Test Bank Chapter 14 Long-Term Liabilities.

CHAPTER 14

LONG-TERM LIABILITIES

IFRS questions are available at the end of this chapter.

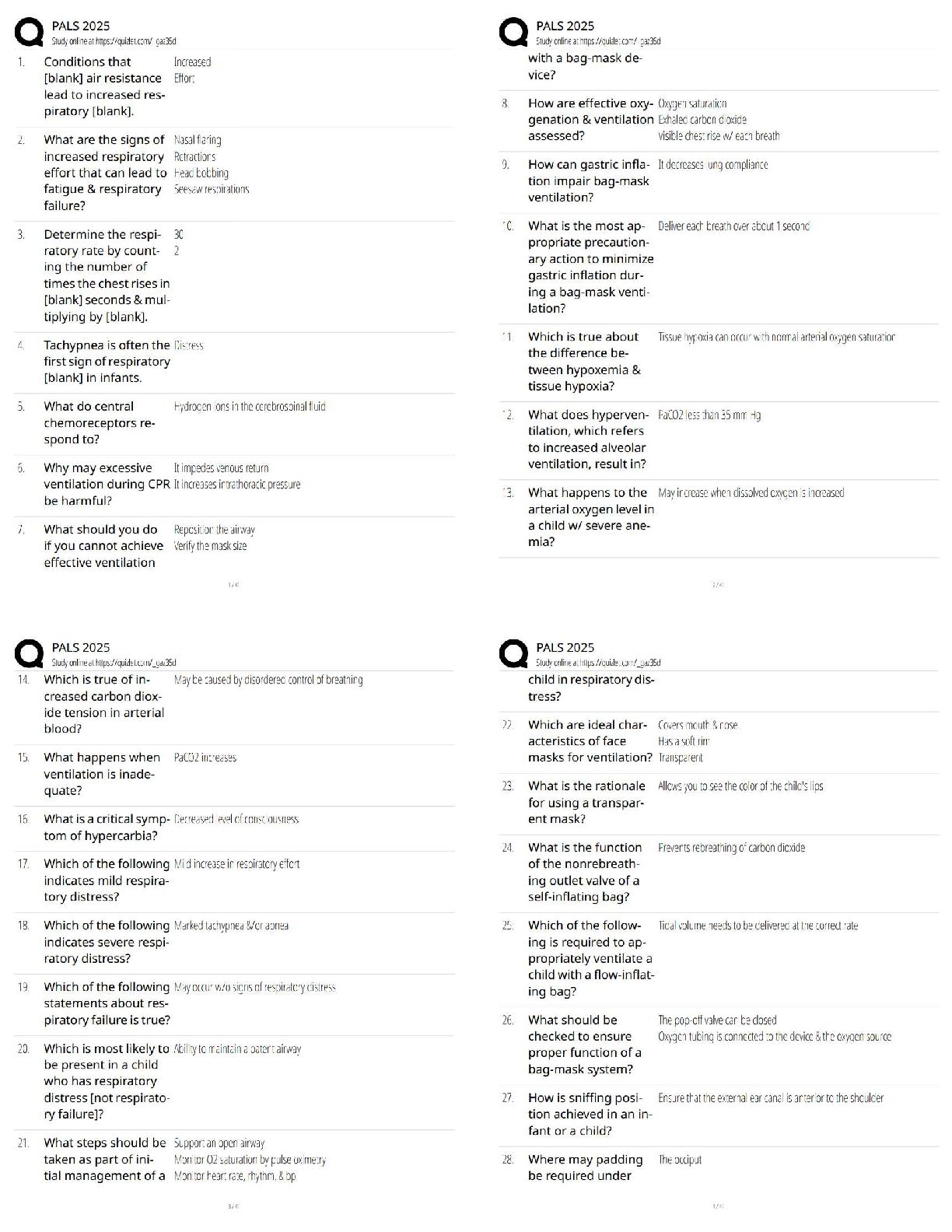

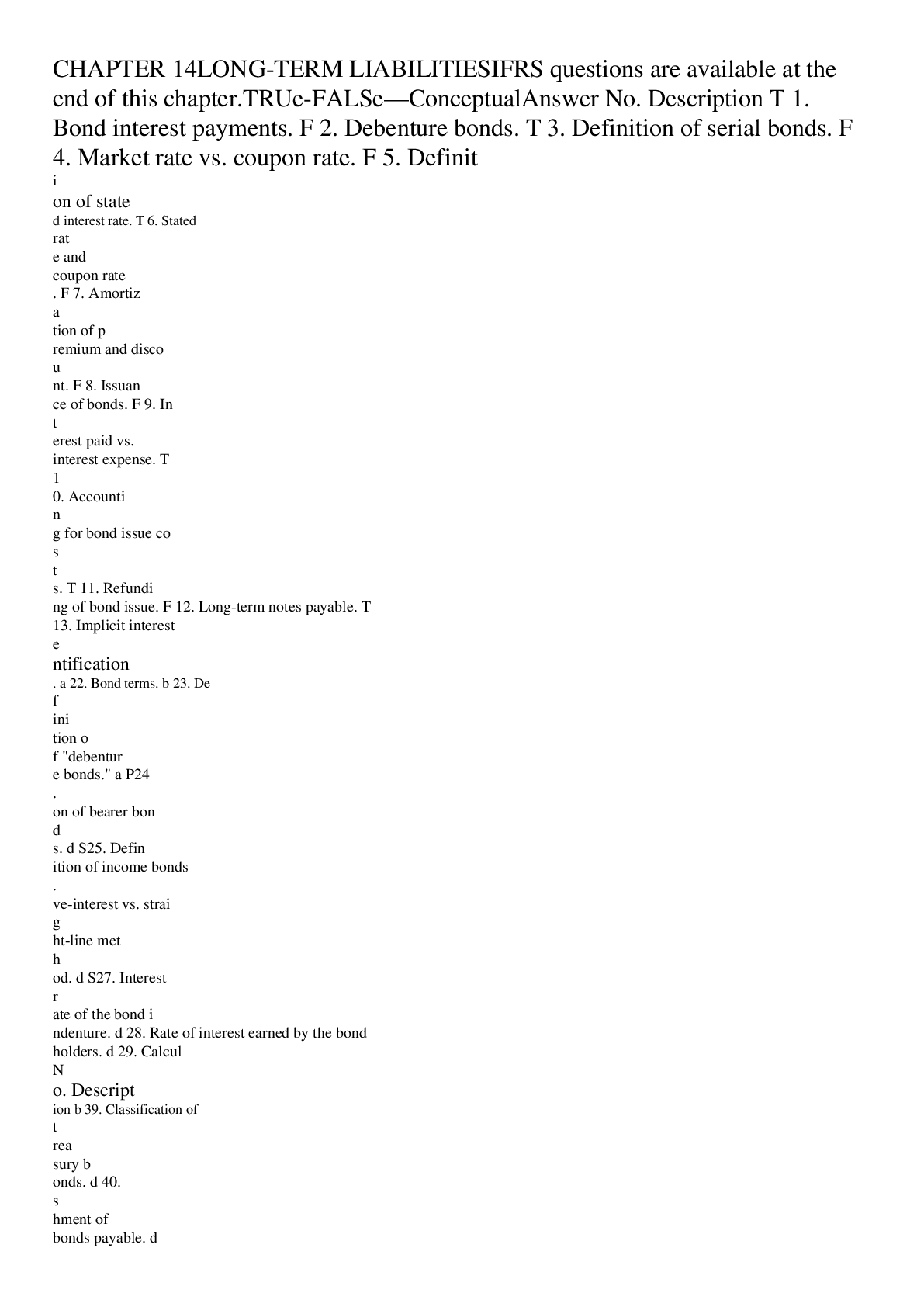

TRUe-FALSe—Conceptual

Answer No. Description

...

Test Bank Chapter 14 Long-Term Liabilities.

CHAPTER 14

LONG-TERM LIABILITIES

IFRS questions are available at the end of this chapter.

TRUe-FALSe—Conceptual

Answer No. Description

T 1. Bond interest payments.

F 2. Debenture bonds.

T 3. Definition of serial bonds.

F 4. Market rate vs. coupon rate.

F 5. Definition of stated interest rate.

T 6. Stated rate and coupon rate.

F 7. Amortization of premium and discount.

F 8. Issuance of bonds.

F 9. Interest paid vs. interest expense.

T 10. Accounting for bond issue costs.

T 11. Refunding of bond issue.

F 12. Long-term notes payable.

T 13. Implicit interest rate.

T 14. Definition of unrealized holiday gain/loss.

T 15. Off-balance-sheet financing.

T 16. Debt to total assets ratio.

F 17. Refinancing long-term debt.

F 18. Times interest earned ratio.

F *19. Loss recognized on impaired loan.

F *20. Gain/loss in troubled debt restructuring.

Multiple Choice—Conceptual

Answer No. Description

a 21. Liability identification.

a 22. Bond terms.

b 23. Definition of "debenture bonds."

a P24. Definition of bearer bonds.

d S25. Definition of income bonds.

a S26. Effective-interest vs. straight-line method.

d S27. Interest rate of the bond indenture.

d 28. Rate of interest earned by the bondholders.

d 29. Calculating the issue price of bonds.

d 30. Calculating the issue price of bonds.

b 31. Premium and interest rates.

a 32. Interest and discount amortization.

d 33. Effective-interest amortization method.

d 34. Impact of effective-interest method.

c 35. Recording bonds issued between interest dates.

d 36. Bonds issued at other than an interest date.

d 37. Classification of bond issuance costs.

c 38. Bond issuance costs.

Multiple Choice—Conceptual (cont.)

Answer No. Description

b 39. Classification of treasury bonds.

d 40. Early extinguishment of bonds payable.

d 41. Gain or loss on extinguishment of debt.

c P42. In-substance defeasance.

c P43. Reporting long-term debt.

a S44. Debt instrument exchanged for property.

d 45. Valuation of note issued in noncash transaction.

d 46. Stated interest rate of note.

c 47. Accounting for the fair value option.

d 48. Off-balance-sheet financing.

c S49. Off-balance-sheet financing.

d S50. Long-term debt maturing within one year.

d 51. Required bond disclosures.

d 52. Long-term debt disclosures.

c 53. Times interest earned ratio.

c. 54. Debt to total assets ratio.

c *55. Modification of terms in debt restructure.

d *56. Gain/loss on troubled debt restructuring.

b *57. Gain/loss on troubled debt restructuring.

b *58. Interest and troubled debt restructuring.

c *59. Creditor's calculations for modification of terms.

P These questions also appear in the Problem-Solving Survival Guide.

S These questions also appear in the Study Guide.

* This topic is dealt with in an Appendix to the chapter.

Multiple Choice—Computational

Answer No. Description

a 60. Calculate the present value of bond principal.

b 61. Calculate the present value of bond interest.

a 62. Determine the issue price of bonds.

c 63. Proceeds from bond issuance.

c 64. Bonds issued between interest dates.

c 65. Proceeds from bond issuance.

c 66. Bonds issued between interest dates.

c 67. Effective-interest method interest expense.

a 68. Effective-interest method carrying value.

d 69. Straight-line method carrying value.

d 70. Straight-line amortization/interest expense.

c 71. Effective-interest method interest expense.

a 72. Effective-interest method carrying value.

d 73. Straight-line method carrying value.

d 74. Straight-line method amortization/interest expense.

b 75. Interest expense using effective-interest method.

c 76. Interest expense using effective-interest method.

d 77. Entry to record issuance of bonds.

a 78. Calculate bond interest expense.

Multiple Choice—Computational (cont.)

Answer No. Description

b 79. Entry to record issuance of bonds.

c 80. Calculate bond interest expense.

b 81. Calculate interest expense for two periods.

b 82. Calculate unamortized bond discount balance.

b 83. Calculate unamortized bond premium balance.

c 84. Calculate interest expense for two periods.

b 85. Entry to record bond redemption.

b 86. Entry to record bond redemption.

b 87. Calculate loss on bond redemption.

c 88. Calculate loss on bond redemption.

c 89. Calculate gain on retirement of bonds.

b 90. Calculate gain on retirement of bonds.

b 91. Calculate loss on retirement of bonds.

b 92. Bond retirement with call premium.

b 93. Calculate loss on retirement of bonds.

b 94. Early extinguishment of debt.

b 95. Early extinguishment of debt.

a 96. Interest on noninterest-bearing note.

c 97. Interest on installment note payable.

b 98. Determine balance of discount on notes payable.

d 99. Calculate times interest earned ratio.

a 100. Calculate times interest earned ratio.

c 101. Calculate income before taxes with times interest earned ratio.

d 102. Determine total long-term liabilities.

b *103. Transfer of equipment in debt settlement.

d *104. Recognizing gain on debt restructure.

a *105. Interest and troubled debt restructuring.

Multiple Choice—CPA Adapted

Answer No. Description

a 106. Determine proceeds from bond issue.

b 107. Determine unamortized bond premium.

a 108. Determine unamortized bond discount.

c 109. Calculate bond interest expense.

a 110. Calculate loss on retirement of bonds.

d 111. Calculate loss on retirement of bonds.

d 112. Calculate gain on retirement of bonds.

c 113. Determine carrying value of bonds to be retired.

c 114. Carrying value of bonds with call provision.

c 115. Classification of gain from debt refunding.

d *116. Classification of gain from troubled debt restructuring.

Exercises

Item Description

E14-117 Terms related to long-term debt.

E14-118 Bond issue price and premium amortization.

E14-119 Amortization of discount or premium.

E14-120 Entries for bonds payable.

E14-121 Retirement of bonds.

E14-122 Early extinguishment of debt.

*E14-123 Accounting for a troubled debt settlement.

*E14-124 Accounting for troubled debt restructuring.

*E14-125 Accounting for troubled debt.

PROBLEMS

Item Description

P14-126 Bond discount amortization.

P14-127 Bond interest and discount amortization.

P14-128 Entries for bonds payable.

P14-129 Entries for bonds payable.

P14-130 Fair value option

*P14-131 Accounting for a troubled debt settlement.

CHAPTER LEARNING OBJECTIVES

1. Describe the formal procedures associated with issuing long-term debt.

2. Identify various types of bond issues.

3. Describe the accounting valuation for bonds at date of issuance.

4. Apply the methods of bond discount and premium amortization.

5. Describe the accounting for the extinguishment of debt.

6. Explain the accounting for long-term notes payable.

7. Describe the accounting for the fair value option.

8. Explain the reporting of off-balance-sheet financing arrangements.

9. Indicate how to present and analyze long-term debt.

*10. Describe the accounting for a debt restructuring.

SUMMARY OF LEARNING OBJECTIVES BY QUESTIONS

Item

Type

Item

Type

Item

Type

Item

Type

Item

Type

Item

Type

Item

Type

Learning Objective 1

1.

TF

21.

MC

22.

MC

Learning Objective 2

2.

TF

3.

TF

23.

MC

P24.

MC

S25.

MC

Learning Objective 3

4.

TF

27.

MC

30.

MC

62.

MC

117.

E

5.

TF

28.

MC

60.

MC

63.

MC

118.

E

6.

TF

29.

MC

61.

MC

65.

MC

126.

P

Learning Objective 4

7.

TF

34.

MC

67.

MC

75.

MC

83.

MC

119.

E

8.

TF

35.

MC

68.

MC

76.

MC

84.

MC

120.

E

9.

TF

36.

MC

69.

MC

77.

MC

106.

MC

126.

P

10.

TF

37.

MC

70.

MC

78.

MC

107.

MC

127.

P

26.

MC

38.

MC

71.

MC

79.

MC

108.

MC

128.

P

31.

MC

39.

MC

72.

MC

80.

MC

109.

MC

129.

P

32.

MC

64.

MC

73.

MC

81.

MC

117.

E

33.

MC

66.

MC

74.

MC

82.

MC

118.

E

Learning Objective 5

11.

TF

85.

MC

89.

MC

93.

MC

111.

MC

115.

MC

122.

E

40.

MC

86.

MC

90.

MC

94.

MC

112.

MC

117.

E

128.

P

41.

MC

87.

MC

91.

MC

95.

MC

113.

MC

120.

E

P42.

MC

88.

MC

92.

MC

110.

MC

114.

MC

121.

E

Learning Objective 6

12.

TF

P43.

MC

45.

MC

47.

MC

97.

MC

13.

TF

S44.

MC

46.

MC

96.

MC

98.

MC

Learning Objective 7

14.

TF

47

MC

130.

P

Learning Objective 8

15.

TF

48.

MC

S49.

MC

Learning Objective 9

16.

TF

18.

TF

51.

MC

53.

MC

99.

MC

101.

MC

17.

TF

S50.

MC

52.

MC

54.

MC

100.

MC

102.

MC

Learning Objective *10

19.

TF

56.

MC

59.

MC

105.

MC

124.

E

20.

TF

57.

MC

103.

MC

106.

MC

125.

E

55.

MC

58.

MC

104.

MC

123.

E

131.

P

Note: TF = True-False E = Exercise

MC = Multiple Choice P = Problem

TRUE FALSE—Conceptual

1. Companies usually make bond interest payments semiannually, although the interest rate is generally expressed as an annual rate.

2. A mortgage bond is referred to as a debenture bond.

3. Bond issues that mature in installments are called serial bonds.

4. If the market rate is greater than the coupon rate, bonds will be sold at a premium.

5. The interest rate written in the terms of the bond indenture is called the effective yield or market rate.

6. The stated rate is the same as the coupon rate.

7. Amortization of a premium increases bond interest expense, while amortization of a discount decreases bond interest expense.

8. A bond may only be issued on an interest payment date.

9. The cash paid for interest will always be greater than interest expense when using effective-interest amortization for a bond.

10. Bond issue costs are capitalized as a deferred charge and amortized to expense over the life of the bond issue.

11. The replacement of an existing bond issue with a new one is called refunding.

12. If a long-term note payable has a stated interest rate, that rate should be considered to be the effective rate.

13. The implicit interest rate is the rate that equates the cash received with the amounts received in the future.

14. An unrealized holding gain or loss is the net change in the fair value of the liability from one period to another, exclusive of interest expense recognized but not recorded.

15. Off-balance-sheet financing is an attempt to borrow monies in such a way to minimize the reporting of debt on the balance sheet.

16. The debt to total assets ratio will go up if an equal amount of assets and liabilities are added to the balance sheet.

17. If a company plans to retire long-term debt from a bond retirement fund, it should report the debt as current.

18. The times interest earned ratio is computed by dividing income before interest expense by interest expense.

*19. The loss to be recognized by a creditor on an impaired loan is the difference between the investment in the loan and the expected undiscounted future cash flows from the loan.

*20. In a troubled debt restructuring, the loss recognized by the creditor will equal the gain recognized by the debtor.

True False Answers—Conceptual

Item

Ans.

Item

Ans.

Item

Ans.

Item

Ans.

1.

T

6.

T

11.

T

16.

T

2.

F

7.

F

12.

F

17.

F

3.

T

8.

F

13.

T

18.

F

4.

F

9.

F

14.

T

19.

F

5.

F

10.

T

15.

T

20.

F

MULTIPLE CHOICE—Conceptual

21. An example of an item which is not a liability is

a. dividends payable in stock.

b. advances from customers on contracts.

c. accrued estimated warranty costs.

d. the portion of long-term debt due within one year.

22. The covenants and other terms of the agreement between the issuer of bonds and the lender are set forth in the

a. bond indenture.

b. bond debenture.

c. registered bond.

d. bond coupon.

23. The term used for bonds that are unsecured as to principal is

a. junk bonds.

b. debenture bonds.

c. indebenture bonds.

d. callable bonds.

P24. Bonds for which the owners' names are not registered with the issuing corporation are called

a. bearer bonds.

b. term bonds.

c. debenture bonds.

d. secured bonds.

S25. Bonds that pay no interest unless the issuing company is profitable are called

a. collateral trust bonds.

b. debenture bonds.

c. revenue bonds.

d. income bonds.

S26. If bonds are issued initially at a premium and the effective-interest method of amortization is used, interest expense in the earlier years will be

a. greater than if the straight-line method were used.

b. greater than the amount of the interest payments.

c the same as if the straight-line method were used.

d. less than if the straight-line method were used.

27. The interest rate written in the terms of the bond indenture is known as the

a. coupon rate.

b. nominal rate.

c. stated rate.

d. coupon rate, nominal rate, or stated rate.

28. The rate of interest actually earned by bondholders is called the

a. stated rate.

b. yield rate.

c. effective rate.

d. effective, yield, or market rate.

Use the following information for questions 29 and 30:

Fox Co. issued $100,000 of ten-year, 10% bonds that pay interest semiannually. The bonds are sold to yield 8%.

29. One step in calculating the issue price of the bonds is to multiply the principal by the table value for

a. 10 periods and 10% from the present value of 1 table.

b. 20 periods and 5% from the present value of 1 table.

c. 10 periods and 8% from the present value of 1 table.

d. 20 periods and 4% from the present value of 1 table.

30. Another step in calculating the issue price of the bonds is to

a. multiply $10,000 by the table value for 10 periods and 10% from the present value of an annuity table.

b. multiply $10,000 by the table value for 20 periods and 5% from the present value of an annuity table.

c. multiply $10,000 by the table value for 20 periods and 4% from the present value of an annuity table.

d. none of these.

31. Reich, Inc. issued bonds with a maturity amount of $200,000 and a maturity ten years from date of issue. If the bonds were issued at a premium, this indicates that

a. the effective yield or market rate of interest exceeded the stated (nominal) rate.

b. the nominal rate of interest exceeded the market rate.

c. the market and nominal rates coincided.

d. no necessary relationship exists between the two rates.

32. If bonds are initially sold at a discount and the straight-line method of amortization is used, interest expense in the earlier years will

a. exceed what it would have been had the effective-interest method of amortization been used.

b. be less than what it would have been had the effective-interest method of amortization been used.

c. be the same as what it would have been had the effective-interest method of amortiza-tion been used.

d. be less than the stated (nominal) rate of interest.

33. Under the effective-interest method of bond discount or premium amortization, the periodic interest expense is equal to

a. the stated (nominal) rate of interest multiplied by the face value of the bonds.

b. the market rate of interest multiplied by the face value of the bonds.

c. the stated rate multiplied by the beginning-of-period carrying amount of the bonds.

d. the market rate multiplied by the beginning-of-period carrying amount of the bonds.

34. When the effective-interest method is used to amortize bond premium or discount, the periodic amortization will

a. increase if the bonds were issued at a discount.

b. decrease if the bonds were issued at a premium.

c. increase if the bonds were issued at a premium.

d. increase if the bonds were issued at either a discount or a premium.

35. If bonds are issued between interest dates, the entry on the books of the issuing corporation could include a

a. debit to Interest Payable.

b. credit to Interest Receivable.

c. credit to Interest Expense.

d. credit to Unearned Interest.

36. When the interest payment dates of a bond are May 1 and November 1, and a bond issue is sold on June 1, the amount of cash received by the issuer will be

a. decreased by accrued interest from June 1 to November 1.

b. decreased by accrued interest from May 1 to June 1.

c. increased by accrued interest from June 1 to November 1.

d. increased by accrued interest from May 1 to June 1.

37. Theoretically, the costs of issuing bonds could be

a. expensed when incurred.

b. reported as a reduction of the bond liability.

c. debited to a deferred charge account and amortized over the life of the bonds.

d. any of these.

38. The printing costs and legal fees associated with the issuance of bonds should

a. be expensed when incurred.

b. be reported as a deduction from the face amount of bonds payable.

c. be accumulated in a deferred charge account and amortized over the life of the bonds.

d. not be reported as an expense until the period the bonds mature or are retired.

39. Treasury bonds should be shown on the balance sheet as

a. an asset.

b. a deduction from bonds payable issued to arrive at net bonds payable and outstanding.

c. a reduction of stockholders' equity.

d. both an asset and a liability.

40. An early extinguishment of bonds payable, which were originally issued at a premium, is made by purchase of the bonds between interest dates. At the time of reacquisition

a. any costs of issuing the bonds must be amortized up to the purchase date.

b. the premium must be amortized up to the purchase date.

c. interest must be accrued from the last interest date to the purchase date.

d. all of these.

41. The generally accepted method of accounting for gains or losses from the early extinguishment of debt treats any gain or loss as

a. an adjustment to the cost basis of the asset obtained by the debt issue.

b. an amount that should be considered a cash adjustment to the cost of any other debt issued over the remaining life of the old debt instrument.

c. an amount received or paid to obtain a new debt instrument and, as such, should be amortized over the life of the new debt.

d. a difference between the reacquisition price and the net carrying amount of the debt which should be recognized in the period of redemption.

P42. "In-substance defeasance" is a term used to refer to an arrangement whereby

a. a company gets another company to cover its payments due on long-term debt.

b. a governmental unit issues debt instruments to corporations.

c. a company provides for the future repayment of a long-term debt by placing purchased securities in an irrevocable trust.

d. a company legally extinguishes debt before its due date.

P43. A corporation borrowed money from a bank to build a building. The long-term note signed by the corporation is secured by a mortgage that pledges title to the building as security for the loan. The corporation is to pay the bank $80,000 each year for 10 years to repay the loan. Which of the following relationships can you expect to apply to the situation?

a. The balance of mortgage payable at a given balance sheet date will be reported as a long-term liability.

b. The balance of mortgage payable will remain a constant amount over the 10-year period.

c. The amount of interest expense will decrease each period the loan is outstanding, while the portion of the annual payment applied to the loan principal will increase each period.

d. The amount of interest expense will remain constant over the 10-year period.

S44. A debt instrument with no ready market is exchanged for property whose fair value is currently indeterminable. When such a transaction takes place

a. the present value of the debt instrument must be approximated using an imputed interest rate.

b. it should not be recorded on the books of either party until the fair value of the property becomes evident.

c. the board of directors of the entity receiving the property should estimate a value for the property that will serve as a basis for the transaction.

d. the directors of both entities involved in the transaction should negotiate a value to be assigned to the property.

45. When a note payable is issued for property, goods, or services, the present value of the note is measured by

a. the fair value of the property, goods, or services.

b. the fair value of the note.

c. using an imputed interest rate to discount all future payments on the note.

d. any of these.

46. When a note payable is exchanged for property, goods, or services, the stated interest rate is presumed to be fair unless

a. no interest rate is stated.

b. the stated interest rate is unreasonable.

c. the stated face amount of the note is materially different from the current cash sales price for similar items or from current fair value of the note.

d. any of these.

47. If a company chooses the fair value option, a decrease in the fair value of the liability is recorded by crediting

a. Bonds Payable.

b. Gain on Restructuring of Debt.

c. Unrealized Holding Gain/Loss-Income.

d. None of these.

48. Which of the following is an example of "off-balance-sheet financing"?

1. Non-consolidated subsidiary.

2. Special purpose entity.

3. Operating leases.

a. 1

b. 2

c. 3

d. All of these are examples of "off-balance-sheet financing."

S49. When a business enterprise enters into what is referred to as off-balance-sheet financing, the company

a. is attempting to conceal the debt from shareholders by having no information about the debt inc

[Show More]

.png)