Accounting > STUDY GUIDE > ACC 422 Final Exam Comprehensive Study Guide (All)

ACC 422 Final Exam Comprehensive Study Guide

Document Content and Description Below

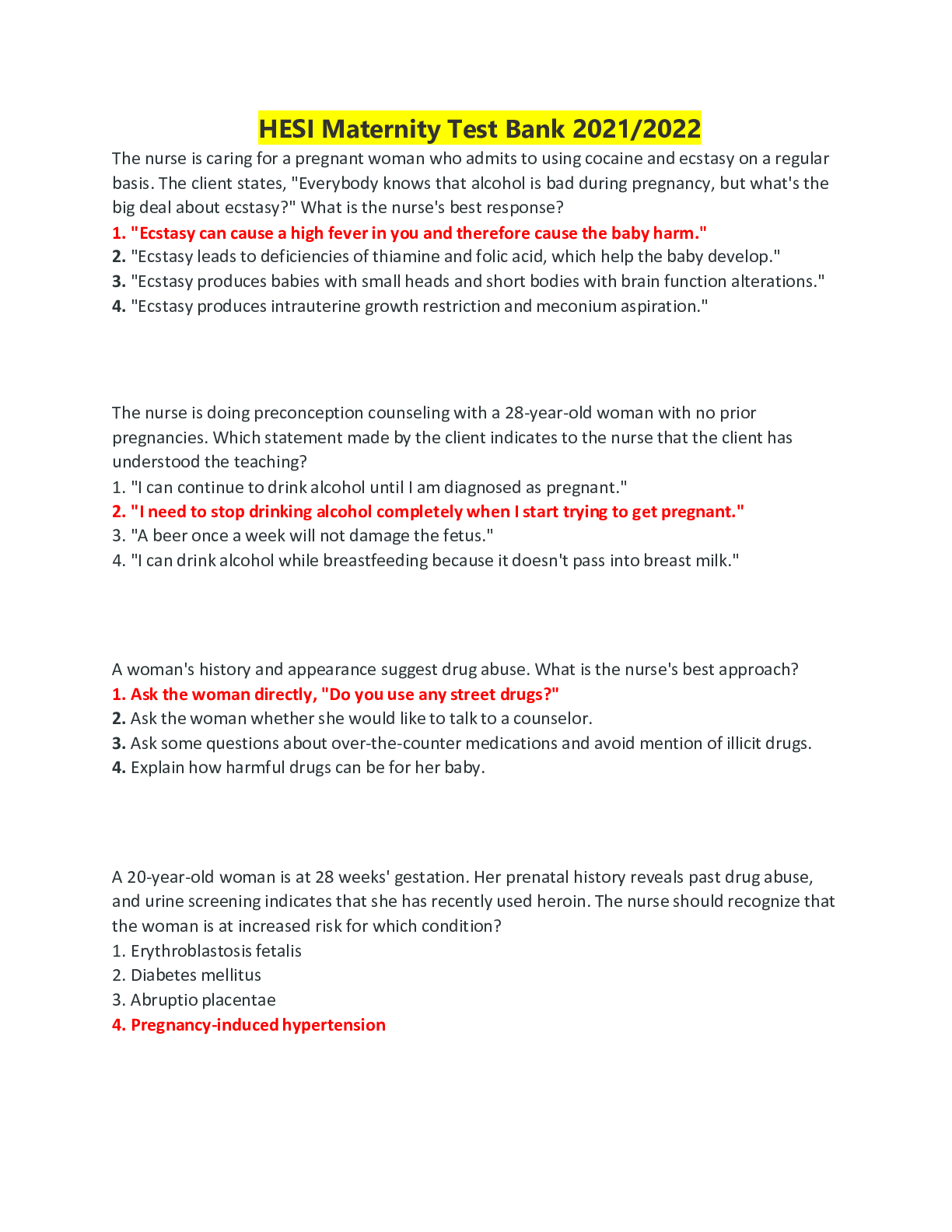

1) Assuming no beginning inventory, what can be said about the trend of inventory prices if cost of goods sold computed when inventory is valued using the FIFO method exceeds cost of goods sold when i... nventory is valued using the LIFO method? A. Prices remained unchanged. B. Prices decreased. C. Price trend cannot be determined from information given. D. Prices increased. 2) Which method of inventory pricing best approximates specific identification of the actual flow of costs and units in most manufacturing situations? A.First-in, first-out B. Average cost C. Base stock D.Last-in, first-out 3) All of the following costs should be charged against revenue in the period in which costs are incurred EXCEPT for A. costs which will NOT benefit any future period. B. manufacturing overhead costs for a product manufactured and sold in the same accounting period. C. costs of normal shrinkage and scrap incurred for the manufacture of a product in ending inventory. D. costs from idle manufacturing capacity resulting from an unexpected plant shutdown. 4) When the direct method is used to record inventory at market A.a loss is recorded directly in the inventory account by crediting inventory and debiting loss on inventory decline. B. the market value figure for ending inventory is substituted for cost and the loss is buried in cost of goods sold C. only the portion of the loss attributable to inventory sold during the period is recorded in the financial statements. D. there is a direct reduction in the selling price of the product that results in a loss being recorded on the income statement prior to the sale. 5) An item of inventory purchased this period for $15.00 has been incorrectly written down to its current replacement cost of $10.00. It sells during the following period for $30.00, its normal selling price, with disposal costs of $3.00 and normal profit of $12.00. Which of the following statements is NOT true? A. The current year's income is understated. B. Income of the following year will be understated. C. The closing inventory of the current year is understated. D. The cost of sales of the following year will be understated. 6) In no case can "market" in the lower-of-cost-or-market rule be more than A. estimated selling price in the ordinary course of business less reasonably predictable costs of completion and disposal. estimated selling price in the ordinary course of business less reasonably predictable B. costs of completion and disposal, an allowance for an approximately normal profit margin, and an adequate reserve for possible future losses. estimated selling price in the ordinary course of business less reasonably predictable C. costs of completion and disposal and an allowance for an approximately normal profit margin. D. estimated selling price in the ordinary course of business. 7) The gross profit method of inventory valuation is invalid when A. there is a substantial increase in inventory during the year. B. NONE OF THESE. C. there is no beginning inventory because it is the first year of operation. D.a portion of the inventory is destroyed. 8) Which of the following is NOT a basic assumption of the gross profit method? A. Goods NOT sold must be on hand. B. THE TOTAL AMOUNT OF PURCHASES AND THE TOTAL AMOUNT OF SALES REMAIN RELATIVELY UNCHANGED FROM THE COMPARABLE PREVIOUS PERIOD. C. If the sales, reduced to the cost basis, are deducted from the sum of the opening inventory plus purchases, the result is the amount of inventory on hand. D. The beginning inventory plus the purchases equal total goods to be accounted for. 9) In 2006, Lucas Manufacturing signed a contract with a supplier to purchase raw materials in 2007 for $700,000. Before the December 31, 2006 balance sheet date, the market price for these materials dropped to $510,000. The journal entry to record this situation at December 31, 2006 will result in a credit that should be reported A. AS A CURRENT LIABILITY. B. on the income statement. C. as an appropriation of retained earnings. D. as a valuation account to Inventory on the balance sheet. 10) The cost of land typically includes the purchase price and all of the following costs EXCEPT A. street lights, sewers, and drainage systems cost. B. assumption of any liens or mortgages on the property. C. PRIVATE DRIVEWAYS AND PARKING LOTS. D. grading, filling, draining, and clearing costs. 11) The cost of land does NOT include A. costs of removing old buildings. B. COSTS OF IMPROVEMENTS WITH LIMITED LIVES. C. costs of grading, filling, draining, and clearing. D. special assessments. 12) Cotton Hotel Corporation recently purchased Holiday Hotel and the land on which it is located with the plan to tear down the Holiday Hotel and build a new luxury hotel on the site. The cost of the Holiday Hotel should be A. written off as an extraordinary loss in the year the hotel is torn down. B. CAPITALIZED AS PART OF THE COST OF THE LAND. C. depreciated over the period from acquisition to the date the hotel is scheduled to be torn down. D. capitalized as part of the cost of the new hotel. 13) To be consistent with the historical cost principle, overhead costs incurred by an enterprise constructing its own building should be A. eliminated completely from the cost of the asset. B. allocated on an opportunity cost basis. C. allocated on the basis of lost production. D. allocated on a pro rata basis between the asset and normal operations. 14) Which of the following costs are capitalized for self-constructed assets? A. Labor and overhead only B. Materials and overhead only C. Materials and labor only D. Materials, labor, and overhead 15) Which of the following assets do NOT qualify for capitalization of interest costs incurred during construction of the assets? A. Assets intended for sale or lease that are produced as discrete projects. B. Assets financed through the issuance of long-term debt. C. Assets under construction for an enterprise's own use. D. Assets NOT currently undergoing the activities necessary to prepare them for their intended use. 16) The cost of a nonmonetary asset acquired in exchange for another nonmonetary asset and the exchange has commercial substance is usually recorded at A. the fair value of the asset given up, and a gain but NOT a loss may be recognized. B. the fair value of the asset received if it is equally reliable as the fair value of the asset given up. C. the fair value of the asset given up, and a gain or loss is recognized. D. either the fair value of the asset given up or the asset received, whichever one results in the largest gain (smallest loss) to the company. 17) Construction of a qualifying asset is started on April 1 and finished on December 1. The fraction used to multiply an expenditure made on April 1 to find weighted-average accumulated expenditures is A.8/12. B. 9/12. C. 8/8. D.11/12. 18) When a plant asset is acquired by issuance of common stock, the cost of the plant asset is properly measured by the A. par value of the stock. B. stated value of the stock. C. book value of the stock. D.market value of the stock. 19) Which of the following principles best describes the conceptual rationale for the methods of matching depreciation expense with revenues? A. Associating cause and effect B. Systematic and rational allocation C. Immediate recognition D. Partial recognition 20) For income statement purposes, depreciation is a variable expense if the depreciation method used is A. units-of-production. B. straight-line. C. sum-of-the-years'-digits. D.declining-balance. 21) If an industrial firm uses the units-of-production method for computing depreciation on its only plant asset, factory machinery, the credit to accumulated depreciation from period to period during the life of the firm will A. be constant. B. vary with unit sales. C. vary with sales revenue. D.vary with production. 22) Lennon Company purchased a depreciable asset for $200,000. The estimated salvage value is $10,000, and the estimated useful life is 10,000 hours. Lennon used the asset for 1,100 hours in the current year. The activity method will be used for depreciation. What is the depreciation expense on this asset? A.$19,000 B. $20,900 C. $22,000 D.$190,000 [$200,000 – $10,000) ÷ 10,000] × 1,100 = $20,900 23) Bigbie Company purchased a depreciable asset for $600,000. The estimated salvage value is $30,000, and the estimated useful life is 10,000 hours. Bigbie used the asset for 1,100 hours in the current year. The activity method will be used for depreciation. What is the depreciation expense on this asset? A.$57,000 B. $62,700 C. $66,000 D.$570,000 [($600,000 – $30,000) ÷ 10,000] × 1,100 = $62,700 24) Starr Company purchased a depreciable asset for $150,000. The estimated salvage value is $10,000, and the estimated useful life is 8 years. The double-declining balance method will be used for depreciation. What is the depreciation expense for the second year on this asset? A.$17,500 B. $26,250 C. $28,125 D.$37,500 $150,000 × [(1 ÷ 8) × 2] = $37,500 ($150,000 – $37,500) × [(1 ÷ 8) × 2] = $28,125 25) The cost of purchasing patent rights for a product that might otherwise have seriously competed with one of the purchaser's patented products should be A. charged off in the current period. amortized over the remaining estimated life of the original patent covering the B. product whose market would have been impaired by competition from the newly patented product. C. amortized over the legal life of the purchased patent. D. added to factory overhead and allocated to production of the purchaser's product. 26) Costs incurred internally to create intangibles are A. capitalized. B. expensed only if they have a limited life. C. capitalized if they have an indefinite life. D.expensed as incurred. 27) Factors considered in determining an intangible asset’s useful life include all of the following EXCEPT A. the expected use of the asset. B. the amortization method used. C. any legal or contractual provisions that may limit the useful life. D. any provisions for renewal or extension of the asset’s legal life 28) Fleming Corporation acquired Out-of-Sight Products on January 1, 2008 for $4,000,000, and recorded goodwill of $750,000 as a result of that purchase. At December 31, 2008, the Out-of-Sight Products Division had a fair value of $3,400,000. The net identifiable assets of the Division (excluding goodwill) had a fair value of $2,900,000 at that time. What amount of loss on impairment of goodwill should Fleming record in 2008? A.$ -0- B. $600,000 C. $250,000 D.$350,000 $3,400,000 – $2,900,000 = $500,000 $750,000 – $500,000 = $250,000. 29) Mining Company acquired a patent on an oil extraction technique on January 1, 2006 for $5,000,000. It was expected to have a 10 year life and no residual value. Mining uses straight-line amortization for patents. On December 31, 2007, the expected future cash flows expected from the patent were expected to be $600,000 per year for the next eight years. The present value of these cash flows, discounted at Mining’s market interest rate, is $2,800,000. At what amount should the patent be carried on the December 31, 2007 balance sheet? A.$5,000,000 B. $2,800,000 C. $4,800,000 D.$4,000,00 0 $5,000,000 – [($5,000,000 ÷ 10) × 2] = $4,000,000 30) General Products Company bought Special Products Division in 2006 and appropriately booked $250,000 of goodwill related to the purchase. On December 31, 2007, the fair value of Special Products Division is $2,000,000 and it is carried on General Product’s books for a total of $1,700,000, including the goodwill. An analysis of Special Products Division’s assets indicates that goodwill of $200,000 exists on December 31, 2007. What goodwill impairment should be recognized by General Products in 2007? A.$0. B. $300,000. C. $200,000. D.$50,000. Since $2,000,000 > $1,700,000, $0 impairment 31) Easton Company and Lofton Company were combined in a purchase transaction. Easton was able to acquire Lofton at a bargain price. The sum of the market or appraised values of identifiable assets acquired less the fair value of liabilities assumed exceeded the cost to Easton. After revaluing noncurrent assets to zero, there was still some "negative goodwill." Proper accounting treatment by Easton is to report the amount as A. an extraordinary gain. B. paid-in capital. C. part of current income in the year of combination. D.a deferred credit and amortize it. 32) Purchased goodwill should A. be written off as soon as possible against retained earnings. B. be written off by systematic charges as a regular operating expense over the period benefited. C. be written off as soon as possible as an extraordinary item. D.not be amortized. 33) The intangible asset goodwill may be A. capitalized only when purchased. B. capitalized only when created internally. C. capitalized either when purchased or created internally. D. written off directly to retained earnings. 34) If a short-term obligation is excluded from current liabilities because of refinancing, the footnote to the financial statements describing this event should include all of the following information EXCEPT A.a general description of the financing arrangement. B. the terms of any equity security issued or to be issued. C. the terms of the new obligation incurred or to be incurred. D. the number of financing institutions that refused to refinance the debt, if any. [Show More]

Last updated: 2 years ago

Preview 1 out of 14 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$8.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 24, 2021

Number of pages

14

Written in

Additional information

This document has been written for:

Uploaded

Mar 24, 2021

Downloads

0

Views

145