Search for

Filter By

Rating

Price in $

Search Results 'Risk'

Showing All results

Sort by

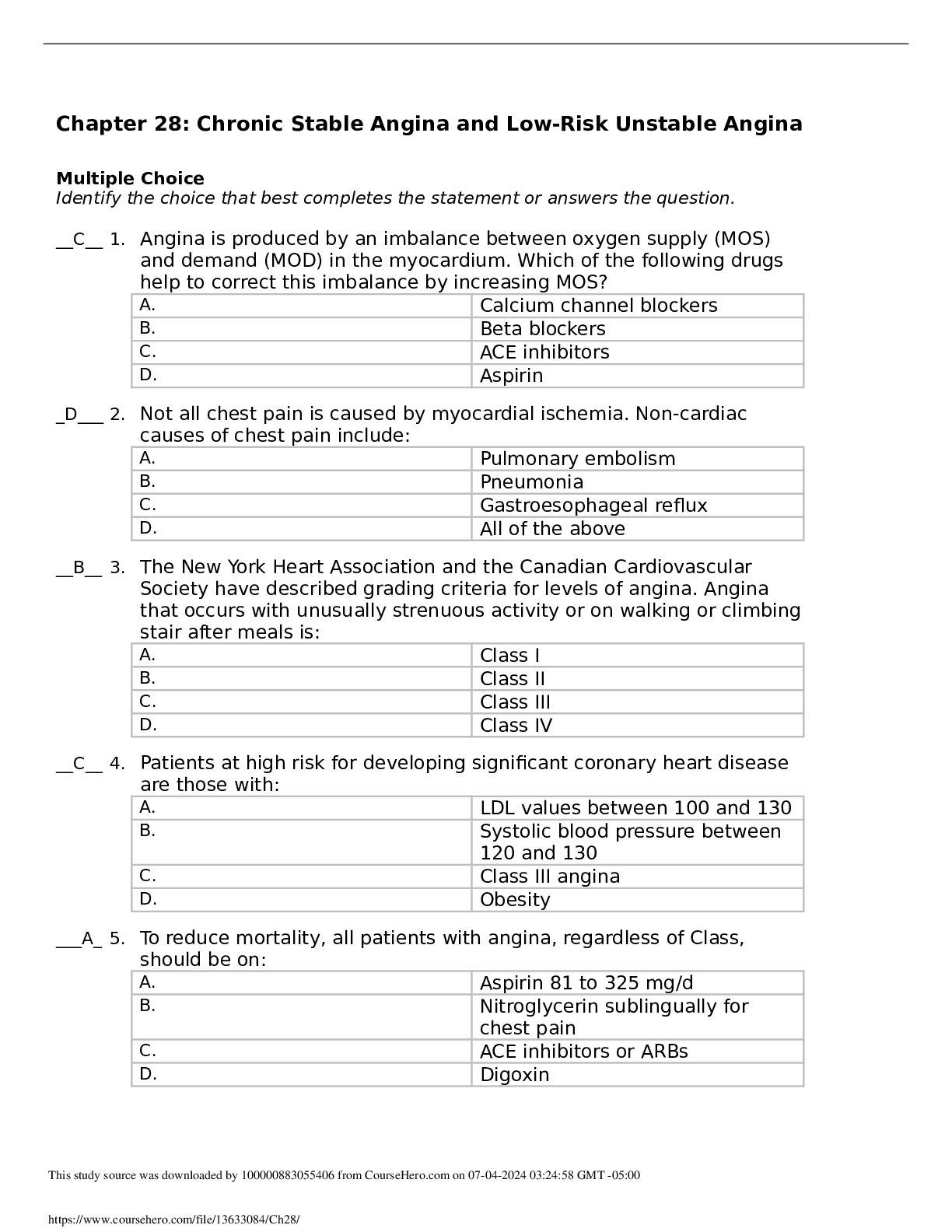

Pharmacology for Nursing Care > QUESTIONS & ANSWERS > NR 508 Chapter 28: Chronic Stable Angina and Low-Risk Unstable Angina – With 100% Correct Answers

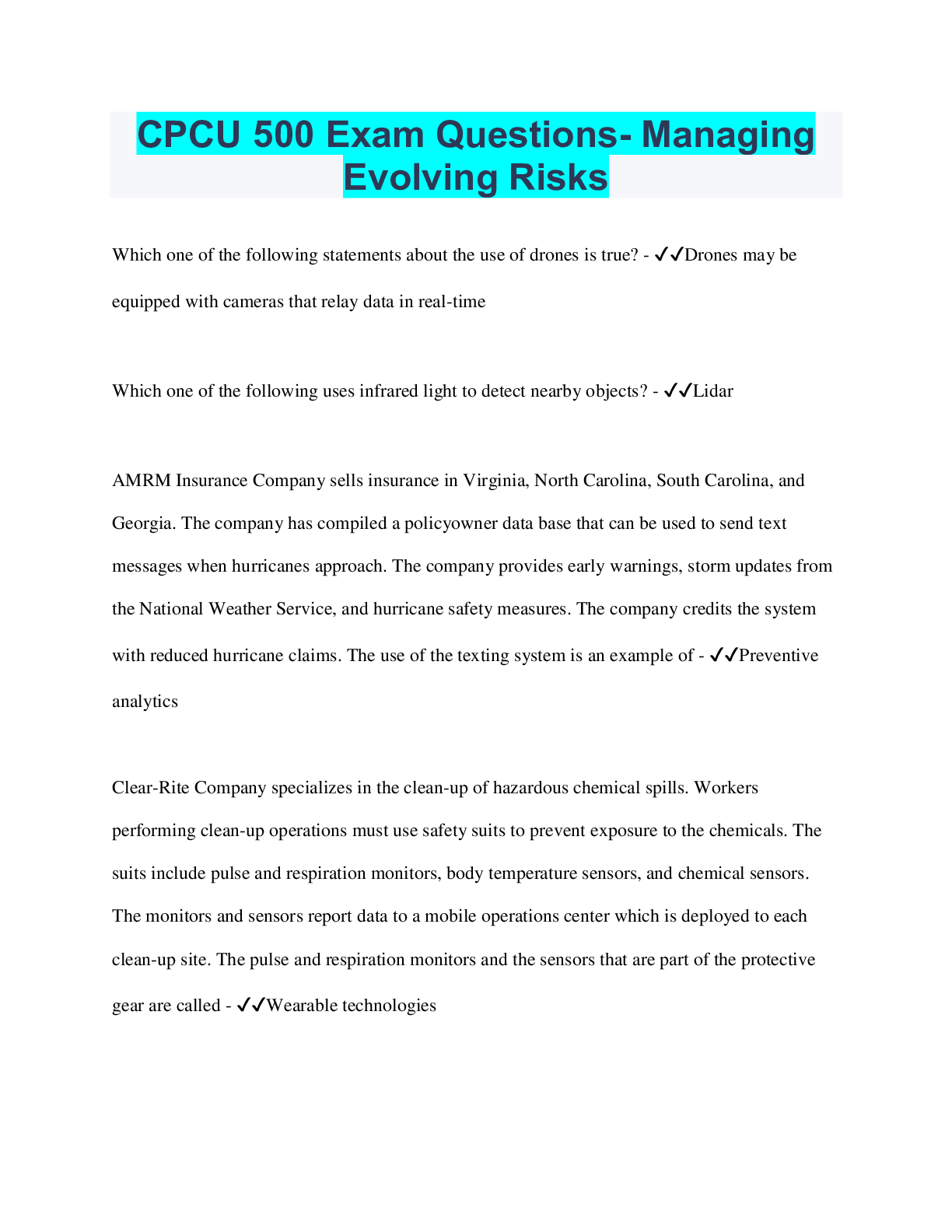

Risk Management and Insurance > QUESTIONS & ANSWERS > CPCU 500 Exam Questions- Managing Evolving Risks

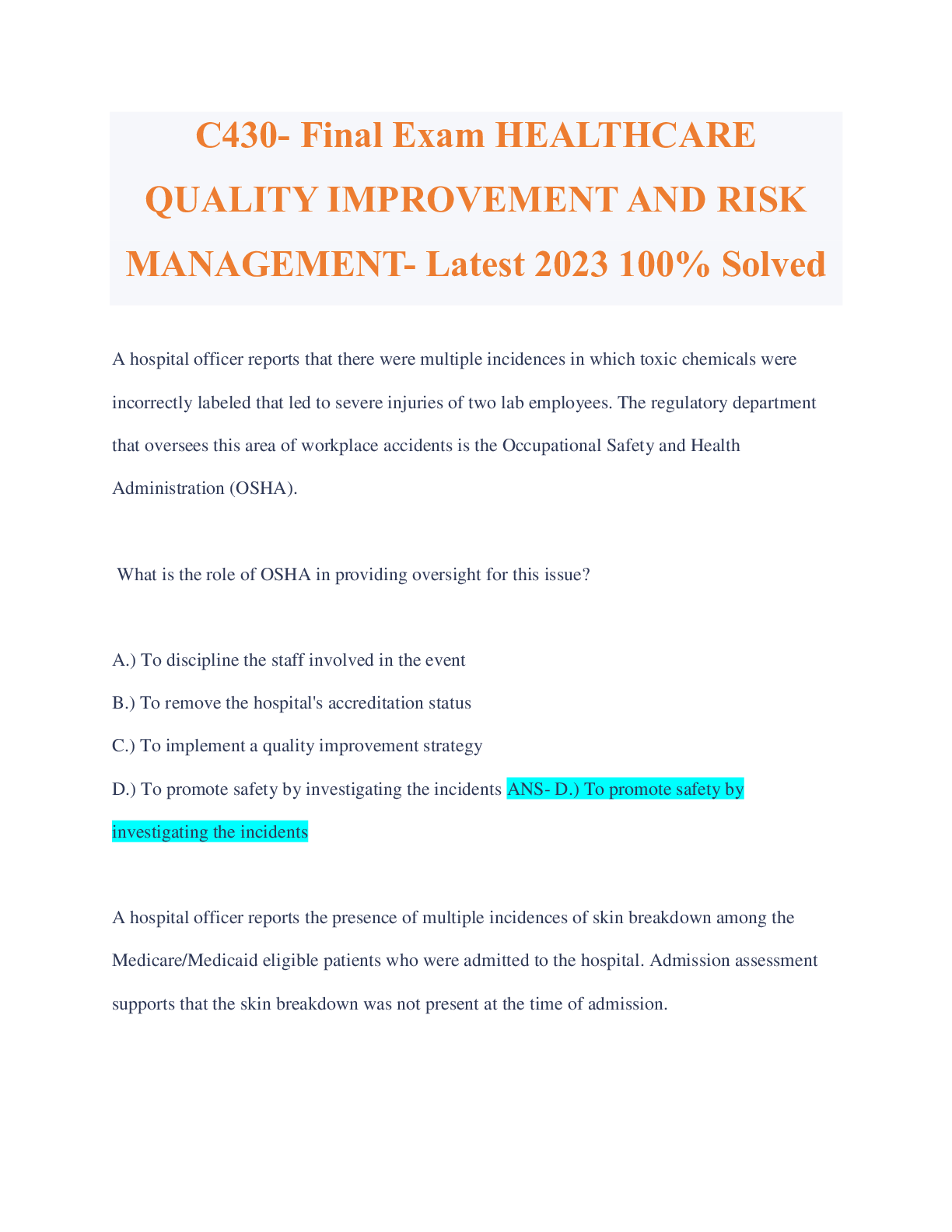

Health Care > QUESTIONS & ANSWERS > C430- Final Exam HEALTHCARE QUALITY IMPROVEMENT AND RISK MANAGEMENT- Latest 2023 100% Solved

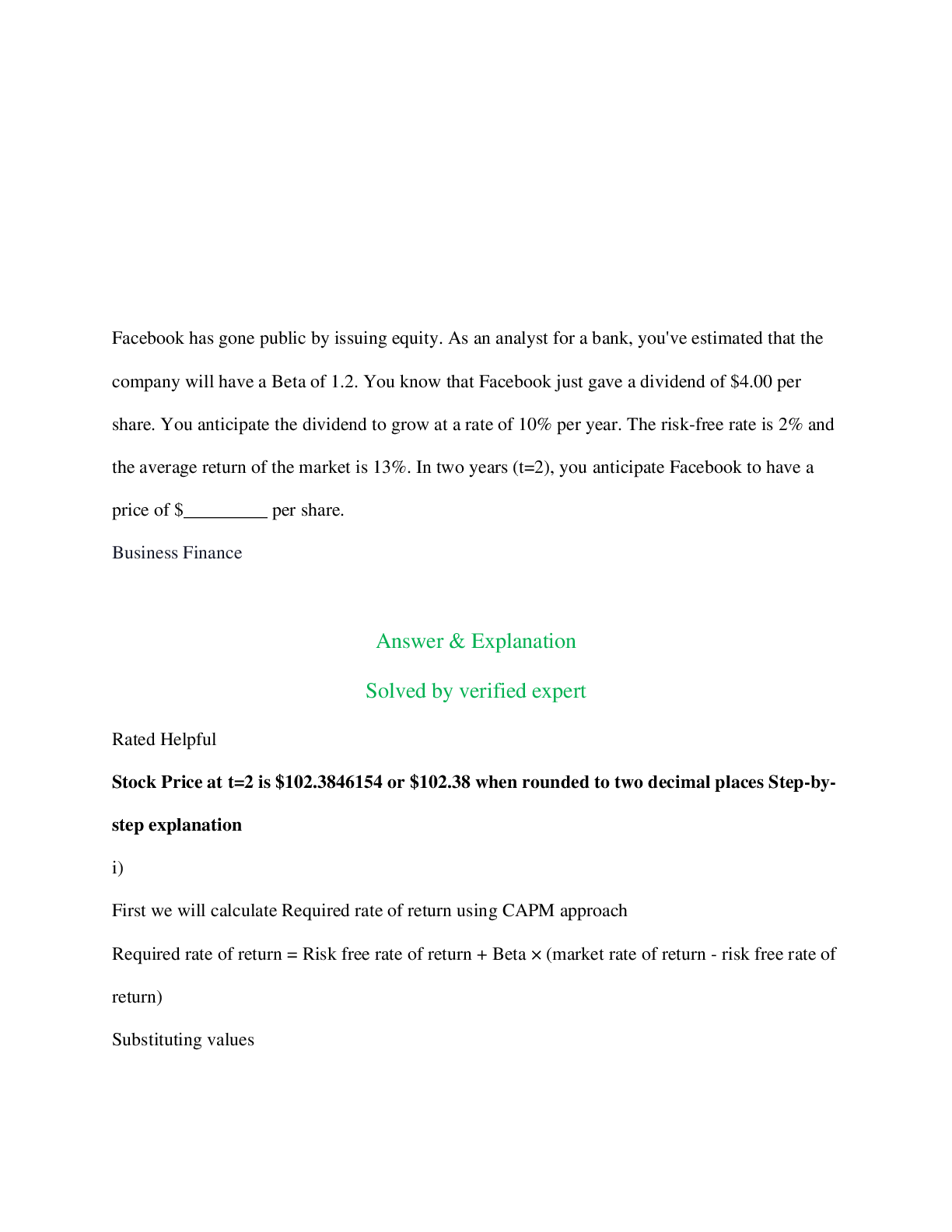

Financial Accounting > QUESTIONS & ANSWERS > Facebook has gone public by issuing equity. As an analyst for a bank, you've estimated that the company will have a Beta of 1.2. You know that Facebook just gave a dividend of $4.00 per share. You anticipate the dividend to grow at a rate of 10% per year. The risk-free rate is 2% and the average return of the market is 13%. In two years (t=2), you anticipate Facebook to have a price of $_________ per share.

Business Administration > QUESTIONS & ANSWERS > Unit 7 Modeling and Practice Guide: ● Insurance ● Insurability ● Deductible ● Premium ● Coverage Limits ● Shared Liability ● Asset Protection ● Risk ● Truth in Lending Act ● Consumer Protection Legislation ● Identity Theft ● Investment Scams ● Pyramid Schemes ● Pump and Dump ● Ponzi Schemes ● Advance Fee Scams ● Better Business Bureau ● Fair Debt Collection Practices Act ● Fair Credit Reporting Act ● Equal Housing Act ● Dodd Frank Act ● Investing ● Skimming ● Phishing ● Data Breaches

Finance > QUESTIONS & ANSWERS > Financial Risk Manager Examination (FRM) Part I Practice Exam. Complete Question and Answer from garp.org

Business > QUESTIONS & ANSWERS > BUSN1-UC MISC Risk Management - New York University: DMA Durham AM HW Write-Up _ Decision Models & Analytics

Operations Management > QUESTIONS & ANSWERS > Harvard University OPERATION 125_You work for Dolphin constructions corporation. The management is excited that you have recently earned your PMP credentials and has invited you to give a brief presentation to the executive team on Project Risk Management.

Information Technology > QUESTIONS & ANSWERS > Official (ISC)² CISSP - Domain 1: Security and Risk Management, Question with answers, graded A+

*NURSING > QUESTIONS & ANSWERS > HMGT 3301 Exam 1 - Chapter 2. All Questions with accurate answers. Graded A+ 1. What is the role of health risk appraisal in health promotion and disease prevention? - ✔✔-a. It is the evaluation of risk factors a