Business > EXAM > Series 7 Practice Exam | 135 Questions with 100% Correct Answers | Updated & Verified | 51 Pages (All)

Series 7 Practice Exam | 135 Questions with 100% Correct Answers | Updated & Verified | 51 Pages

Document Content and Description Below

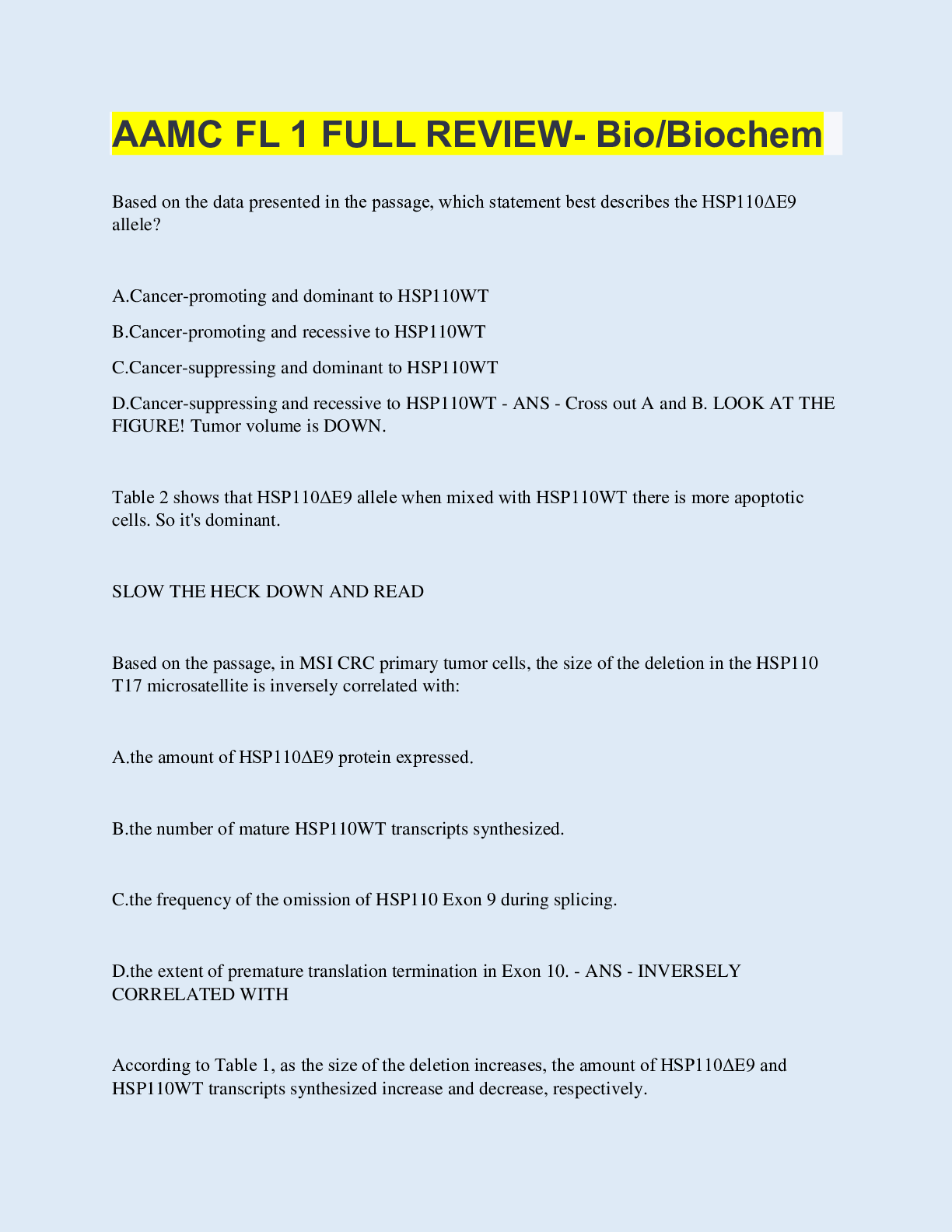

XYZ County Sewer Revenue 6.5% municipal bonds mature in 20 years. If they are currently offered at 92, they have a yield to maturity of approximately - ANS - A) 7.19%.* B) 5.96%. C) 6.50%. D) ... 6.23%. A customer interested in a collateralized mortgage obligation (CMO) might look to which of the following for historical data or projections regarding mortgage prepayments? - ANS - A) DEA B) PSA C) FINRA D) Bond Buyer * Your customer, who lives in State A, is in the highest federal and state income tax bracket. She is considering purchasing some State B municipal bonds with an Aa rating for her portfolio. You correctly explain that municipal bonds generally pay - ANS - A) higher interest rates than corporate issuers of the same quality and maturity, but this is offset by the more favorable tax treatment of the interest. B) lower interest rates than corporate issuers of the same quality and maturity because the interest is tax free on a state, local, [Show More]

Last updated: 2 years ago

Preview 1 out of 51 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$15.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 03, 2022

Number of pages

51

Written in

Additional information

This document has been written for:

Uploaded

Oct 03, 2022

Downloads

0

Views

57

.png)

.png)

.png)