ACCT 212 Week 7 Homework

Preston Stores is authorized to issue 18,000 shares of common stock. During a two-month period,

Preston completed these stocktransactions:

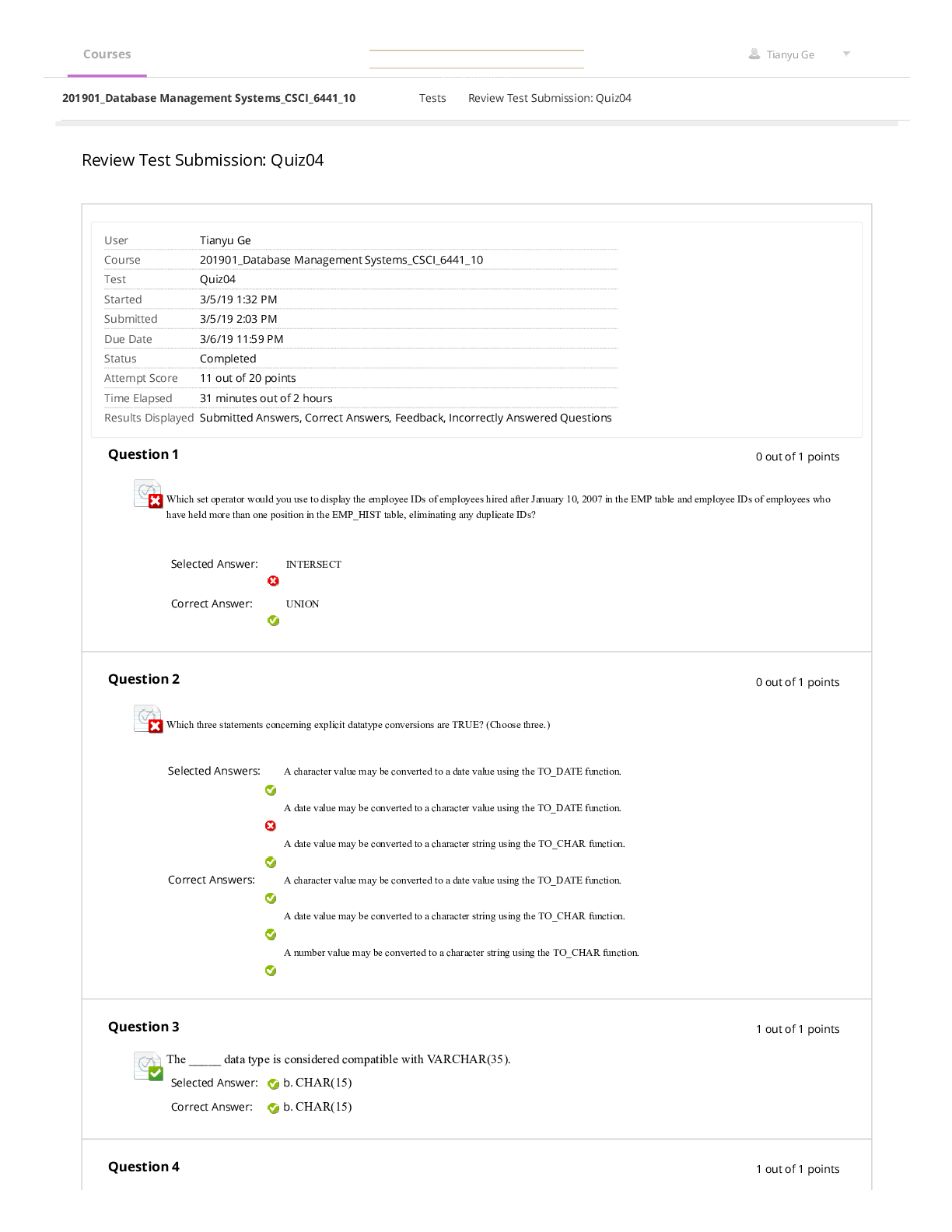

Question 1a: Journalize the first transaction. (Recor

...

ACCT 212 Week 7 Homework

Preston Stores is authorized to issue 18,000 shares of common stock. During a two-month period,

Preston completed these stocktransactions:

Question 1a: Journalize the first transaction. (Record debits first, then credits. Exclude explanations

from any journal entries.)

Answer 1a:

Explanation 1a: We are told that on February 23, the company issued 1,700 shares of $2.00 par

common stock for cash of $12.50 per share. Before we can journalize the transaction, recall that the

cash received is determined by multiplying the number of shares issued by the issue price per share.

Also recall that the par value of the stock is credited to Common Stock and the remainder is credited to

Paid-in Capital in Excess of Par-Common.

Question 1b: Journalize the second transaction. (Record debits first, then credits. Exclude

explanations from any journal entries.)

Answer 1b:

Explanation 1b: Next we are told that on March 12, the company received inventory with a market

value of $15,000 and equipment with market value of $45,000 for 2,900 shares of the $2.00 par

common stock. Recall that Common Stock is increased by the number of shares issued times the par

value. The amount over the par value is credited to Paid-in Capital.

Question 1c: The company's Retained Earnings account has a balance of $44,000. Prepare

the stockholders' equity section of Preston's balance sheet for the transactions. Begin by selecting the

appropriate accounts for the balance sheet.

Answer 1c:

Explanation 1c: When reporting stockholders' equity on the balance sheet, a corporation lists its

accounts in this order:

Preferred stock (whenever it exists) comes first and is usually reported as a single amount.

Common stock lists the par value per share, the number of shares authorized, the number of

shares issued, and the number of shares outstanding.

Additional paid-in capital combines Paid-in capital in excess of par plus Paid-in capital from

other sources. Additional paid-in capital belongs to the common stockholders.

Outstanding stock equals issued stock minus treasury stock.

Retained earnings comes after the paid-in capital accounts.

Treasury stock is reported, usually at cost, as a deduction.

Accumulated other comprehensive income is added (or accumulated other comprehensive

loss is deducted). This account may be listed either before or after Treasury Stock.

Begin by selecting the appropriate accounts for the stockholders' equity portion of

Preston Stores' balance sheet. Use the transaction information provided and the information to help

you determine which accounts to report.

Question 1d: Calculate the total par value of all common stock issued during the period using the

information given. (Enter the accounts in the proper order for the stockholders' equity section of the

balance sheet.)

Answer 1d:

Most corporations issue common stock for a price above par. Because the entity is dealing with its

own stockholders, a sale of stock above par does not result in a gain, income, or profit to the

corporation. Therefore, a company will credit its Common Stock account for the par value or

stated value, with any excess credited to additional paid-in capital.

Explanation 1d: Stock may be par value stock or no-par value stock. Par value stock is stock with an

arbitrary amount assigned to each share when it is originally authorized by the corporate charter. Nopar stock does not have par value. Most companies set the par value of their common stock low to

avoid future legal difficulties. When a corporation sells par value common stock, the par value per

share multiplied by the number of shares sold is credited to the Common Stock account. The par value

of the common stock issued is separated out and reported on the Common Stock line of the balance

sheet. We are told that Preston Stores is authorized to issue 18,000 shares of common stock.

Question 1e: Determine the total additional paid-in capital attributable to the common stock

transactions during the period using the T-account below.

Answer 1e:

Explanation 1e: When a corporation issues stock and receives assets other than cash, the company

records the assets received at their current market value and credits the stock and additional paid-in

capital accounts accordingly. The assets' prior book value isn't relevant because the stockholder will

demand stock equal to the market value of the asset given.

Question 1f: The company's Retained Earnings account has a balance of $44,000. Complete the

statement by calculating totalstockholders' equity

[Show More]

(1).png)

q&a.png)

.png)