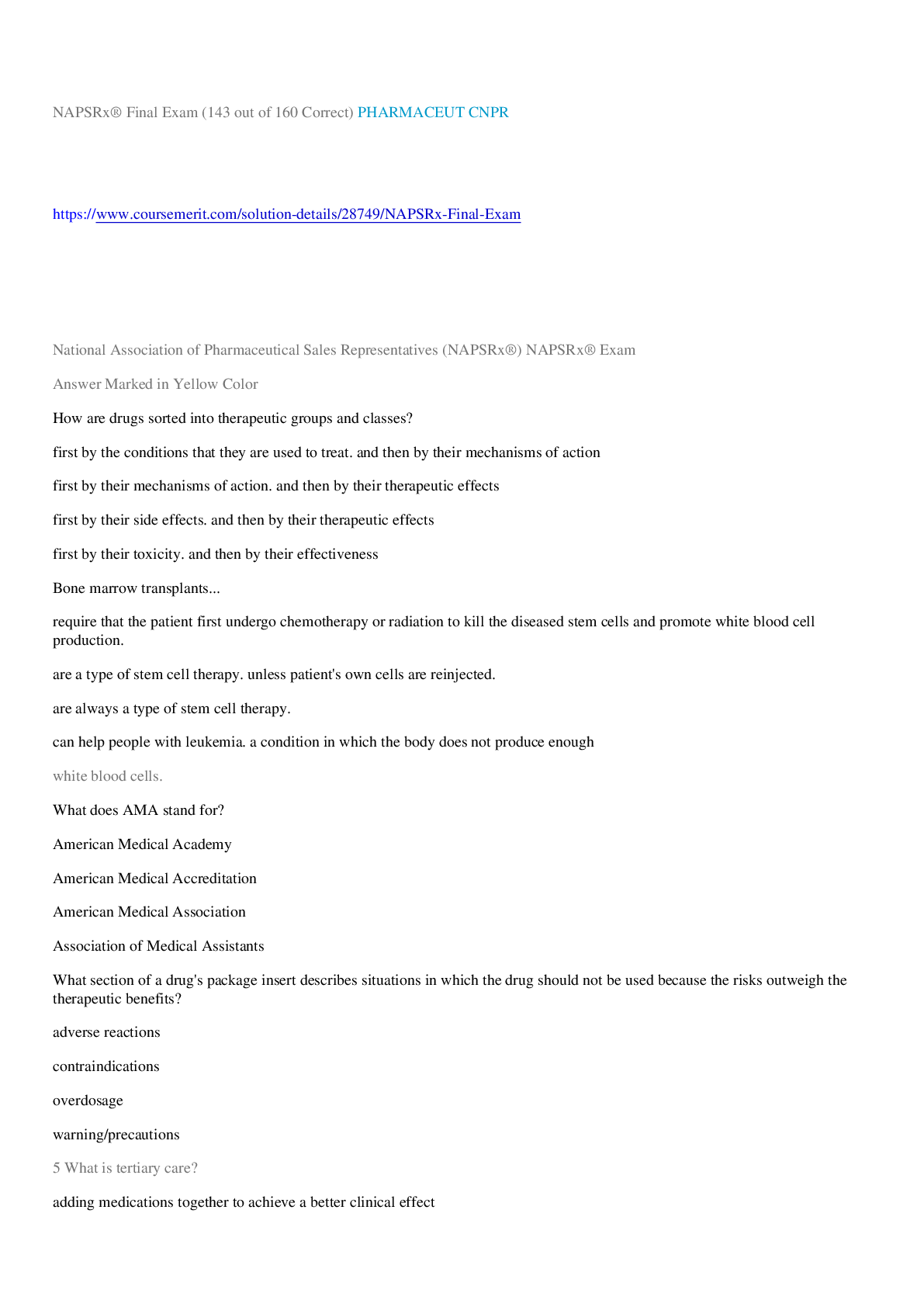

OCR AS Level Economics H060-01 Microeconomics MERGED QUESTION PAPER AND MARK SCHEME

$ 15

RN VATI PHARMACOLOGY ASSESSMENT REMEDIATION; Complete

$ 9

[eBook] [PDF] Family Law for Paralegals, 8th Edition By Shoshanna Ehrlich

$ 33

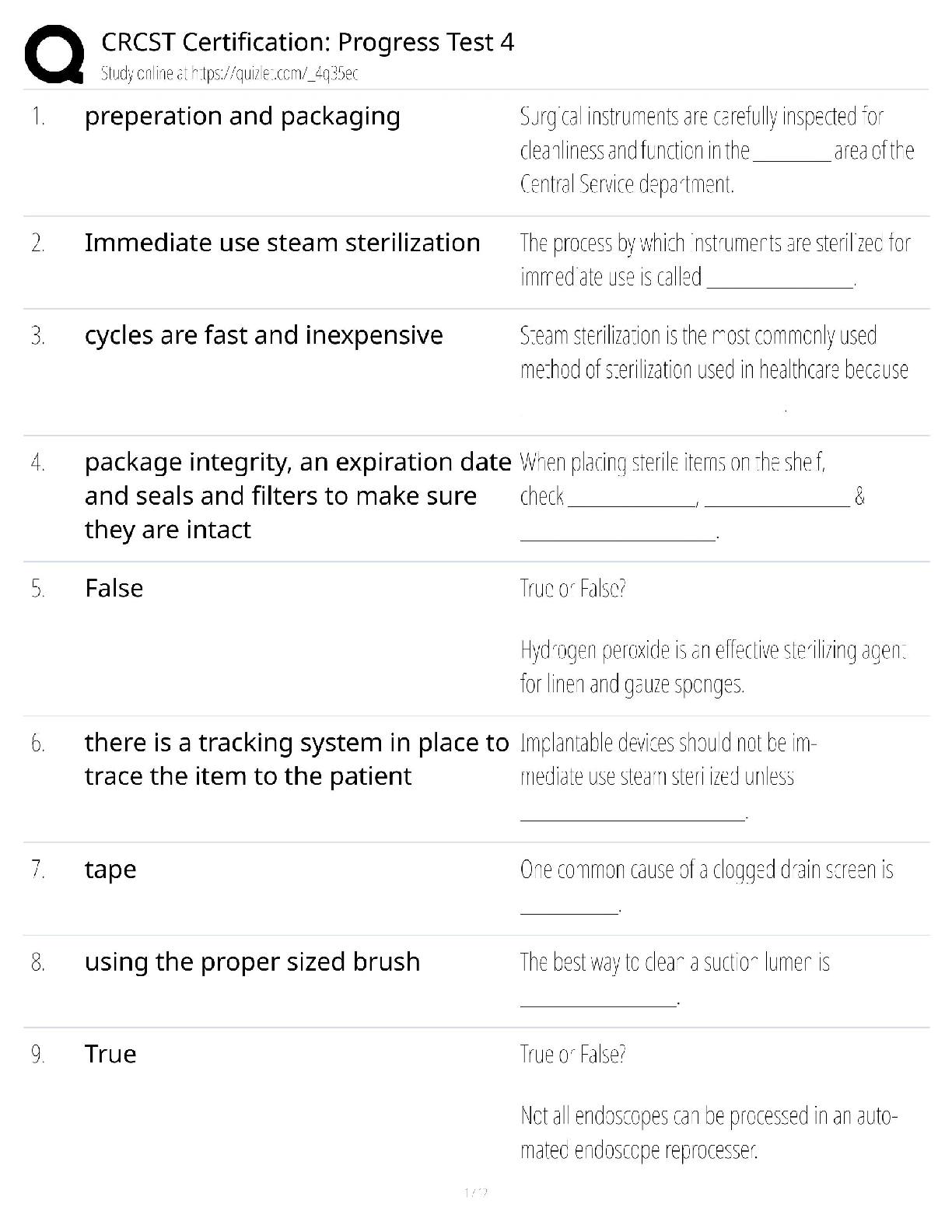

ATI PN Med Surg Final Proctored exam 2022 retake guide questions and Answers Exam (elaborations)

$ 5.5

ATI PN FUNDAMENTALS OF NURSING 2023

$ 40

Test Bank for Chemistry The Central Science 13th Edition by Theodore E. Brown, H. Eugene LeMay, Bruce E. Bursten, Catherine Murphy, Patrick Woodward, Matthew E. Stoltzfus

$ 26

Test Bank For Chemistry An Introduction to General Organic and Biological Chemistry 11th Edition By Karen Timberlake

$ 30

[eBook] [PDF] Elements of Clinical Study Design, Biostatistics & Research By Aditya Patel, S. S. Patel

$ 25

TEST BANK PRIMARY CARE A COLLABORATIVE PRACTICE, 5TH EDITION BY TERRY MAHAN BUTTARO

$ 20

Conceptual Physics 13th Edition By Hewitt | Solutions Manual All Chapters, 100% Original Verified

$ 25

PN COMPREHENSIVE

$ 40

Maternal-Child-Nursing-5th-Edition-by-McKinney.

$ 7.5

eBook Fundamentals of Corporate Finance, 5th Edition By Jonathan Berk, Peter DeMarzo, Jarrad Harford

$ 25

AQA AS PHYSICS Paper 2 QP 2021

$ 10

FedVTE Mobile and Device Security Latest 2022

$ 3

Global Health Care Issues and Policies, 4th Edition By Carol Holtz [PDF] [eBook]

$ 25

BIO 123 SCIENTIFIC METHOD ASSESSMENT REVISED WITH COMPLETE ANSWERS 2022

$ 10

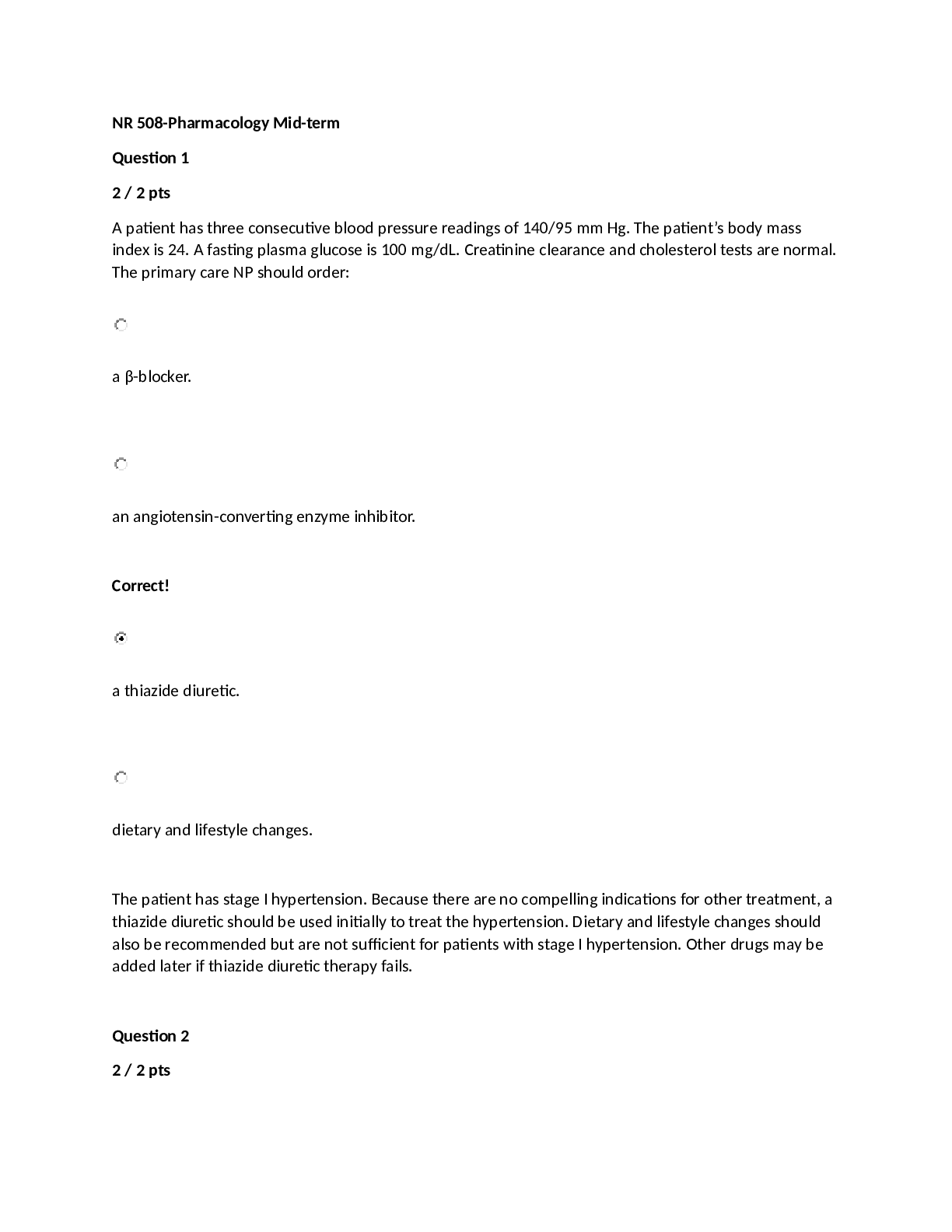

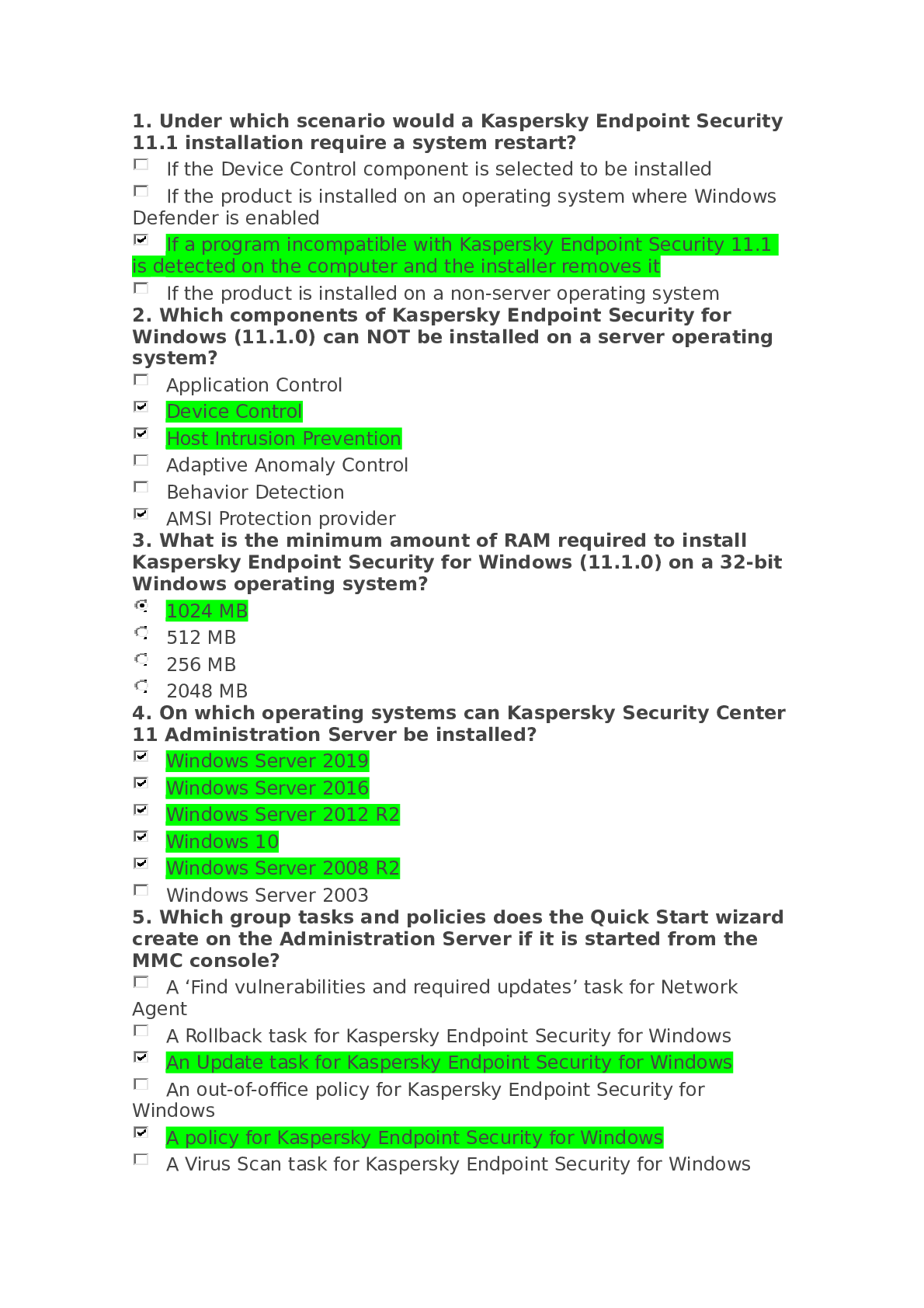

.png)

AQA A-level PHYSICS 7408/1 Paper 1 Mark scheme June 2021 Version: 1.0 Final

$ 10

NRNP6552 Week 3 Knowledge Check Latest 2021 (Advanced Nurse Practice in Reproductive Health Care)

$ 15

BIO 151 (Essential Human Anatomy and Physiology I w/Lab) – Module 2 Problem Set | Portage Learning | Verified Solutions Included

$ 15

Answer to Appendix case study [Appendicitis/Appendectomy SKINNY Reasoning Suggested Answer Guidelines]

$ 12

CHEM 120 Week 2 Ionic Compounds

$ 14

Instructor Manual For Connections A World History (Volume 2) 4th Edition By Edward Judge, John Langdon

$ 29

Unit 1: Essential Legal Concepts

$ 6

EDEXCEL ALEVEL 2022 BIOLOGY A QUESTION PAPER 1

$ 3

NRNP 6635_Disc Wk 1 - Class 6635 Submission 2020

$ 12.5

Correct Study Guide, Download to Score A.png)

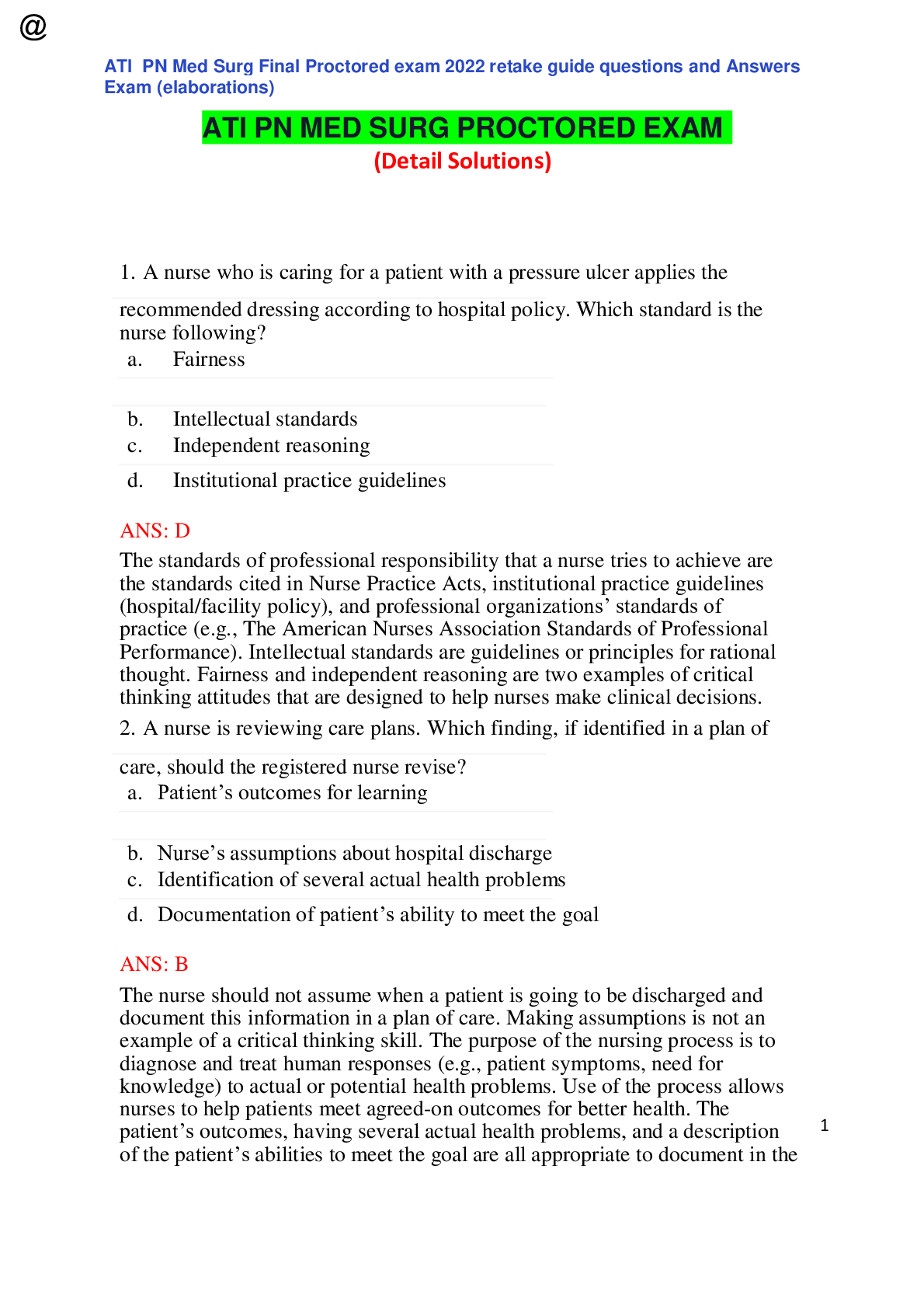

Case Study: Pediatric Asthma, UNFOLDING Reasoning, Jared Johnson, 10 years old, (Latest 2021) Correct Study Guide, Download to Score A

$ 15

Foundations of Maternal-Newborn and Women's Health Nursing 8th Edition Murray Test Bank

$ 13

eBook Understanding Diversity in Human Behavior and Development in the Social Environment 1st Edition by Marquitta S. Dorsey

$ 29

.png)

EDEXCEL Examiners’ Report Principal Examiner Feedback November 2021;/

$ 13.5

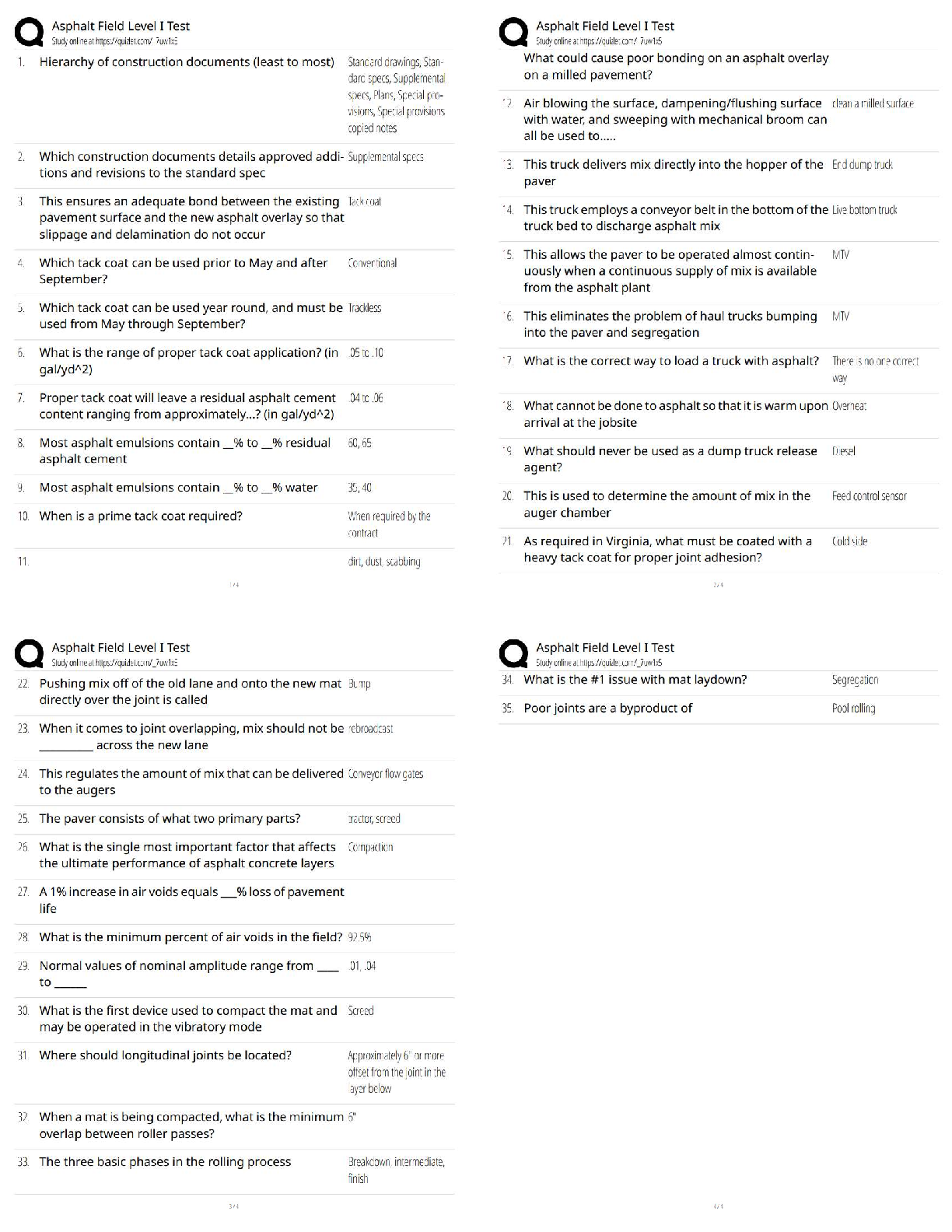

OCR AS Level Economics H060-01 Microeconomics MERGED QUESTION PAPER AND MARK SCHEME

$ 15.5

Economics H060/01: Microeconomics Advanced Subsidiary GCE Question Paper

$ 6.5

Chapter 27: Assessment of the Respiratory System

$ 9

Unit 4 - Session 2

$ 10

RIMS - CRMP COMPLETE STUDY GUIDE; 1 ANALYZE THE BUSINESS MODEL, 2 DEVELOPING ORGANIZATIONAL RISK STRATEGIES, 3 RIMS CRMP-IMPLEMENTING THE RISK PROCESS, 4 DEVELOPING ORGANIZATIONAL RISK MANAGEMENT COMPETENCY, 5 SUPPORTING DECISION MAKING|QUESTIONS WITH CORRECT ANSWERS

$ 11.5

Chemistry A Molecular Approach 5th Edition By Nivaldo J. Tro (Test Bank All Chapters)

$ 25

.png)

WGU C207 Quizes Latest 2023 Already Passed

$ 10

NRS 428VN Topic 5 Benchmark - Community Teaching Plan: Community Presentation

$ 9

.png)

FIN 101 Mid Term-Financial Management Notes Questions And Answers;TOP SCORE./ BEST SOLUTION

$ 18.5

Test Bank for A Topical Approach to the Developing Person Through the Life Span, 1st Edition by Kathleen Stassen Berger

$ 24

MED SURG EXAM B 2022