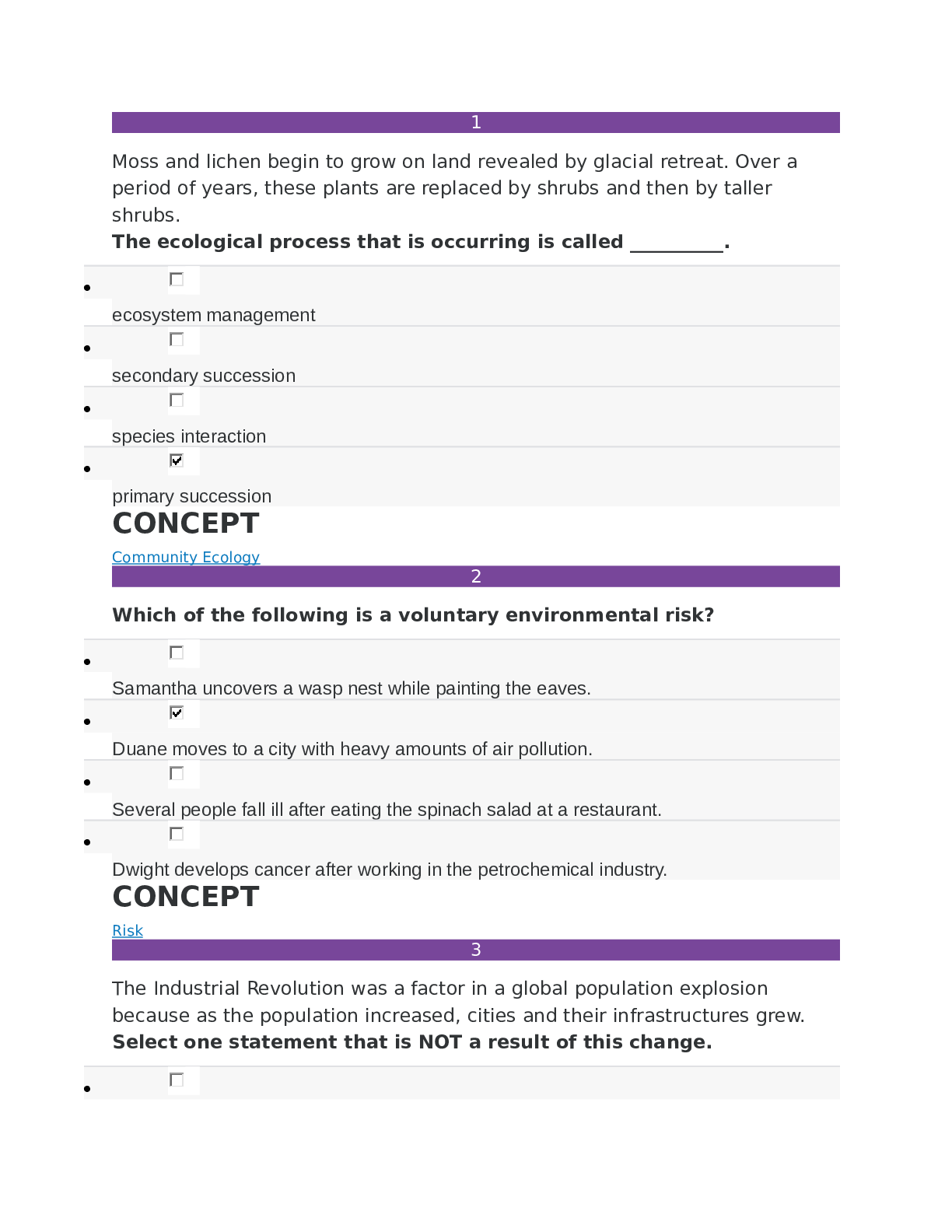

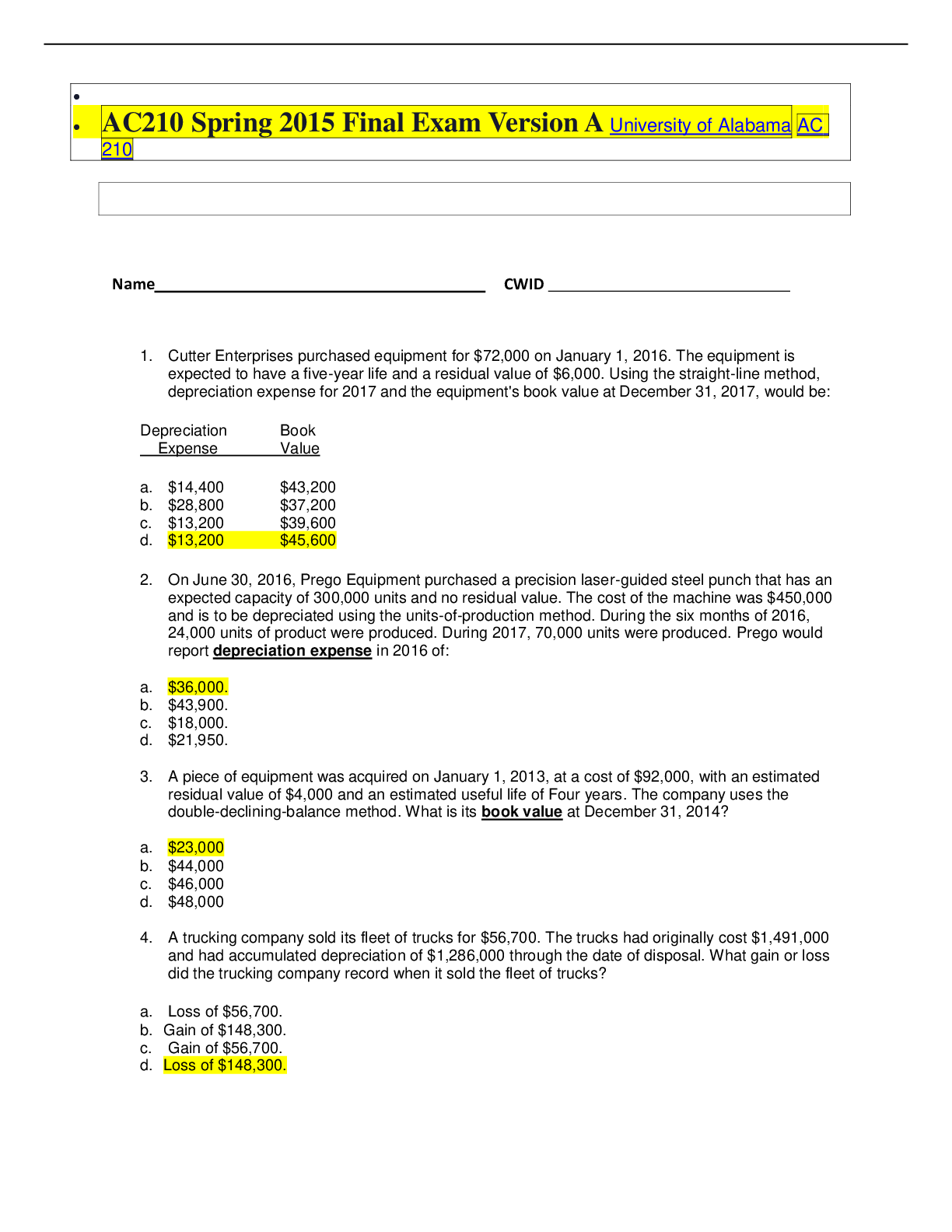

AC210 Spring 2015 Final Exam Version A University of Alabama AC 210

Document Content and Description Below

1. Cutter Enterprises purchased equipment for $72,000 on January 1, 2016. The equipment is

expected to have a five-year life and a residual value of $6,000. Using the straight-line method,

depreciat

...

ion expense for 2017 and the equipment's book value at December 31, 2017, would be:

Depreciation Book

Expense Value

a. $14,400 $43,200

b. $28,800 $37,200

c. $13,200 $39,600

d. $13,200 $45,600

2. On June 30, 2016, Prego Equipment purchased a precision laser-guided steel punch that has an

expected capacity of 300,000 units and no residual value. The cost of the machine was $450,000

and is to be depreciated using the units-of-production method. During the six months of 2016,

24,000 units of product were produced. During 2017, 70,000 units were produced. Prego would

report depreciation expense in 2016 of:

a. $36,000.

b. $43,900.

c. $18,000.

d. $21,950.

3. A piece of equipment was acquired on January 1, 2013, at a cost of $92,000, with an estimated

residual value of $4,000 and an estimated useful life of Four years. The company uses the

double-declining-balance method. What is its book value at December 31, 2014?

a. $23,000

b. $44,000

c. $46,000

d. $48,000

4. A trucking company sold its fleet of trucks for $56,700. The trucks had originally cost $1,491,000

and had accumulated depreciation of $1,286,000 through the date of disposal. What gain or loss

did the trucking company record when it sold the fleet of trucks?

a. Loss of $56,700.

b. Gain of $148,300.

c. Gain of $56,700.

d. Loss of $148,300.

[Show More]

Last updated: 3 years ago

Preview 1 out of 7 pages

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)