Financial Accounting > QUESTIONS & ANSWERS > ACC 3100 Final Exam_Q&A. All Answers Indicated. Baruch College, CUNY__Isaac Inc. began operations in (All)

ACC 3100 Final Exam_Q&A. All Answers Indicated. Baruch College, CUNY__Isaac Inc. began operations in January 2021. For some property sales, Isaac recognizes income in the period of sale for financial reporting purposes.

Document Content and Description Below

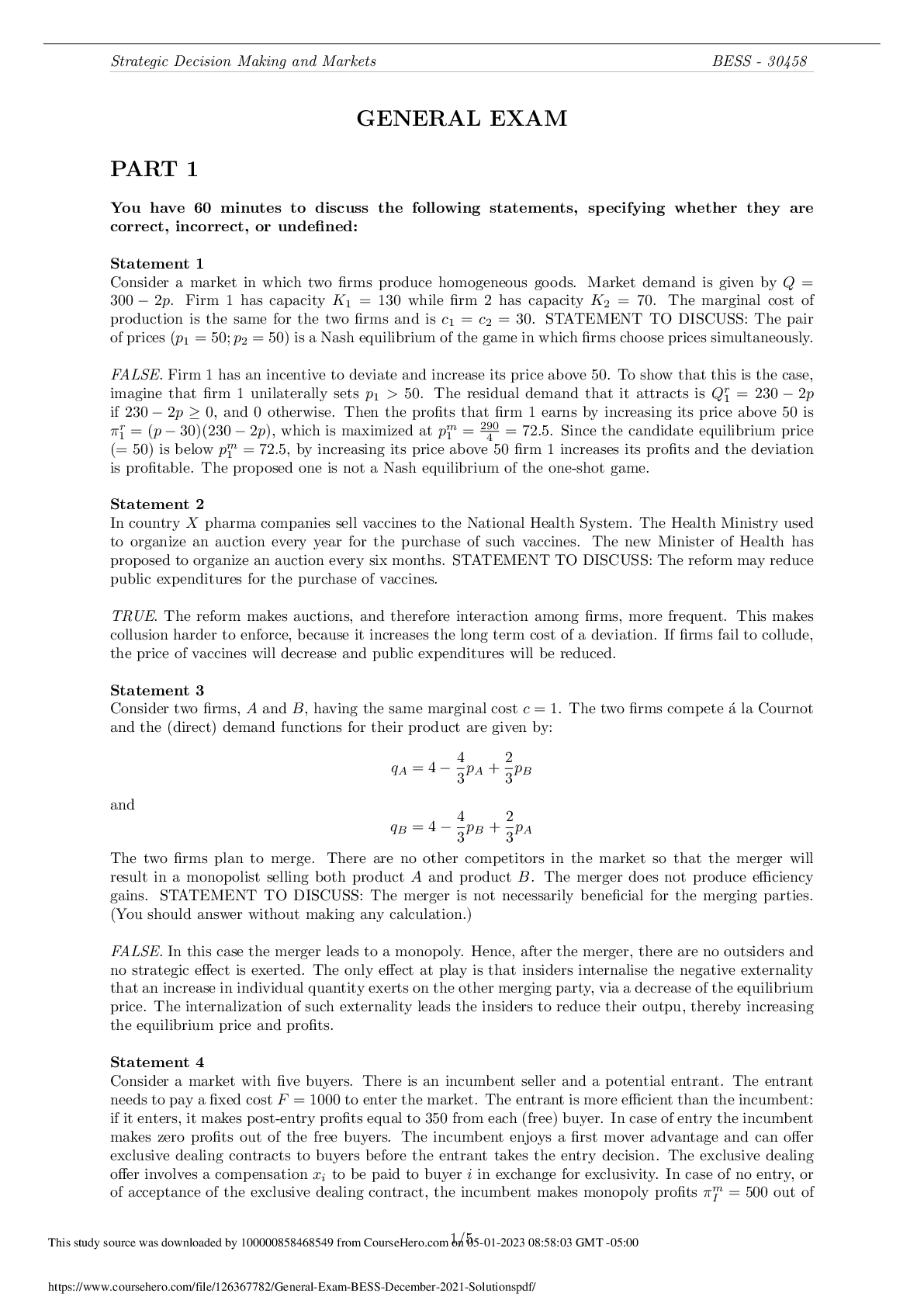

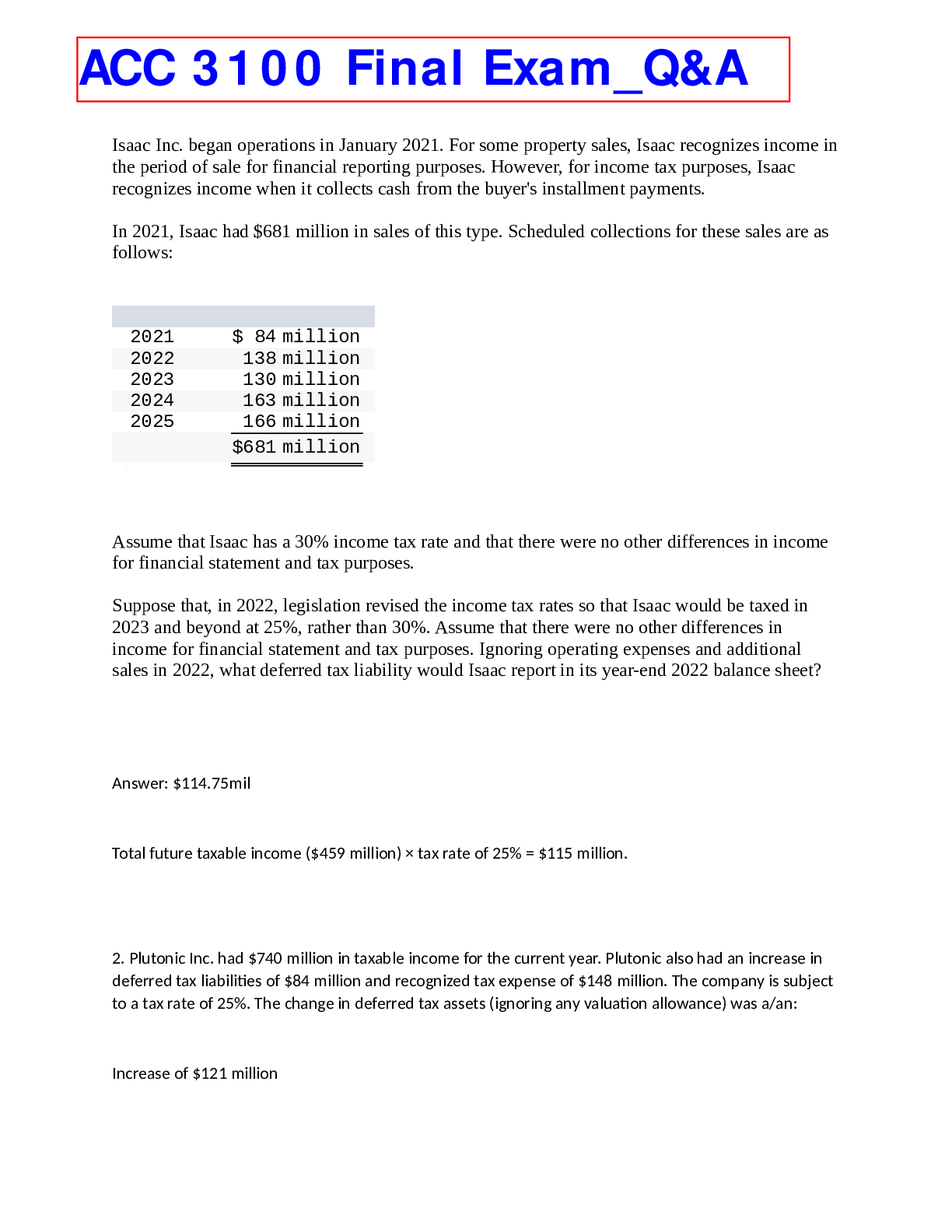

ACC 3100 Final Exam_Q&A. All Answers Indicated. Baruch College, CUNY Isaac Inc. began operations in January 2021. For some property sales, Isaac recognizes income in the period of sale for financial ... reporting purposes. However, for income tax purposes, Isaac recognizes income when it collects cash from the buyer's installment payments. Assume that Isaac has a 30% income tax rate and that there were no other differences in income for financial statement and tax purposes. Suppose that, in 2022, legislation revised the income tax rates so that Isaac would be taxed in 2023 and beyond at 25%, rather than 30%. Assume that there were no other differences in income for financial statement and tax purposes. Ignoring operating expenses and additional sales in 2022, what deferred tax liability would Isaac report in its year-end 2022 balance sheet? 2. Plutonic Inc. had $740 million in taxable income for the current year. Plutonic also had an increase in deferred tax liabilities of $84 million and recognized tax expense of $148 million. The company is subject to a tax rate of 25%. The change in deferred tax assets (ignoring any valuation allowance) was a/an: Increase of $121 million [Show More]

Last updated: 2 years ago

Preview 1 out of 20 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$11.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 06, 2023

Number of pages

20

Written in

All

Additional information

This document has been written for:

Uploaded

Apr 06, 2023

Downloads

0

Views

114