Finance > EXAM > Concordia University FINA 410 MCQ Mid-term Questions and Answers (ALL ANSWERS ARE CORRECT) (All)

Concordia University FINA 410 MCQ Mid-term Questions and Answers (ALL ANSWERS ARE CORRECT)

Document Content and Description Below

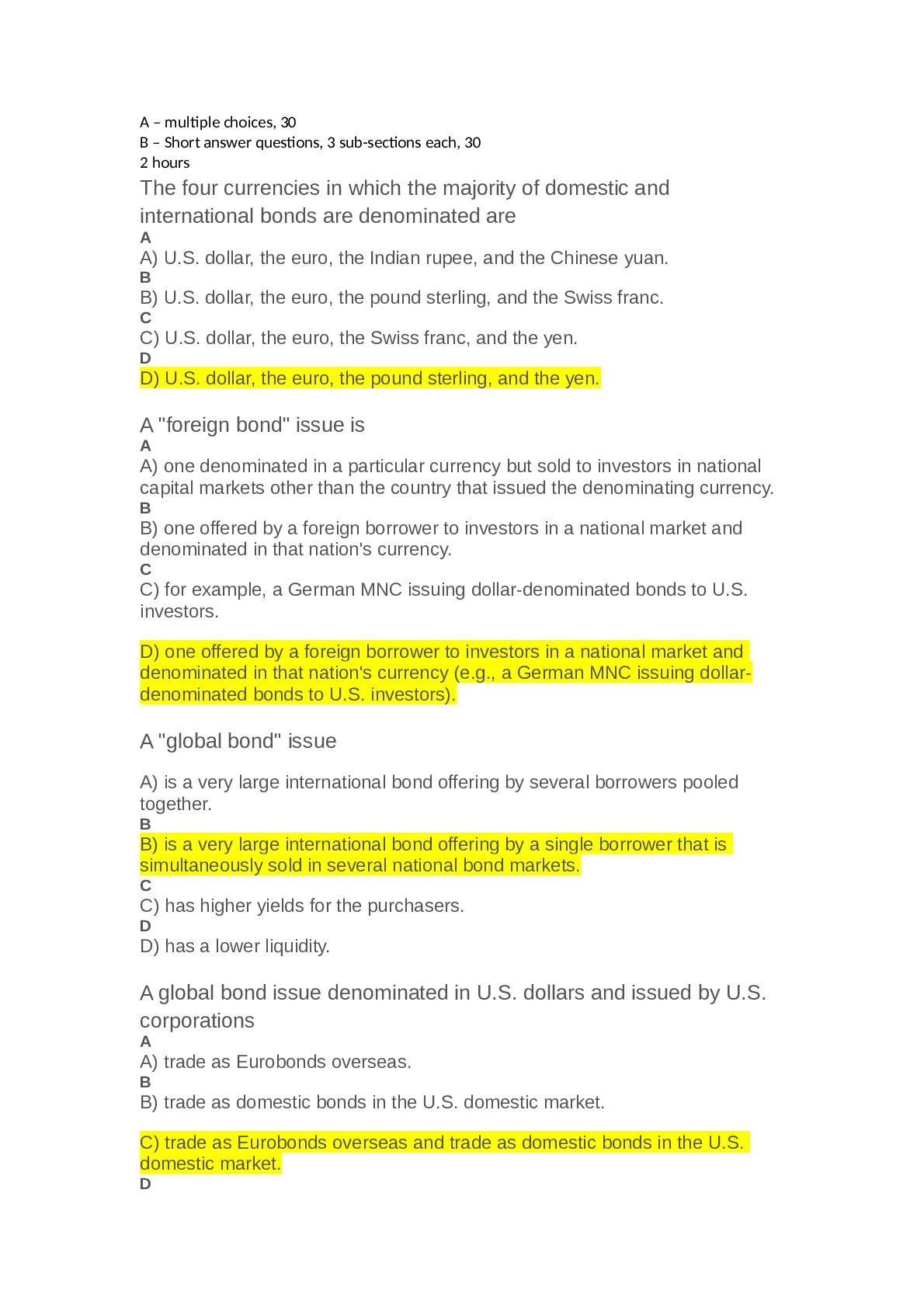

A – multiple choices, 30 B – Short answer questions, 3 sub-sections each, 30 2 hours The four currencies in which the majority of domestic and international bonds are denominated are A A) U.... S. dollar, the euro, the Indian rupee, and the Chinese yuan. B B) U.S. dollar, the euro, the pound sterling, and the Swiss franc. C C) U.S. dollar, the euro, the Swiss franc, and the yen. D D) U.S. dollar, the euro, the pound sterling, and the yen. A "foreign bond" issue is A A) one denominated in a particular currency but sold to investors in national capital markets other than the country that issued the denominating currency. B B) one offered by a foreign borrower to investors in a national market and denominated in that nation's currency. C C) for example, a German MNC issuing dollar-denominated bonds to U.S. investors. D D) one offered by a foreign borrower to investors in a national market and denominated in that nation's currency (e.g., a German MNC issuing dollardenominated bonds to U.S. investors). A "global bond" issue A A) is a very large international bond offering by several borrowers pooled together. B B) is a very large international bond offering by a single borrower that is simultaneously sold in several national bond markets. C C) has higher yields for the purchasers. D D) has a lower liquidity. A global bond issue denominated in U.S. dollars and issued by U.S. corporations A A) trade as Eurobonds overseas. B B) trade as domestic bonds in the U.S. domestic market. C C) trade as Eurobonds overseas and trade as domestic bonds in the U.S. domestic market. D D) none of the options Straight fixed-rate bond issues have A A) a designated maturity date at which the principal of the bond issue is promised to be repaid. During the life of the bond, fixed coupon payments, which are a percentage of the face value, are paid as interest to the bondholders. B B) a designated maturity date at which the principal of the bond issue is promised to be repaid. During the life of the bond, coupon payments, which are a percentage of the face value, are computed according to a fixed formula. C C) a fixed payment, which amortizes the debt, like a house payment or car payment. D D) none of the options Six-month U.S. dollar LIBOR is currently 4.25 percent; your firm issued floating-rate notes indexed to six-month U.S. dollar LIBOR plus 50 basis points. What is the amount of the next semi-annual coupon payment per U.S. $1,000 of face value? A A) $43.75 B B) $47.50 C C) $23.75 D D) $46.875 Floating-rate notes (FRN) A A) experience very volatile price changes between reset dates. B B) are typically medium-term bonds with coupon payments indexed to some reference rate (e.g., LIBOR). C C) appeal to investors with strong need to preserve the principal value of the investment should they need to liquidate prior to the maturity of the bonds. D D) are typically medium-term bonds with coupon payments indexed to some reference rate (e.g., LIBOR), and appeal to investors with strong need to preserve the principal value of the investment should they need to liquidate prior to the maturity of the bonds. There are two types of equity related bonds: A A) convertible bo [Show More]

Last updated: 2 years ago

Preview 1 out of 15 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 11, 2022

Number of pages

15

Written in

Additional information

This document has been written for:

Uploaded

Mar 11, 2022

Downloads

0

Views

89