Economics > TEST BANKS > Fundamentals of Corporate Finance 12th edition Ross, Westerfield, and Jordan (All)

Fundamentals of Corporate Finance 12th edition Ross, Westerfield, and Jordan

Document Content and Description Below

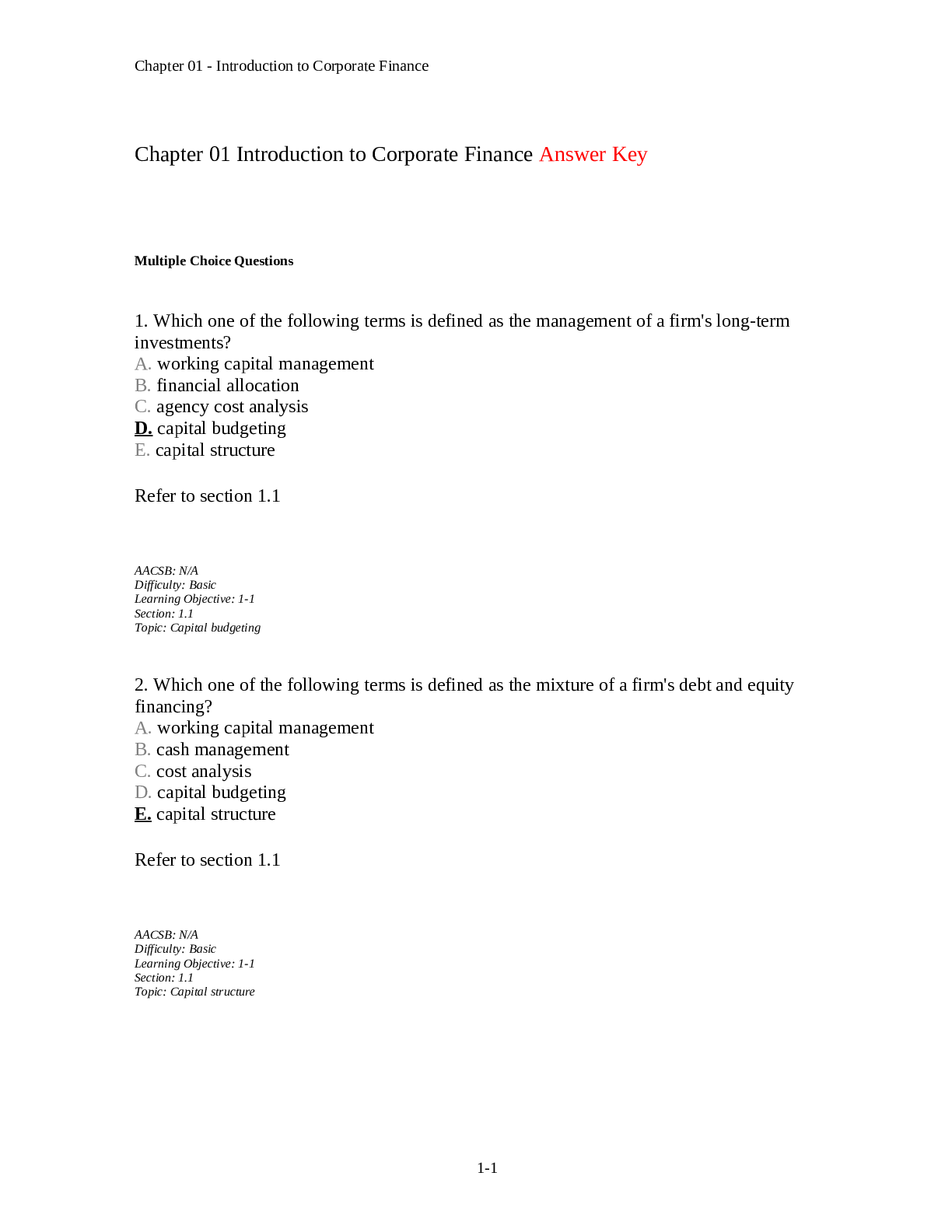

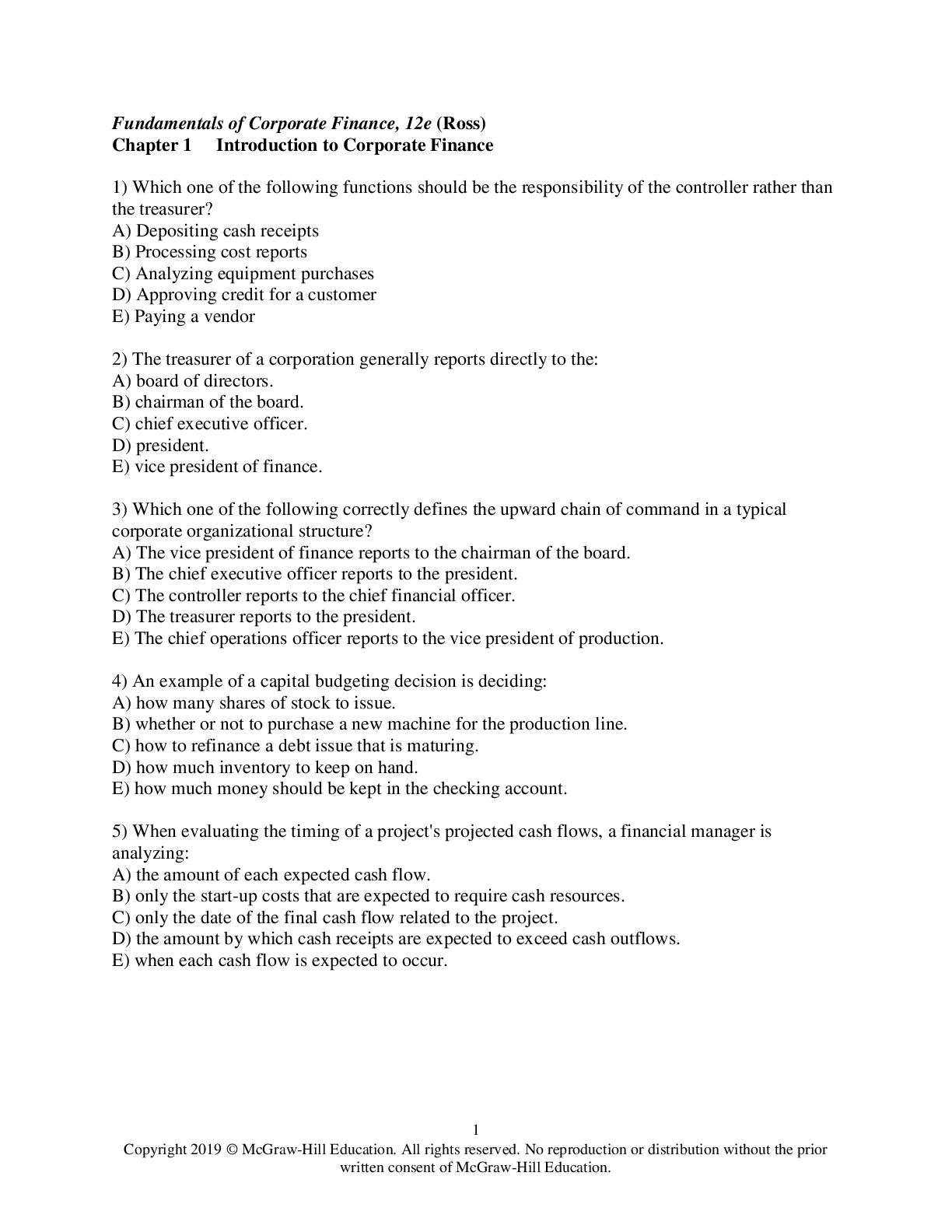

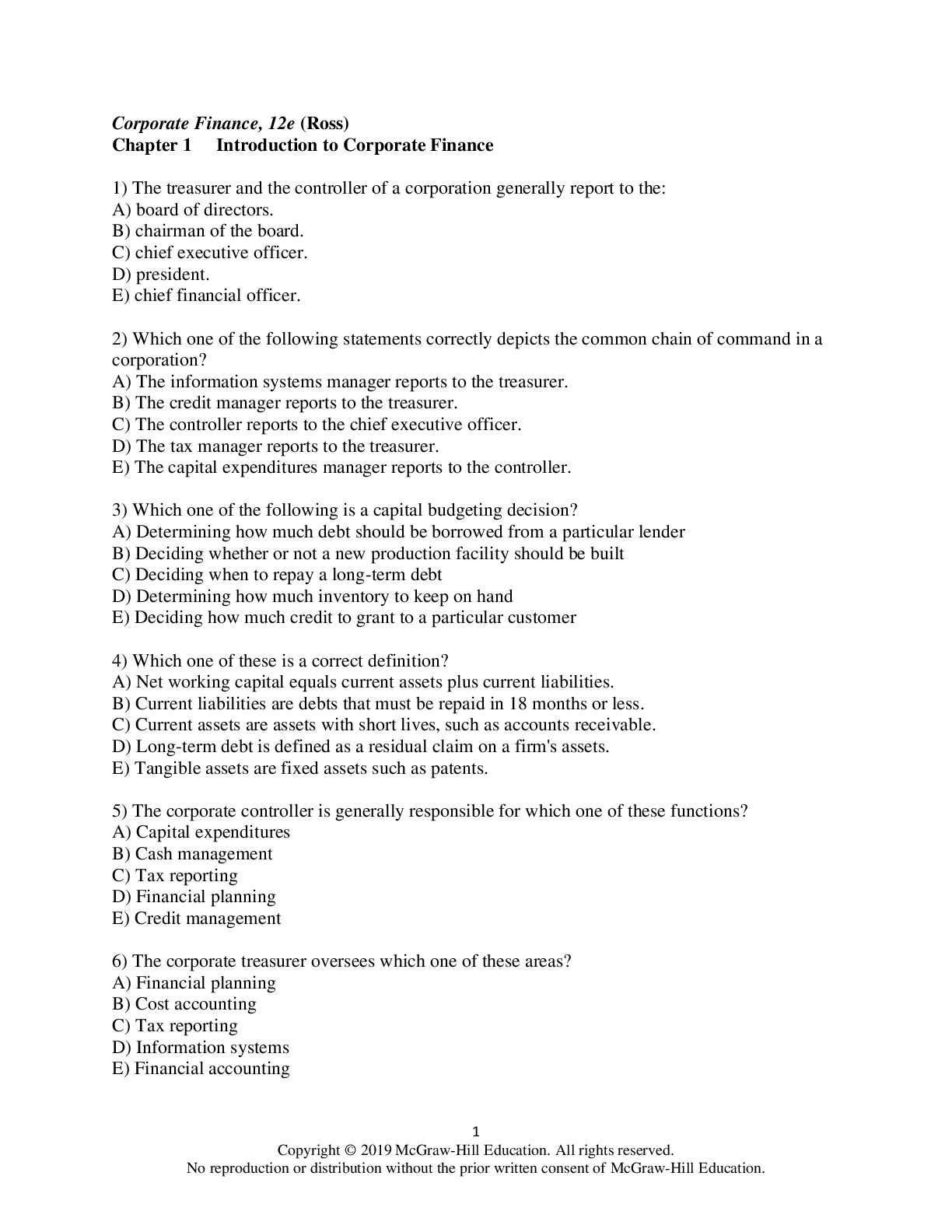

CHAPTER 1 INTRODUCTION TO CORPORATE FINANCE Answers to Concepts Review and Critical Thinking Questions 1. Capital budgeting (deciding whether to expand a manufacturing plant), capital structure (... deciding whether to issue new equity and use the proceeds to retire outstanding debt), and working capital management (modifying the firm’s credit collection policy with its customers). 2. Disadvantages: unlimited liability, limited life, difficulty in transferring ownership, difficulty in raising capital funds. Some advantages: simpler, less regulation, the owners are also the managers, sometimes personal tax rates are better than corporate tax rates. 3. The primary disadvantage of the corporate form is the double taxation to shareholders of distributed earnings and dividends. Some advantages include: limited liability, ease of transferability, ability to raise capital, and unlimited life. 4. In response to Sarbanes-Oxley, small firms have elected to go dark because of the costs of compliance. The costs to comply with Sarbox can be several million dollars, which can be a large percentage of a small firm’s profits. A major cost of going dark is less access to capital. Since the firm is no longer publicly traded, it can no longer raise money in the public market. Although the company will still have access to bank loans and the private equity market, the costs associated with raising funds in these markets are usually higher than the costs of raising funds in the public market. 5. The treasurer’s office and the controller’s office are the two primary organizational groups that report directly to the chief financial officer. The controller’s office handles cost and financial accounting, tax management, and management information systems, while the treasurer’s office is responsible for cash and credit management, capital budgeting, and financial planning. Therefore, the study of corporate finance is concentrated within the treasury group’s functions. CONTINUED............. [Show More]

Last updated: 2 years ago

Preview 1 out of 459 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$15.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 28, 2022

Number of pages

459

Written in

Additional information

This document has been written for:

Uploaded

Mar 28, 2022

Downloads

0

Views

104