C121 SURVEY OF UNITED STATE HISTORY TASKED 1 COMPLETE (Passed) WESTERN GOVERNORS UNIVERSITY.

$ 13

BIO 100 Unit 5 Pre-Test _ 2020 – Troy University | BIO 100 Unit 5 Pre-Test _ 2020

$ 12.5

NR 511 MIDTERM EXAM (VERSION 4) / NR511 MIDTERM EXAM |139 Q & A | LATEST-2021 |: DIFFERENTIAL DIAGNOSIS AND PRIMARY CARE PRACTICUM: CHAMBERLAIN COLLEGE OF NURSING |100% CORRECT ANSWERS, DOWNLOAD TO SCORE A|

$ 14

eBook Problems And Solutions In Mathematical Olympiad 2nd Edition By Xiong-hui Zhao

$ 29

AQA A-LEVEL BIOLOGY PAPER 1 2020 QUESTION PAPER(VERIFIED QUESTIONS 2020

$ 10

AQA A-LEVEL BIOLOGY 7402-3 Paper 3 Merged Question Paper and Mark Scheme Actual 2024

$ 15.5

PSY 550 Week 3 Assignment, Informed Consent and Debriefing

$ 9

NR-603 Week 5 APEA Predictor – Part 2

$ 9

Pearson Edexcel International GCSE Mathematics B PAPER 1 4MB1/01 question paper 2022

$ 5

.png)

Pearson Edexcel GCE Question Booklet + Mark Scheme (Results) November 2021 Further Mathematics Advanced Level in Futher Mathematics Paper 9FM0/3A

$ 10

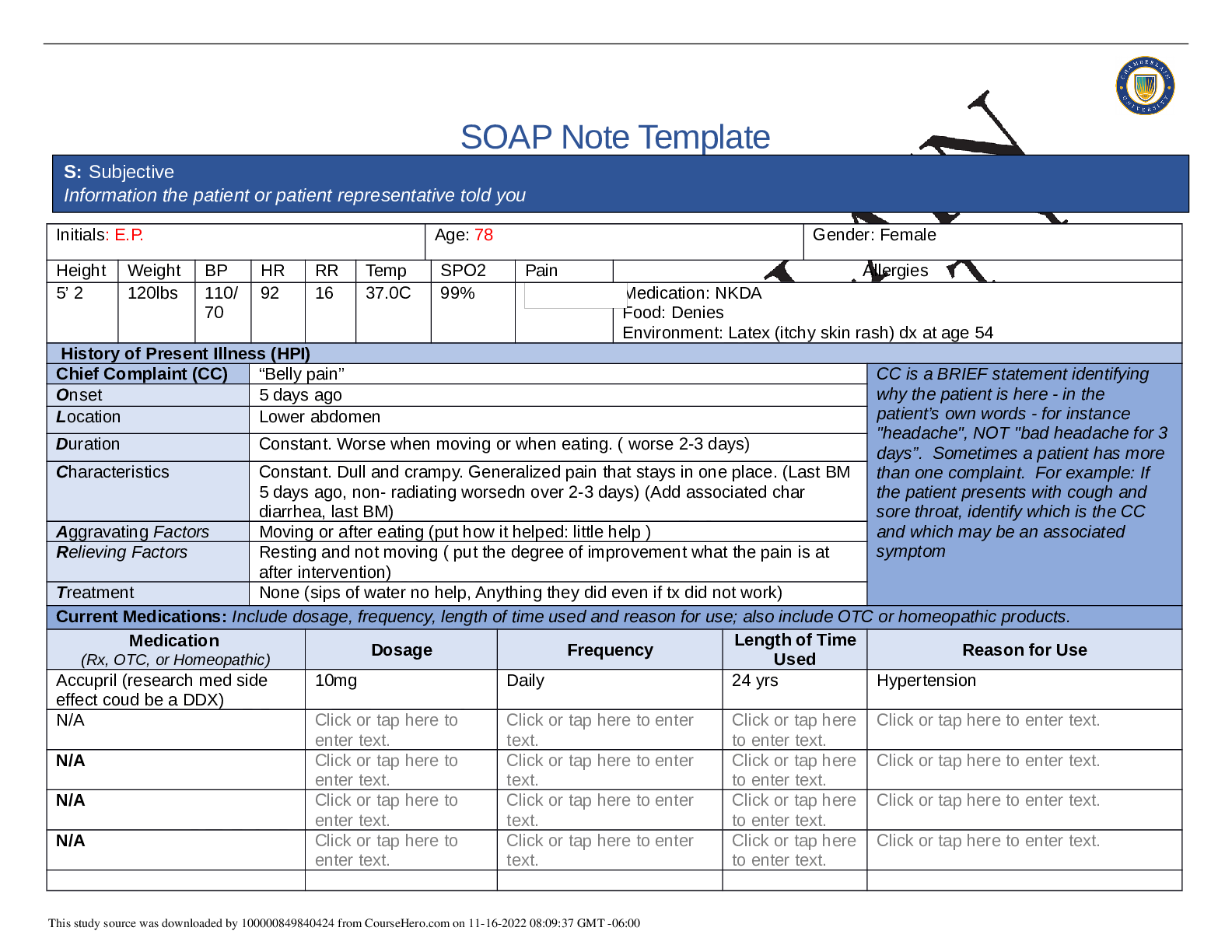

Summary NR 509 Week 5 Abdominal Pain SOAP Note

$ 11

PSYC-110N Week 7 Assignment: You Decide: Psychological Disorders Create a Case! (Obsessive-Compulsive Disorder (OCD)

- A Graded, Quality Work.png)

- Latest 2022.png)

_Score 2831 Art history 1 Challenge Milestone 1 unit 1 Sophia Course (solution).png)