Test Bank Chapter 13 Current Liabilities and Contingencies.

CHAPTER 13

CURRENT LIABILITIES AND CONTINGENCIES

IFRS questions are available at the end of this chapter.

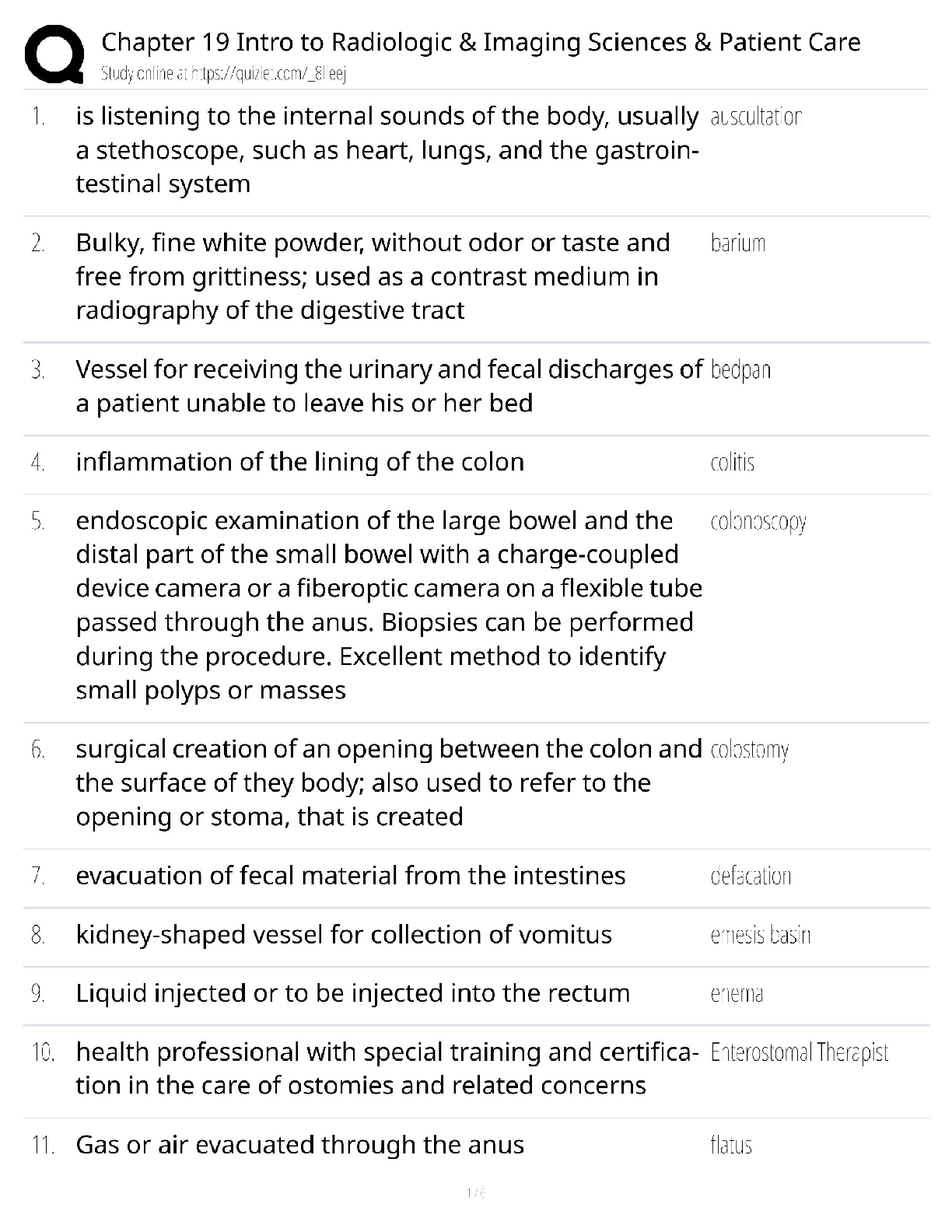

TRUE-FALSE—Conceptual

An

...

Test Bank Chapter 13 Current Liabilities and Contingencies.

CHAPTER 13

CURRENT LIABILITIES AND CONTINGENCIES

IFRS questions are available at the end of this chapter.

TRUE-FALSE—Conceptual

Answer No. Description

F 1. Zero-interest-bearing note payable.

F 2. Dividends in arrears.

T 3. Examples of unearned revenues.

T 4. Reporting discount on Notes Payable.

F 5. Currently maturing long-term debt.

F 6. Excluding short-term debt refinanced.

T 7. Accounting for sales tax collected.

F 8. Accounting for sick pay.

T 9. Social security taxes as liabilities.

F 10. Definition of accumulation rights.

T 11. Recognizing compensated absences expense.

F 12. Accruing estimated loss contingency.

T 13. Disclosing gain contingencies.

F 14. Sales-type warranty profit.

T 15. Fair value of asset retirement obligation.

T 16. Reporting a litigation liability.

F 17. Expense warranty approach.

F 18. Acid-test ratio components.

F 19. Affect on current ratio.

T 20. Reporting current liabilities.

Multiple Choice—Conceptual

Answer No. Description

d 21. Definition of a liability.

d 22. Nature of current liabilities.

a 23. Recording of accounts payable.

a 24. Classification of notes payable.

b 25. Classification of discounts on notes payable.

d 26. Identify current liability.

c 27. Bonds reported as current liability.

d 28. Identify item which is not a current liability.

c 29. Dividends reported as current liability.

d 30. Classification of stock dividends distributable.

c 31. Identify item which is not a current liability.

d 32. Identify current liability.

c 33. Characteristic of current liability.

d 34. Definition of a liability.

b 35. Importance of liability section of balance sheet.

a 36. Current liabilities and operating cycle.

Multiple Choice—Conceptual (cont.)

Answer No. Description

a 37. Present value and concept of a liability.

c 38. Zero-interest-bearing notes payable.

d 39. Callable debt reporting.

d 40. Condition to exclude short-term obligation.

a 41. Ability to consummate refinancing of short-term debt.

b 42. Disclosure of preferred dividends not declared.

c 43. Example of unearned revenue.

d 44. Short-term obligations expected to be refinanced.

d 45. Ability to consummate refinancing of short-term obligations.

d 46. Determine what is a liability.

a 47. Classification of sales taxes.

d S48. Disclosure for short-term debt refinanced.

b S49. Vested rights vs. accumulated rights.

d P50. Deductions in computing net pay.

d 51. Employer's payroll tax expense.

d 52. Accrual of a liability for compensated absences.

c 53. Accrual of a liability for compensated absences.

d 54. Accrual of a liability for compensated absences.

d 55. Compensated absences.

d 56. Requirements for compensated absences accrual.

b 57. Condition for sick pay accrual.

c 58. Payroll tax deduction.

d 59. Definition of a contingency.

b 60. Recording contingent liability.

a 61. Example of contingent liability.

d 62. Recording contingent liability.

d 63. Disclosure of a gain contingency.

d 64. Disclosure of contingencies.

b 65. Accrual of loss contingency.

a 66. Litigation and loss contingencies.

c 67. Accrual of a contingent liability.

d 68. Source of a contingent liability.

b 69. Asset retirement obligation.

c 70. Asset retirement obligation.

c 71. Classification of warranty liability.

c 72. Liability accrual due to governmental action.

a 73. Accrual of product warranties.

b P74. Determining loss amount to report.

d S75. Reporting lawsuit loss and liability.

d S76. Accrual method for warranty costs.

c 77. Accrual warranty method.

d 78. Cash-basis warranty method.

a 79. Characteristic of expense warranty approach.

b 80. Accounting for discount coupon.

a 81. Condition to recognize asset retirement obligation.

b 82. Recording liability for pending litigation.

d 83. Computation of acid-test ratio.

c 84. Current ratio information.

Multiple Choice—Conceptual (cont.)

Answer No. Description

c S85. Presentation of current liabilities.

a P86. Current ratio formula.

d 87. Disclosure of accrued liabilities.

d 88. Acid-test ratio elements.

d 89. Items included in current ratio and acid-test ratio.

P These questions also appear in the Problem-Solving Survival Guide.

S These questions also appear in the Study Guide.

Multiple Choice—Computational

Answer No. Description

b 90. Adjusting entry involving discount on short-term note payable.

d 91. Calculate effective interest on discounted note.

a 92. Calculate cost of inventory purchase.

d 93. Calculate interest expense.

b 94. Calculate interest expense.

c 95. Reporting 5-year note in financial statements.

b 96. Calculate unearned revenue.

d 97. Calculate amount of sales tax payable.

b 98. Determine amount of short-term debt to be reported.

d 99. Determine amount of short-term debt to be reported.

b 100. Calculate sales taxes for the month.

b 101. Calculate amount of sales taxes payable.

c 102. Determine amount of sales subject to sales tax.

a 103. Short-term debt to be excluded.

a 104. Short-term debt to be excluded.

d 105. Federal/state unemployment taxes.

d 106. Federal/state unemployment taxes.

c 107. Vacation liability accrual.

c 108. Vacation liability accrual.

c 109. Calculate payroll tax expense.

d 110. Calculation of vacation expense to be recognized.

a 111. Calculation of accrued liability to be recognized for compensated balances.

d 112. Effect of payroll taxes on assets / liabilities.

a 113. Record vacation liability accrual.

b 114. Record loss contingency amount.

d 115. Record asset retirement obligation.

d 116. Calculate extended warranty contract profit.

c 117. Calculate warranty liability.

b 118. Calculate rebate expense and liability.

d 119. Asset retirement obligation.

a 120. Calculate insurance expense and loss.

b 121. Calculate rebate expense and liability.

d 122. Asset retirement obligation.

d 123. Calculate warranty liability.

Multiple Choice—Computational (cont.)

Answer No. Description

b 124. Calculate liability for premiums.

d 125. Calculate warranty liability.

b 126. Calculate liability for premiums.

d 127. Determine premiums expense for the year.

d 128. Calculate estimated liability for premiums.

d 129. Calculate estimated liability for premiums.

b 130. Determine amount to accrue as a loss contingency.

d 131. Accrue warranty expense for the year.

a 132. Calculate warranty liability.

d 133. Determine amount to accrue as a gain contingency.

b 134. Calculate liability for unredeemed coupons.

c 135. Calculate the quick (acid-test) ratio.

Multiple Choice—CPA Adapted

Answer No. Description

a 136. Knowledge of accounts payable.

b 137. Determine current and long-term portions of debt.

c 138. Determine accrued interest payable.

d 139. Determine amount of short-term debt to be reported.

a 140. Calculate accrued salaries payable.

d 141. Accrual of payroll taxes.

b 142. Calculate unearned service contract revenue.

c 143. Determine liability from unredeemed trading stamps.

d 144. Determine range of loss accrual.

d 145. Calculate the estimated warranty liability.

c 146. Disclosure of a casualty claim.

Exercises

Item Description

E13-147 Notes payable.

E13-148 Payroll entries.

E13-149 Compensated absences.

E13-150 Contingent liabilities.

E13-151 Premiums.

E13-152 Premiums.

PROBLEMS

Item Description

P13-153 Accounts and notes payable.

P13-154 Refinancing of short-term debt.

P13-155 Premiums.

P13-156 Warranties.

CHAPTER LEARNING OBJECTIVES

1. Describe the nature, type, and valuation of current liabilities.

2. Explain the classification issues of short-term debt expected to be refinanced.

3. Identify types of employee-related liabilities.

4. Identify the criteria used to account for and disclose gain and loss contingencies.

5. Explain the accounting for different types of loss contingencies.

6. Indicate how to present and analyze liabilities and contingencies.

SUMMARY OF LEARNING OBJECTIVES BY QUESTIONS

Item

Type

Item

Type

Item

Type

Item

Type

Item

Type

Item

Type

Item

Type

Learning Objective 1

1.

TF

22.

MC

27.

MC

32.

MC

37.

MC

92.

MC

138.

MC

2.

TF

23.

MC

28.

MC

33.

MC

38.

MC

93.

MC

147.

E

3.

TF

24.

MC

29.

MC

34.

MC

39.

MC

94.

MC

153.

P

4.

TF

25.

MC

30.

MC

35.

MC

90.

MC

136.

MC

21.

MC

26.

MC

31.

MC

36.

MC

91.

MC

137.

MC

Learning Objective 2

5.

TF

41.

MC

45.

MC

95.

MC

99.

MC

103.

MC

6.

TF

42.

MC

46.

MC

96.

MC

100.

MC

104.

MC

7.

TF

43.

MC

47.

MC

97.

MC

101.

MC

139.

MC

40.

MC

44.

MC

S48.

MC

98.

MC

102.

MC

154.

P

Learning Objective 3

8.

TF

46.

MC

52.

MC

56.

MC

106.

MC

110.

MC

140.

MC

9.

TF

S49.

MC

53.

MC

57.

MC

107.

MC

111.

MC

141.

MC

10.

TF

P50.

MC

54.

MC

58.

MC

108.

MC

112.

MC

148.

E

11.

TF

51.

MC

55.

MC

105.

MC

109.

MC

113.

MC

149.

E

Learning Objective 4

12.

TF

46.

MC

60.

MC

62.

MC

64.

MC

66.

MC

68.

MC

13.

TF

59.

MC

61.

MC

63.

MC

65.

MC

67.

MC

150.

E

Learning Objective 5

14.

TF

72.

MC

79.

MC

117.

MC

124.

MC

131.

MC

145.

MC

15.

TF

73.

MC

80.

MC

118.

MC

125.

MC

132.

MC

146.

MC

16.

TF

P74.

MC

81.

MC

119.

MC

126.

MC

133.

MC

151.

E

17.

TF

S75.

MC

82.

MC

120.

MC

127.

MC

134.

MC

152.

E

69.

MC

S76.

MC

114.

MC

121.

MC

128.

MC

142.

MC

155.

P

70.

MC

77.

MC

115.

MC

122.

MC

129.

MC

143.

MC

156.

P

71.

MC

78.

MC

116.

MC

123.

MC

130.

MC

144.

MC

Learning Objective 6

18.

TF

20.

TF

84.

MC

P86.

MC

88.

MC

135.

MC

154.

P

19.

TF

83.

MC

S85.

MC

87.

MC

89.

MC

153.

P

155.

P

Note: TF = True-False E = Exercise

MC = Multiple Choice P = Problem

TRUE-FALSE—Conceptual

1. A zero-interest-bearing note payable that is issued at a discount will not result in any interest expense being recognized.

2. Dividends in arrears on cumulative preferred stock should be recorded as a current liability.

3. Magazine subscriptions and airline ticket sales both result in unearned revenues.

4. Discount on Notes Payable is a contra account to Notes Payable on the balance sheet.

5. All long-term debt maturing within the next year must be classified as a current liability on the balance sheet.

6. A short-term obligation can be excluded from current liabilities if the company intends to refinance it on a long-term basis.

7. Many companies do not segregate the sales tax collected and the amount of the sale at the time of the sale.

8. A company must accrue a liability for sick pay that accumulates but does not vest.

9. Companies report the amount of social security taxes withheld from employees as well as the companies’ matching portion as current liabilities until they are remitted.

10. Accumulated rights exist when an employer has an obligation to make payment to an employee even after terminating his employment.

11. Companies should recognize the expense and related liability for compensated absences in the year earned by employees.

12. Companies should accrue an estimated loss from a loss contingency if information available prior to the issuance of financial statements indicates that it is probable that a liability has been incurred.

13. A company discloses gain contingencies in the notes only when a high probability exists for realizing them.

14. The expected profit from a sales type warranty that covers several years should all be recognized in the period the warranty is sold.

15. The fair value of an asset retirement obligation is recorded as both an increase to the related asset and a liability.

16. The cause for litigation must have occurred on or before the date of the financial statements to report a liability in the financial statements.

17. Under the expense warranty approach, companies charge warranty costs only to the period in which they comply with the warranty.

18. Prepaid insurance should be included in the numerator when computing the acid-test (quick) ratio.

19. Paying a current liability with cash will always reduce the current ratio.

20. Current liabilities are usually recorded and reported in financial statements at their full maturity value.

True False Answers—Conceptual

Item

Ans.

Item

Ans.

Item

Ans.

Item

Ans.

1.

F

6.

F

11.

T

16.

T

2.

F

7.

T

12.

F

17.

F

3.

T

8.

F

13.

T

18.

F

4.

T

9.

T

14.

F

19.

F

5.

F

10.

F

15.

T

20.

T

MULTIPLE CHOICE—Conceptual

21. Liabilities are

a. any accounts having credit balances after closing entries are made.

b. deferred credits that are recognized and measured in conformity with generally accepted accounting principles.

c. obligations to transfer ownership shares to other entities in the future.

d. obligations arising from past transactions and payable in assets or services in the future.

22. Which of the following is a current liability?

a. A long-term debt maturing currently, which is to be paid with cash in a sinking fund

b. A long-term debt maturing currently, which is to be retired with proceeds from a new debt issue

c. A long-term debt maturing currently, which is to be converted into common stock

d. None of these

23. Which of the following is true about accounts payable?

1. Accounts payable should not be reported at their present value.

2. When accounts payable are recorded at the net amount, a Purchase Discounts account will be used.

3. When accounts payable are recorded at the gross amount, a Purchase Discounts Lost account will be used.

a. 1

b. 2

c. 3

d. Both 2 and 3 are true.

24. Among the short-term obligations of Lance Company as of December 31, the balance sheet date, are notes payable totaling $250,000 with the Madison National Bank. These are 90-day notes, renewable for another 90-day period. These notes should be classified on the balance sheet of Lance Company as

a. current liabilities.

b. deferred charges.

c. long-term liabilities.

d. intermediate debt.

25. Which of the following is not true about the discount on short-term notes payable?

a. The Discount on Notes Payable account has a debit balance.

b. The Discount on Notes Payable account should be reported as an asset on the balance sheet.

c. When there is a discount on a note payable, the effective interest rate is higher than the stated discount rate.

d. All of these are true.

26. Which of the following may be a current liability?

a. Withheld Income Taxes

b. Deposits Received from Customers

c. Deferred Revenue

d. All of these

27. Which of the following items is a current liability?

a. Bonds (for which there is an adequate sinking fund properly classified as a long-term investment) due in three months.

b. Bonds due in three years.

c. Bonds (for which there is an adequate appropriation of retained earnings) due in eleven months.

d. Bonds to be refunded when due in eight months, there being no doubt about the marketability of the refunding issue.

28. Which of the following should not be included in the current liabilities section of the balance sheet?

a. Trade notes payable

b. Short-term zero-interest-bearing notes payable

c. The discount on short-term notes payable

d. All of these are included

29. Which of the following is a current liability?

a. Preferred dividends in arrears

b. A dividend payable in the form of additional shares of stock

c. A cash dividend payable to preferred stockholders

d. All of these

30. Stock dividends distributable should be classified on the

a. income statement as an expense.

b. balance sheet as an asset.

c. balance sheet as a liability.

d. balance sheet as an item of stockholders' equity.

31. Of the following items, the only one which should not be classified as a current liability is

a. current maturities of long-term debt.

b. sales taxes payable.

c. short-term obligations expected to be refinanced.

d. unearned revenues.

32. An account which would be classified as a current liability is

a. dividends payable in the company's stock.

b. accounts payable—debit balances.

c. losses expected to be incurred within the next twelve months in excess of the company's insurance coverage.

d. none of these.

33. Which of the following is a characteristic of a current liability but not a long-term liability?

a. Unavoidable obligation.

b. Present obligation that entails settlement by probable future transfer or use of cash, goods, or services.

c. Liquidation is reasonably expected to require use of existing resources classified as current assets or create other current liabilities.

d. Transaction or other event creating the liability has already occurred.

34. Which of the following is not considered a part of the definition of a liability?

a. Unavoidable obligation.

b. Transaction or other event creating the liability has already occurred.

c. Present obligation that entails settlement by probable future transfer or use of cash, goods, or services.

d. Liquidation is reasonably expected to require use of existing resources classified as current assets or create other current liabilities.

35. Why is the liability section of the balance sheet of primary importance to bankers?

a. To evaluate the entity's credit quality.

b. To assist in understanding the entity's liquidity.

c. To better understand sources of repayment.

d. To evaluate operating efficiency.

36. What is the relationship between current liabilities and a company's operating cycle?

a. Liquidation of current liabilities is reasonably expected within the company's operating cycle (or one year if less).

b. Current liabilities are the result of operating transactions.

c. Current liabilities can't exceed the amount incurred in one operating cycle.

d. There is no relationship between the two.

37. What is the relationship between present value and the concept of a liability?

a. Present values are used to measure certain liabilities.

b. Present values are not used to measure liabilities.

c. Present values are used to measure all liabilities.

d. Present values are only used to measure long-term liabilities.

38. What is a discount as it relates to zero-interest-bearing notes payable?

a. The discount represents the lender's costs to underwrite the note.

b. The discount represents the credit quality of the borrower.

c. The discount represents the cost of borrowing.

d. The discount represents the allowance for uncollectible amounts.

39. Where is debt callable by the creditor reported on the debtor's financial statements?

a. Long-term liability.

b. Current liability if the creditor intends to call the debt within the year, otherwise a long-term liability.

c. Current liability if it is probable that creditor will call the debt within the year, otherwise a long-term liability.

d. Current liability.

40. Which of the following is not a condition necessary to exclude a short-term obligation from current liabilities?

a. Intend to refinance the obligation on a long-term basis.

b. Obligation must be due with one year.

c. Demonstrate the ability to complete the refinancing.

d. Subsequently refinance the obligation on a long-term basis.

41. Which of the following does not demonstrate evidence regarding the ability to consummate a refinancing of short-term debt?

a. Management indicated that they are going to refinance the obligation.

b. Actually refinance the obligation.

c. Have capacity under existing financing agreements that can be used to refinance the obligation.

d. Enter into a financing agreement that clearly permits the entity to refinance the obligation.

42. A company has not declared a dividend on its cumulative preferred stock for the past three years. What is the required accounting treatment or disclosure in this situation?

a. Record a liability for cumulative amount of preferred stock dividends not declared.

b. Disclose the amount of the dividends in arrears.

c. Record a liability for the current year's dividends only.

d. No disclosure or recognition is required.

43. Which of the following situations may give rise to unearned revenue?

a. Providing trade credit to customers.

b. Selling inventory.

c. Selling magazine subsc

[Show More]

.png)