Financial Accounting > EXAMs > ACCT 557 week 8 finals 2021 (All)

ACCT 557 week 8 finals 2021

Document Content and Description Below

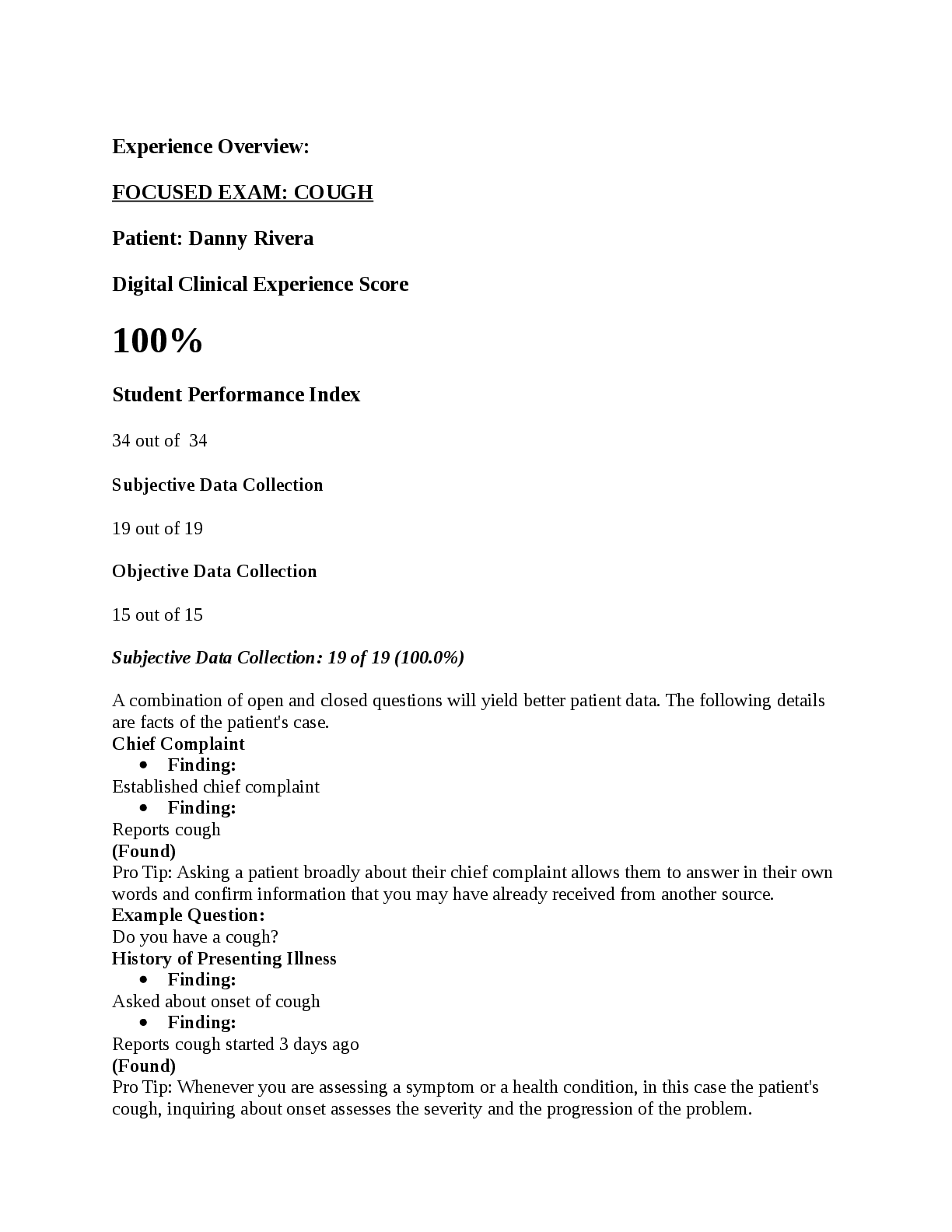

. Question : (TCO A) Amazon Building, Inc. won a bid for a new warehouse building contract. Below is information from the project accountant. Total Construction Fixed Price $10,000,000 Construc ... tion Start Date June 13, 2012 Construction Complete Date December 16, 2013 As of Dec. 31… 2012 2013 Actual cost incurred $4,500,000 $2,360,000 Estimated remaining costs $2,250,000 $- Billed to customer $6,000,000 $4,000,000 Received from customer $5,000,000 $3,500,000 Assuming Amazon Building, Inc. uses the completed contract method, what amount of gross profit would be recognized in 2013? Student Answer: $973,333 $1,640,000 $2,093,333 $3,140,000 Instructor Explanation: General Feedback: See Chapter 18. 10000000 - (4500000 + 2360000) Points Received: 0 of 5 Comments: Question 2 . Question : (TCO B) At the beginning of 2012, Annie, Inc. has a deferred tax asset of $7,500 and deferred tax liability of $10,500. In 2012, pretax financial income was $826,000 and the tax rate was 35%. Pretax income included: Interest income from municipal bonds $15,000 Accrued warranty costs, estimated to be used in 2013 $74,000 Prepaid rent expense, will be used in 2013 $31,000 Installment sales revenue, to be collected in 2013 $56,000 Operating loss carryforward $71,000 [Show More]

Last updated: 3 years ago

Preview 1 out of 14 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$17.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 13, 2021

Number of pages

14

Written in

All

Additional information

This document has been written for:

Uploaded

Sep 13, 2021

Downloads

0

Views

40