Keller Graduate School of Management

AC551 Federal Taxes and Decisions

Final Exam – Professor Abner

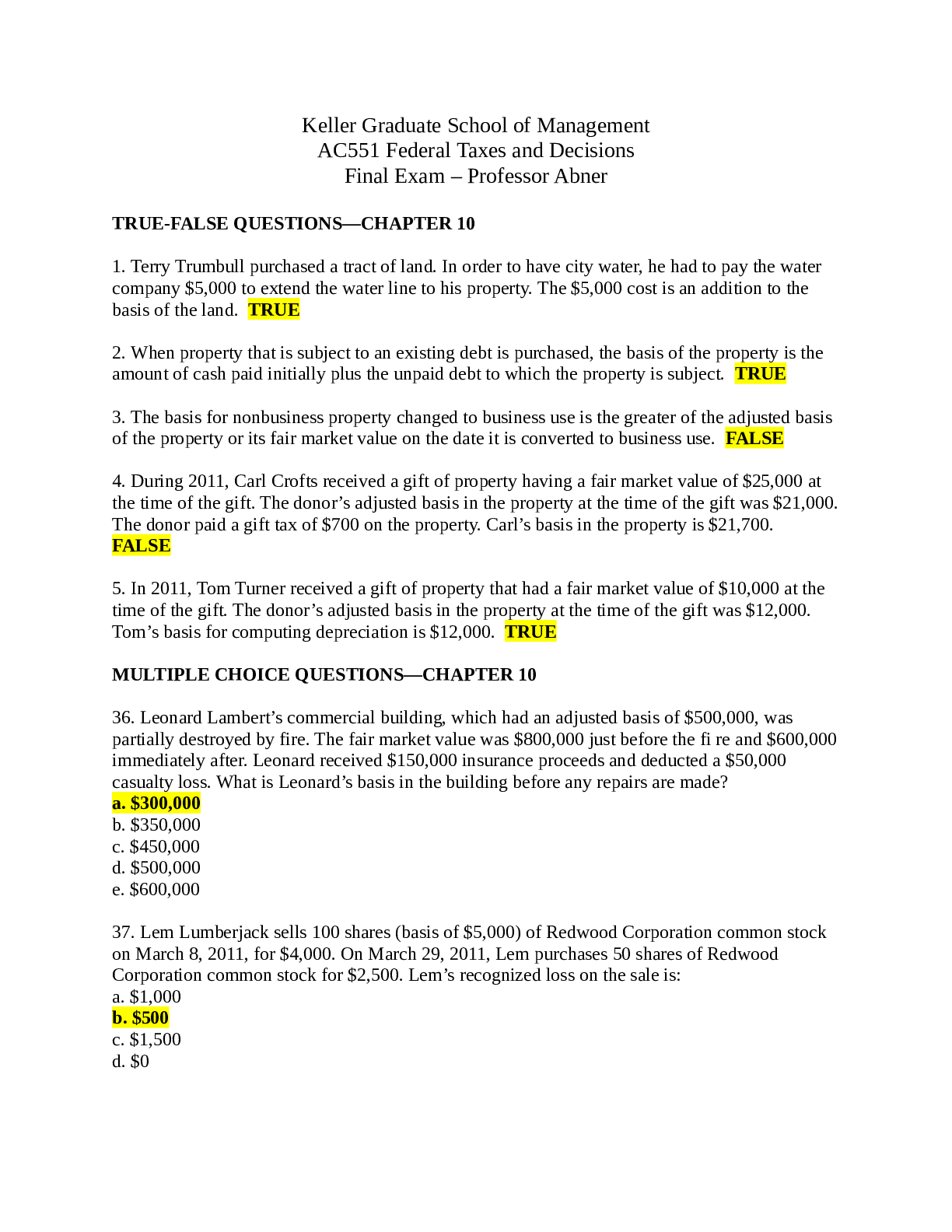

TRUE-FALSE QUESTIONS—CHAPTER 10

1. Terry Trumbull purchased a tract of land. In order to have city water, he had to

...

Keller Graduate School of Management

AC551 Federal Taxes and Decisions

Final Exam – Professor Abner

TRUE-FALSE QUESTIONS—CHAPTER 10

1. Terry Trumbull purchased a tract of land. In order to have city water, he had to pay the water

company $5,000 to extend the water line to his property. The $5,000 cost is an addition to the

basis of the land. TRUE

2. When property that is subject to an existing debt is purchased, the basis of the property is the

amount of cash paid initially plus the unpaid debt to which the property is subject. TRUE

3. The basis for nonbusiness property changed to business use is the greater of the adjusted basis

of the property or its fair market value on the date it is converted to business use. FALSE

4. During 2011, Carl Crofts received a gift of property having a fair market value of $25,000 at

the time of the gift. The donor’s adjusted basis in the property at the time of the gift was $21,000.

The donor paid a gift tax of $700 on the property. Carl’s basis in the property is $21,700.

FALSE

5. In 2011, Tom Turner received a gift of property that had a fair market value of $10,000 at the

time of the gift. The donor’s adjusted basis in the property at the time of the gift was $12,000.

Tom’s basis for computing depreciation is $12,000. TRUE

MULTIPLE CHOICE QUESTIONS—CHAPTER 10

36. Leonard Lambert’s commercial building, which had an adjusted basis of $500,000, was

partially destroyed by fire. The fair market value was $800,000 just before the fi re and $600,000

immediately after. Leonard received $150,000 insurance proceeds and deducted a $50,000

casualty loss. What is Leonard’s basis in the building before any repairs are made?

a. $300,000

b. $350,000

c. $450,000

d. $500,000

e. $600,000

37. Lem Lumberjack sells 100 shares (basis of $5,000) of Redwood Corporation common stock

on March 8, 2011, for $4,000. On March 29, 2011, Lem purchases 50 shares of Redwood

Corporation common stock for $2,500. Lem’s recognized loss on the sale is:

a. $1,000

b. $500

c. $1,500

d. $0

[Show More]