ACCT 305Apollo Shoes 7e Solution_Liabilities

Teaching Notes

The liability portion of the audit will consist of both current liabilities and long-term liabilities. We will have two lead schedules (current and long-ter

...

ACCT 305Apollo Shoes 7e Solution_Liabilities

Teaching Notes

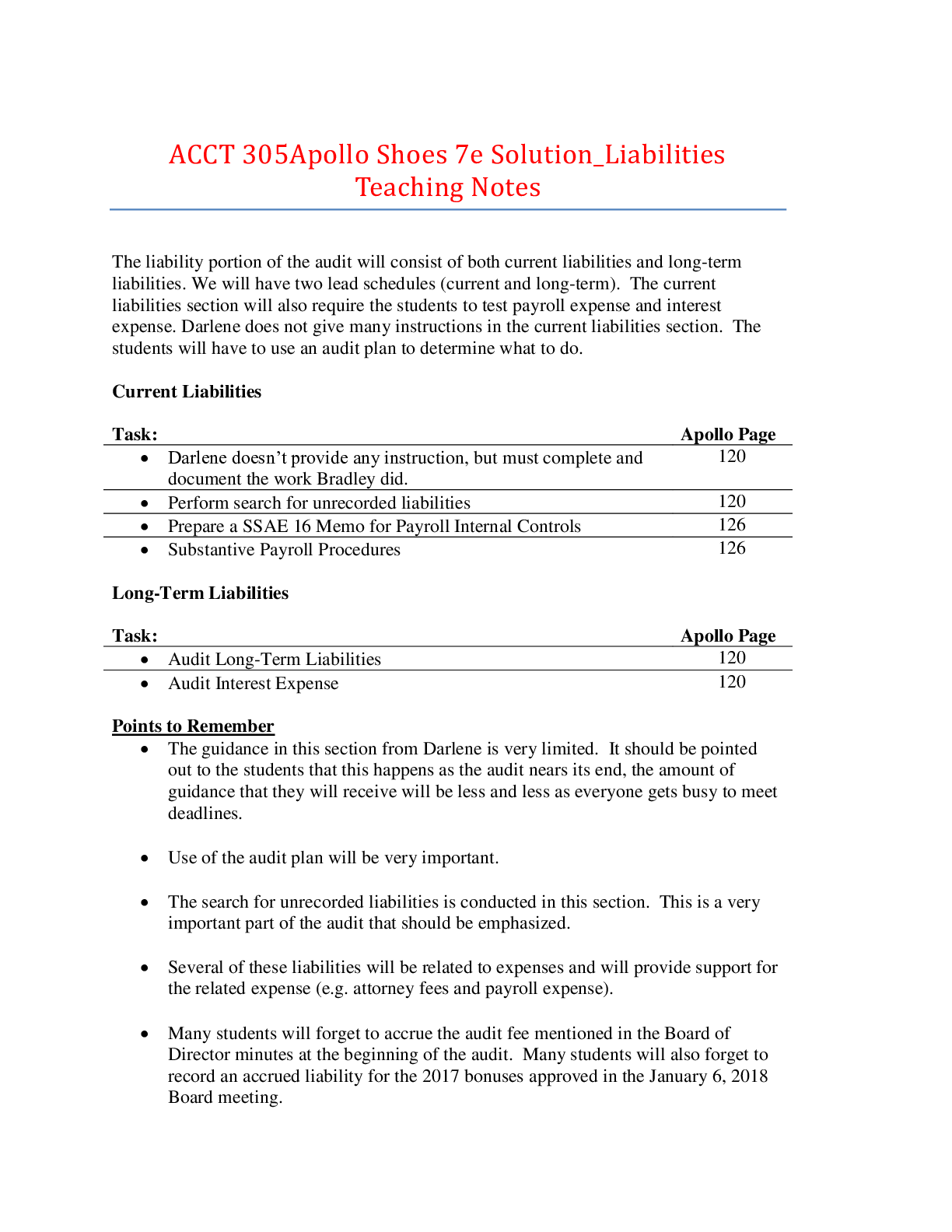

The liability portion of the audit will consist of both current liabilities and long-term liabilities. We will have two lead schedules (current and long-term). The current liabilities section will also require the students to test payroll expense and interest expense. Darlene does not give many instructions in the current liabilities section. The students will have to use an audit plan to determine what to do.

Current Liabilities

Task: Apollo Page

• Darlene doesn’t provide any instruction, but must complete and document the work Bradley did. 120

• Perform search for unrecorded liabilities 120

• Prepare a SSAE 16 Memo for Payroll Internal Controls 126

• Substantive Payroll Procedures 126

Long-Term Liabilities

Task: Apollo Page

• Audit Long-Term Liabilities 120

• Audit Interest Expense 120

Points to Remember

• The guidance in this section from Darlene is very limited. It should be pointed out to the students that this happens as the audit nears its end, the amount of guidance that they will receive will be less and less as everyone gets busy to meet deadlines.

• Use of the audit plan will be very important.

• The search for unrecorded liabilities is conducted in this section. This is a very important part of the audit that should be emphasized.

• Several of these liabilities will be related to expenses and will provide support for the related expense (e.g. attorney fees and payroll expense).

• Many students will forget to accrue the audit fee mentioned in the Board of Director minutes at the beginning of the audit. Many students will also forget to record an accrued liability for the 2017 bonuses approved in the January 6, 2018 Board meeting.

• There will be a question concerning the Anglonesia R&R Institute invoice. On D-4, we note that it was been received on December 31st. This liability SHOULD be recorded. In the Inventory it was counted and included. Thus, to make inventory balance, costs of goods sold must have been adjusted. Thus, the entry to record this will be to adjust CGS.

• Payroll will also need to be tested. The 2017 calendar used in this case does not have the actual year-end. December 31, 2017 is on a Wednesday for this case. The actual 31st is a Sunday. Wednesday was chosen so students would have to address payroll accruals in the case. Per the manual, payroll is paid on Fridays, so payroll expense needs to be accrued for three days (30% of 12/26 payroll).

• The Payroll Flow Chart and Bridge Working Paper should be included in Internal Controls.

• Under the Notes payable section, interest expense should also be tested.

• Interest Payable, Bonus Payable and Dividends Payable accounts are added to the current liabilities lead schedule. There are no existing accounts related to these amounts, so the student will have to create new ones.

• In the search for unrecorded liabilities Check No. 3628 is payment to Sam Shaw for washing cars. Shaw is an employee of the firm which makes this a related party transaction. And, although only a few thousand dollars, this does not appear to an arm’s-length transaction as the cost per car greatly exceeds any reasonable rate for washing cars. The aggregate cost for a complete detailing of all Apollo owned cars would be far less than half this amount. There is no basis in the case for proposing any adjustment, but students should be suspicious of the transaction, and a few should identify that it is a related party transaction. This can also be the basis for a discussion around, “Is there such a thing as an immaterial related party transaction?

[Show More]