Financial Accounting > EXAMs > Governmental Accounting (1-17 Questions With 100% Correct Answers) (All)

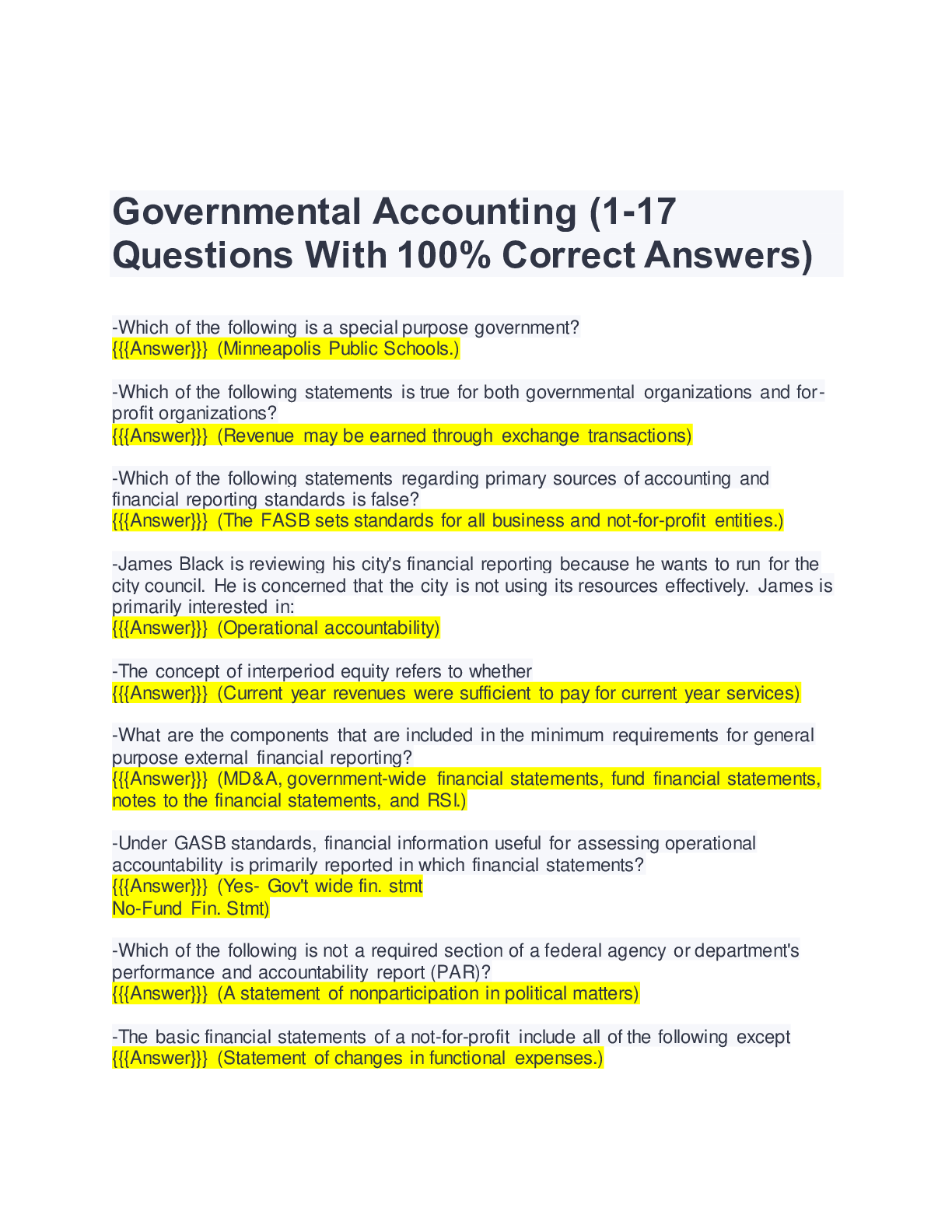

Governmental Accounting (1-17 Questions With 100% Correct Answers)

Document Content and Description Below

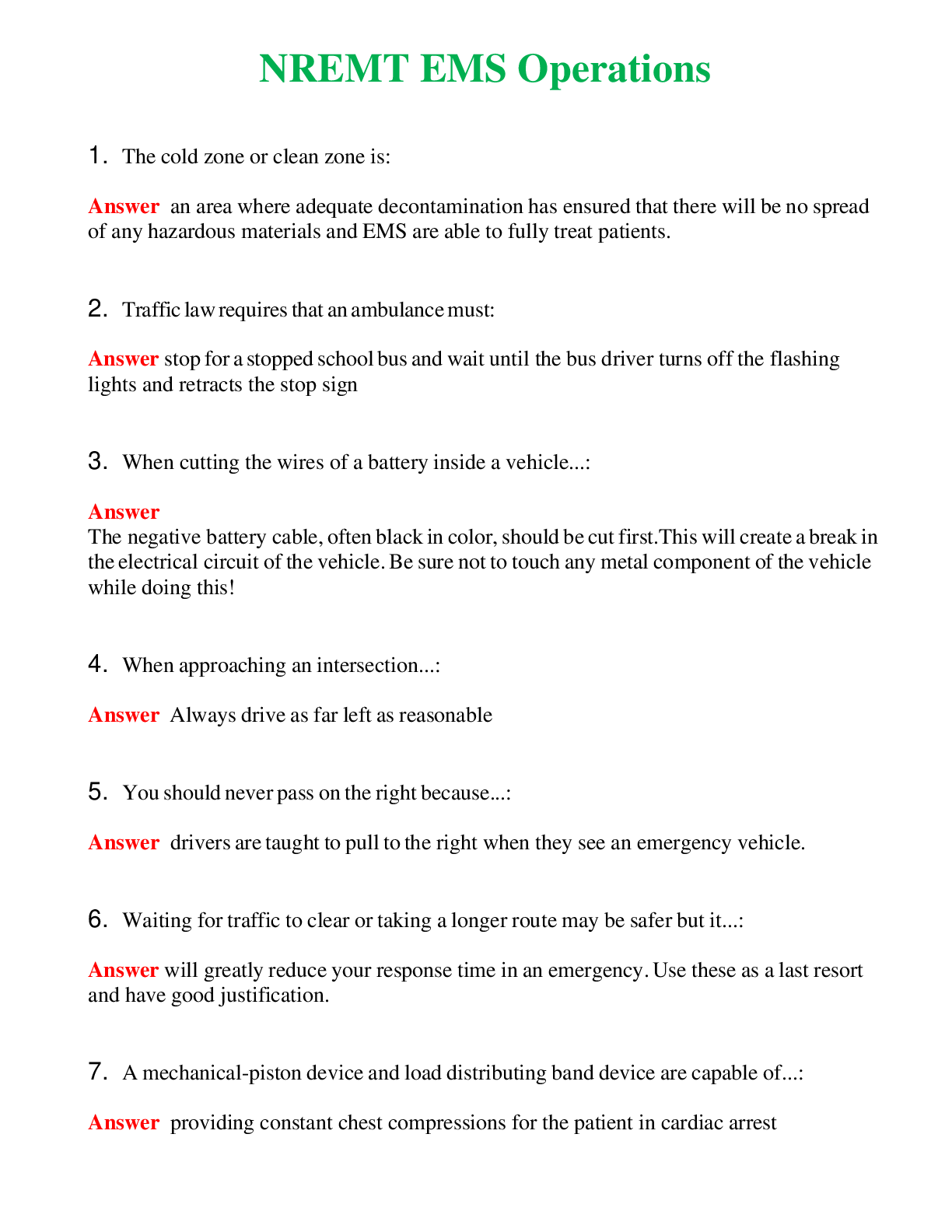

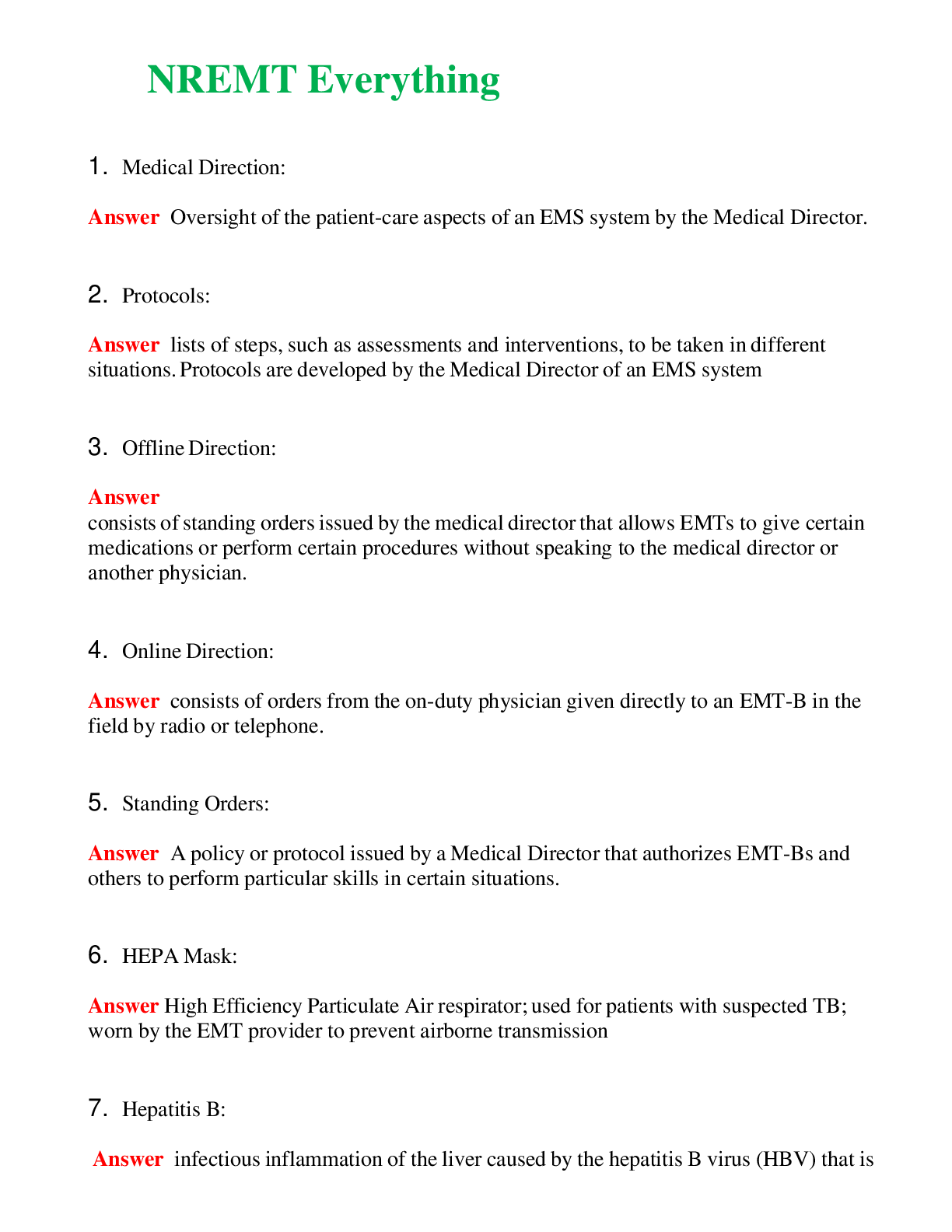

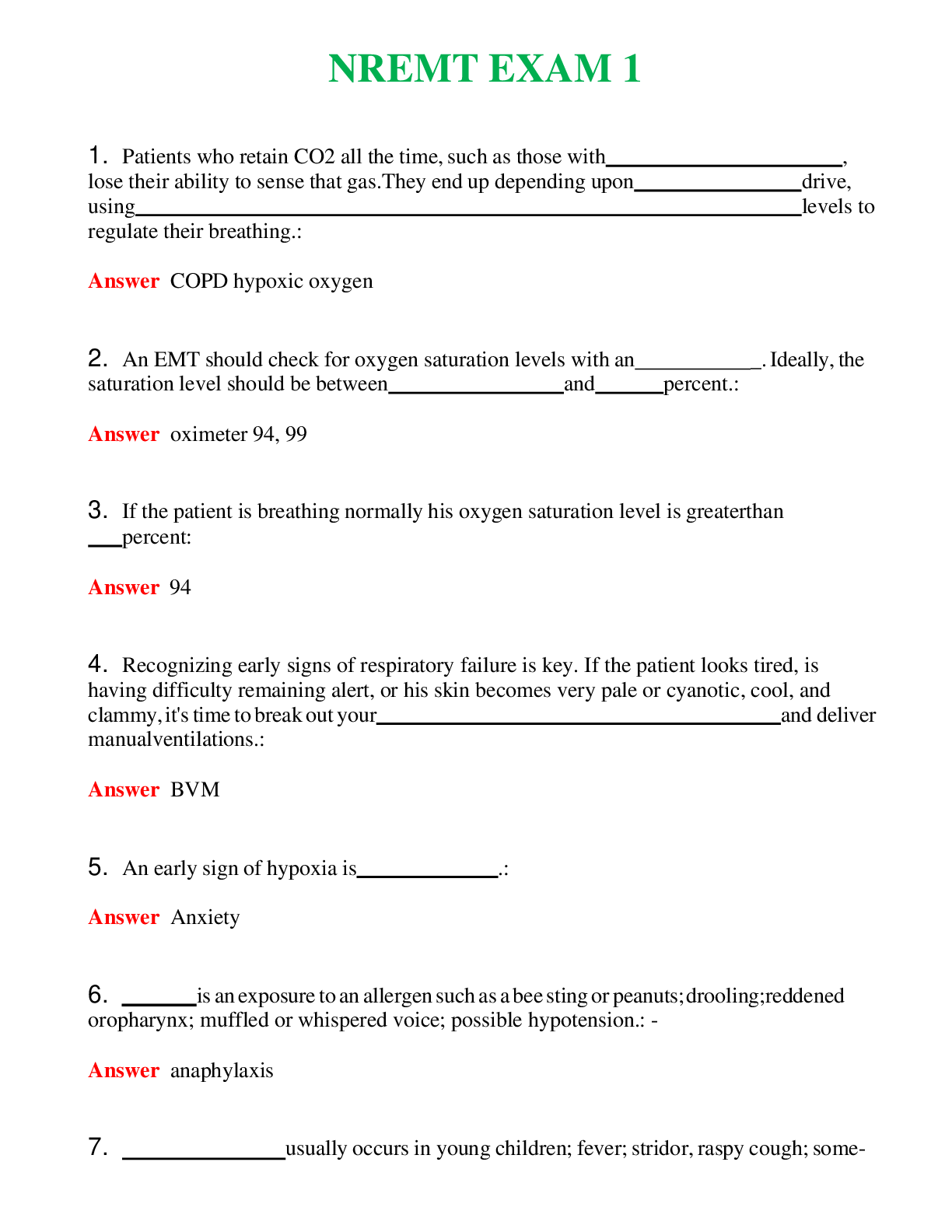

Governmental Accounting (1-17 Questions With 100% Correct Answers) -Which of the following is a special purpose government? {{{Answer}}} (Minneapolis Public Schools.) -Which of the following ... statements is true for both governmental organizations and for-profit organizations? {{{Answer}}} (Revenue may be earned through exchange transactions) -Which of the following statements regarding primary sources of accounting and financial reporting standards is false? {{{Answer}}} (The FASB sets standards for all business and not-for-profit entities.) -James Black is reviewing his city's financial reporting because he wants to run for the city council. He is concerned that the city is not using its resources effectively. James is primarily interested in: {{{Answer}}} (Operational accountability) -The concept of interperiod equity refers to whether {{{Answer}}} (Current year revenues were sufficient to pay for current year services) -What are the components that are included in the minimum requirements for general purpose external financial reporting? {{{Answer}}} (MD&A, government-wide financial statements, fund financial statements, notes to the financial statements, and RSI.) -Under GASB standards, financial information useful for assessing operational accountability is primarily reported in which financial statements? {{{Answer}}} (Yes- Gov't wide fin. stmt No-Fund Fin. Stmt) -Which of the following is not a required section of a federal agency or department's performance and accountability report (PAR)? {{{Answer}}} (A statement of nonparticipation in political matters) -The basic financial statements of a not-for-profit include all of the following except {{{Answer}}} (Statement of changes in functional expenses.) -The primary reason that not-for-profit (NFP) organizations should report expenses incurred for program purposes separately from those for supporting services such as management and general and fund-raising is that {{{Answer}}} (Donors, potential donors, oversight bodies, and others need to know what percentage of total expenses are being incurred for carrying out the NFP's programs.) -Which of the following statements is true regarding the definition of a fund? {{{Answer}}} (A fund is a fiscal entity that is designed to provide reporting that demonstrates conformance with finance-related legal and contractual provisions) -Which of the following statements is true regarding the basic financial statements of a state or local government? {{{Answer}}} (All these answer choices are correct.) -Which of the following sets of elements are common to both governmental financial statements and for-profit financial statements? {{{Answer}}} (Assets and liabilities.) -The measurement focus and basis of accounting that should be used for the governmental fund financial statements are: {{{Answer}}} (Measurement Focus: Current Financial Resources Basis of Accounting: Modified Accural) -Which of the following amounts that are identified at the end of the fiscal year would be classified as a restricted fund balance? {{{Answer}}} (A federal grant that is to be used for playground equipment) -Separate reporting for major funds is needed because {{{Answer}}} (Users of government financial statements need to be able to examine funds that represent large dollar amounts of a government's resources and activities.) -Assets and liabilities of activities for which the government is acting in either a custodial or trustee capacity for individuals, organizations, or other governments should be reported in {{{Answer}}} (The fiduciary fund financial statements) -Under the modified accrual basis of accounting {{{Answer}}} (Revenues are recognized when current financial resources become measurable and available to pay current-period obligations.) -Financial information about an internal service fund should be reported in the proprietary fund financial statements and the: {{{Answer}}} (Either governmental activities or business-type activities column of the government-wide financial statements, depending on whether the internal service fund predominantly serves governmental activities or business-type activities.) -Based on this information, which funds should be reported as major funds? {{{Answer}}} (General Fund and Library Fund.) -Which of the following is not an information characteristic that the GASB identifies as important in government financial reports? {{{Answer}}} (Conciseness.) -How should an item of information that helps explain the riskiness of the Investments account reported on the balance sheet be communicated in the financial report? {{{Answer}}} (Report as a note disclosure.) -How does the GASB recommend governments report budgetary information? {{{Answer}}} (As required supplementary information.) -Where should a deferred inflow of resources be reported on the financial statements? {{{Answer}}} (After the liabilities section on the statement of net position.) -Which of the following fund(s) will generally be the only fund(s) that can report a positive unassigned fund balance? {{{Answer}}} (General Fund) -Which of the following best describes the recommended format for the government-wide statement of activities? {{{Answer}}} (Expenses minus program revenues equals net (expense) revenue. Net (expense) revenue plus general revenues equals change in net position.) -Which of the following is an acceptable method of reporting depreciation expense for depreciable assets used by governmental activities? {{{Answer}}} (Either report as a direct expense of the function or program with which the related depreciable assets are identified or report as an indirect expense on a separate line if the depreciable assets benefit all functions or programs.) -Which of the following accounts neither increases nor decreases the fund balance of the General Fund during the fiscal year? {{{Answer}}} (Encumbrances.) -When determining taxable property for the purpose of the property tax levy, which of the following would likely be excluded from the calculation? {{{Answer}}} (All these answer options are correct.) -Which of the following statements is true for other financing uses but is not true for expenditures? {{{Answer}}} (Arise from interfund transfers out.) -An internal allocation of funds on a periodic basis, which is often used to regulate the use of appropriations over a budgetary period, is called {{{Answer}}} (An allotment.) -According to GASB standards, expenditures are classified by {{{Answer}}} (Fund, function or program, organization unit, activity, character, and object.) -Under GASB requirements for external financial reporting, the budgetary comparison schedule (or statement) would be found as a part of {{{Answer}}} (Either required supplementary information (RSI) or basic financial statements, as elected by the government.) -Before placing a purchase order, a department should check that available appropriations are sufficient to cover the cost of the item being ordered. This type of budgetary control is achieved by reviewing: {{{Answer}}} (Appropriations minus the sum of expenditures and outstanding encumbrances.) -Spruce City's finance department recorded the recently adopted General Fund budget at the beginning of the current fiscal year. The budget approved estimated revenues of $1,100,000 and appropriations of $1,000,000. Which of the following is the correct journal entry to record the budget? {{{Answer}}} (Estimated Revenues: 1,100,000 Budgetary Fund Balance: 100,000 Appropriations: 1,000,000) -Which of the following is correct concerning the presentation of the budgetary comparison schedule? {{{Answer}}} (The Actual column is required to be presented using the government's budgetary basis of accounting.) -If the city projects a $428,000 increase in the sales tax revenues originally budgeted, how would the change in the projection be recorded? {{{Answer}}} (Estimated Revenue: 428,000 Budgetary Fund Balance: 428,000) -If it is in accordance with the government's policies, which of the following budgetary accounts can remain open at the fiscal year-end? {{{Answer}}} (Encumbrances.) -Which of the following best identifies when an encumbrance is recorded? {{{Answer}}} (When goods or services are ordered.) -Supplies ordered by the Public Works function of the General Fund were received at an actual price that was less than the estimated price listed on the purchase order. What effect will this have on Public Work's appropriations available balance? {{{Answer}}} (Increases) -When equipment is purchased with General Fund resources, which of the following accounts should be debited in the General Fund? {{{Answer}}} (Expenditures) -When equipment is purchased with General Fund resources, which of the following accounts should be debited in the governmental activities journal? {{{Answer}}} (Equipment) -Goods for which a purchase order had been placed at an estimated cost of $1,600 were received at an actual cost of $1,550. The journal entry in the General Fund to record the receipt of the goods will include a: {{{Answer}}} (All of the above are correct.) -Which of the following properly represents the format of the government-wide statement of net position? {{{Answer}}} (Assets and deferred outflows minus liabilities and deferred inflows equal net position.) -Garden City has calculated that General Fund property tax revenues of $4,608,000 are required for the current fiscal year. Over the past several years, the city has collected 96 percent of all property taxes levied. The city levied property taxes in the amount that will generate the required $4,608,000. Which of the following general journal entries would correctly record the property tax levy? {{{Answer}}} (Tax Receivable: 4,800,000 Allowance:192,000 Revenue: 4,608,000) -The Town of Freeport collected $3,000 of prior year property taxes six months after year-end. Which of the following would not be part of the entry to record collection of delinquent taxes in the General Fund? {{{Answer}}} (A debit to Taxes Receivable—Delinquent for $3,000.) -The Village of Frederick borrowed $1,000,000 from a local bank by issuing 4 percent tax anticipation notes. If the village repaid the tax anticipation notes six months later after collecting its next installment of property taxes, the General Fund journal entry to record the repayment will include: {{{Answer}}} (Both debit to Tax Anticipation Notes Payable for $1,000,000 and debit to Expenditures for $20,000.) -Which of the following transactions is reported on the government-wide financial statements? {{{Answer}}} (The City Airport Fund, an enterprise fund, transfers a portion of boarding fees charged to passengers to the General Fund.) [Show More]

Last updated: 3 years ago

Preview 1 out of 22 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$13.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 29, 2022

Number of pages

22

Written in

All

Additional information

This document has been written for:

Uploaded

Mar 29, 2022

Downloads

0

Views

76