Finance > SOLUTIONS MANUAL > FINB4063 Week 1 Answer Solution (All)

FINB4063 Week 1 Answer Solution

Document Content and Description Below

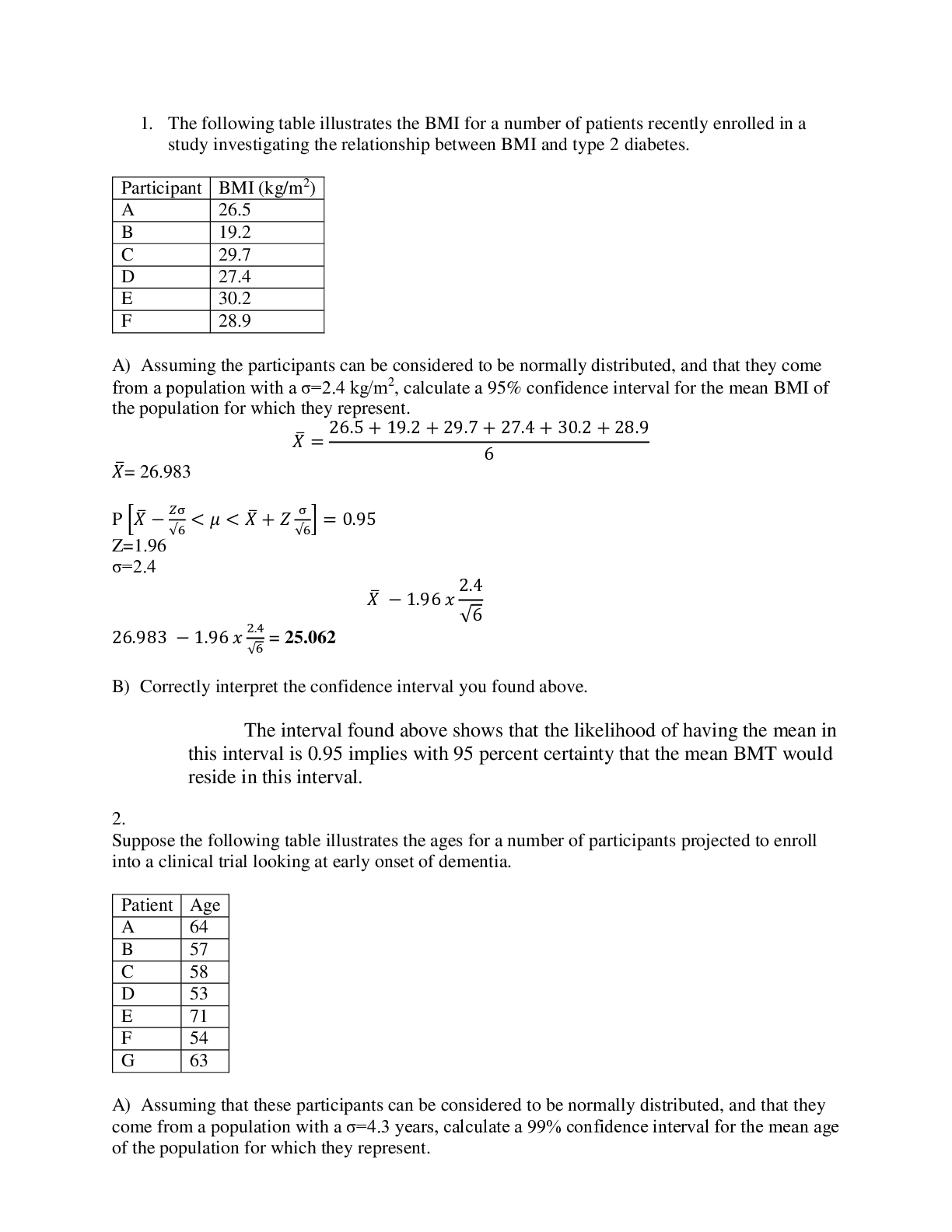

I need help to solve some problems from book Corporate Investment Analysis – in FINANCE. Book from: Reilly, F. & brown, K. (2009). Investment Analysis and Portfolio Management (9th ed.). Mason, OH: ... South-Western/ Cengage Learning. Book used by Strayer University. I need help to solve those 3 problems: 1, 2, and 3 1). On February 1, you bought 100 shares of stock in the Francesca Corporation for $34 a share and a year later you sold it for $39 a share. During the year, you received a cash dividend of $1.50 a share. Compute your HPR and HPY on this Francesca stock investment. 2). On august 15, you purchased 100 shares of stock in the Cara Cotton Company at $65 a share and a year later you sold it for $61 a share. During the year, you received dividends of $3 a share. Compute your HPR and HPY on your investment in Cara Cotton. 3). You are considering acquiring shares of common stock in the Madison Beer Corporation. Your rate of return expectations are as follows: MADISON BEER CORP. Possible Rate of Return Probability - 0.10 0.30 0.00 0.10 0.10 0.30 0.25 0.30 Compute the expected return [ E (Ri) ] on your investment in Madison Beer. [Show More]

Last updated: 2 years ago

Preview 1 out of 3 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$2.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 12, 2022

Number of pages

3

Written in

All

Additional information

This document has been written for:

Uploaded

Mar 12, 2022

Downloads

0

Views

91

.png)