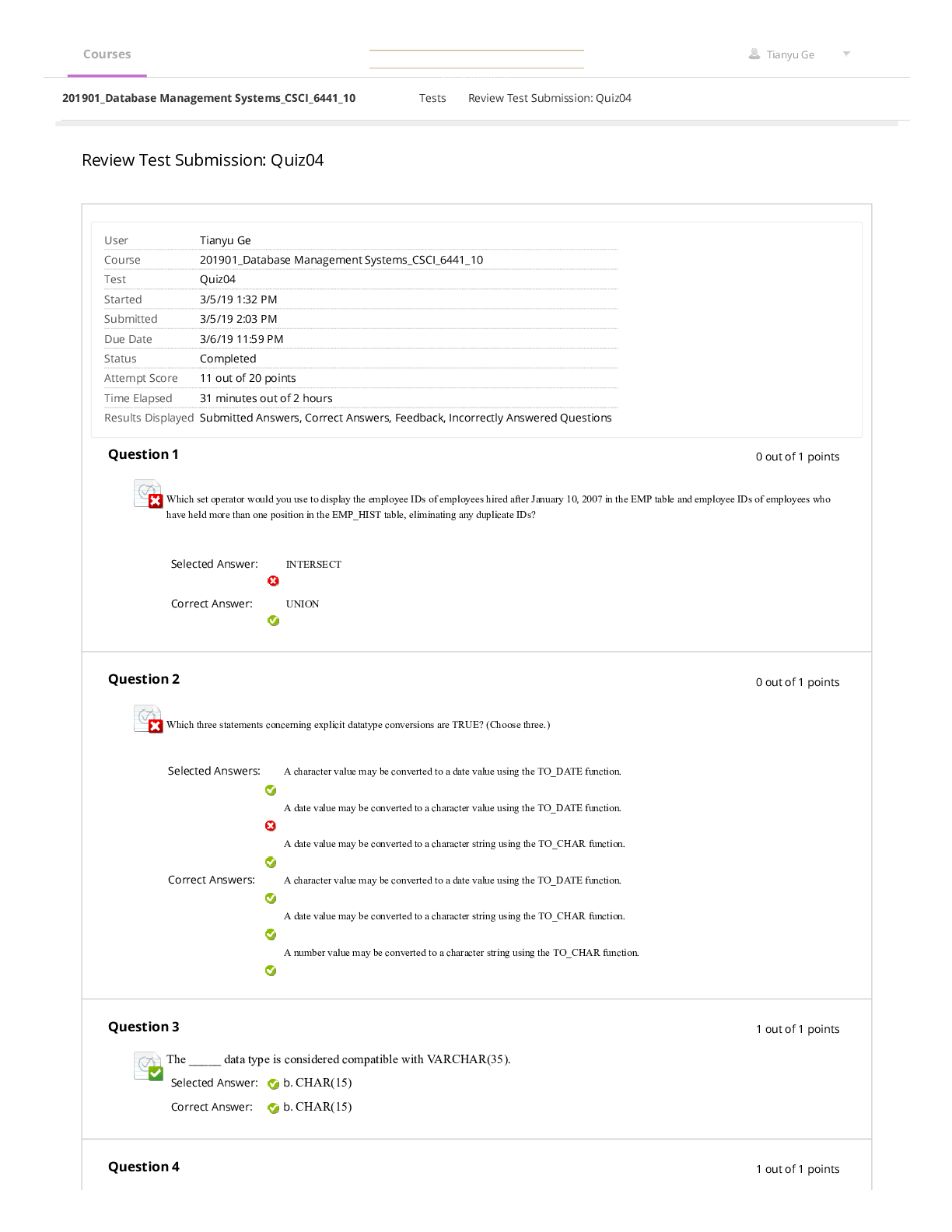

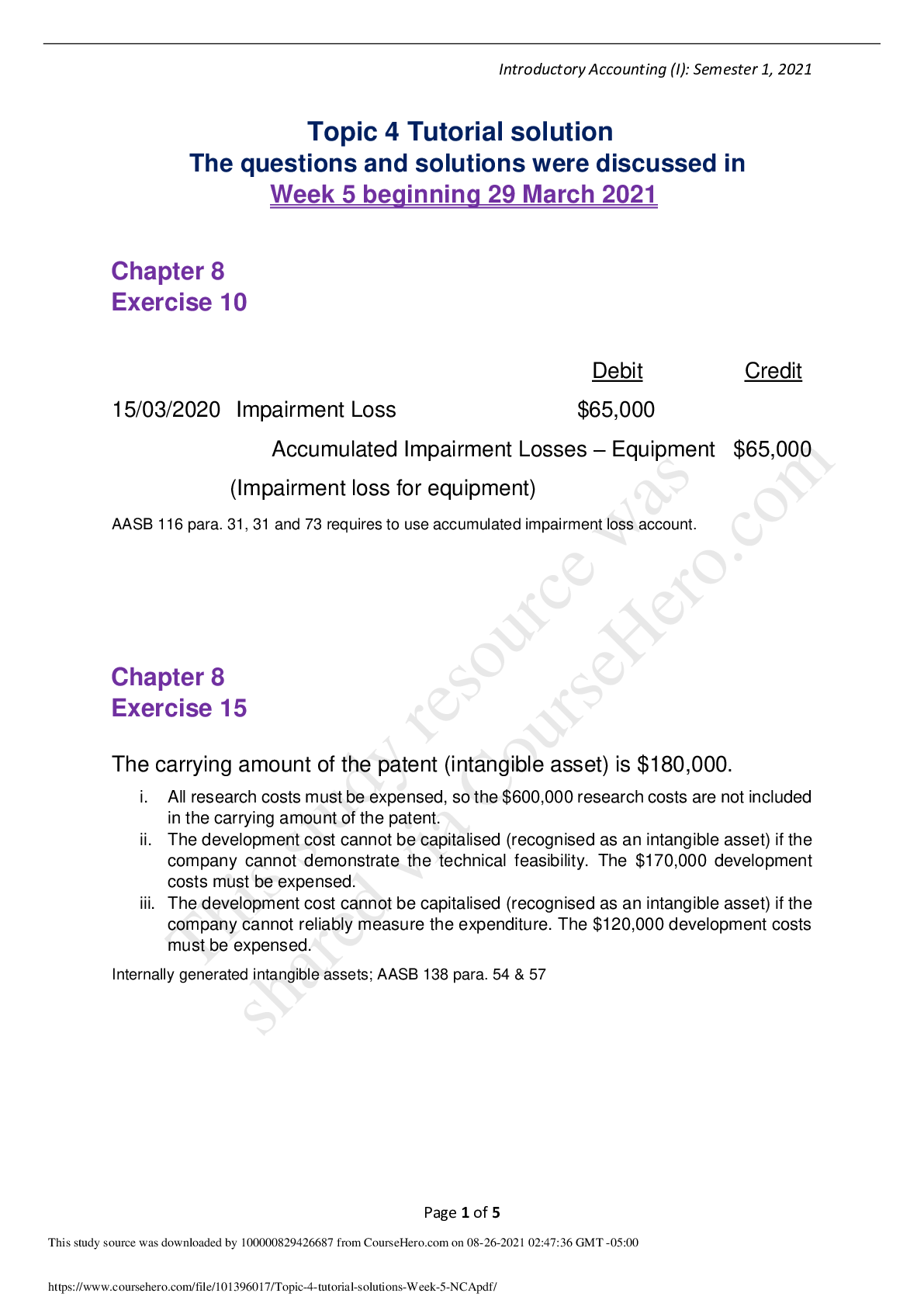

Financial Accounting > QUESTIONS & ANSWERS > ACCTING 1002Topic 4 tutorial solutions Week 5 (NCA) Topic 4 Tutorial solution The questions and solu (All)

ACCTING 1002Topic 4 tutorial solutions Week 5 (NCA) Topic 4 Tutorial solution The questions and solutions were discussed in Week 5 beginning 29 March 2021

Document Content and Description Below

Last updated: 3 years ago

Preview 1 out of 5 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$15.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 26, 2021

Number of pages

5

Written in

All

Additional information

This document has been written for:

Uploaded

Aug 26, 2021

Downloads

0

Views

85

(1).png)

q&a.png)

.png)