.png)

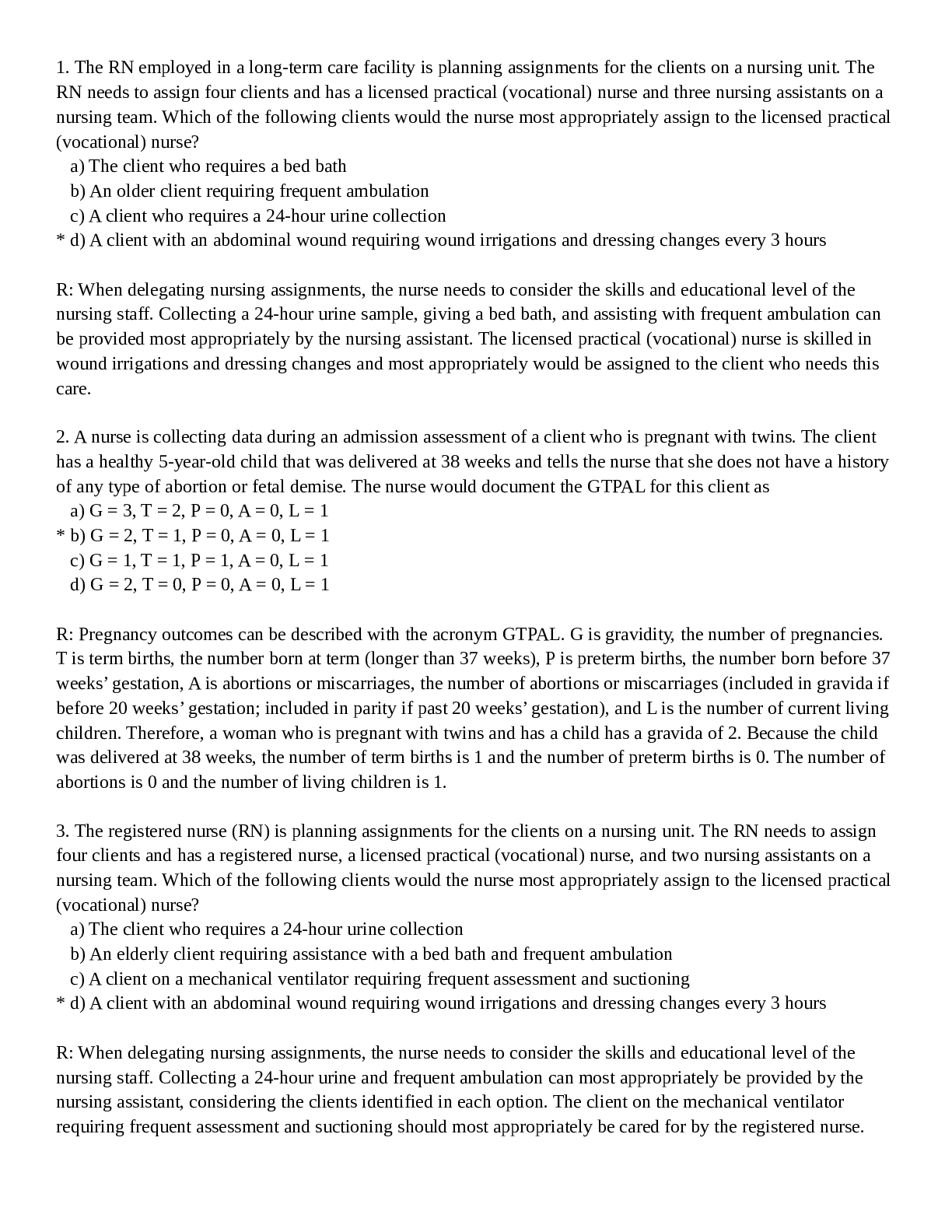

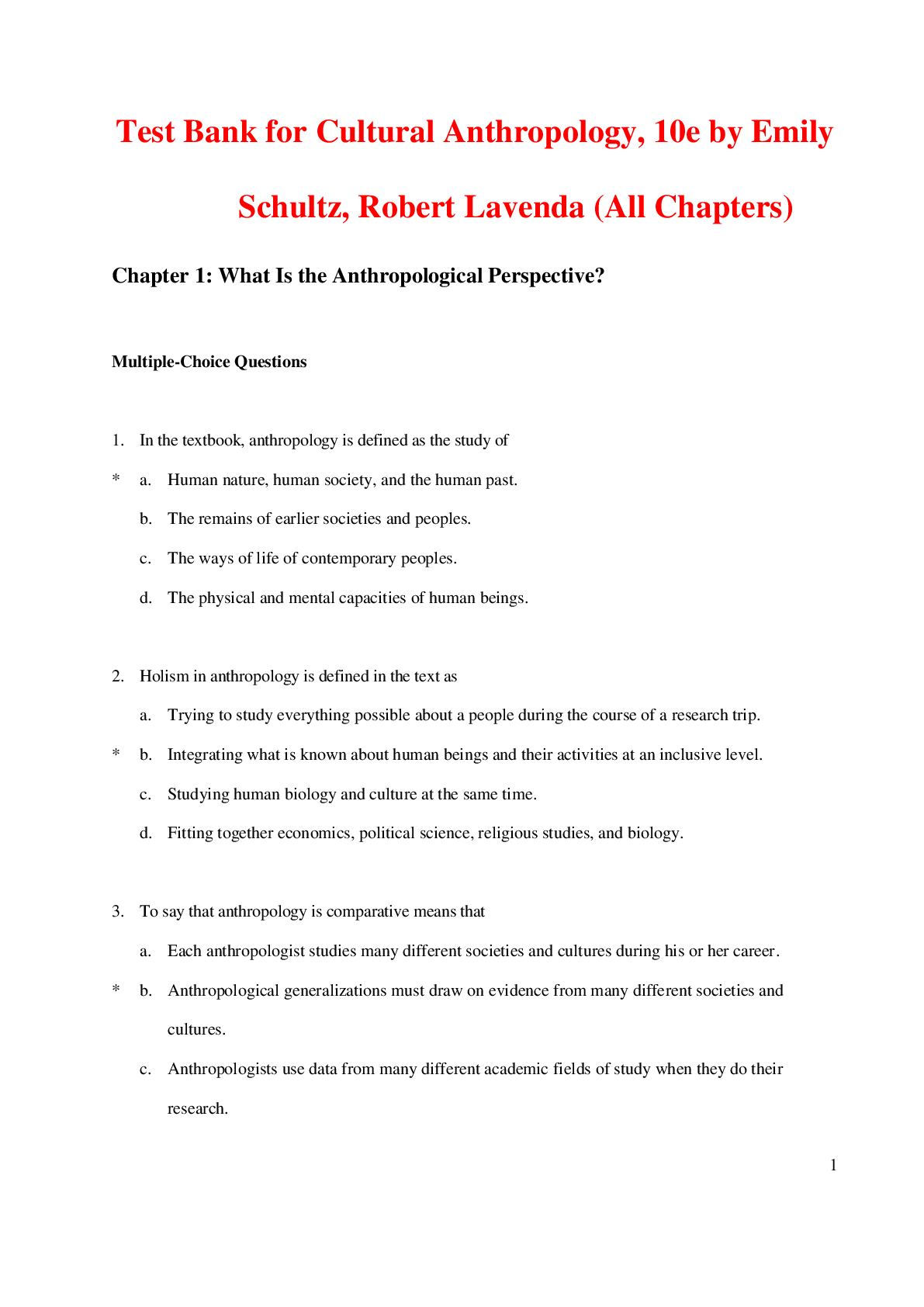

NYC Food Protection Quizzes (1-15 Combined)

$ 16

Portage Learning- BIOD 151 Exam 1-2022

$ 10.5

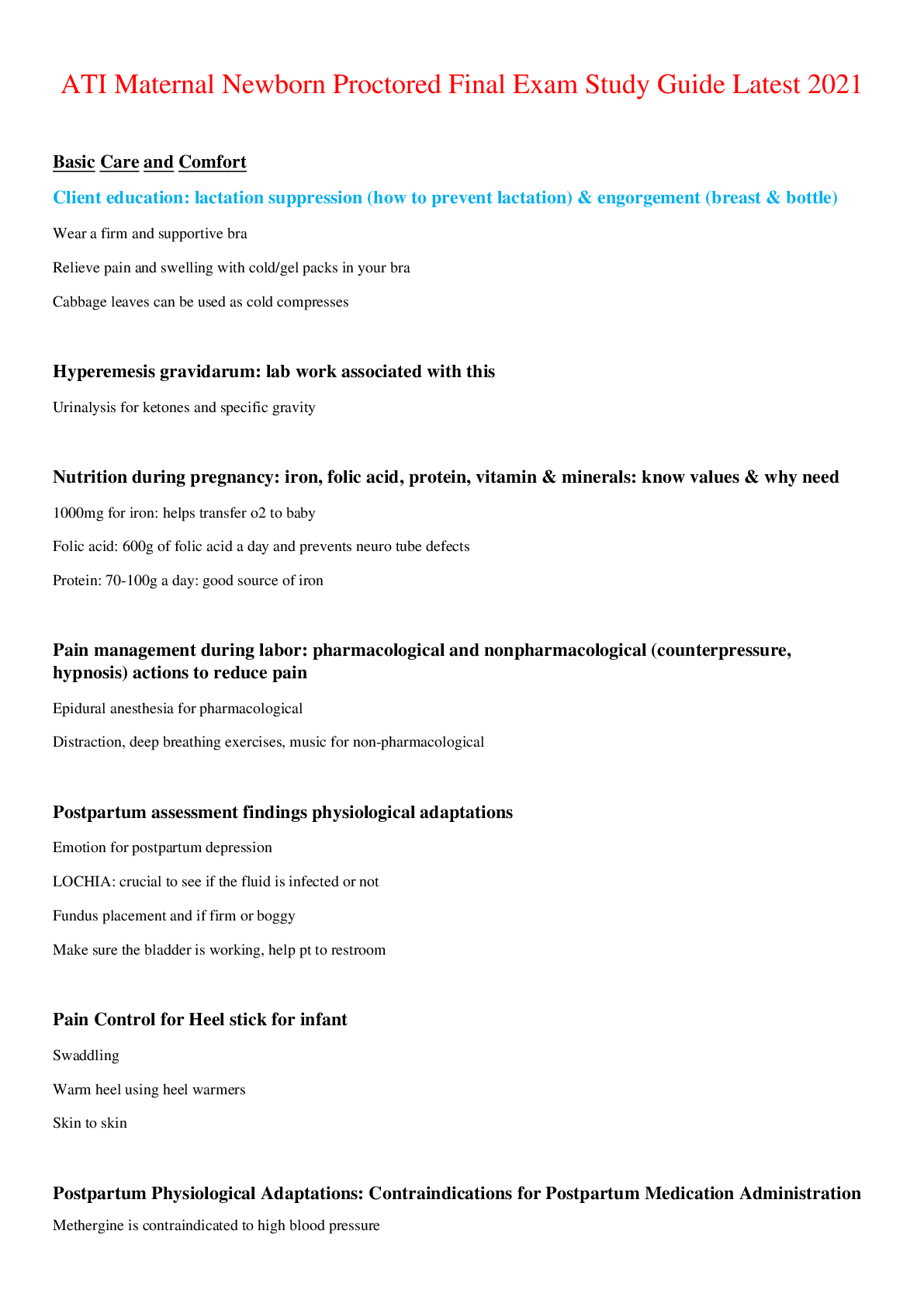

ATI Maternal-Newborn Proctored Final Exam Study Guide Latest 2021

$ 14

PN Hesi Exit Exam 2021.

$ 15

AQA A-level BIOLOGY 7402/2 Paper 2 2019 Mark scheme

$ 8

NURS 680 B week 4 __ Already Graded A

$ 10.5

Lim quizzes and midterm

$ 13

NR 511 Week 1 Clinical Readiness Exam | 70 Questions and Answers

$ 11

Assignment_Week_6__EBP_Change_Process_FORM.docx (1) (1)

$ 12

ATI Community Health Proctor Exam latest

$ 9.5

NSG 6435 Peds FINAL USE

$ 17

GCSE (9-1) MATHEMATICS J560/03 Paper 3 (Foundation Tier) PRACTICE PAPER (SET 2) MARK SCHEME

$ 7.5

Exam_1_BIO_117_BIO_117_NEW_2023_2024_Introduction_to_Anatomy_and

$ 15

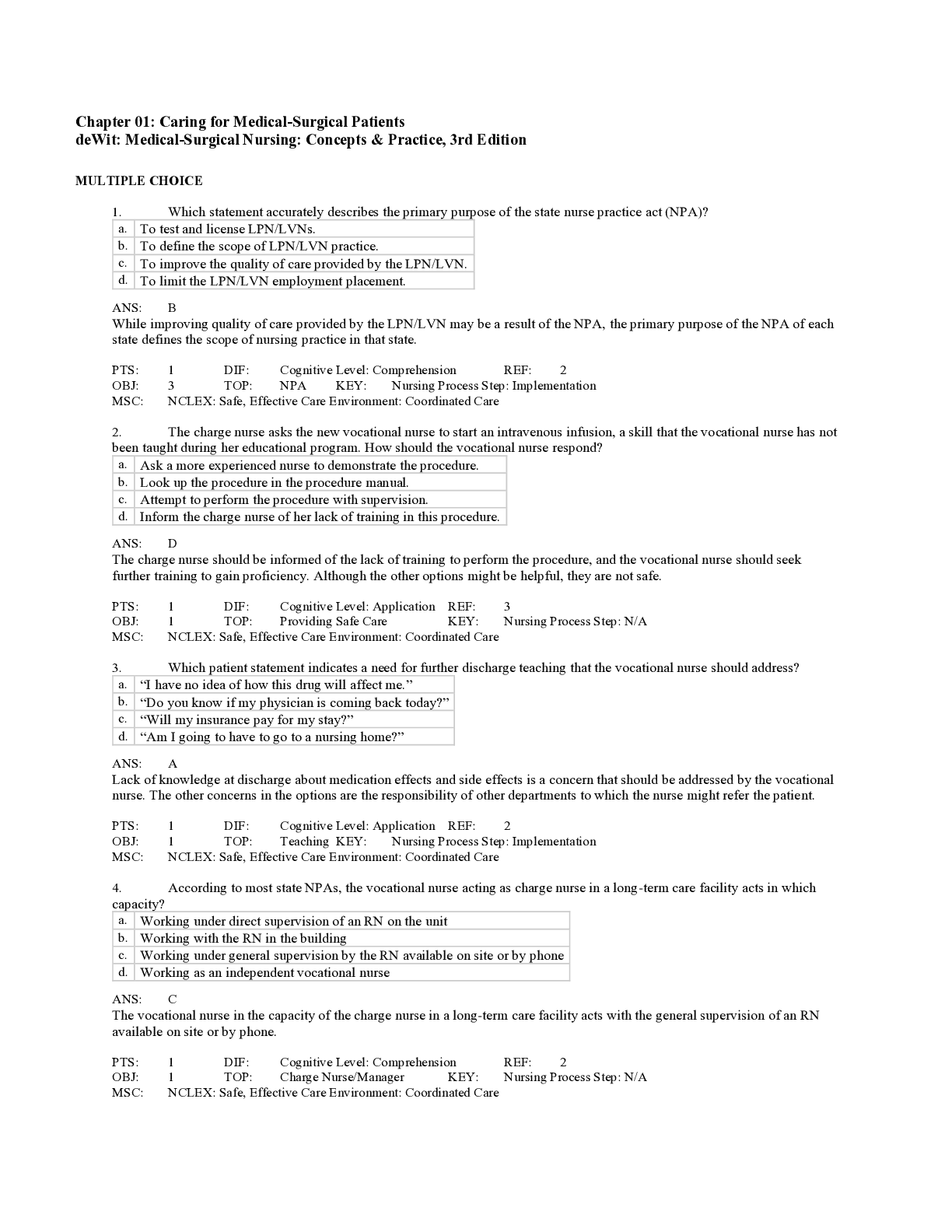

NCLEX-PN Exam Pack Part 6 Updated 2022 detailed solutions | All answers provided

$ 14

Physical Geography in Diagrams, 4th Edition By R.B Bunnett, Seema Parihar (eBook)

$ 25

ATI_Pharmacology_2019_B.docx (1)

$ 10

WGU C724 (Information Systems Management) Questions and Answers Already Passed

$ 8

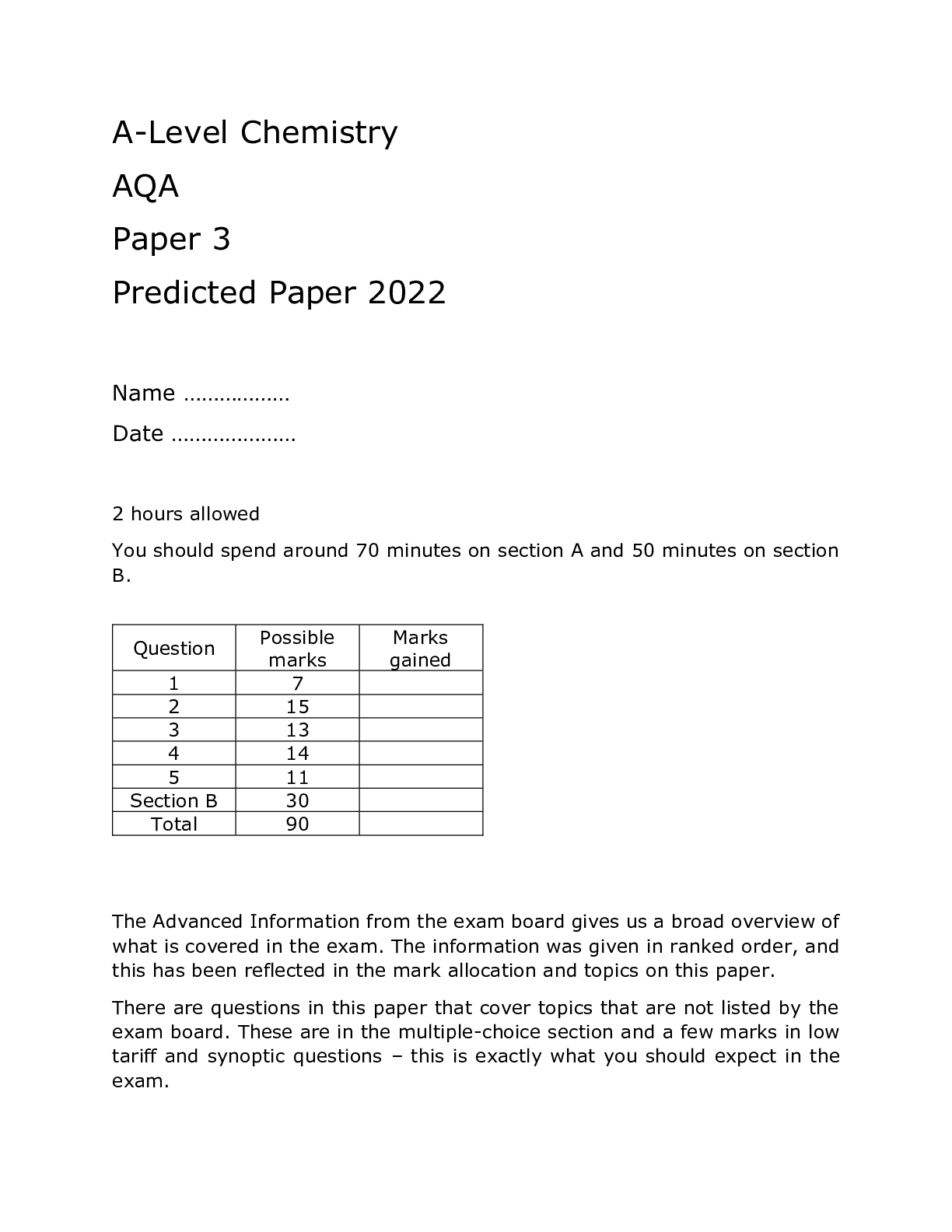

AQA_A Level Chemistry Paper 3_Predicted Paper 2022

$ 7.5

ATI comprehensive EXAM 2022

$ 10

ETHC 210 exam 8 liberty university practice exam updated solutions with questions and answers

$ 9

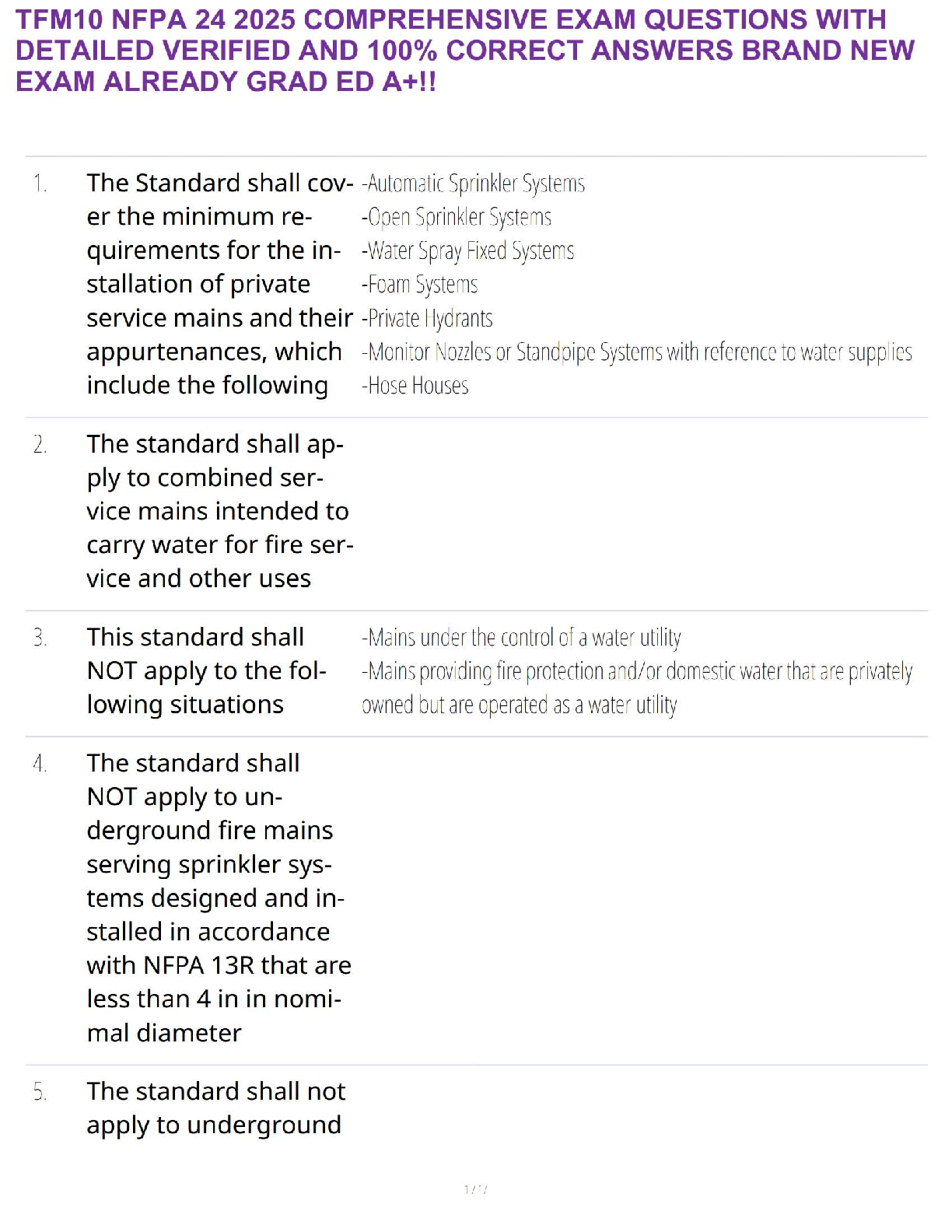

TFM10 – NFPA 24 (2025) Exam Guide | Comprehensive Questions with Verified & 100% Correct Answers (A+ Graded | Brand New)

$ 15.5

ASCP- Clinical Chemistry| 126 question| with complete solutions

$ 10

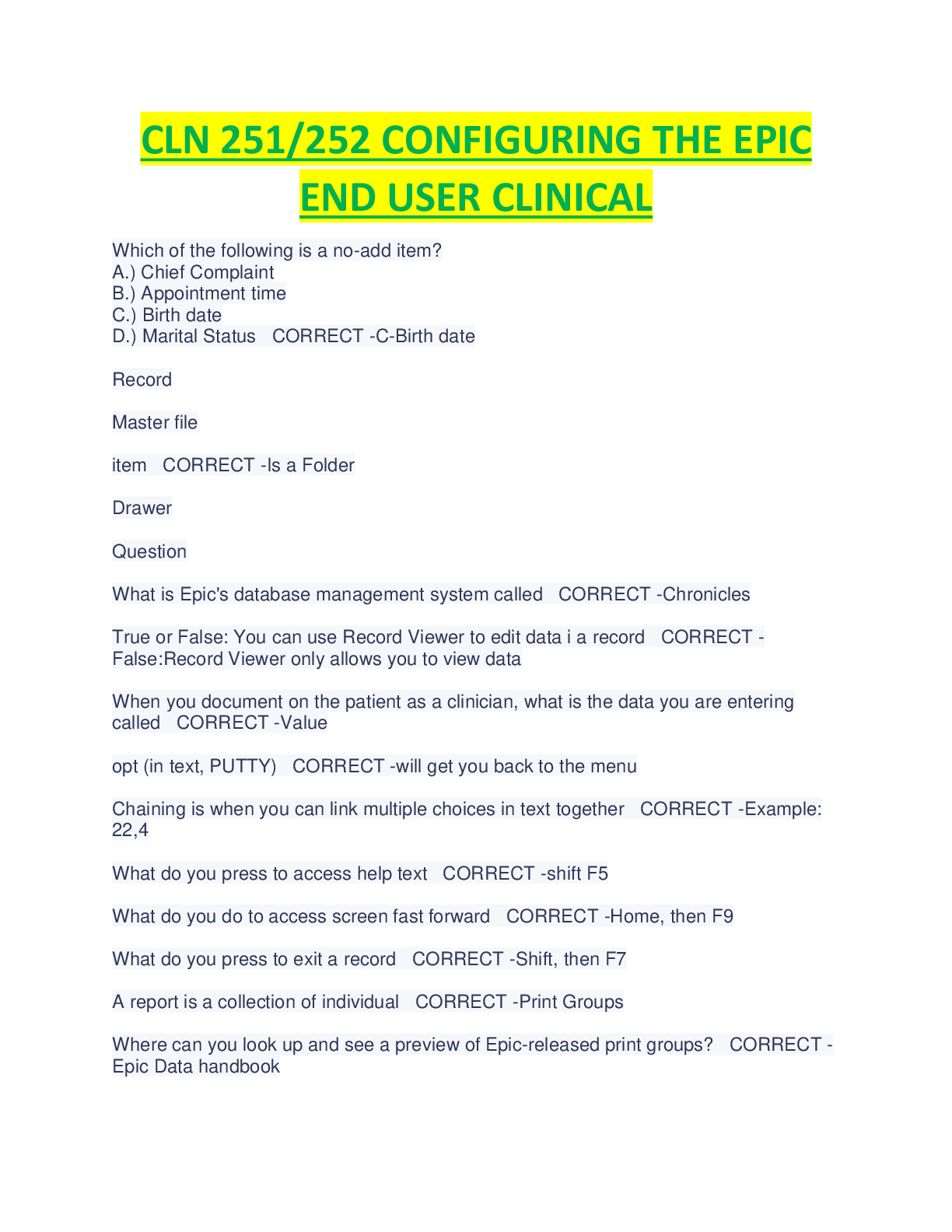

CLN 251/252-CONFIGURING THE EPIC| END USER CLINICAL ( SHARE END OF CHAPTER E-LEARNING) 2023 SERIES

$ 9.5

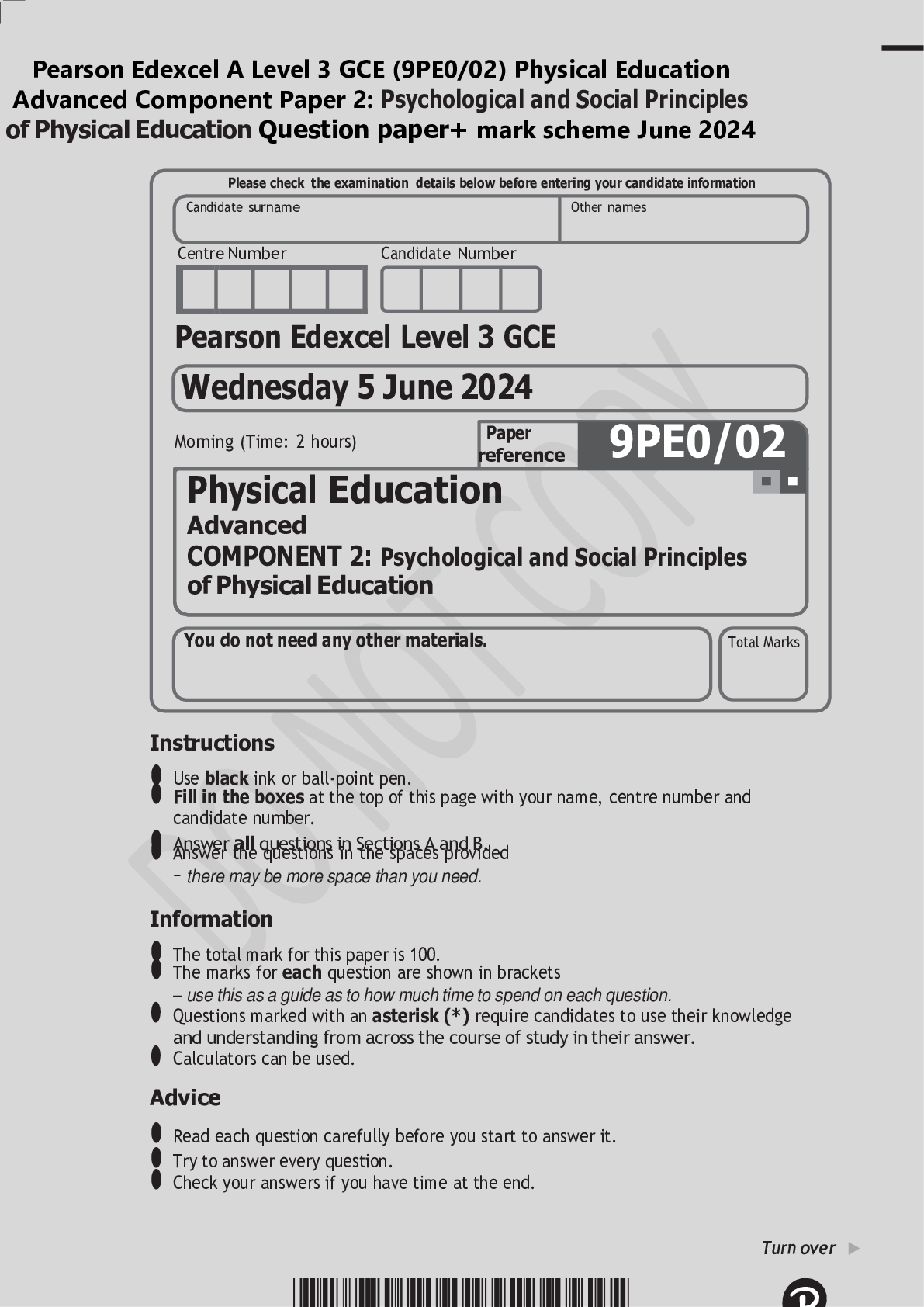

Pearson Edexcel A Level 3 GCE (9PE0/02) Physical Education Advanced Component Paper 2: Psychological and Social Principles of Physical Education Question paper+ mark scheme June 2024

$ 7

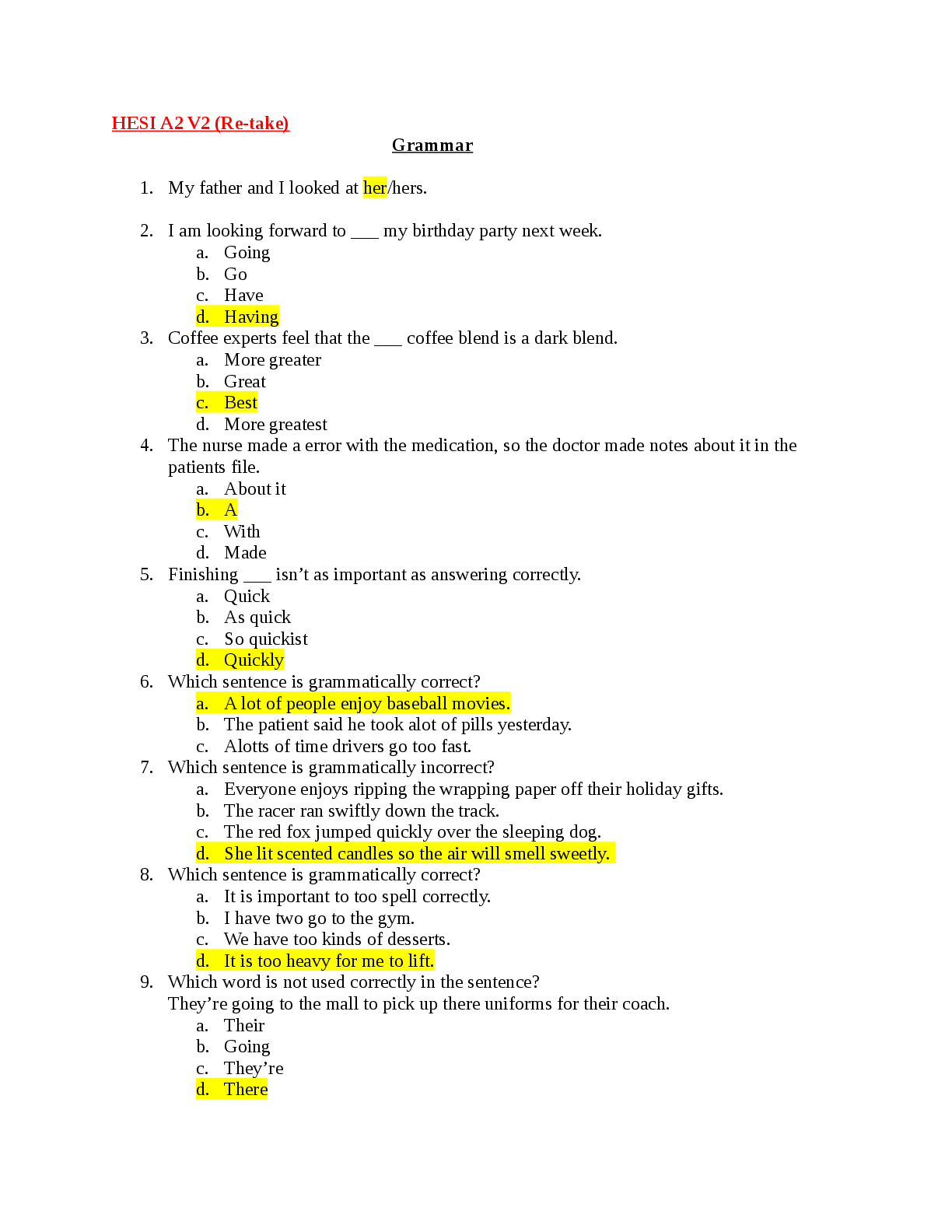

HESI A2 Study_Guide Questions and Answers

$ 20

eBook PDF Lifespan Development 5th Edition By Robert Feldman

$ 20

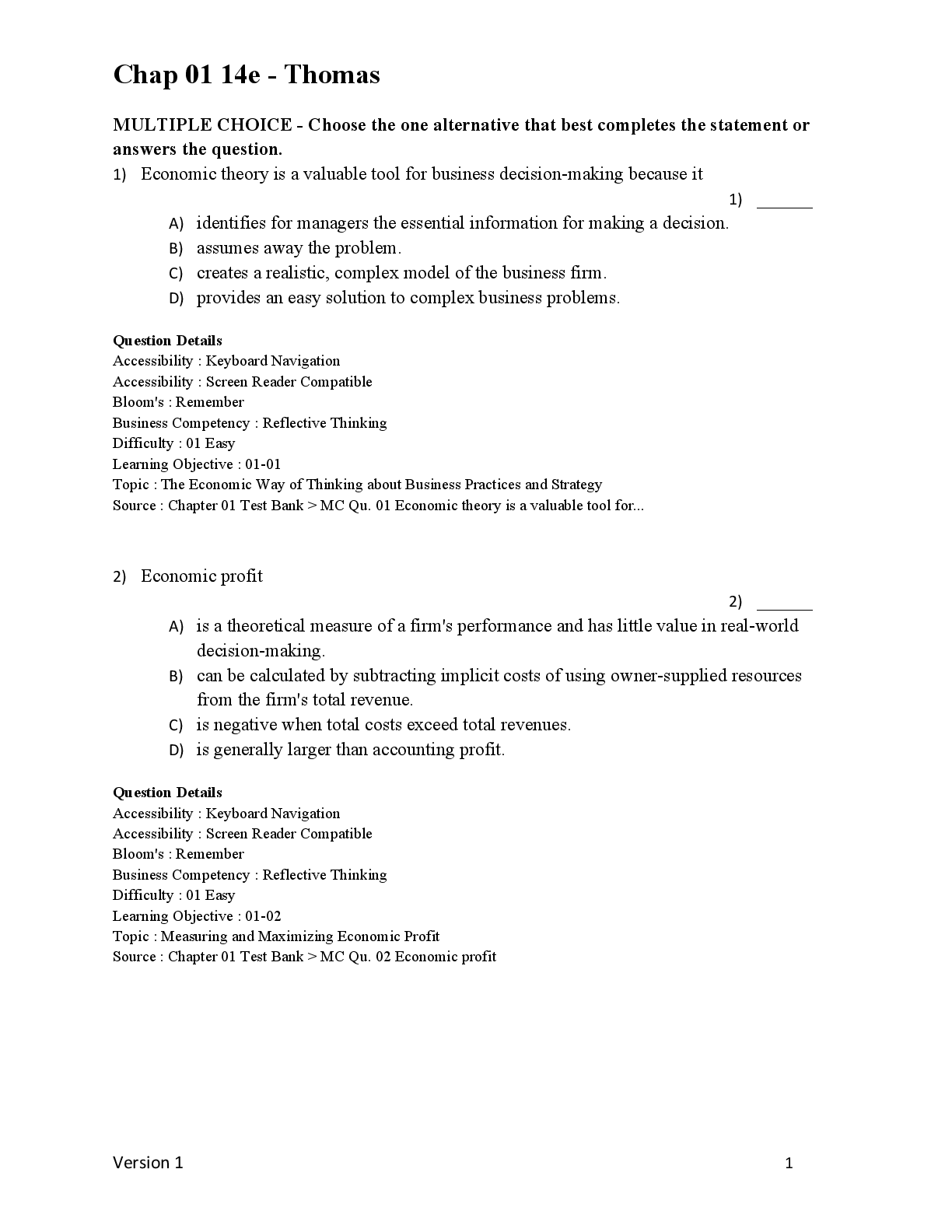

.png)

SCI 200--Unit 4 Challenge 1 Questions and Answers 100% Solved

$ 10

.png)

Pearson Edexcel Level 3 GCE Chemistry Advanced PAPER 3: General and Practical Principles in Chemistry 9CH0/03

$ 8

eBook [PDF] Introduction to Probability and Statistics for Engineers and Scientists 6th Edition By Sheldon Ross

$ 30

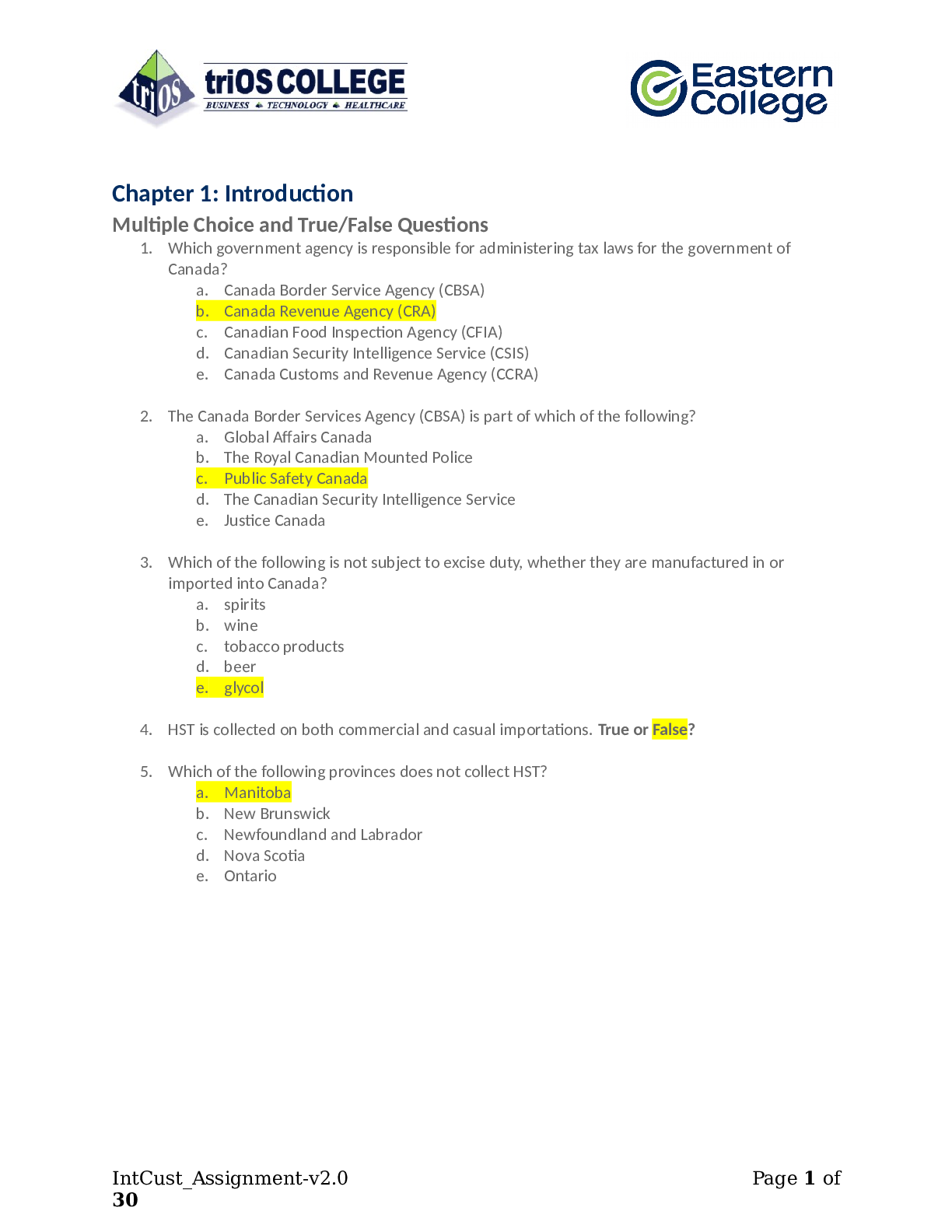

Assignment_File___Review_Questions_1749_( with 100% verified answers)

$ 7

LEG 100 - WEEK 8 - PAULA PLAINTIFFS REALLY BAD WEEK, PART 2

$ 6

AHIP - Final Examination-latest-with 100% verified answers-2022

$ 13

ATI Focus Review Remediated MEDSURG: 2016 complete solution A grade guide.

$ 9

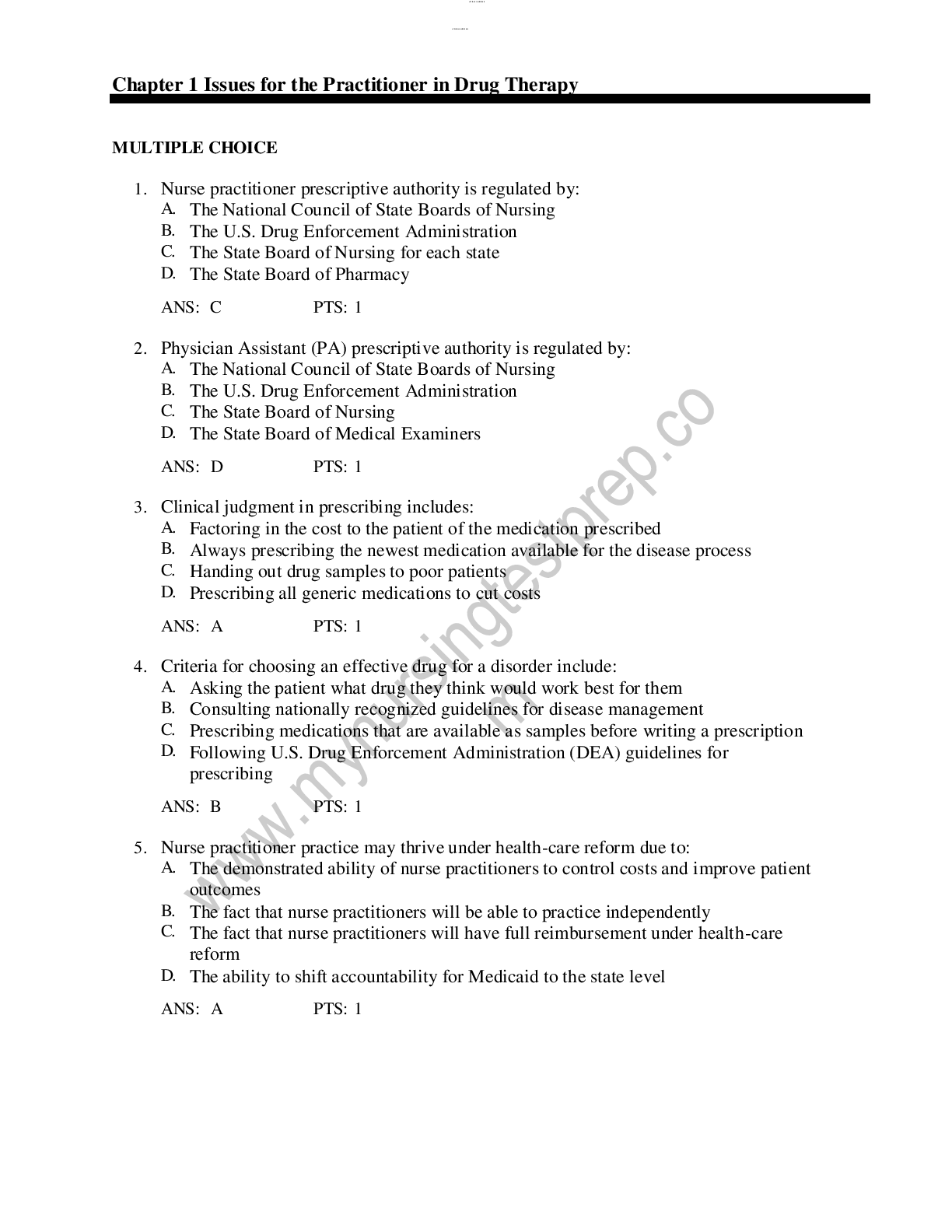

.png)

Psychology 1002 Manual

$ 12.5

eBook [ PDF] Challenging Cases in Respirology and Critical Care By Singh, Gurmeet

$ 25

TEST BANK for Horngren's Accounting, Volume 1, 12th Canadian Edition by Miller-Nobles, Mattison, Ella Mae Matsumura, Mowbray, Meissner, Jo-Ann Johnston

$ 20

BISC 101 Midterm 1 questions and answers with complete solution 2024

$ 14

Hesi review points march

$ 24

CPA LEVEL I REGULATION (REG) PRACTICE EXAM Q & A 2024

$ 16

PERIOPERATIVE NCLEX WITH COPLETE SOLUTION AND SOLVED.100% VERIFIED.

$ 12

Curriculum - Business Administration

$ 24.5

BIO 202L Lab 14 Worksheet- The Urinary System

$ 12

OTF Trivia Exam 31 Questions with Verified Answers,100% CORRECT

$ 7.5

AGRONOMIE GENERALE VOLUME HORAIRE : 20 HEURES

.png)

.png)

.png)