Finance > TEST BANKS > Chapter 04 Long-Term Financ FIN 3716 (All)

Chapter 04 Long-Term Financ FIN 3716

Document Content and Description Below

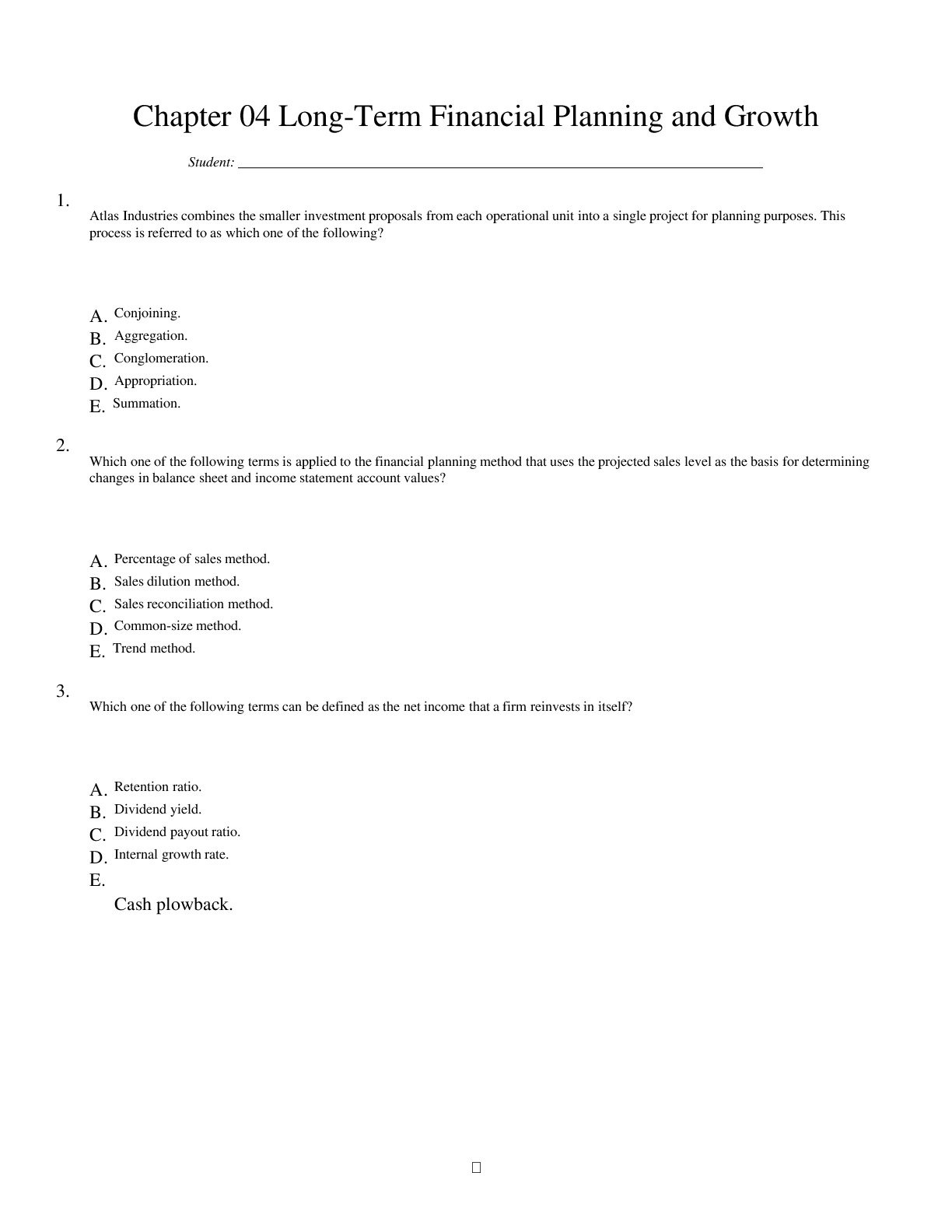

Chapter 04 Long-Term Financ FIN 3716 Chapter 04 LongTerm Financial Planning and Growth Student: ___________________________________________________________________________ 1. Atlas Ind ... ustries combines the smaller investment proposals from each operational unit into a single project for planning purposes. This process is referred to as which one of the following? A. Conjoining. B. Aggregation. C. Conglomeration. D. Appropriation. E. Summation. 2. Which one of the following terms is applied to the financial planning method that uses the projected sales level as the basis for determining changes in balance sheet and income statement account values? A. Percentage of sales method. B. Sales dilution method. C. Sales reconciliation method. D. Commonsize method. E. Trend method. 3. Which one of the following terms can be defined as the net income that a firm reinvests in itself? A. Retention ratio. B. Dividend yield. C. Dividend payout ratio. D. Internal growth rate. E. Cash plowback. 4. Which one of the following ratios identifies the amount of total assets a firm needs in order to generate $1 in sales? A. Return on assets. B. Equity multiplier. C. Retention ratio. D. Capital intensity ratio. E. Fixed asset turnover ratio. 5. The internal growth rate of a firm is best described as the: A. Minimum growth rate achievable assuming a 100 percent retention ratio. B. Minimum growth rate achievable if the firm maintains a constant equity multiplier. C. Maximum growth rate achievable excluding external financing of any kind. D. Maximum growth rate achievable excluding any external equity financing while maintaining a constant debtequity ratio. E. Maximum growth rate achievable with unlimited debt financing. 6. The sustainable growth rate of a firm is best described as the: A. Minimum growth rate achievable assuming a 100 percent retention ratio. B. Minimum growth rate achievable if the firm maintains a constant equity multiplier. C. Maximum growth rate achievable excluding external financing of any kind. D. Maximum growth rate achievable excluding any external equity financing while maintaining a constant debtequity ratio. E. Maximum growth rate achievable with unlimited debt financing. 7. You are developing a financial plan for a corporation. Which of the following questions will be considered as you develop this plan? I. How much net working capital will be needed? II. Will additional fixed assets be required? III. Will dividends be paid to shareholders? IV. How much new debt must be obtained? A. I and IV only. B. II and III only. C. I, III, and IV only. D. II, III, and IV only. E. I, II, III, and IV. [Show More]

Last updated: 2 years ago

Preview 1 out of 133 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$8.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 18, 2021

Number of pages

133

Written in

All

Additional information

This document has been written for:

Uploaded

Aug 18, 2021

Downloads

0

Views

60

.png)

.png)