Page:of 30

Automatic Zoom Actual Size Page Fit

...

Page:of 30

Automatic Zoom Actual Size Page Fit Page Width 50% 75% 100% 125% 150% 200% 300% 400%

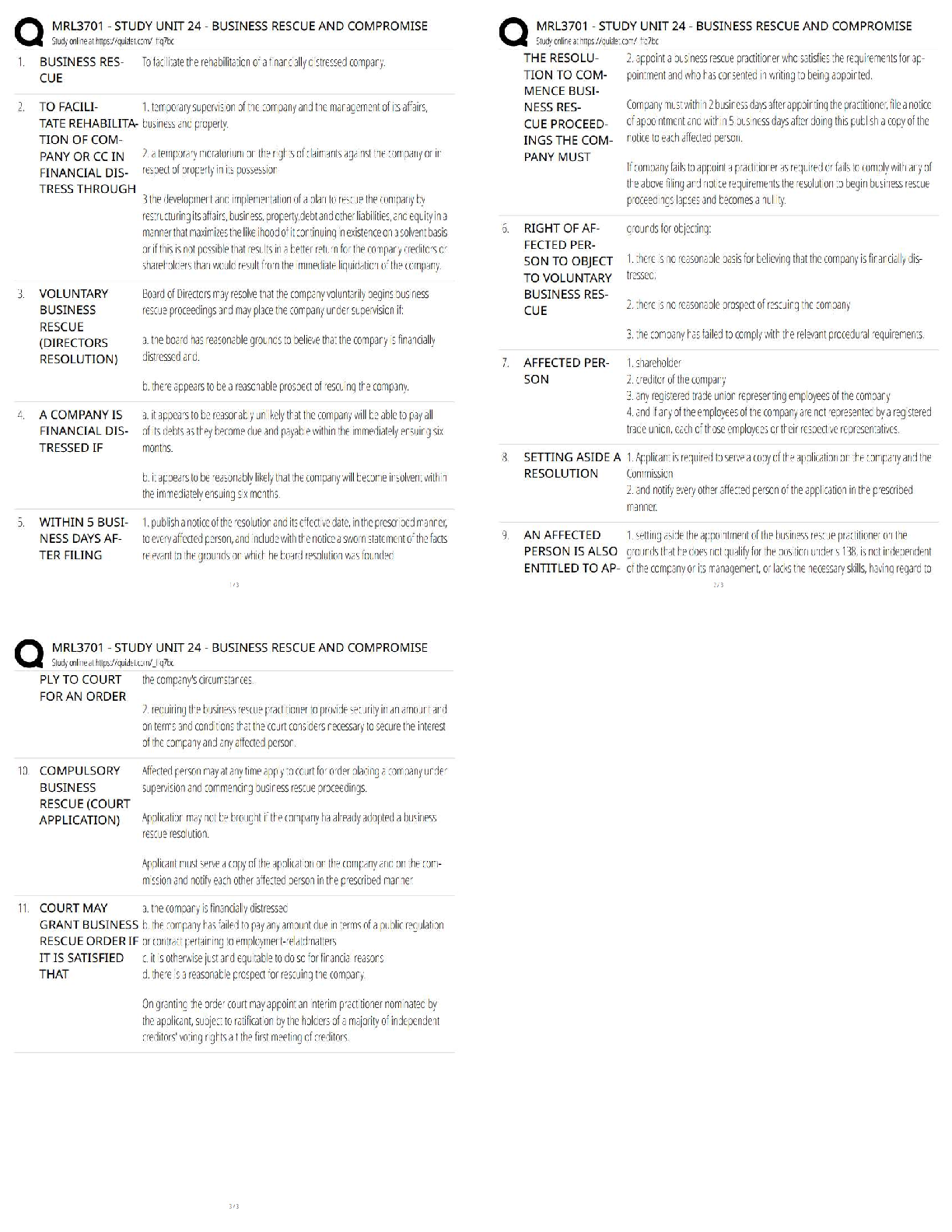

Chapter 04 - Activity-Based Costing and Cost Management

Chapter 4

Activity-Based Costing and Cost Management

ANSWERS TO QUESTIONS

1.

Volume-based measures include drivers such as machine hours and direct labor

hours which increase in proportion to increases in production volume. Non-

volume drivers do not vary with production volume and include items such as

number of batches or square footage of the facility.

2.

In the traditional cost system, indirect costs are assigned on the basis of volume-

based allocation measures such as direct labor hours or machine hours

regardless of whether they are incurred relative to that volume-based measure.

3.

Traditional costing systems tend to overcost high volume products and under-

cost low volume products that are often more complex to produce.

4.

Activity Based Costing (ABC) assigns indirect costs to products and services

based on the activities they require. Costs are assigned to various activity pools

and then products are “charged” for the activities they consume. Traditional

costing systems allocate overhead strictly on the basis of volume using cost

drivers such as direct labor hours or machine hours.

5.

Businesses that produce a variety of products or services that differ in production

volume, resources consumed, and/or attention required during the manufacturing

process would be candidates for activity based costing.

6.

ABC uses a two-stage process in which indirect costs are first assigned to

activities, and then assigned to individual products and services based on their

activities requirements.

7.

The categories of activity pools include facility level, product level, customer

level, batch level, and unit level.

8.

In a service setting, unit-level activities are related to individual customers and

are called customer-level activities. Batch-level activities are related to a group

of customers and might be called group-level activities. Product level activities

are related to a type of service offering, and would be called service-level

activities. Finally, facility level activities relate to the organization overall and

might be referred to as company-wide activities.

4-

1

.

Chapter 04 - Activity-Based Costing and Cost Management

9.

Activity based costing (ABC) classifies costs into different categories because

some costs are related to production volume while others are not. Thus, ABC

groups costs on the basis of level (unit, batch, product, customer or facility) and

appropriate cost drivers.

10.

Facility level – company payroll; customer level – customer design changes;

product level – architectural drawing for a particular floor plan; batch – paving

costs for a planned community; unit level – inspection costs

11.

A unit-level activity could be a driving lesson with a single student. A group-level

activity could be a defensive driving class given to a group of people. A service-

level activity could be purchasing a new video to show during the defensive

driving class, or maintaining the cars using for driving lessons. A facility-level

activity would include company-wide advertising or paying utilities and taxes

12.

The activity rate method involves computing an activity rate by dividing the total

cost pool by the estimated amount of allocation base. This activity rate is then

multiplied by the amount of allocation base consumed by each product. The

activity proportion method assigns activity costs to individual products by

calculating the proportion of the total cost driver consumed by each product line.

13.

Activity based management (ABM) encompasses all of the actions that

managers take to improve operations or reduce costs based on the ABC data.

To get benefits of ABC, managers must use it to manage the underlying activities

and identify activities that would benefit from process improvements.

14.

Benchmarking is a process in which managers can compare their own activity

rates to other firms in the industry, or to the best performing firms in other

industries. Benchmarking can be used to pinpoint areas where the company is

ahead or behind the competition, and provides managers with incentives to

improve their own operations.

15.

A non-value-added activity is one that, if eliminated, would not reduce the value

of the product or service in the eyes of the customer. For a construction

company, a value-added activity would be installation of the carpet or plumbing.

A non-value-added activity would be costs of storing components of the house

such as cabinetry or appliances prior to their installation.

16.

The four types of quality costs are prevention costs, appraisal or inspection

costs, internal failure costs, and external failure costs.

4-

2

Chapter 04 - Activity-Based Costing and Cost Management

17.

Target costing determines what the product’s cost must be in order to meet the

market price and still provide a profit for the company's shareholders. It is also

sometimes called cost planning because it requires managers to think about

costs "up-front" so that they can design and manufacture products to a cost that

will satisfy both customers (through the market price) and shareholders (through

a target profit).

18.

In a JIT system, materials are purchased and units are made only as they are

needed to satisfy customer demand. JIT is a "demand pull" system, where

materials and products are pulled through the manufacturing system based on

customer demand, as opposed to a traditional manufacturing setting where

products are pushed through the system and often end up sitting in inventory.

The primary benefit of JIT is the elimination of inventory storage costs which are

a non-value-added activity.

19.

Advantages of activity based costing include more accurate product costing and

better information about different products’ relative consumption of manufacturing

resources. The primary disadvantage is the complexity of ABC and the effort

needed to determine multiple cost pools and cost drivers.

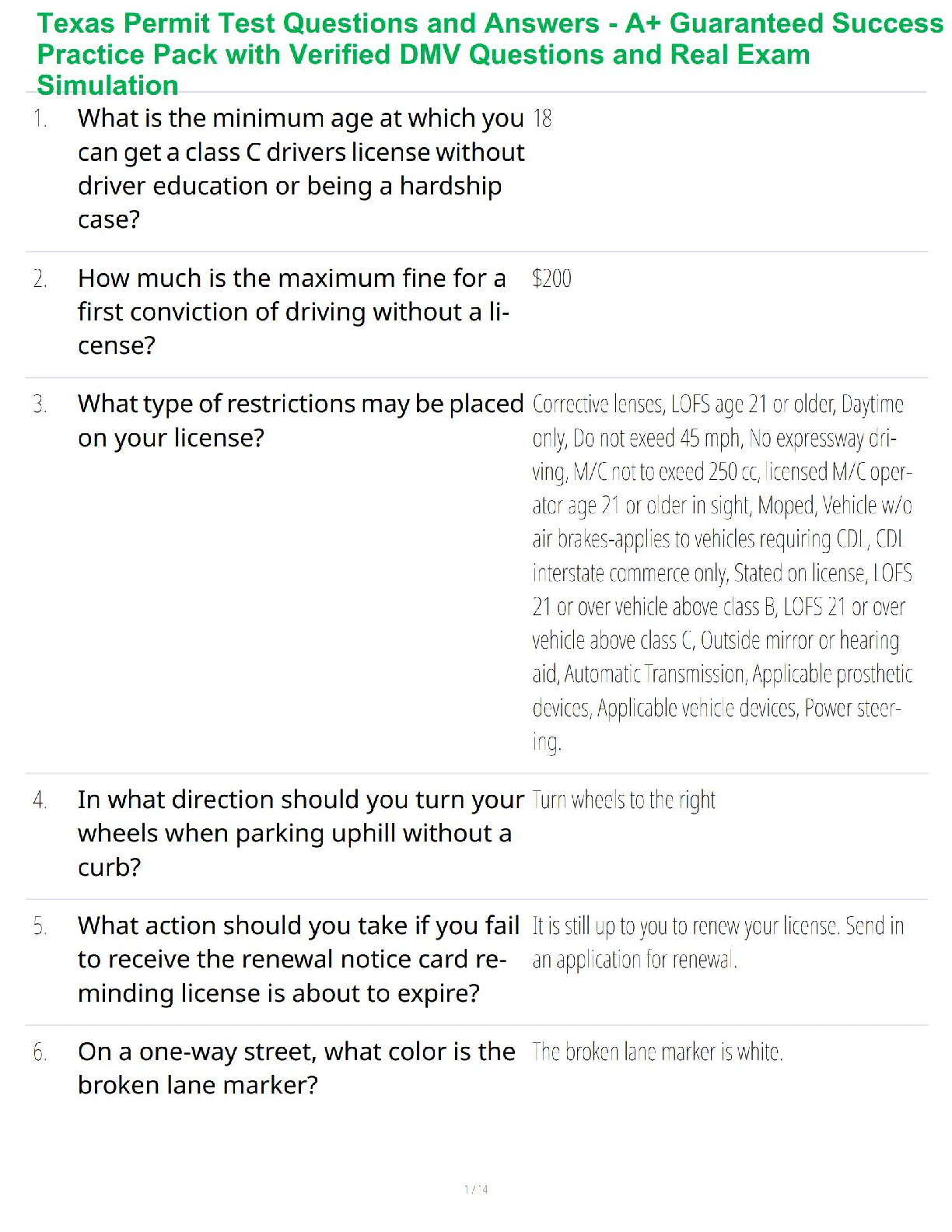

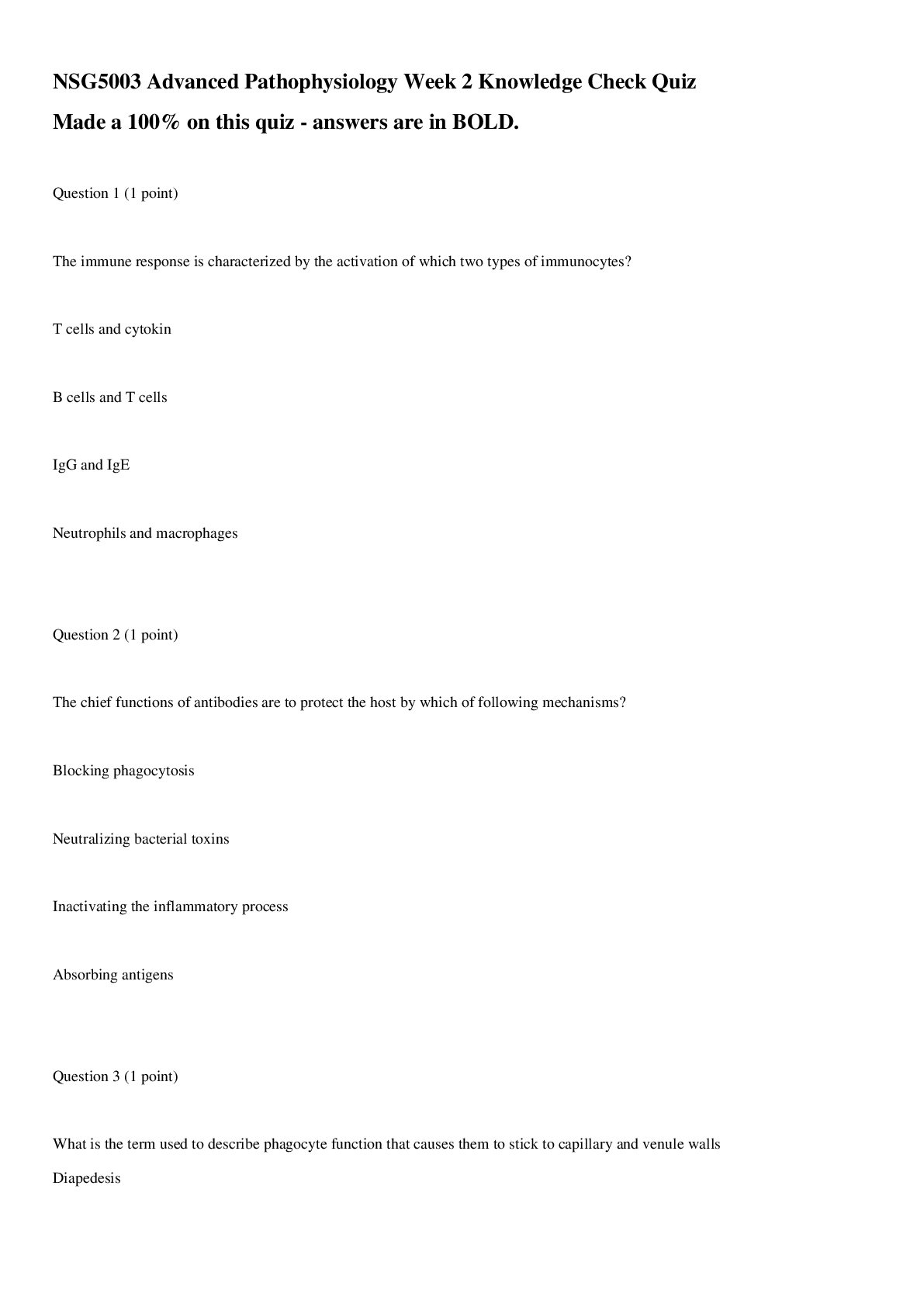

Authors' Recommended Solution Time

(Time in minutes)

Mini-exercises

Exercises

Problems

Cases and

Projects*

No.

Time

No.

Time

No.

Time

No.

Time

1

3

1

4

PA-1

9

1

30

2

4

2

4

PA-2

9

2

30

3

4

3

5

PA-3

10

3

30

4

4

4

5

PA-4

10

4

30

5

4

5

4

PA-5

10

5

30

6

3

6

5

PB-1

9

7

4

7

5

PB-2

9

8

3

8

6

PB-3

10

9

3

9

6

PB-4

10

10

3

10

6

PB-5

10

11

3

11

6

12

3

12

7

13

7

14

7

15

5

16

5

17

5

18

5

19

5

4-

3

.

[Show More]

![Preview image of [Solved] Volume-based measures include drivers such as machine hours and direct labor document](https://scholarfriends.com/storage/Managerial-Accounting-Whitecotton-2nd-edition-solution-chapter-4.png)

.png)