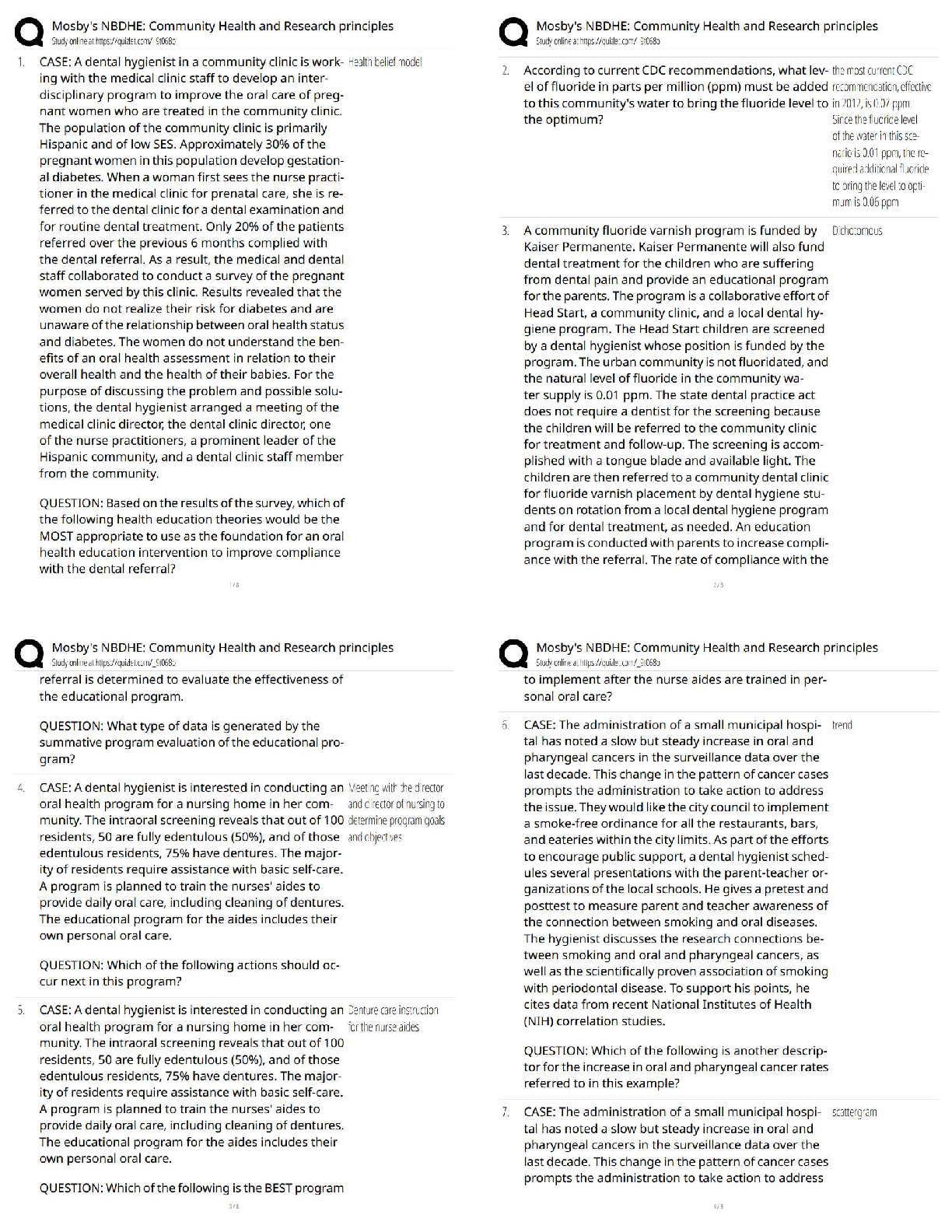

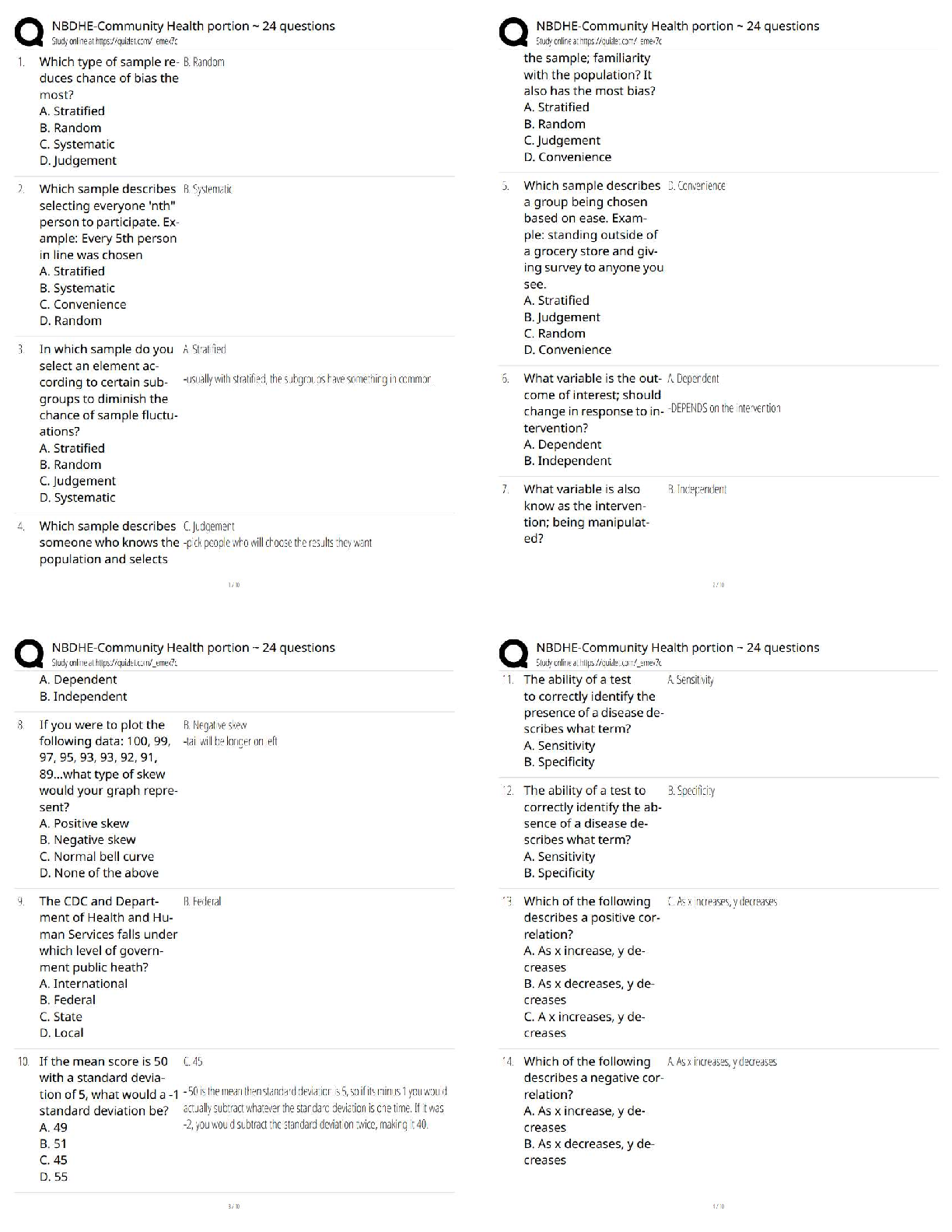

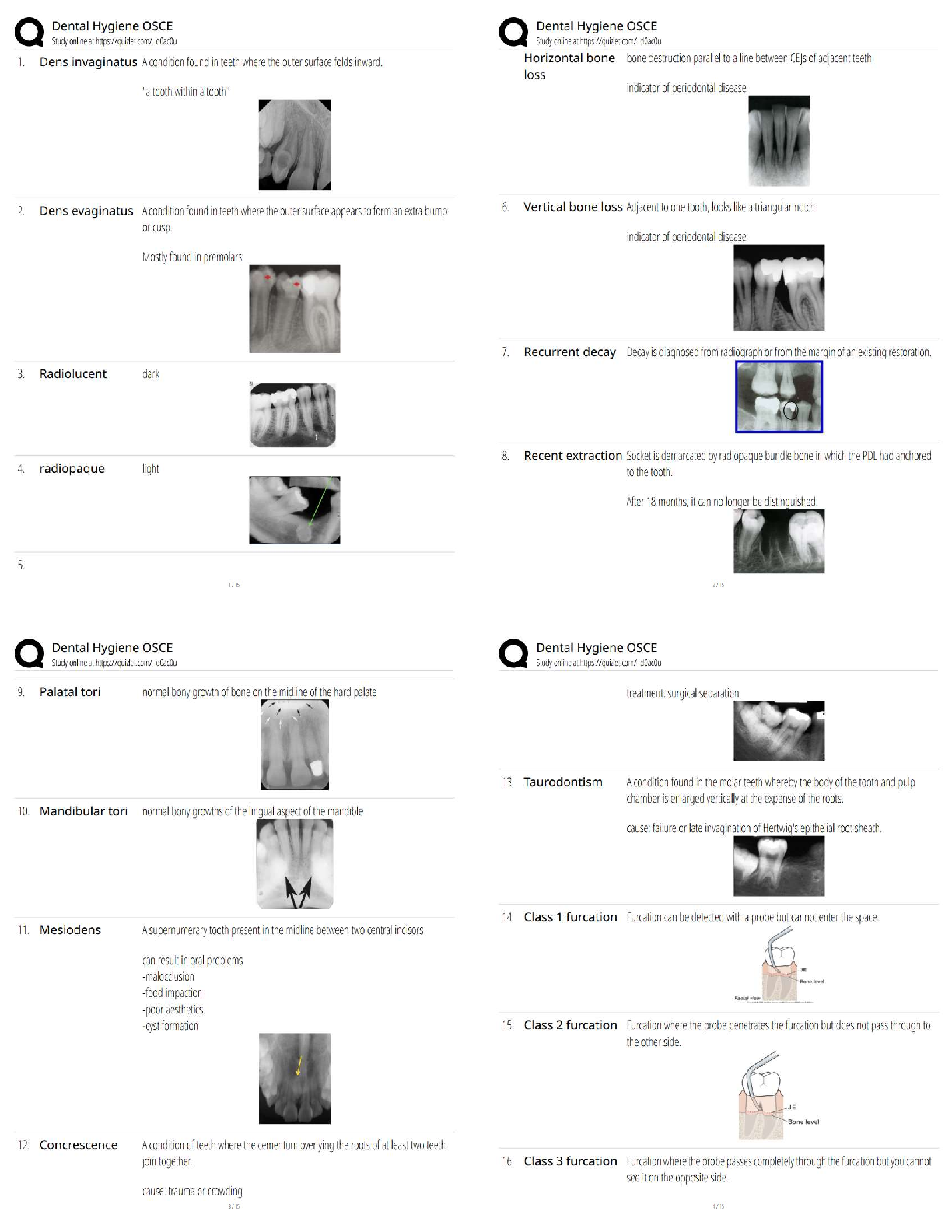

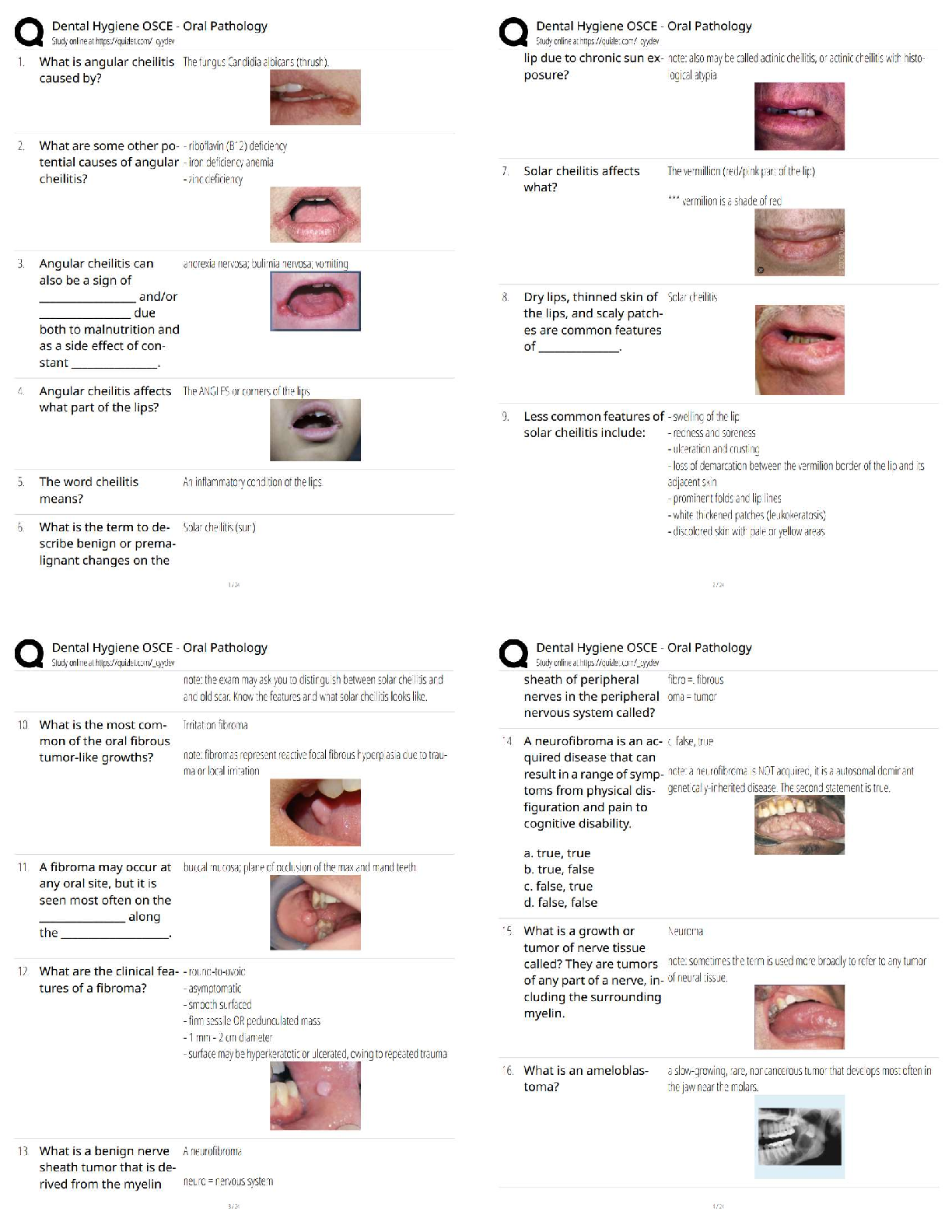

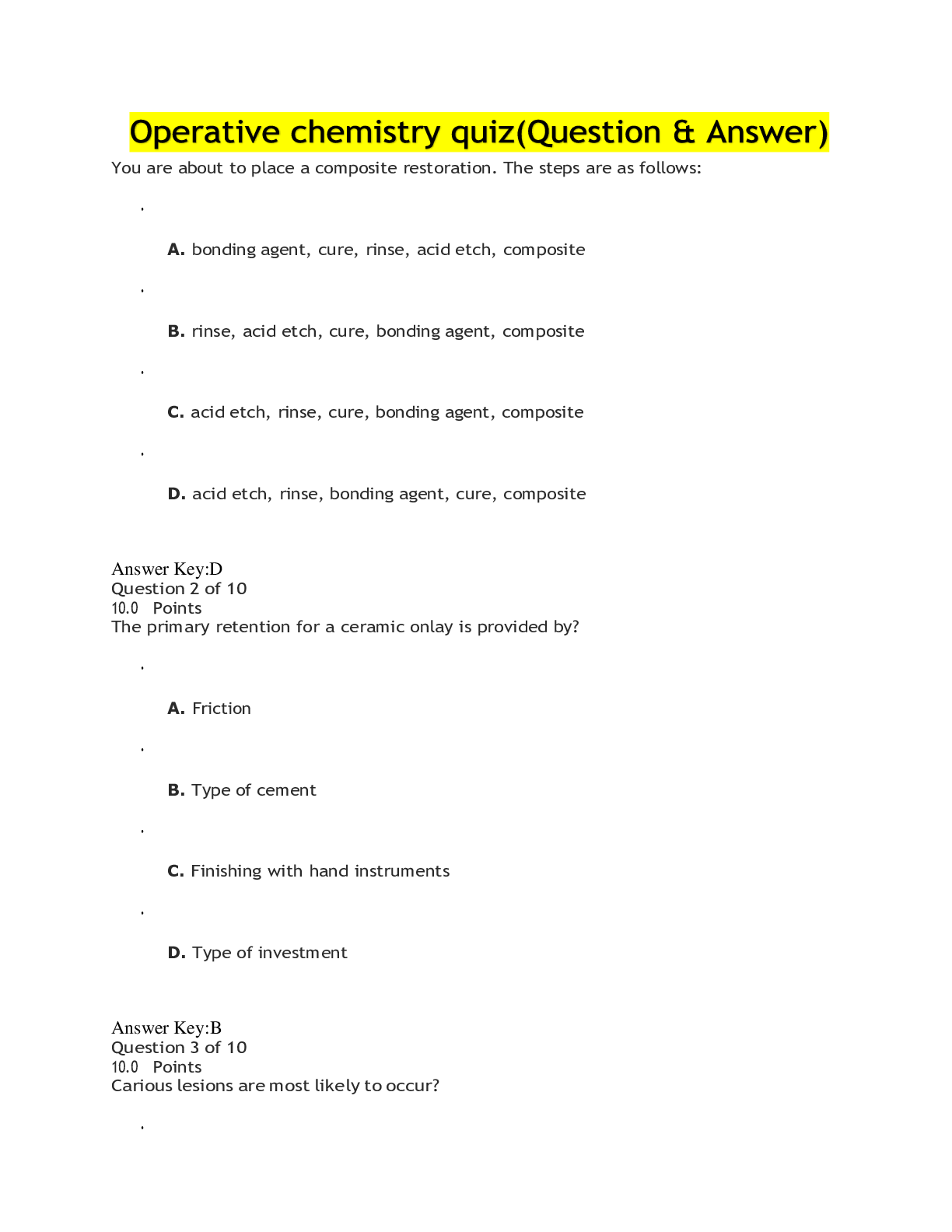

Financial Accounting > QUESTIONS & ANSWERS > ACCT 212 Week 2 Quiz (Summer 2020) (All)

ACCT 212 Week 2 Quiz (Summer 2020)

Document Content and Description Below

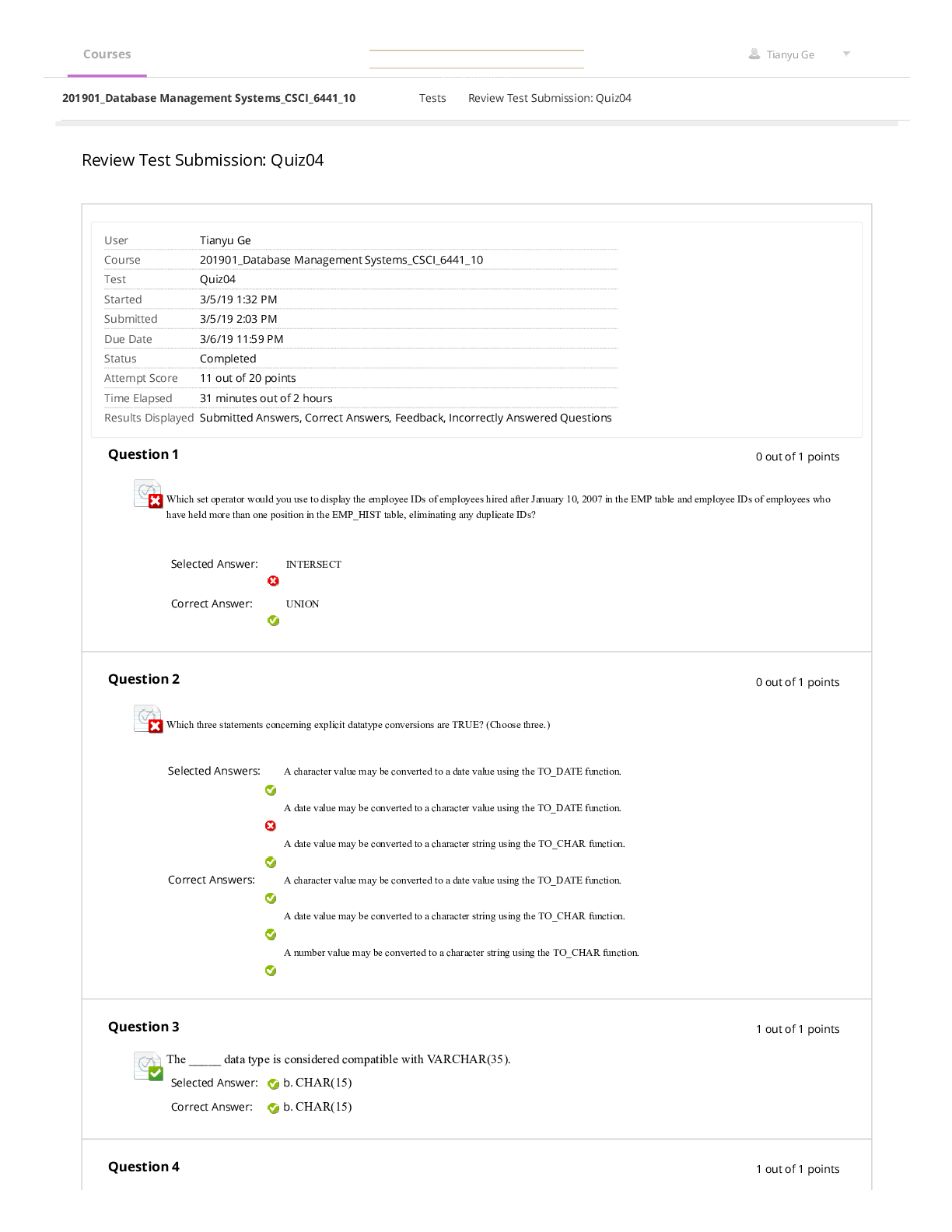

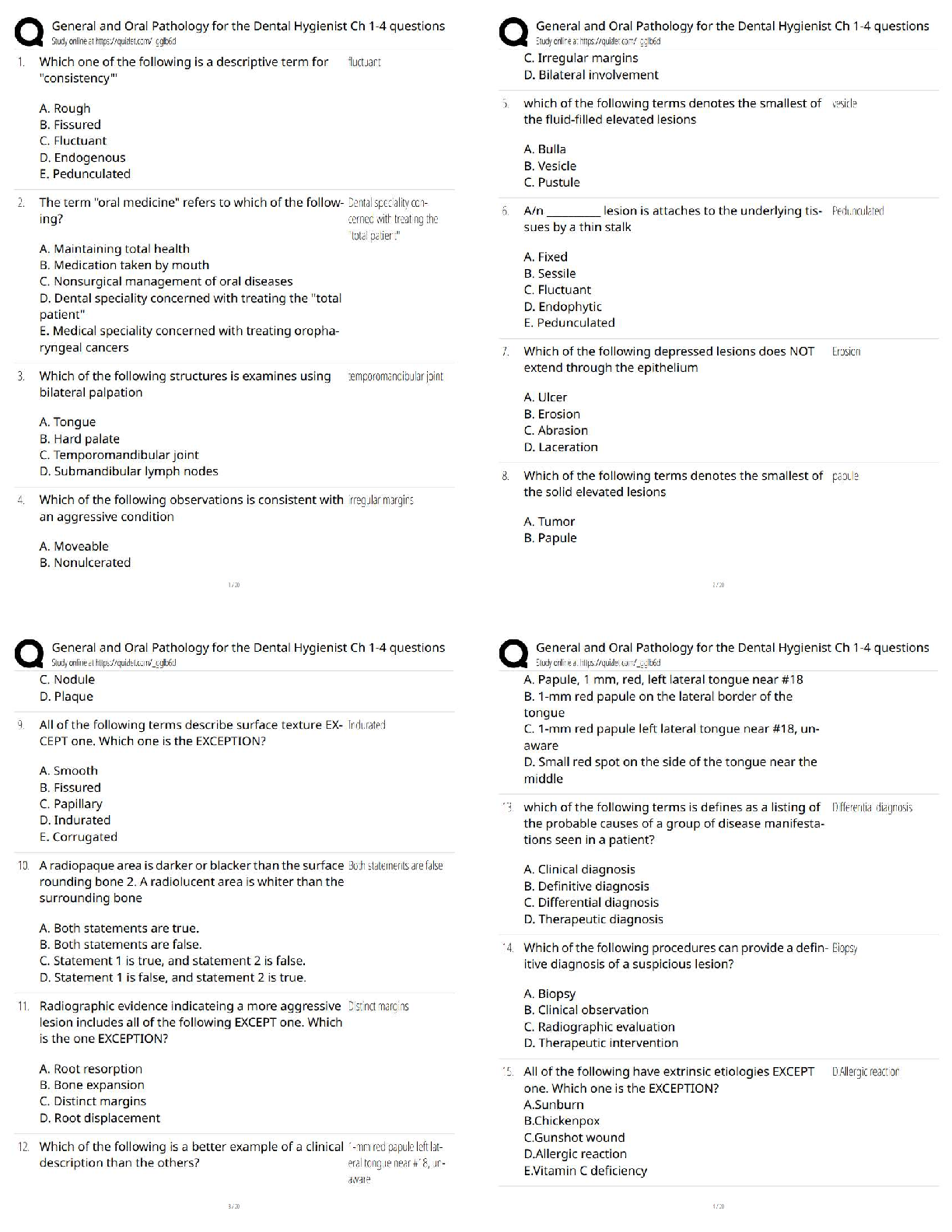

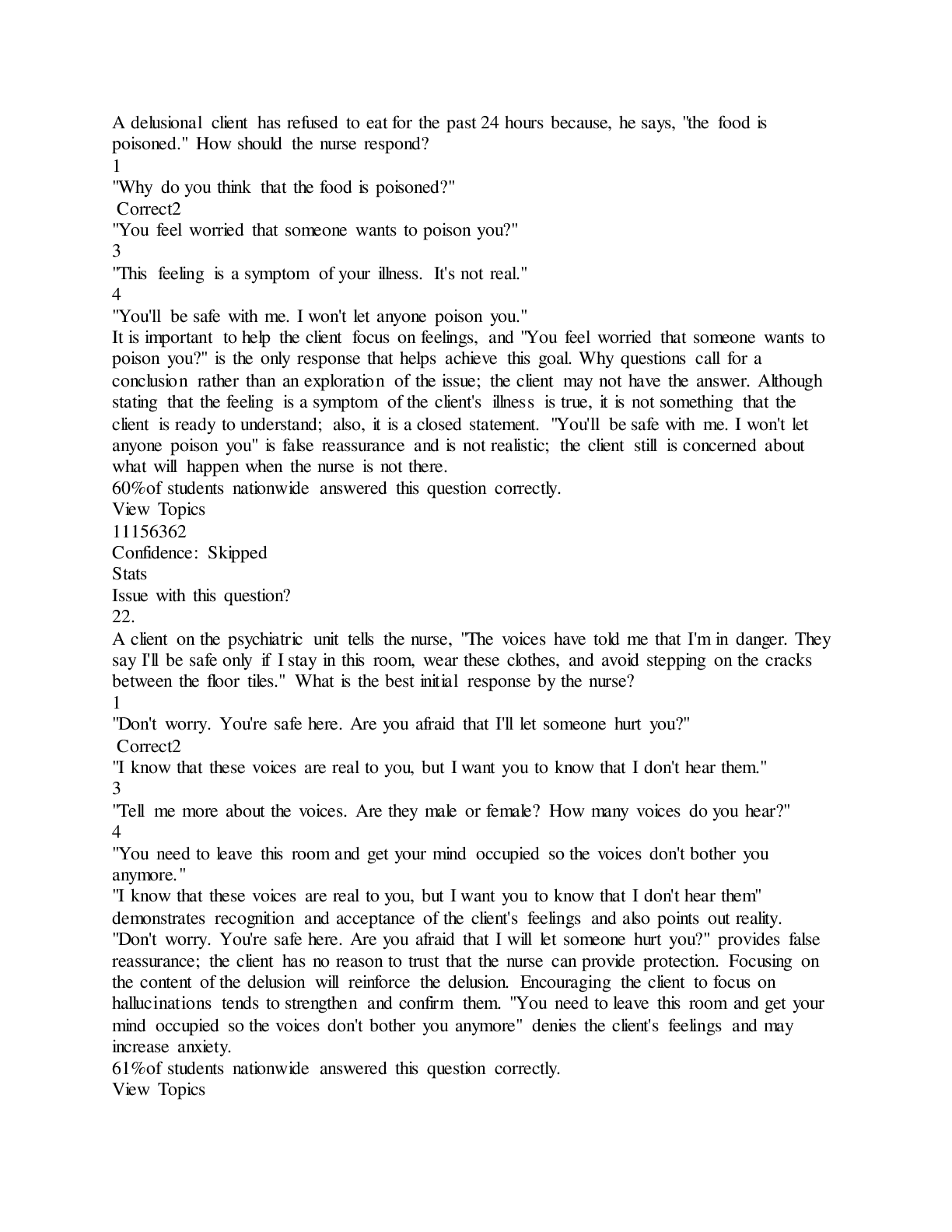

Question: A company completed the following transactions during the month of October: Question: A company had credit sales of $ 34,000 and cash sales of $ 20,000 during the month of May. Also during ... May, the company paid wages of $ 25,000 and utilities of $ 10,000. It also received payments from customers on account totaling $ 5,200. What was the company’s net income for the month? Question: A company received $ 34,000 cash and issued common stock in exchange. How does this transaction affect the accounting equation? Question: Which accounts are … by debits? Question: Posting is: Question: A business paid $ 3,100 on account. The journal entry would: Question: On May 1, a business provided legal services to a client and billed the client $ 2,400. The client promised to pay the business in one month. Which journal entry should the business record on May 1? Question: The Accounts Receivable account for Johnny’s Mechanic Shop had a beginning balance of $ 36,000. During the month, Johnny made sales on account of $ 42,000. The ending balance in the Accounts Receivable account is $ 32,000. What are cash collections for the month? Question: A company completed the following transactions during the month of October: Question: What was the company’s net income for the month? [Show More]

Last updated: 3 years ago

Preview 1 out of 12 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$14.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 13, 2021

Number of pages

12

Written in

All

Additional information

This document has been written for:

Uploaded

Aug 13, 2021

Downloads

0

Views

83

(1).png)

q&a.png)

.png)