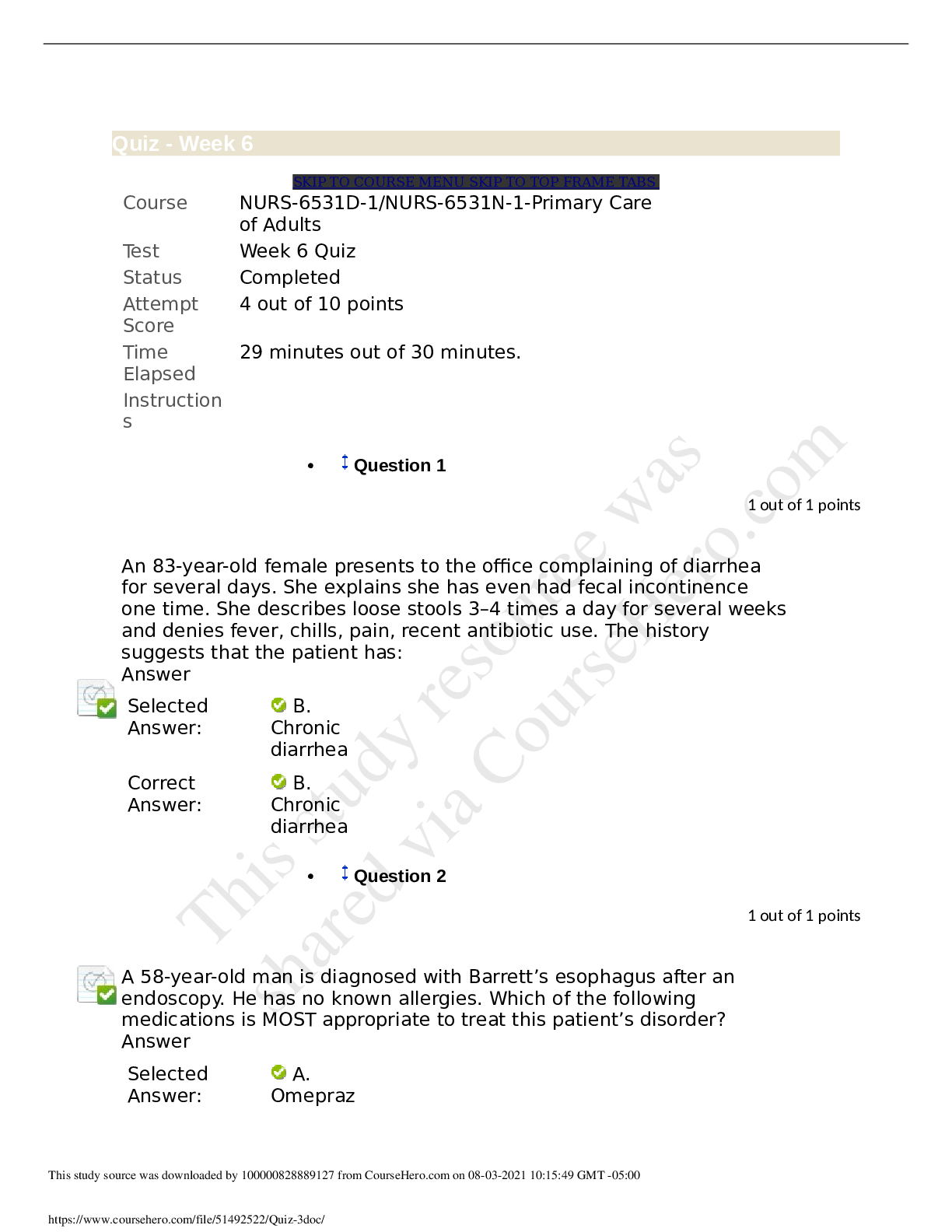

Economics > QUESTIONS & ANSWERS > RPA Questions and Answers Latest Updated 2022 Rated A (All)

RPA Questions and Answers Latest Updated 2022 Rated A

Document Content and Description Below

RPA Questions and Answers Latest Updated 2022 Rated A appraisal ✔✔Estimate of the value or monetary worth of an item of property as of a particular date USPAP ✔✔Uniform Standards of Profess... ional Appraisal Practice USPAP ✔✔Appraisers follow Appraisal Standards Board ✔✔Part of the appraisal foundation that develops, publishes, interprets, and amends the standards of uspap on behalf of appraisers and the users of appraisal services USPAP standard 6 ✔✔Mass development and reporting Scope of Work ✔✔Type and extent of research and analysis in an appraisal or appraisal review assignment Work file ✔✔documentation necessary to support an appraiser's analyses, opinions, and conclusions Signed certification ✔✔Uspap compliant appraisal report must contain a signed certification Appraisal Practice ✔✔Valuation services performed by an individual acting as an appraiser, including but not limited to appraisal and appraisal review. Appraiser ✔✔One who is expected to perform valuation services competently and in a manner that is independent, impartial, and objective. Mass appraisal ✔✔the process of valuing a universe of properties as of a given date using standard methodology, employing common data, and allowing for statistical testing Mass Appraisal Model ✔✔A mathematical expression of how supply and demand factors interact in a market. RPA ✔✔Registered professional appraiser , 5 years to get, can get in 3 RTA ✔✔Registered texas assessor / collector RTC ✔✔Registered Texas collector Under tdlr ✔✔Registrants must be guided by the principle that property taxation should be fair and uniform and apply all laws, rules, methods and procedures in a uniform manner to all taxpayers Code of ethis under tdlr ✔✔Not accept or solicit any gift, favor or service that might reasonably tend to influence the registrant in the discharge of official duties Appearance of Impropriety ✔✔Expectation of a lower value appraisal district is a ✔✔Independent political subdivision Appraisal Review Board ✔✔Approves arb orders by majority vote Taxing unit rolls must be approved by ✔✔Taxing unit governing body Who must approve opitionql local tax exemptions ✔✔Taxing unit governing body Exemption determines ✔✔Taxable value Taxing unit collects less than its levy , then the unit must first meet ✔✔Debt obligations under normal circumstances the state comptroller property tax assistance division conducts a property value study or a cad and its schools districts ✔✔Biennially Arb challenge ✔✔What a taxing unit files to have a hearing( have to file within 15 days after records are submitted to arb) Market Value ✔✔The price at which a property would transfer, for cash or it's equivalent, under prevailing market conditions rendition ✔✔Statement listing taxable property and the name and address of the owner. This statement may contain an owners estimate of the property value Tax Certificate ✔✔Report showing the amount of delinquent taxes, penalties and interest due on a property according to current tax records Appraisal Roll ✔✔Listing of taxable property with name and address of owners and the taxable value tax roll ✔✔Contains everything from appraisal roll plus the tax levy ( value x rate) Appraisal phase ✔✔January 1 equalization phase ✔✔May 15 Assessment Phase ✔✔July 25 Collections phase ✔✔October 1 Value as of ✔✔January 1 Notices sent and records submitted to arb ✔✔May 15 Appraisal records approved ✔✔July 20 Chief appraiser certifies the appraisal roll ✔✔July 25 Tax bills mailed ✔✔October 1 Taxes become delinquent ✔✔Feb 1 Effective Tax Rate ✔✔Tax rate that will generate this year the same tax levy as last year using this years taxable value Rollback ✔✔The m&o rate plus 8 % the debt rate Formula for calculating a tax levy ✔✔Tax levy = taxable value x tax rate Special Use Valuation ✔✔Not an exemption, valuation of ag, timber, recreational land Chief appraiser must value and list , in the appraisal records for real property, Land and improvement values separately ✔✔ [Show More]

Last updated: 2 years ago

Preview 1 out of 13 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 21, 2022

Number of pages

13

Written in

Additional information

This document has been written for:

Uploaded

Sep 21, 2022

Downloads

0

Views

115

.png)

.png)