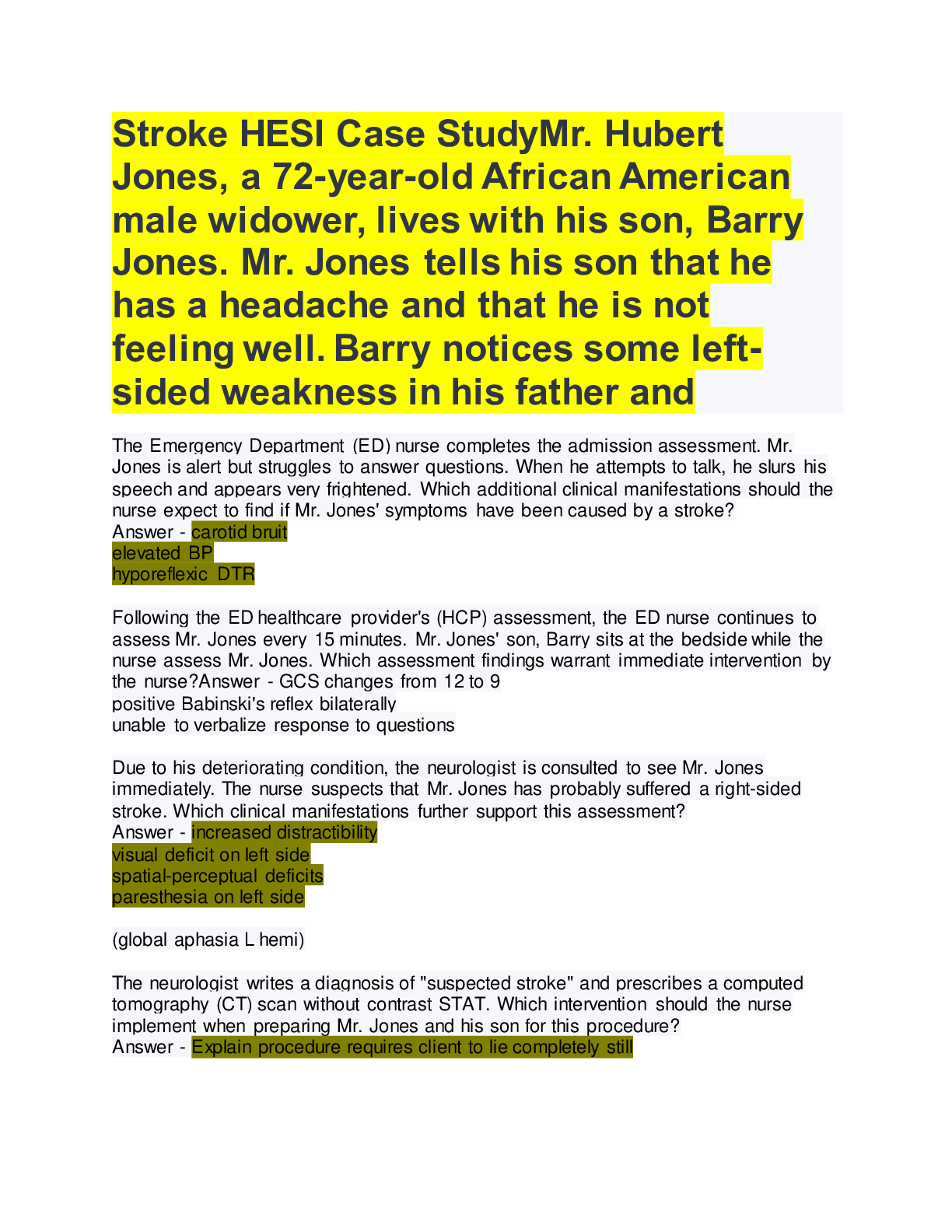

ATI PN COMPREHENSIVE EXIT 2023 WITH NGN

$ 16.5

.png)

NASM-CPT Final Exam Study Guide, Updated 2022, Fully Explained.

$ 14.5

PALS - Written Test and Case Study Exam Review Material with Complete solution

$ 8

Veterinary Technician National Examination VTNE Practice Test A with COMPLETE SOLUTION

$ 12

NR 509 Week 6 Pediatric SOAP Note, Summer 2020 complete solution

$ 8

Communicable Disease Nies COLLEGE OF NURSING

$ 9

EPIC AMB400 - Sample Test, KAW - AMB 400, AMB 400, AMB400 Chapter, AMB400 Review questions, KAW - AMB 400 Reviewing the Chapter - Procedure Build, AMB 400 - Dynamic OCCs - Referrals, AMB 400 - Immunizations, Amb 400 - Preference Lists, AMB 400

$ 12

ATI-RN COMPREHENSIVE PREDICTOR EXIT EXAM 2024 WITH NGN

$ 11

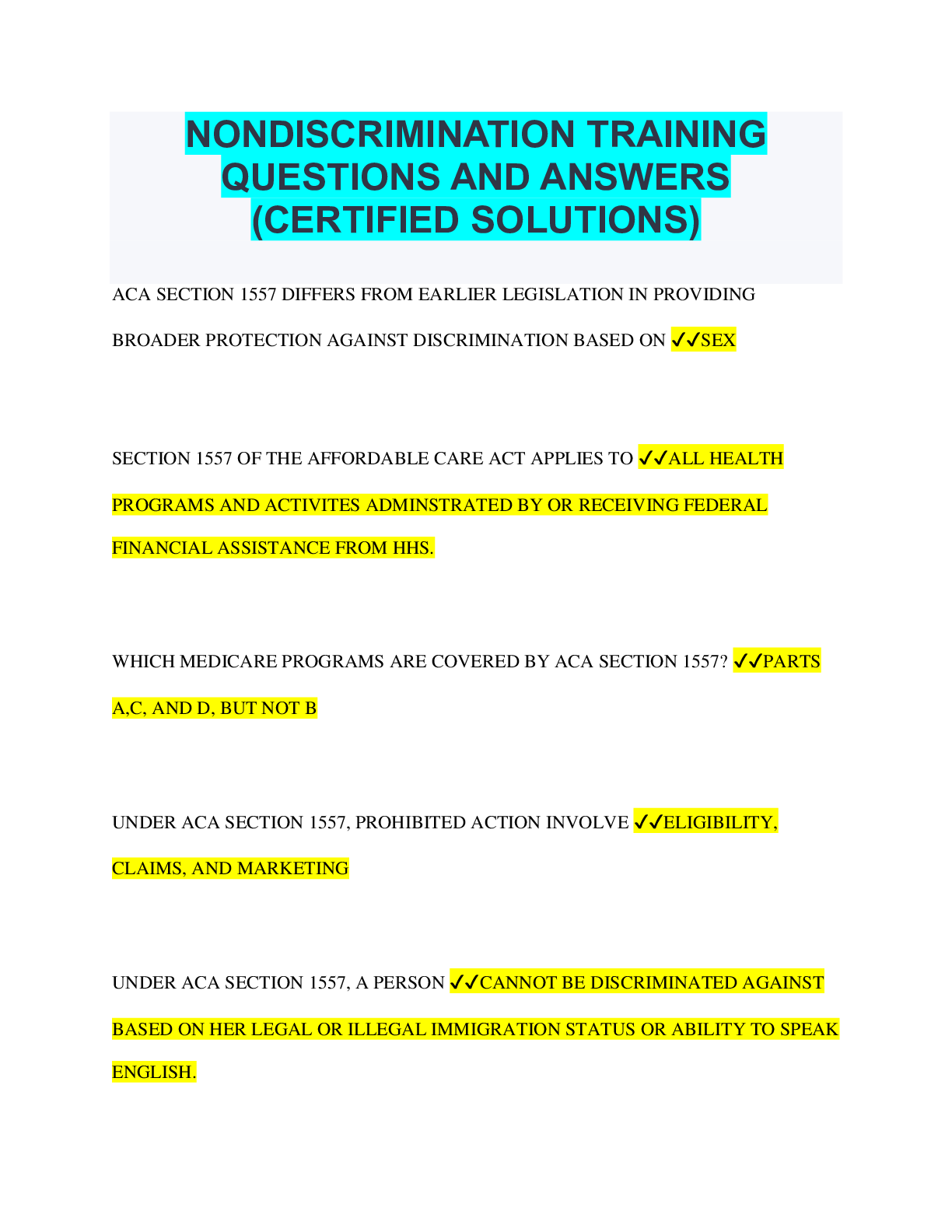

NONDISCRIMINATION TRAINING QUESTIONS AND ANSWERS (CERTIFIED SOLUTIONS)

$ 4.5

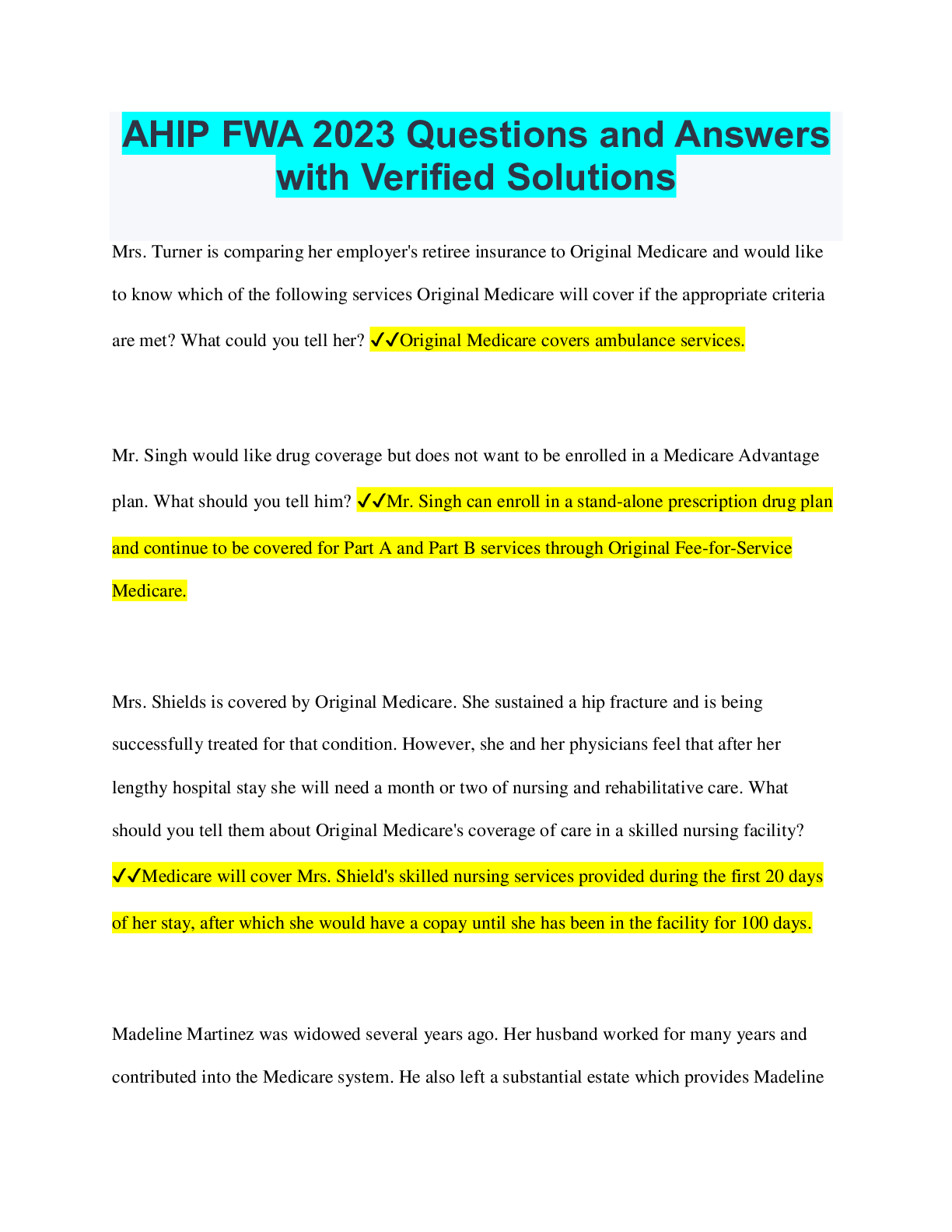

AHIP FWA 2023 Questions and Answers with Verified Solutions

$ 14.5

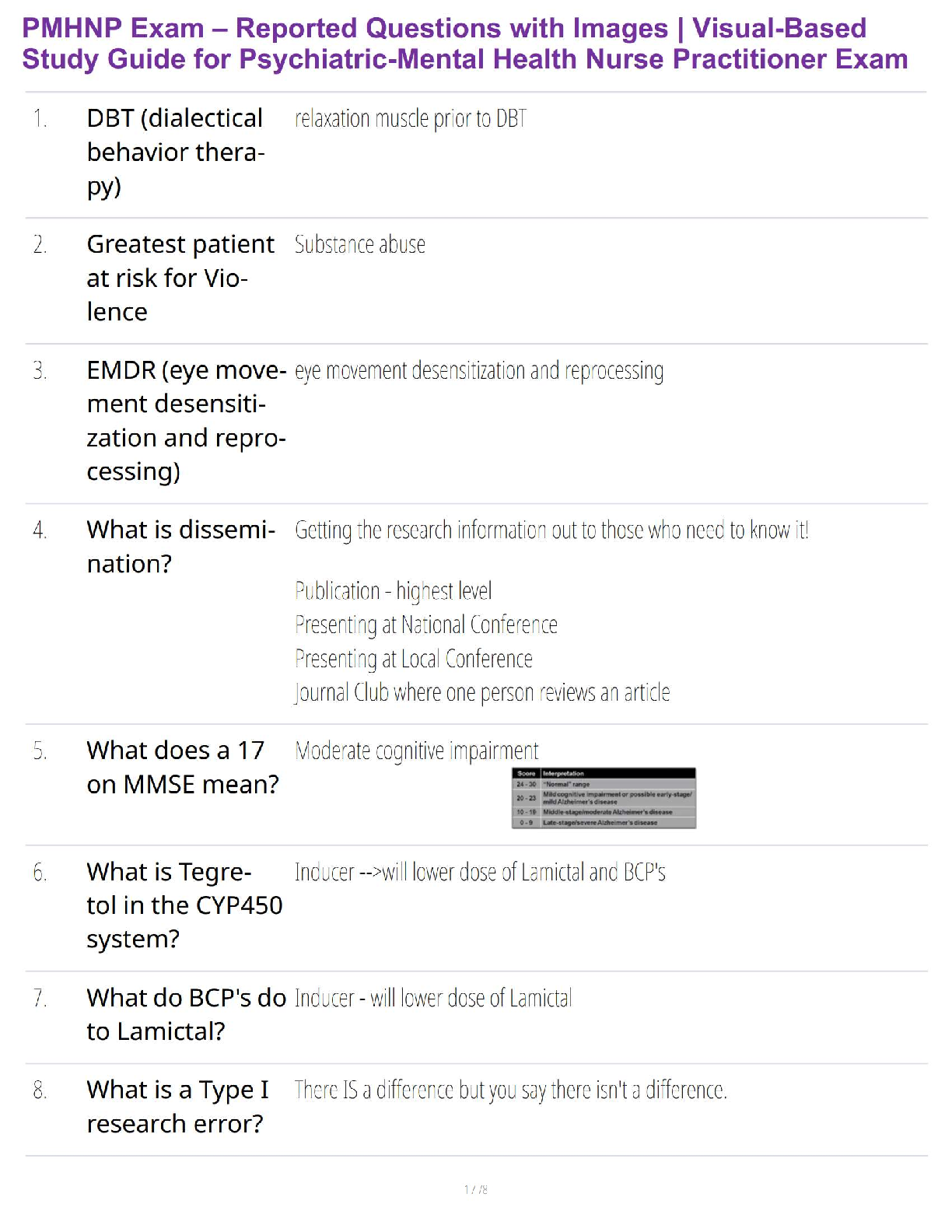

PMHNP Exam – Reported Questions with Images | Visual-Based Study Guide for Psychiatric-Mental Health Nurse Practitioner Exam

$ 26.5

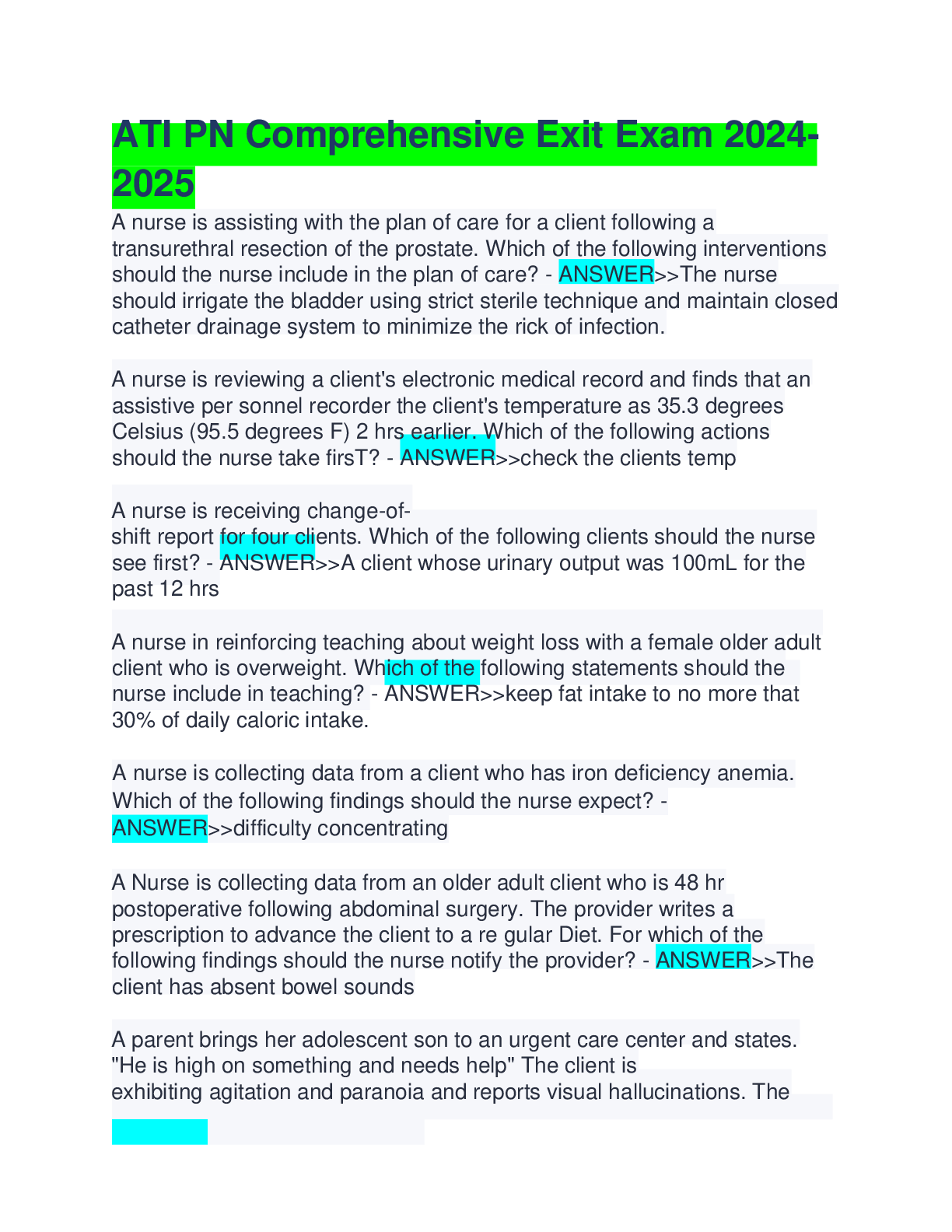

Ati pn comprehensive exit exam 2024 2025

$ 35.5

CAAN DCF QUESTIONS AND ANSWERS RATED A.

$ 13

IELTS: Intermediate Describing Qualities Vocabulary Set 7

$ 5.5

PSY 105 (Introduction to Psychology) – Quiz 1 | Strayer University | Verified Q&A for 2025

$ 7.5

Student Exploration: Circuit BuilderGizmo Electricity 2022

$ 12

Saunders Medsurg Skin Integumentary

$ 14.5

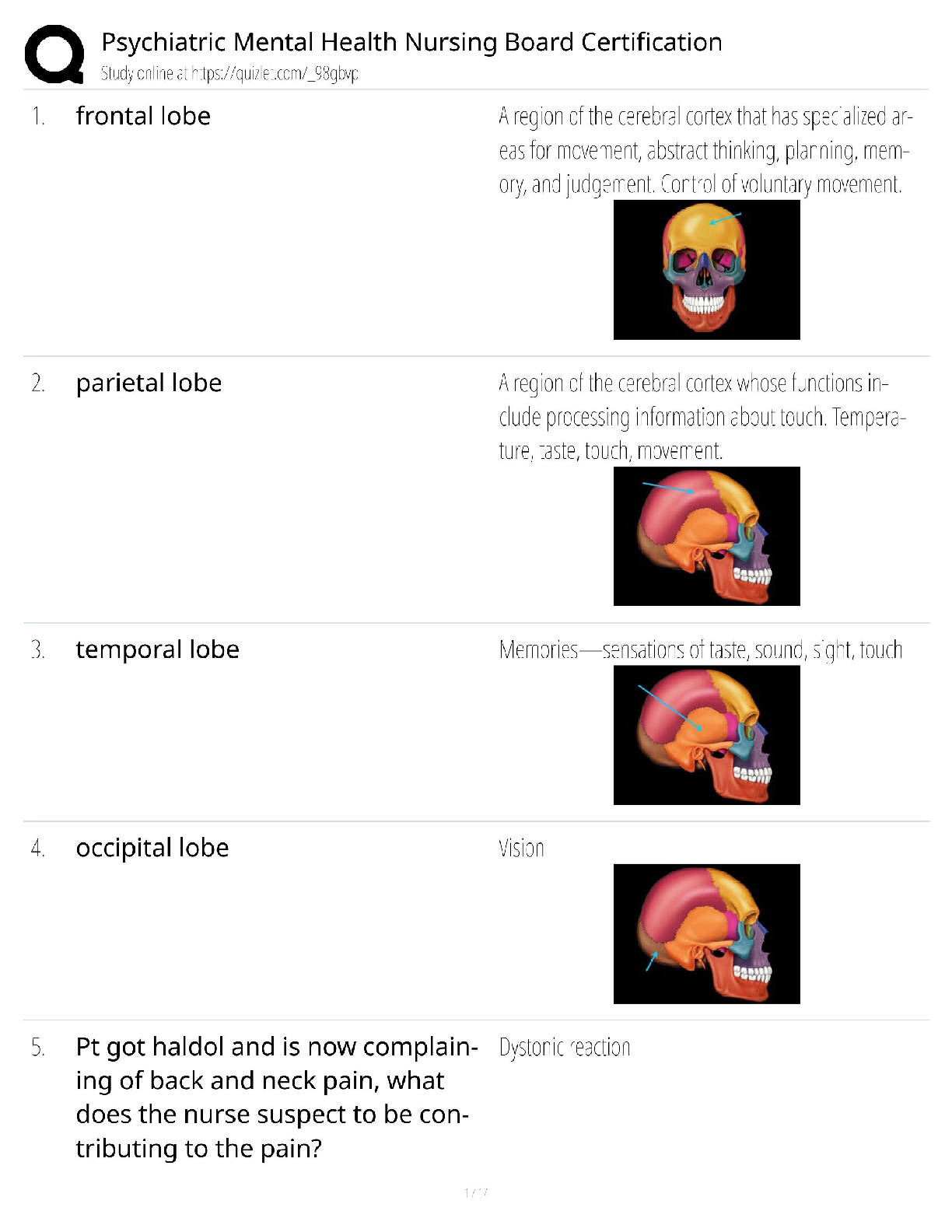

PMHNP Board Certification / Psychiatric Mental Health Nurse / 2026 Update / Practice Test & Review

$ 21.5

TNCC EXAM Questions and Answers Latest Update 2024

$ 12

Test Bank for Essentials of Psychiatric Mental Health Nursing 3rd Edition by Varcarolis 2 A+ 2025

$ 9.5

NURS_6531_courseSchedule LATEST

$ 15

AHIP TRAINING Medicare Fraud, Waste, and Abuse Training Questions and Answers with Verified Solutions

.png)