Education > QUESTIONS & ANSWERS > Test Bank Chapter 11 Depreciation, Impairments, and Depletion. (All)

Test Bank Chapter 11 Depreciation, Impairments, and Depletion.

Document Content and Description Below

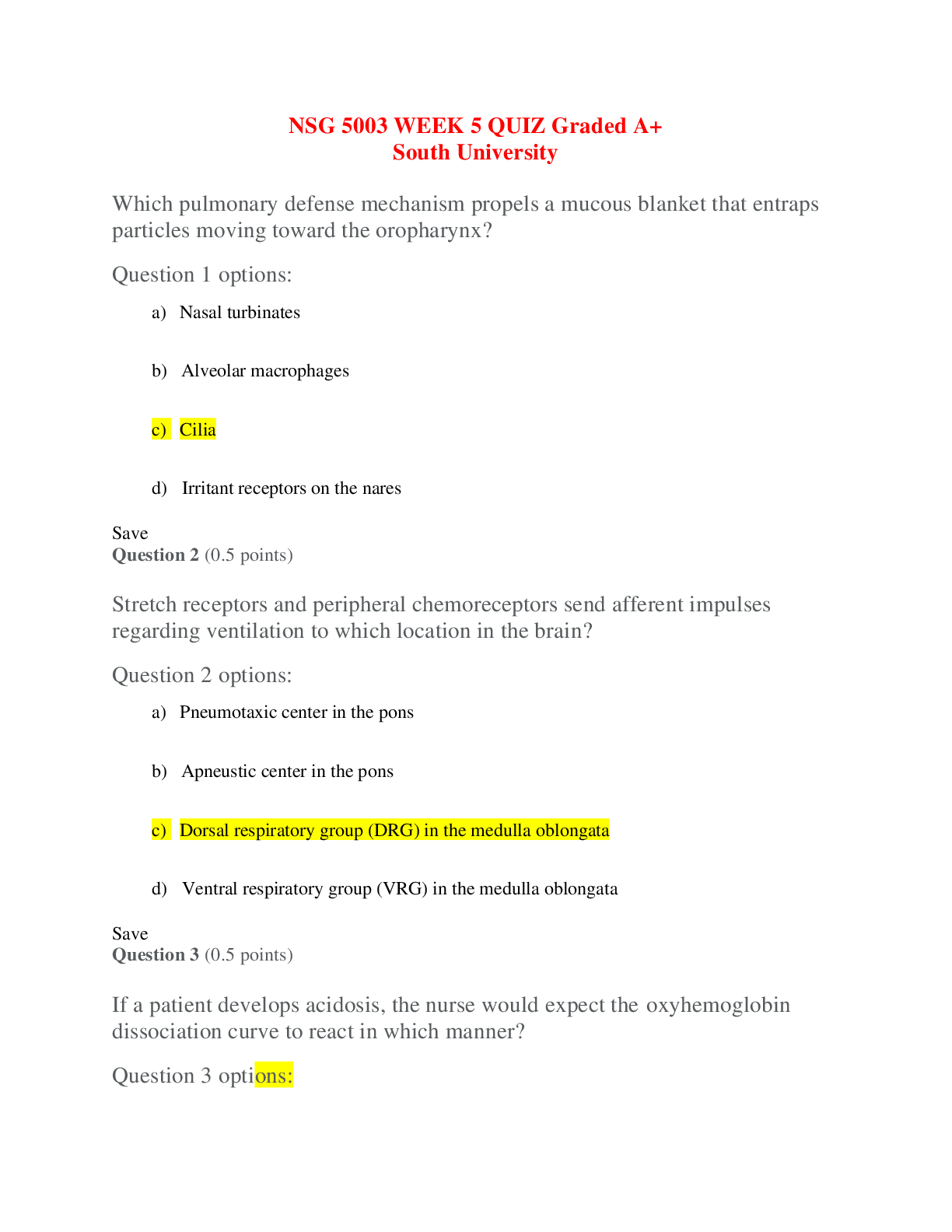

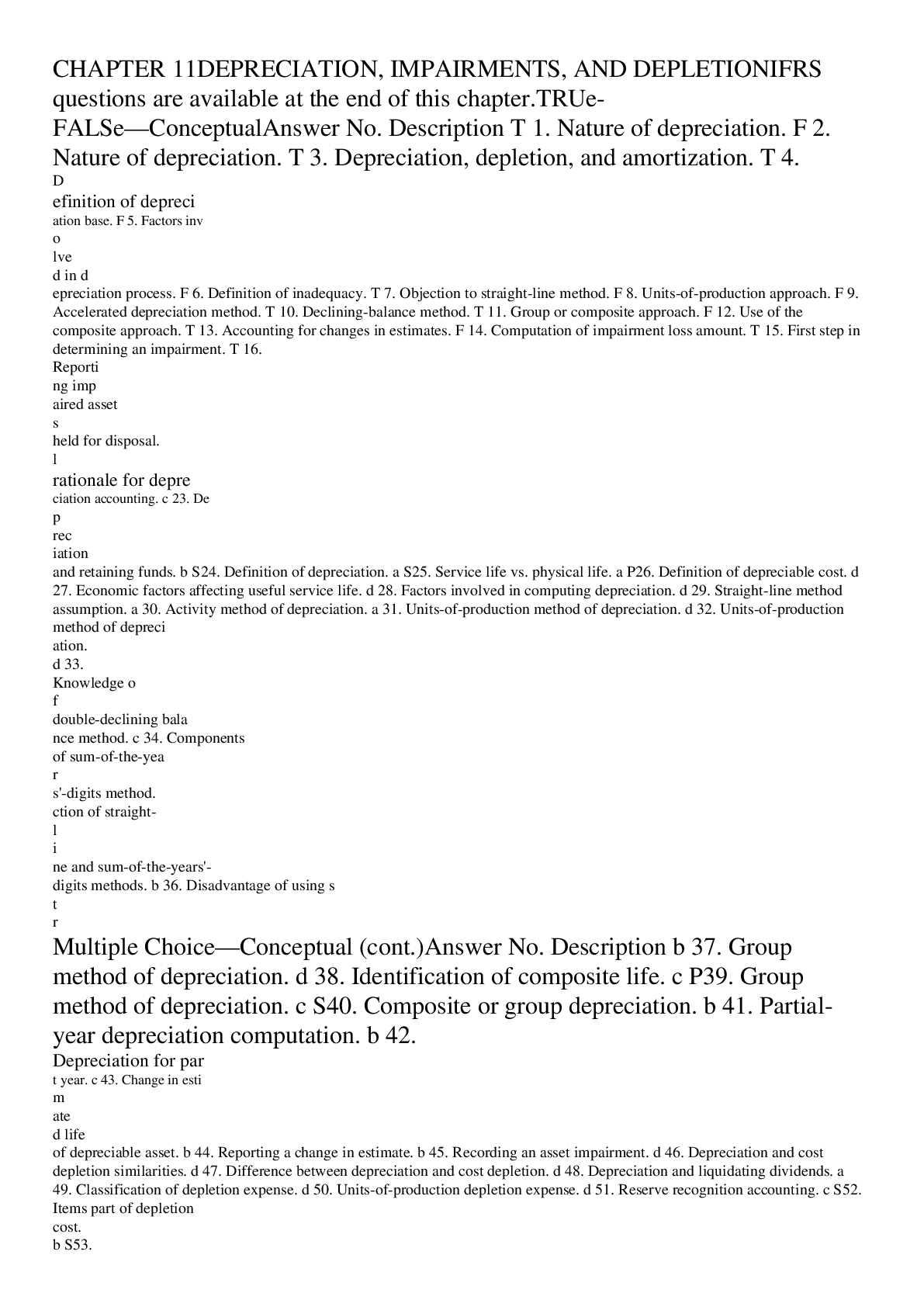

Test Bank Chapter 11 Depreciation, Impairments, and Depletion. CHAPTER 11 DEPRECIATION, IMPAIRMENTS, AND DEPLETION IFRS questions are available at the end of this chapter. T... RUe-FALSe—Conceptual Answer No. Description T 1. Nature of depreciation. F 2. Nature of depreciation. T 3. Depreciation, depletion, and amortization. T 4. Definition of depreciation base. F 5. Factors involved in depreciation process. F 6. Definition of inadequacy. T 7. Objection to straight-line method. F 8. Units-of-production approach. F 9. Accelerated depreciation method. T 10. Declining-balance method. T 11. Group or composite approach. F 12. Use of the composite approach. T 13. Accounting for changes in estimates. F 14. Computation of impairment loss amount. T 15. First step in determining an impairment. T 16. Reporting impaired assets held for disposal. F 17. Method used to compute depletion. T 18. Costs included in depletion base. F 19. Computing asset turnover ratio. T 20 Profit margin on sales ratio. Multiple Choice—Conceptual Answer No. Description d 21. Knowledge of depreciation accounting. b 22. Conceptual rationale for depreciation accounting. c 23. Depreciation and retaining funds. b S24. Definition of depreciation. a S25. Service life vs. physical life. a P26. Definition of depreciable cost. d 27. Economic factors affecting useful service life. d 28. Factors involved in computing depreciation. d 29. Straight-line method assumption. a 30. Activity method of depreciation. a 31. Units-of-production method of depreciation. d 32. Units-of-production method of depreciation. d 33. Knowledge of double-declining balance method. c 34. Components of sum-of-the-years'-digits method. c 35. Graphic depiction of straight-line and sum-of-the-years'-digits methods. b 36. Disadvantage of using straight-line method. Multiple Choice—Conceptual (cont.) Answer No. Description b 37. Group method of depreciation. d 38. Identification of composite life. c P39. Group method of depreciation. c S40. Composite or group depreciation. b 41. Partial-year depreciation computation. b 42. Depreciation for part year. c 43. Change in estimated life of depreciable asset. b 44. Reporting a change in estimate. b 45. Recording an asset impairment. d 46. Depreciation and cost depletion similarities. d 47. Difference between depreciation and cost depletion. d 48. Depreciation and liquidating dividends. a 49. Classification of depletion expense. d 50. Units-of-production depletion expense. d 51. Reserve recognition accounting. c S52. Items part of depletion cost. b S53. Required disclosures for depreciation. b P54. Definition of book value. d 55. Disclosure of depreciation policy. d 56. Asset turnover ratio. d 57. Return on total assets ratio. c *58. Objectives of MACRS method. d *59. Factors to consider in MACRS tax depreciation. c *60. Effect of accelerated depreciation on the income statement. P These questions also appear in the Problem-Solving Survival Guide. S These questions also appear in the Study Guide. * This topic is dealt with in an Appendix to the chapter. Multiple Choice—Computational Answer No. Description c 61. Factors involved in depreciation. c 62. Calculate depreciation using activity method. b 63. Calculate double-declining balance depreciation. c 64. Calculate double-declining balance depreciation. b 65. Calculate depreciation using activity method. c 66. Calculate depreciation using activity method. b 67. Calculate depreciation using activity method. c 68. Calculate depreciation using double-declining balance method. b 69. Calculate depreciation using activity method. c 70. Calculate depreciation using double-declining balance method. b 71. Calculate depreciation using double-declining balance. b 72. Calculate depreciation using double-declining balance. b 73. Calculate depreciation using double-declining balance. b 74. Calculate depreciation using double-declining balance. c 75. Sum-of-the-years'-digits method. Multiple Choice—Computational (cont.) Answer No. Description b 76. Sum-of-the-years'-digits method. a 77. Calculate depreciation using sum-of-the-years'-digits. c 78. Calculate depreciation using sum-of-the-years'-digits. c 79. Determine acquisition cost from sum-of-the-years'-digits. b 80. Determine acquisition cost from sum-of-the-years'-digits. c 81. Calculate gain on sale of machinery. a 82. Determine depreciation expense from change in Accumulated Depreciation account. c 83. Determine depreciation expense from change in Accumulated Depreciation account. a 84. Determine composite rate of depreciation. a 85. Determine composite life of a group of assets. d 86. Depreciation and partial periods. c 87. Change in estimated useful life. d 88. Depreciation and partial periods. c 89. Change in estimated useful life. a 90. Entry under composite method. b 91. Calculate depreciation expense after change in estimate. b 92. Compute composite depreciation rate. c 93. Compute composite life of assets. a 94. Determine amount of impairment loss. d 95. Recognizing loss on impairment. a 96. Recognizing loss on impairment. c 97. Recognizing loss on impairment. b 98. Change in estimated life of equipment. a 99. Determine depreciation expense after major overhaul. b 100. Determine depreciation expense after major overhaul. c 101. Record permanent impairment in value of fixed asset. c 102. Calculate units-of-production depletion expense. c 103. Calculate units-of-production depletion expense. b 104. Calculate units-of-production depletion expense. d 105. Calculate units-of-production depletion expense. b 106. Capitalization of exploration costs and discovery values. a 107. Calculate depletion per ton. b 108. Entry to record depletion. c 109. Calculate asset turnover ratio. a 110. Calculate return on total assets. d 111. Calculate asset turnover ratio. c 112. Calculate return on total assets. c 113. Calculate asset turnover ratio. c 114. Calculate asset turnover ratio. a *115. Calculate MACRS depreciation for the year. d *116. Calculate MACRS depreciation using optional straight-line method. Multiple Choice—CPA Adapted Answer No. Description c 117. Calculate depreciation using 150% declining balance. b 118. Double-declining balance method. b 119. Determine accumulated depreciation balance using sum-of-the-years'-digits. a 120. Calculate depreciation expense using sum-of-the-years'-digits. d 121. Effect of salvage value on accumulated depreciation. b 122. Effect of including salvage value in depreciation base. b 123. Effect of decreasing charge methods on sale of asset. b 124. Units-of-production depletion expense. c 125. Calculate depletion expense for the year. Exercises Item Description E11-126 Definitions. E11-127 Depreciation methods. E11-128 True or False. E11-129 Calculate depreciation. E11-130 Calculate depreciation. E11-131 Asset depreciation and disposition. E11-132 Composite depreciation. E11-133 Depletion allowance. PROBLEMS Item Description P11-134 Depreciation methods. P11-135 Adjustment of depreciable base. P11-136 Impairment. P11-137 Impairment. CHAPTER LEARNING OBJECTIVES 1. Explain the concept of depreciation. 2. Identify the factors involved in the depreciation process. 3. Compare activity, straight-line, and decreasing charge methods of depreciation. 4. Explain special depreciation methods. 5. Explain the accounting issues related to asset impairment. 6. Explain the accounting procedures for depletion of natural resources. 7. Explain how to report and analyze property, plant, and equipment and natural resources. *8. Describe income tax methods of depreciation. SUMMARY OF LEARNING OBJECTIVES BY QUESTIONS Item Type Item Type Item Type Item Type Item Type Item Type Item Type Learning Objective 1 1. TF 3. TF 22. MC S24. MC 2. TF 21. MC 23. MC 126. E Learning Objective 2 4. TF 6. TF P26. MC 28. MC 62. MC 5. TF S25. MC 27. MC 61. MC 127. E Learning Objective 3 7. TF 33. MC 65. MC 72. MC 79. MC 119. MC 129. E 8. TF 34. MC 66. MC 73. MC 80. MC 120. MC 130. E 9. TF 35. MC 67. MC 74. MC 81. MC 121. MC 131. E S29. MC 36. MC 68. MC 75. MC 82. MC 122. MC 134. P 30. MC 62. MC 69. MC 76. MC 83. MC 123. MC 31. MC 63. MC 70. MC 77. MC 117. MC 127. E 32. MC 64. MC 71. MC 78. MC 118. MC 128. E Learning Objective 4 11. TF 37. MC S40. MC 85. MC 88. MC 91. MC 128. E 12. TF 38. MC S41. MC 86. MC 89. MC 92. MC 132. E 13. TF P39. MC 84. MC 87. MC 90. MC 93. MC Learning Objective 5 14. TF 42. MC 45. MC 96. MC 99. MC 127. E 137. P 15. TF 43. MC 94. MC 97. MC 100. MC 135. P 16. TF 44. MC 95. MC 98. MC 101. MC 136. P Learning Objective 6 17. TF 47. MC 50. MC 102. MC 105. MC 108. MC 133. E 18. TF 48. MC 51. MC 103. MC 106. MC 124. MC 46. MC 49. MC S52. MC 104. MC 107. MC 125. MC Learning Objective 7 19. TF S53. MC 55. MC 57. MC 110. MC 112. MC 114. MC 20. TF P54. MC 56. MC 109. MC 111. MC 113. MC Learning Objective *8 58. MC 59. MC 60. MC 115. MC 116. MC Note: TF = True-False MC = Multiple Choice P = Problem E = Exercise TRUE-FALSE—Conceptual 1. Depreciation is a means of cost allocation, not a matter of valuation. 2. Depreciation is based on the decline in the fair market value of the asset. 3. Depreciation, depletion, and amortization all involve the allocation of the cost of a long-lived asset to expense. 4. The cost of an asset less its salvage value is its depreciation base. 5. The three factors involved in the depreciation process are the depreciation base, the useful life, and the risk of obsolescence. 6. Inadequacy is the replacement of one asset with another more efficient and economical asset. 7. The major objection to the straight-line method is that it assumes the asset’s economic usefulness and repair expense are the same each year. 8. The units-of-production approach to depreciation is appropriate when depreciation is a function of time instead of activity. 9. An accelerated depreciation method is appropriate when the asset’s economic usefulness is the same each year. 10. The declining-balance method does not deduct the salvage value in computing the depreciation base. 11. Gains or losses on disposals of assets do not distort periodic income when the group or composite method is used to compute depreciation. 12. Companies frequently use the composite approach when the assets are similar in nature and have approximately the same useful lives. 13. Changes in estimates are handled prospectively by dividing the asset’s book value less any salvage value by the remaining estimated life. 14. An impairment loss is the amount by which the carrying amount of the asset exceeds the sum of the expected future net cash flows from the use of that asset. 15. The first step in determining whether an impairment has occurred is to estimate the future net cash flows expected from the use of that asset and its eventual disposition. 16. Impaired assets held for disposal should be reported at the lower of cost or net realizable value. 17. Normally, companies compute depletion on a straight-line basis. 18. Intangible development costs and restoration costs are part of the depletion base. 19. The asset turnover ratio is computed by dividing net sales by ending total assets. 20. The profit margin on sales ratio is a measure for analyzing the use of property, plant, and equipment. True False Answers—Conceptual Item Ans. Item Ans. Item Ans. Item Ans. 1. T 6. F 11. T 16. T 2. F 7. T 12. F 17. F 3. T 8. F 13. T 18. T 4. T 9. F 14. F 19. F 5. F 10. T 15. T 20. T MULTIPLE CHOICE—Conceptual 21. The following is true of depreciation accounting. a. It is not a matter of valuation. b. It is part of the matching of revenues and expenses. c. It retains funds by reducing income taxes and dividends. d. All of these. 22. Which of the following principles best describes the conceptual rationale for the methods of matching depreciation expense with revenues? a. Associating cause and effect b. Systematic and rational allocation c. Immediate recognition d. Partial recognition 23. Depreciation accounting a. provides funds. b. funds replacements. c. retains funds. d. all of these. S24. Which of the following most accurately reflects the concept of depreciation as used in accounting? a. The process of charging the decline in value of an economic resource to income in the period in which the benefit occurred. b. The process of allocating the cost of tangible assets to expense in a systematic and rational manner to those periods expected to benefit from the use of the asset. c. A method of allocating asset cost to an expense account in a manner which closely matches the physical deterioration of the tangible asset involved. d. An accounting concept that allocates the portion of an asset used up during the year to the contra asset account for the purpose of properly recording the fair market value of tangible assets. S25. The major difference between the service life of an asset and its physical life is that a. service life refers to the time an asset will be used by a company and physical life refers to how long the asset will last. b. physical life is the life of an asset without consideration of salvage value and service life requires the use of salvage value. c. physical life is always longer than service life. d. service life refers to the length of time an asset is of use to its original owner, while physical life refers to how long the asset will be used by all owners. P26. The term "depreciable base," or "depreciation base," as it is used in accounting, refers to a. the total amount to be charged (debited) to expense over an asset's useful life. b. the cost of the asset less the related depreciation recorded to date. c. the estimated market value of the asset at the end of its useful life. d. the acquisition cost of the asset. 27. Economic factors that shorten the service life of an asset include a. obsolescence. b. supersession. c. inadequacy. d. all of these. 28. Which of the following is not one of the basic questions that must be answered before the amount of depreciation charge can be computed? a. What is the depreciation base to use for the asset? b. What is the asset's useful life? c. What method of cost apportionment is best for this asset? d. What product or service is the asset related to? S29. Which of the following is a realistic assumption of the straight-line method of depreciation? a. The asset's economic usefulness is the same each year. b. The repair and maintenance expense is essentially the same each period. c. The rate of return analysis is enhanced using the straight-line method. d. Depreciation is a function of time rather than a function of usage. 30. The activity method of depreciation a. is a variable charge approach. b. assumes that depreciation is a function of the passage of time. c. conceptually associates cost in terms of input measures. d. all of these. 31. For income statement purposes, depreciation is a variable expense if the depreciation method used is a. units-of-production. b. straight-line. c. sum-of-the-years'-digits. d. declining-balance. 32. If an industrial firm uses the units-of-production method for computing depreciation on its only plant asset, factory machinery, the credit to accumulated depreciation from period to period during the life of the firm will a. be constant. b. vary with unit sales. c. vary with sales revenue. d. vary with production. 33. Use of the double-declining balance method a. results in a decreasing charge to depreciation expense. b. means salvage value is not deducted in computing the depreciation base. c. means the book value should not be reduced below salvage value. d. all of these. 34. Use of the sum-of-the-years'-digits method a. results in salvage value being ignored. b. means the denominator is the years remaining at the beginning of the year. c. means the book value should not be reduced below salvage value. d. all of these. 35. A graph is set up with "yearly depreciation expense" on the vertical axis and "time" on the horizontal axis. Assuming linear relationships, how would the graphs for straight-line and sum-of-the-years'-digits depreciation, respectively, be drawn? a. Vertically and sloping down to the right b. Vertically and sloping up to the right c. Horizontally and sloping down to the right d. Horizontally and sloping up to the right 36. A principal objection to the straight-line method of depreciation is that it a. provides for the declining productivity of an aging asset. b. ignores variations in the rate of asset use. c. tends to result in a constant rate of return on a diminishing investment base. d. gives smaller periodic write-offs than decreasing charge methods. 37. Each year a company has been investing an increasingly greater amount in machinery. Since there is a large number of small items with relatively similar useful lives, the company has been applying straight-line depreciation at a uniform rate to the machinery as a group. The ratio of this group's total accumulated depreciation to the total cost of the machinery has been steadily increasing and now stands at .75 to 1.00. The most likely explanation for this increasing ratio is the a. company should have been using one of the accelerated methods of depreciation. b. estimated average life of the machinery is less than the actual average useful life. c. estimated average life of the machinery is greater than the actual average useful life. d. company has been retiring fully depreciated machinery that should have remained in service. 38. For the composite method, the composite a. rate is the total cost divided by the total annual depreciation. b. rate is the total annual depreciation divided by the total depreciable cost. c. life is the total cost divided by the total annual depreciation. d. life is the total depreciable cost divided by the total annual depreciation. P39. Watkins Truck Rental uses the group depreciation method for its fleet of trucks. When it retires one of its trucks and receives cash from a salvage company, the carrying value of property, plant, and equipment will be decreased by the a. original cost of the truck. b. original cost of the truck less the cash proceeds. c. cash proceeds received. d. cash proceeds received and original cost of the truck. S40. Composite or group depreciation is a depreciation system whereby a. the years of useful life of the various assets in the group are added together and the total divided by the number of items. b. the cost of individual units within an asset group is charged to expense in the year a unit is retired from service. c. a straight-line rate is computed by dividing the total of the annual depreciation expense for all assets in the group by the total cost of the assets. d. the original cost of all items in a given group or class of assets is retained in the asset account and the cost of replacements is charged to expense when they are acquired. S41. When depreciation is computed for partial periods under a decreasing charge depreciation method, it is necessary to a. charge a full year's depreciation to the year of acquisition. b. determine depreciation expense for the full year and then prorate the expense between the two periods involved. c. use the straight-line method for the year in which the asset is sold or otherwise disposed of. d. use a salvage value equal to the first year's partial depreciation charge. 42. Depreciation is normally computed on the basis of the nearest a. full month and to the nearest cent. b. full month and to the nearest dollar. c. day and to the nearest cent. d. day and to the nearest dollar. 43. Myers Company acquired machinery on January 1, 2007 which it depreciated under the straight-line method with an estimated life of fifteen years and no salvage value. On January 1, 2012, Myers estimated that the remaining life of this machinery was six years with no salvage value. How should this change be accounted for by Myers? a. As a prior period adjustment b. As the cumulative effect of a change in accounting principle in 2012 c. By setting future annual depreciation equal to one-sixth of the book value on January 1, 2012 d. By continuing to depreciate the machinery over the original fifteen year life 44. A change in estimate should a. result in restatement of prior period statements. b. be handled in current and future periods. c. be handled in future periods only. d. be handled retroactively. 45. Lynch Printing Company determines that a printing press used in its operations has suffered a permanent impairment in value because of technological changes. An entry to record the impairment should a. recognize an extraordinary loss for the period. b. include a credit to the equipment accumulated depreciation account. c. include a credit to the equipment account. d. not be made if the equipment is still being used. 46. Which of following is not a similarity in the accounting treatment for depreciation and cost depletion? a. The estimated life is based on economic or productive life. b. Assets subject to either are reported in the same classification on the balance sheet. c. The rates may be changed upon revision of the estimated productive life used in the original rate computations. d. Both depreciation and depletion are based on time. 47. Which of the fo [Show More]

Last updated: 2 years ago

Preview 1 out of 27 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$14.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Nov 03, 2020

Number of pages

27

Written in

Additional information

This document has been written for:

Uploaded

Nov 03, 2020

Downloads

0

Views

89

.png)