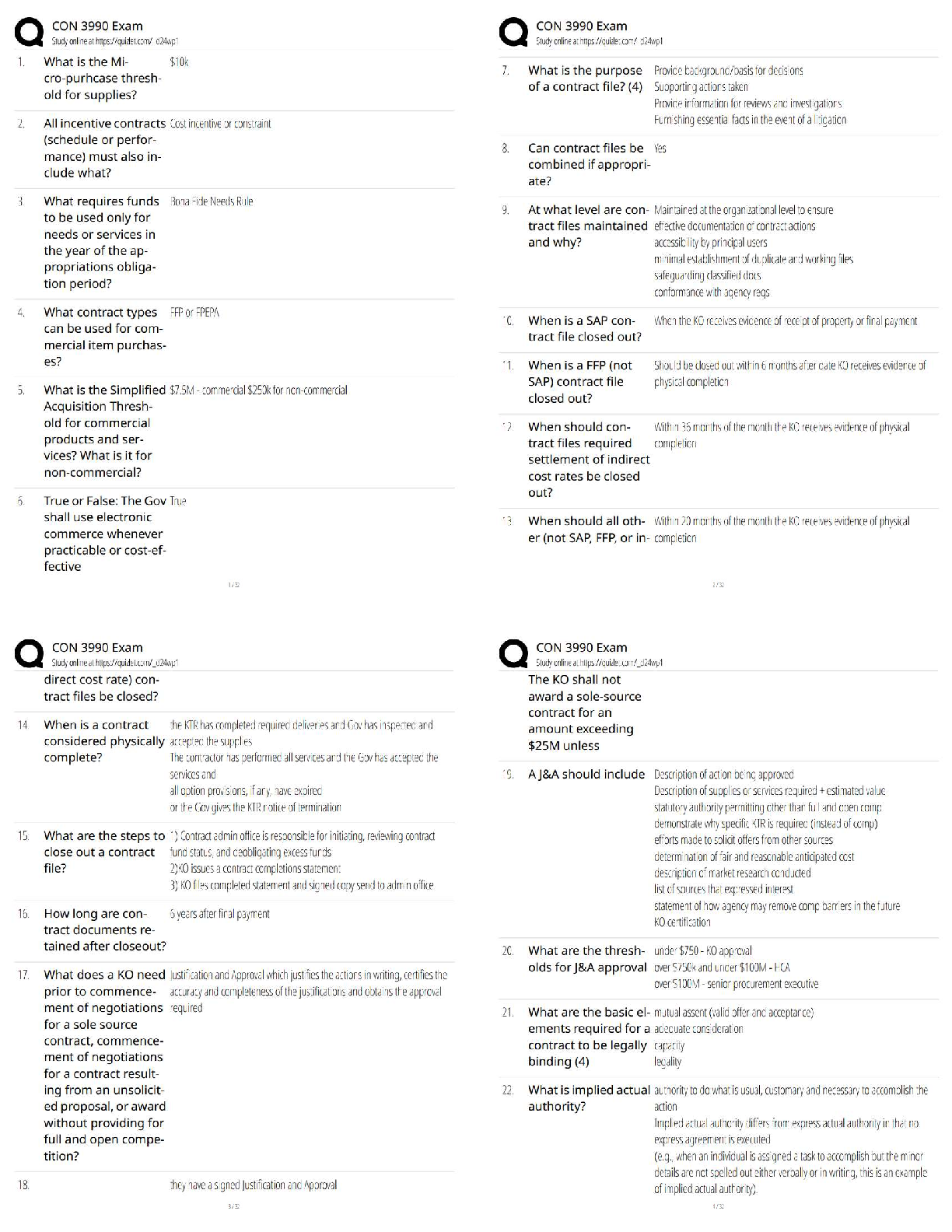

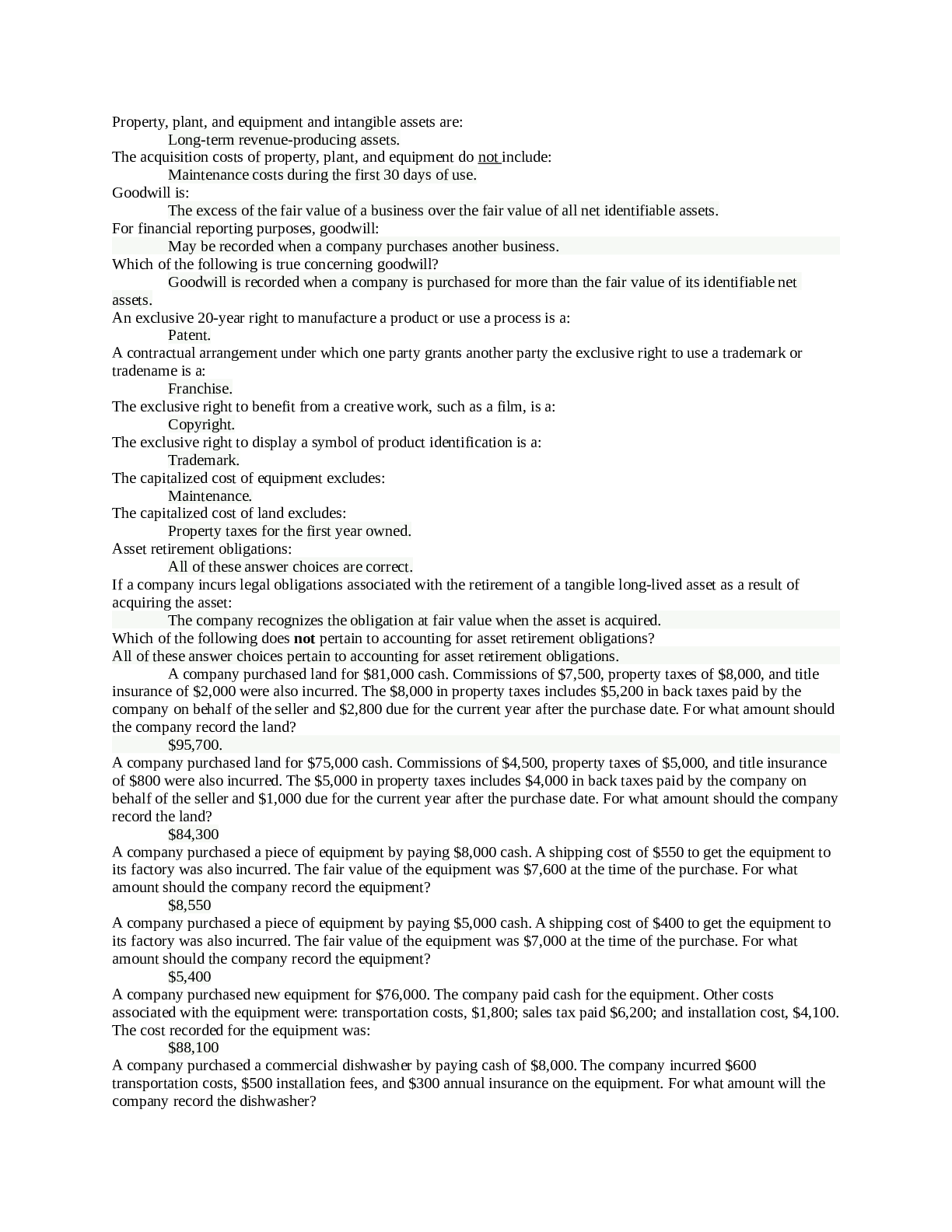

1. Question: Which of the following expenditures should … as an asset? Interest costs during the construction period of a new building.

2. Question: A company purchased land and building from a seller for $900,000. A

...

1. Question: Which of the following expenditures should … as an asset? Interest costs during the construction period of a new building.

2. Question: A company purchased land and building from a seller for $900,000. A separate appraisal reveals the fair value of the land to … $200,000 and the fair value of the building to … $800,000. For what amount would the company record land at the time of purchase?

3. Question: Kansas Enterprises … equipment for $80,500 on January 1, 2021. The equipment is expected to have a ten-year service life, with a residual value of $7,350 at the end of ten years.

Using the straight-line method, depreciation expense for 2021 would … : Cost of Equipment: $80,500

Less: salvage value: $7,350 Depreciatable value: $73,150 Estimated Life: 10 years

4. Question: Kansas Enterprises … equipment for $74,000 on January 1, 2021. The equipment is expected to have a five-year service life, with a residual value of $7,800 at the end of five years.

Using the double-declining balance method, depreciation expense for 2021 would … : (Do not round your intermediate calculations)

5. Question: Western Wholesale Foods incurs the following expenditures during the current fiscal year. How should Western account for each of these expenditures?

6. Question: Which of the following is not a current liability? An … line of credit.

7. Question: The Pita Pit borrowed $190,000 on November 1, 2021, and … a six- month note bearing interest at 12%. Principal and interest are payable in full at maturity on May 1, 2022.

In connection with this note, The Pita Pit should report interest expense at December 31, 2021, in the amount of: (Do not round your intermediate calculations.)

1 November 01, 2021 ($190,000 x 12% x 2 / 12) = $3,800

2 December 31, 2021 ($190,000 x 12% x 1 / 12) = $1,900

3 February 01, 2022 ($190,000 x 12% x 2 / 12) = $3,800

a. The Pita Pit borrowed $200,000 on November 1, 2021, and … a six-month note bearing interest at 12%. Principal and interest are payable in full at maturity on May 1, 2022.

In connection with this note, The Pita Pit should report interest expense at December 31, 2021, in the amount of: (Do not round your intermediate calculations.)

8. Question: Which of the following is not an advantage of debt financing?

9. Question: In each succeeding payment on an installment note: The amount that goes to interest expense decreases

10. Question: If bonds are … with a stated interest rate higher than the market interest rate, the bonds will … issued at

A Premium

[Show More]

(1).png)

q&a.png)

.png)