Financial Accounting > QUESTIONS & ANSWERS > Cost Accounting and Control 2019 Edition Problem and Solutions_ CHAPTER 4 – Accounting for Factory (All)

Cost Accounting and Control 2019 Edition Problem and Solutions_ CHAPTER 4 – Accounting for Factory Overhead

Document Content and Description Below

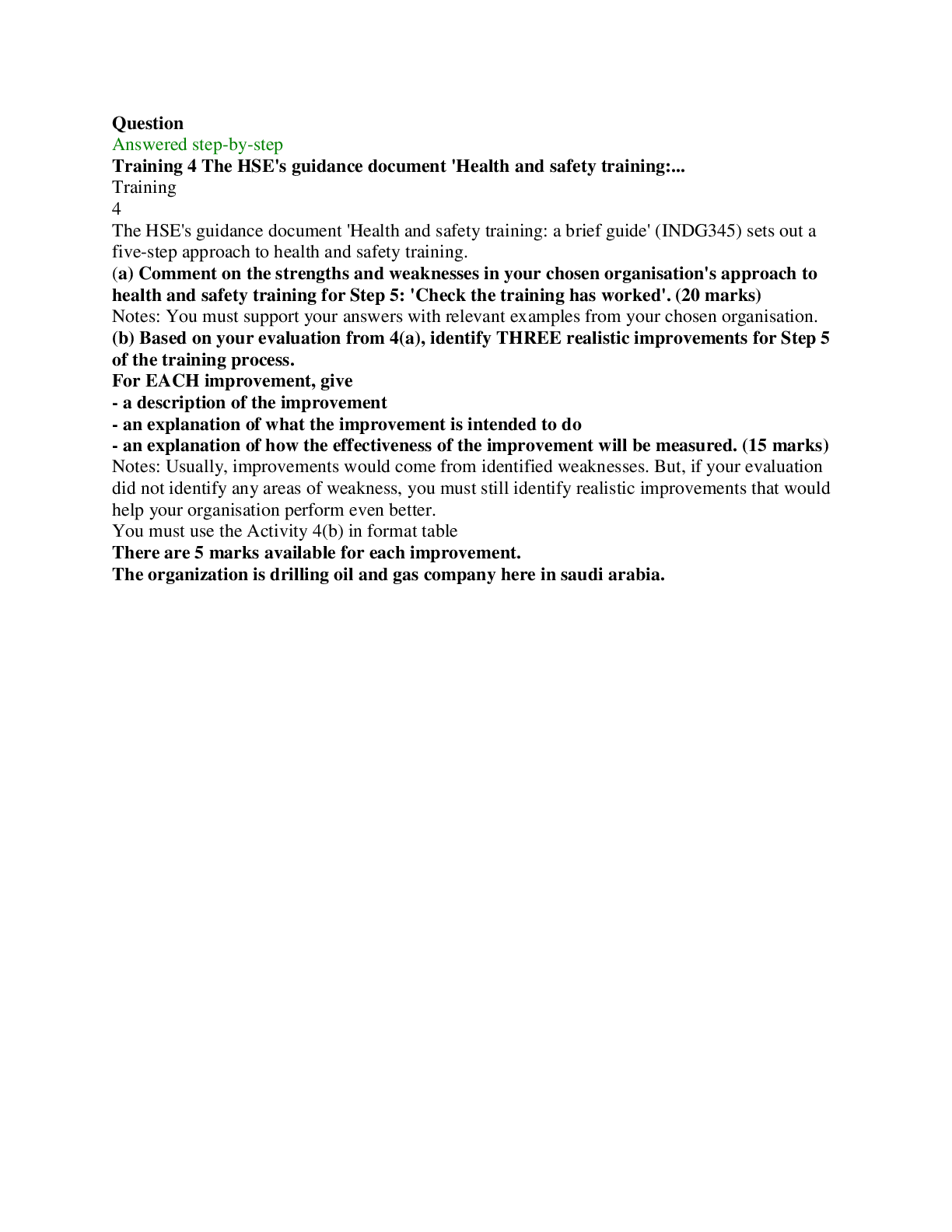

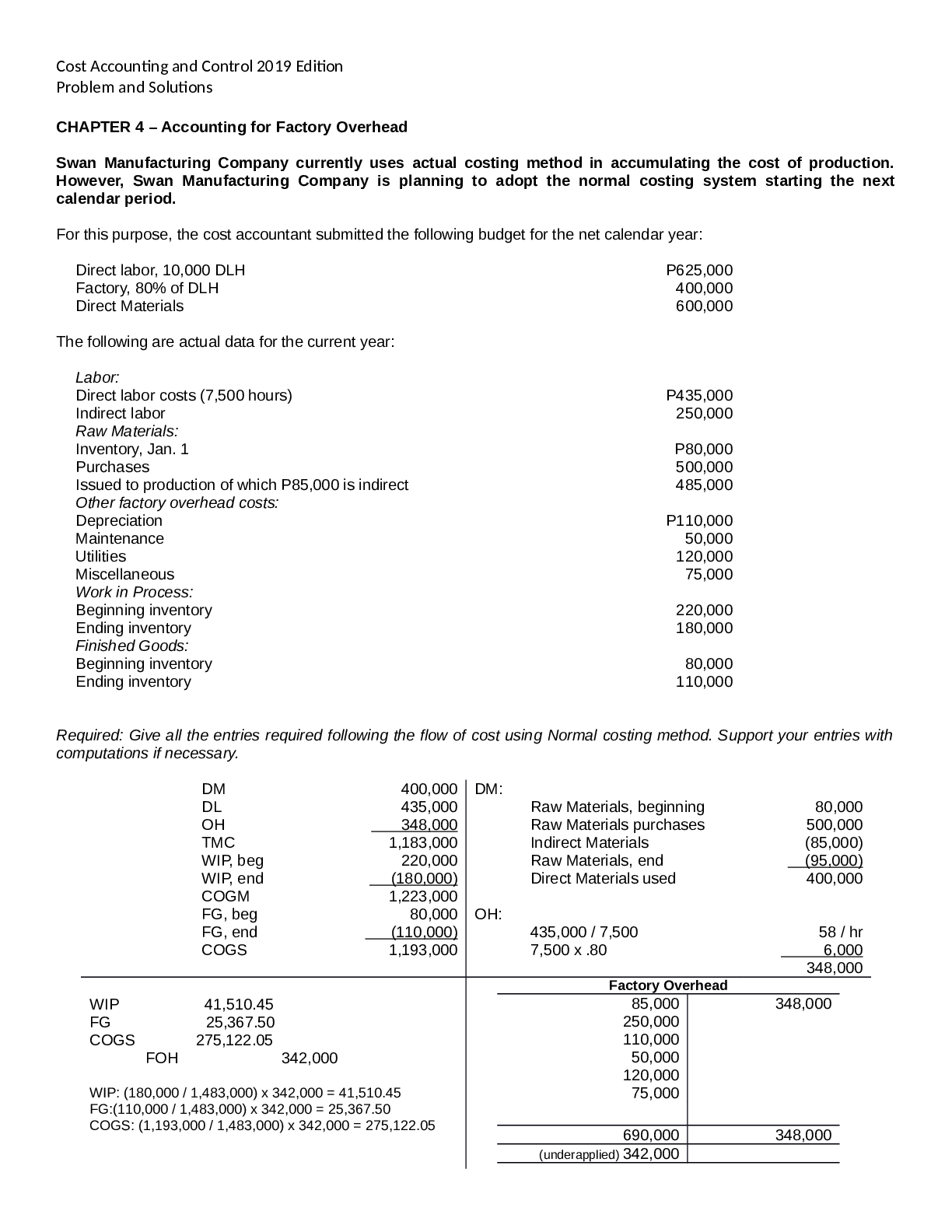

Cost Accounting and Control 2019 Edition Problem and Solutions CHAPTER 4 – Accounting for Factory Overhead Swan Manufacturing Company currently uses actual costing method in accumulating the cost... of production. However, Swan Manufacturing Company is planning to adopt the normal costing system starting the next calendar period. Cost Accounting and Control 2019 Edition Problem and Solutions Ex 4-2 Normal Costing – Plant wide vs. Departmental Rate Rock manufacturing has three departments: design, machine sewing, and beading. The design department overhead consists of computers and software for computer-assisted design. The sewing department overhead consists of thread, seeing machines, and small tools. The beading department has very little overhead, just thread and some glue and all departments are assigned a share of utilities, rent, and others. Information on estimated overhead and direct labor hours for the year by department are as follows: Ex 4-3. Pre-determined OH rate and application of overhead to job Maryose Company applies manufacturing overhead to jobs on the basis of machine hours used. Overhead costs are expected to total P550,000 for the year, and machine usage is estimated at 250,000 hours. In January, P52,000 of overhead costs are incurred and 240,000 machine hours are worked. Required: 1. Determine the amount of applied factory overhead for the year 2. Determine the over or under applied overhead at December 31 Ex 4-5. Departmental rate and plant wide rate Ex. 4-7. Normal Costing Star Manufacturing Company produces objects d’art. Account balances for the company at the beginning and end of July of the current year are shown below: Accounts July 1 July 31 Raw materials inventory Work in process inventory Finished goods P85,000 98,000 50,000 P105,000 80,000 75,000 During the month, Star’s Manufacturing Company purchased P150,000 of raw materials; Factory payroll was P120,000 of which 25% is for indirect laborers. Other factory overhead amounted to P45,000. Overhead was applied at 80% of direct labor cost. All sales are marked at 40% above cost. Havianas Manufacturing Company does not maintain backup documents for the computer files. In June, some of the current data were lost, and you have been asked to help reconstruct the data. The following beginning balances are known as of June 1. Direct materials inventory Work in process inventory Finished goods inventory Actual factory overhead Accounts payable P12,000 4,500 11,000 16,500 6,000 Reviewing old documents and interviewing selected employees, the following information was gathered: a. The job cost sheets showed materials of P2,600 were included in the June 30 work in process inventory. Also, 300 direct labor hours have been utilized at P6 per hour on the work in process at June 30. b. The accounts payable account is for direct materials only. The clerk remembers clearly that the balance in the accounts payable account on June 30 was P8,000. An analysis of canceled checks shows payments of P40,000 were made to suppliers during the month. c. Payroll records show that 5,200 direct labor hours were recorded for the month. It was verified that there were no variations in pay rates among employees during the period. d. Records at the warehouse indicate that finished goods inventory totaled P16,000 on June 30. e. The predetermined overhead rate was based on an estimated 60,000 direct labor hours to be worked during the year, and an estimated P180,000 in factory overhead costs. f. Another records kept manually indicated that cost of goods sold in June totaled P84,000. 14. The costs of goods manufactured in June amounts to: a. P11,000 c. P84,000 b. P49,000 d. P89,000 Cost of goods manufactured Finished goods, beginning Finished goods, end Cost of goods sold 89,000 11,000 (16,000) 84,000Cost Accounting and Control 2019 Edition Problem and Solutions Pearl Company uses normal costing system, Partially completed T-accounts and additional information for the year are as follows: [Show More]

Last updated: 2 years ago

Preview 1 out of 35 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$4.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jan 14, 2023

Number of pages

35

Written in

Additional information

This document has been written for:

Uploaded

Jan 14, 2023

Downloads

0

Views

61