Business > TEST BANKS > Principles of Taxation for Business and Investment Planning, 2023 26th Edition by Jones, Shelley, Sa (All)

Principles of Taxation for Business and Investment Planning, 2023 26th Edition by Jones, Shelley, Sandra and Kubick Test Bank

Document Content and Description Below

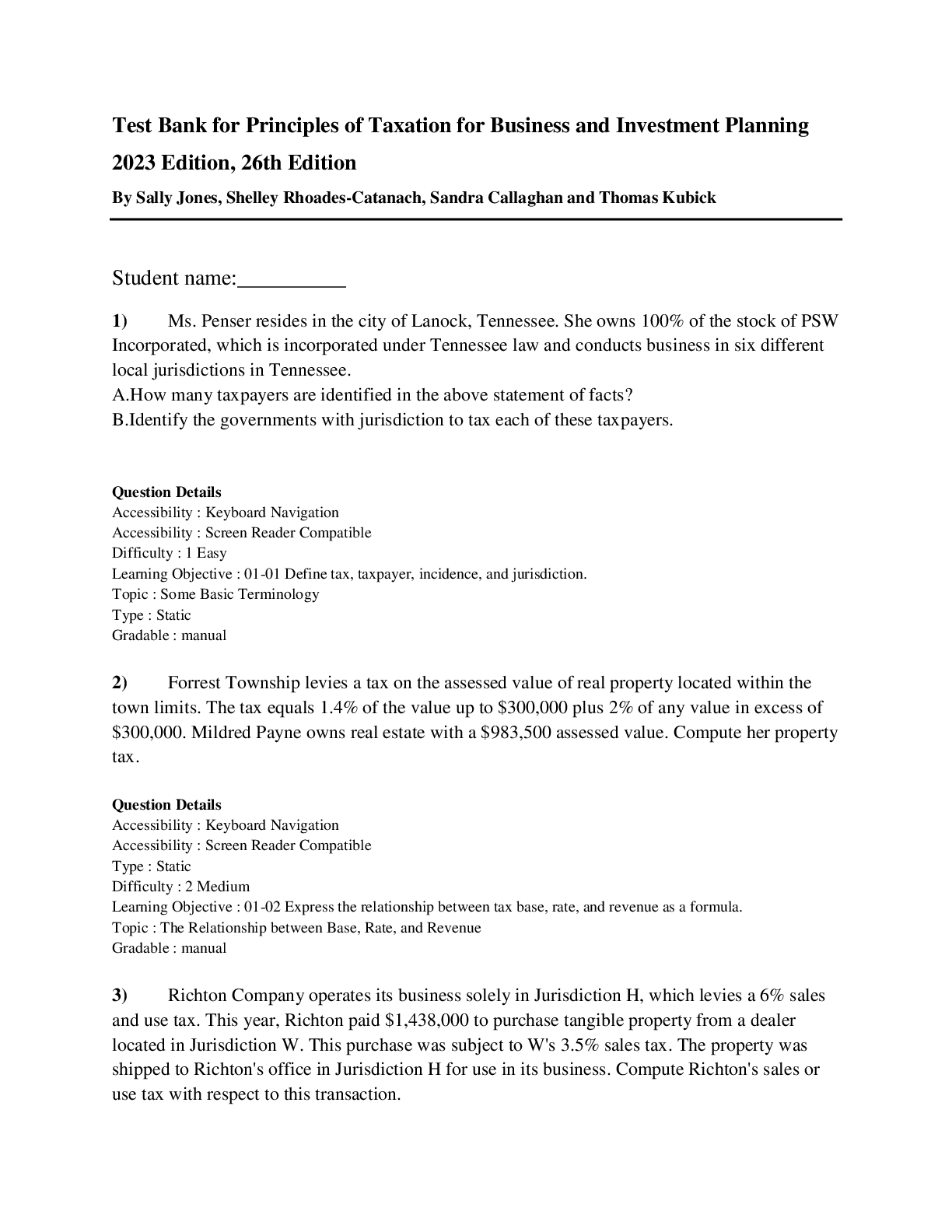

1) Ms. Penser resides in the city of Lanock, Tennessee. She owns 100% of the stock of PSW Incorporated, which is incorporated under Tennessee law and conducts business in six different local juris... dictions in Tennessee. A.How many taxpayers are identified in the above statement of facts? B.Identify the governments with jurisdiction to tax each of these taxpayers. 2) Forrest Township levies a tax on the assessed value of real property located within the town limits. The tax equals 1.4% of the value up to $300,000 plus 2% of any value in excess of $300,000. Mildred Payne owns real estate with a $983,500 assessed value. Compute her property tax. 3) Richton Company operates its business solely in Jurisdiction H, which levies a 6% sales and use tax. This year, Richton paid $1,438,000 to purchase tangible property from a dealer located in Jurisdiction W. This purchase was subject to W's 3.5% sales tax. The property was shipped to Richton's office in Jurisdiction H for use in its business. Compute Richton's sales or use tax with respect to this transaction. [Show More]

Last updated: 7 months ago

Preview 1 out of 577 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$28.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Dec 12, 2024

Number of pages

577

Written in

Additional information

This document has been written for:

Uploaded

Dec 12, 2024

Downloads

0

Views

20