COMPREHENSIVE EXAMINATION E

Approximate

Problem Topic

...

COMPREHENSIVE EXAMINATION E

Approximate

Problem Topic Time

E-I Long-Term Contracts. 15 min.

E-II Installment Sales Method. 20 min.

E-III Deferred Income Taxes. 25 min.

E-IV Pensions. 15 min.

E-V Leases. 25 min.

100 min.

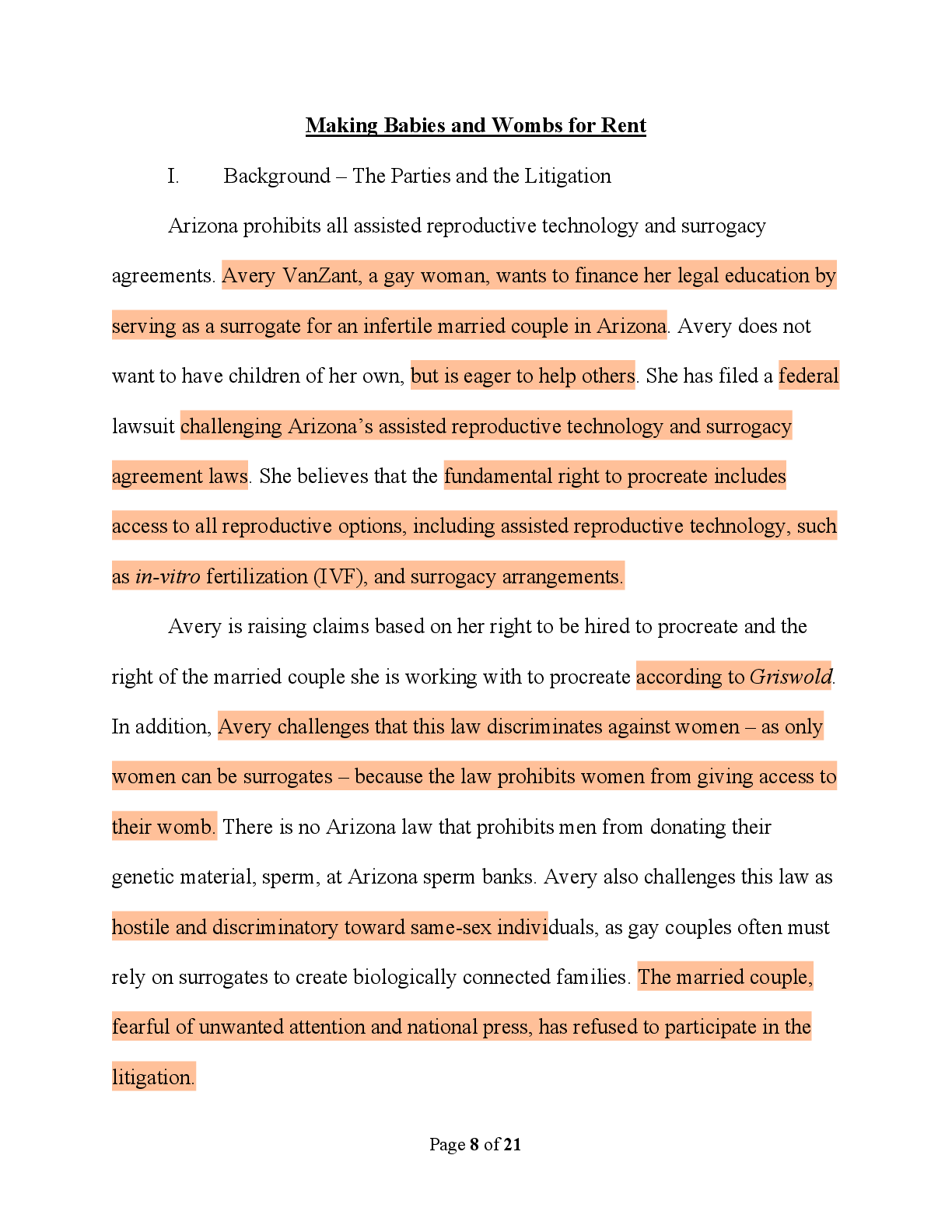

Problem E-I — Long-Term Contracts.

Edwards Company contracted on 4/1/12 to construct a building for $2,300,000. The project was completed in 2014. Additional data follow:

2012 2013 2014

Costs incurred to date $ 560,000 $1,350,000 $1,900,000

Estimated cost to complete 1,040,000 450,000 —

Billings to date 500,000 1,800,000 2,300,000

Collections to date 400,000 1,300,000 2,200,000

Instructions

(a) Calculate the income recognized by Edwards under the percentage-of-completion method of accounting in each of the years 2012, 2013, and 2014.

(b) Prepare all necessary entries for the year 2013.

(c) Present the balance sheet disclosures at December 31, 2013. Proper headings or subheadings must be indicated.

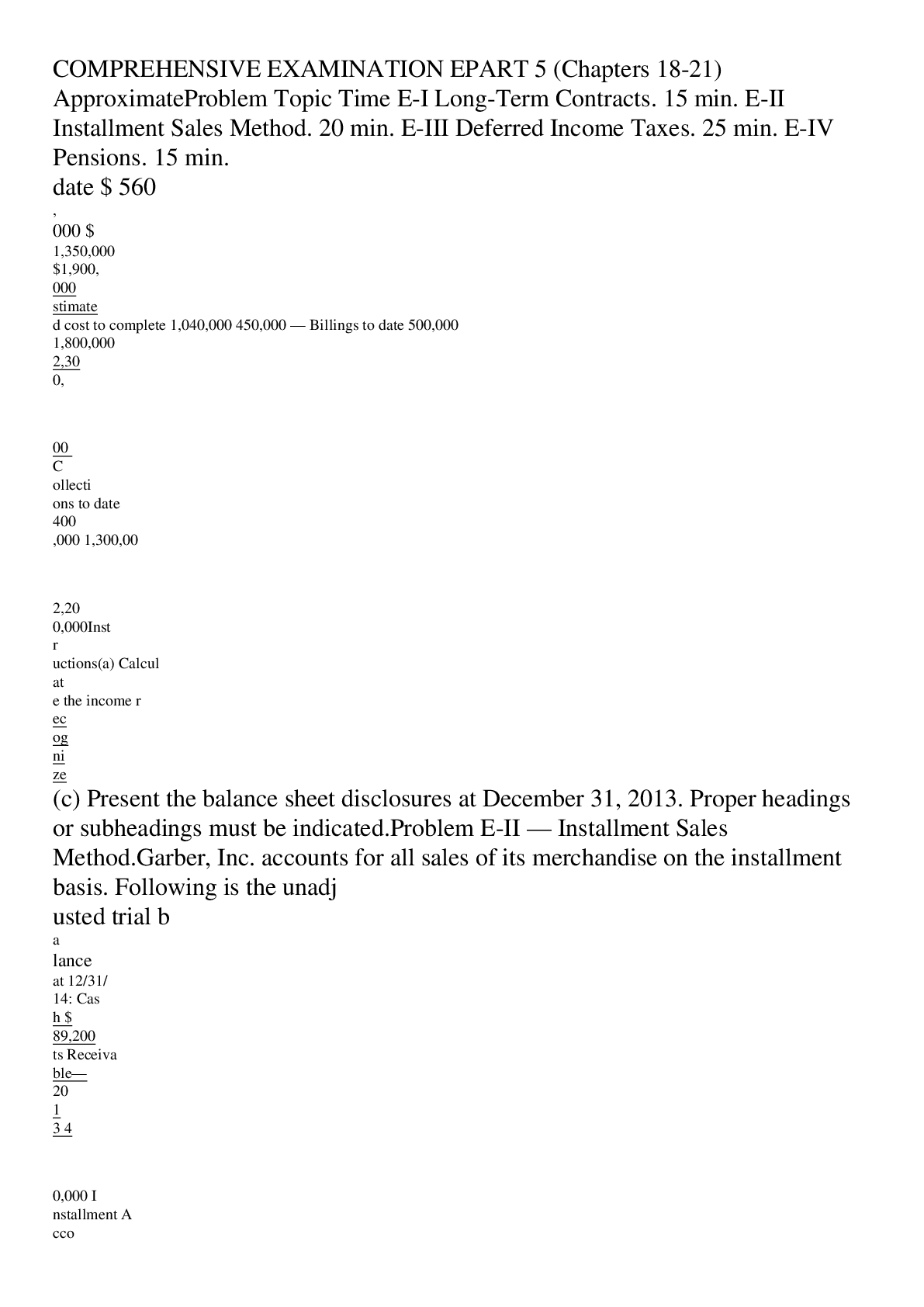

Problem E-II — Installment Sales Method.

Garber, Inc. accounts for all sales of its merchandise on the installment basis. Following is the unadjusted trial balance at 12/31/14:

Cash $ 89,200

Installment Accounts Receivable—2012 170,000

Installment Accounts Receivable—2013 400,000

Installment Accounts Receivable—2014 750,000

Inventory, 1/1/14 78,000

Repossessed Merchandise 22,000

Accounts Payable $ 136,000

Deferred Gross Profit—2012 84,000

Deferred Gross Profit—2013 175,000

Common Stock 600,000

Retained Earnings 406,200

Installment Sales 1,000,000

Purchases 738,000

Loss on Repossession 4,000

Operating Expenses 150,000

$2,401,200 $2,401,200

Additional Data: 2012 Gross Profit Rate = 32%; Inventory 12/31/14 = $159,000; Repossessed merchandise 12/31/14 = $14,000;

Merchandise sold in 2013 was repossessed in 2014 and the following entry was prepared (assume correctly):

Deferred Gross Profit—2013................................. 14,000

Repossessed Merchandise.................................... 22,000

Loss on Repossession ........................................... 4,000

Installment Accounts Receivable—2013... 40,000

Problem E-II (cont.)

Instructions

(a) Determine collections during 2014 on Installment A/R for each of the years 2012, 2013, and 2014.

(b) Without prejudice to your answer in Part (a), assume that total collections on Installment Accounts Receivable during 2014 were $1,060,000; $220,000 from 2012, $300,000 from 2013, and $540,000 from 2014. Prepare all necessary adjusting and closing entries at 12/31/14.

Problem E-III — Deferred Income Taxes.

In 2013, the initial year of its existence, Dexter Company's accountant, in preparing both the income statement and the tax return, developed the following list of items causing differences between accounting and taxable income:

1. The company sells its merchandise on an installment contract basis. In 2013, Dexter elected, for tax purposes, to report the gross profit from these sales in the years the receivables are collected. However, for financial statement purposes, the company recognized all the gross profit in 2013. These procedures created a $500,000 difference between book and taxable incomes. The future collection of the installment contracts receivables are expected to result in taxable amounts of $250,000 in each of the next two years. (Note: the company treats installment contracts receivable as a current asset on its balance sheet.)

2. The company has also chosen to depreciate all of its depreciable assets on an accelerated basis for tax purposes but on a straight-line basis for accounting purposes. These procedures resulted in $60,000 excess depreciation for tax purposes over accounting depreciation. The temporary difference due to excess tax depreciation will reverse equally over the three year period from 2014-2016.

3. Dexter leased some of its property to Baker Company on July 1, 2013. The lease was to expire on July 1, 2015 and the monthly rentals were to be $60,000. Baker, however, paid the first year's rent in advance and Dexter reported this entire amount on its tax return. These procedures resulted in a $360,000 difference between book and taxable incomes. (Note: this lease was an operating lease and Dexter classified the unearned rent as a current liability on its balance sheet.)

4. Dexter owns $200,000 of bonds issued by the State of Oregon upon which 5% interest is paid annually. In 2013, Dexter showed $10,000 of income from the bonds on its income statement but did not show any of this amount on its tax return. (Note: these bonds are classified as long-term investments on Dexter's balance sheet.)

5. In 2013, Dexter insured the lives of its chief executives. The premiums paid amounted to $12,000 and this amount was shown as an expense on the income statement. However, this amount was not deducted on the tax return. The company is the beneficiary.

Problem E-III (cont.)

Instructions

Assuming that the income statement of Dexter Company showed "Income before income taxes" of $1,200,000; that the enacted tax rates are 40% for all years; and that no other differences between book and taxable incomes existed, except for those mentioned above:

(a) Compute the income tax payable.

(b) Prepare a schedule of future taxable and (deductible) amounts at the end of 2013.

(c) Prepare a schedule of deferred tax (asset) and liability at the end of 2013.

(d) Compute the net deferred tax expense (benefit) for 2013.

(e) Make the journal entry recording income tax expense, income tax payable, and deferred income taxes for 2013.

(f) Indicate how income tax expense and any deferred income taxes should be disclosed on the financial statements under generally accepted accounting principles. Show the amounts for these items and indicate specifically where they would be disclosed.

Problem E-IV — Pensions.

Presented below is information related to Stage Department Stores, Inc. pension plan for 2013.

Service cost $520,000

Funding contribution for 2013 500,000

Settlement rate used in actuarial computation 10%

Expected return on plan assets 9%

Amortization of PSC (due to benefit increase) 90,000

Amortization of unrecognized net gains 48,000

Projected benefit obligation (at beginning of period) 540,000

Fair value of plan assts (at beginning of period) 360,000

Instructions

(a) Compute the amount of pension expense to be reported for 2013. (Show computations.)

(b) Prepare the journal entry to record pension expense and the employer’s contribution for 2013.

Problem E-V — Leases.

On January 1, 2013, Foley Company (as lessor) entered into a noncancelable lease agreement with Pinkley Company for machinery which was carried on the accounting records of Foley at $5,436,000 and had a market value of $5,760,000. Minimum lease payments under the lease agreement which expires on December 31, 2022, total $8,520,000. Payments of $852,000 are due each January 1. The first payment was made on January 1, 2013 when the lease agreement was finalized. The interest rate of 10% which was stipulated in the lease agreement is the implicit rate set by the lessor. The effective interest method of amortization is being used. Pinkley expects the machine to have a ten-year life with no salvage value, and be depreciated on a straight-line basis. Collectibility of the rentals is reasonably predictable, and there are no important uncertainties surrounding the costs yet to be incurred by the lessor.

Instructions

(a) From the lessee's viewpoint, what kind of lease is the above agreement? From the lessor's viewpoint, what kind of lease is the above agreement?

(b) What should be the income before income taxes derived by Foley from the lease for the year ended December 31, 2013?

(c) Ignoring income taxes, what should be the expenses incurred by Pinkley from this lease for the year ended December 31, 2013?

(d) What journal entries should be recorded by Pinkley Company on January 1, 2013?

(e) What journal entries should be recorded by Foley Company on January 1, 2013?

[Show More]