Financial Accounting > QUESTIONS & ANSWERS > Southwestern Oklahoma State University ACCTG 4013Chap010 Chap 010 . (All)

Southwestern Oklahoma State University ACCTG 4013Chap010 Chap 010 .

Document Content and Description Below

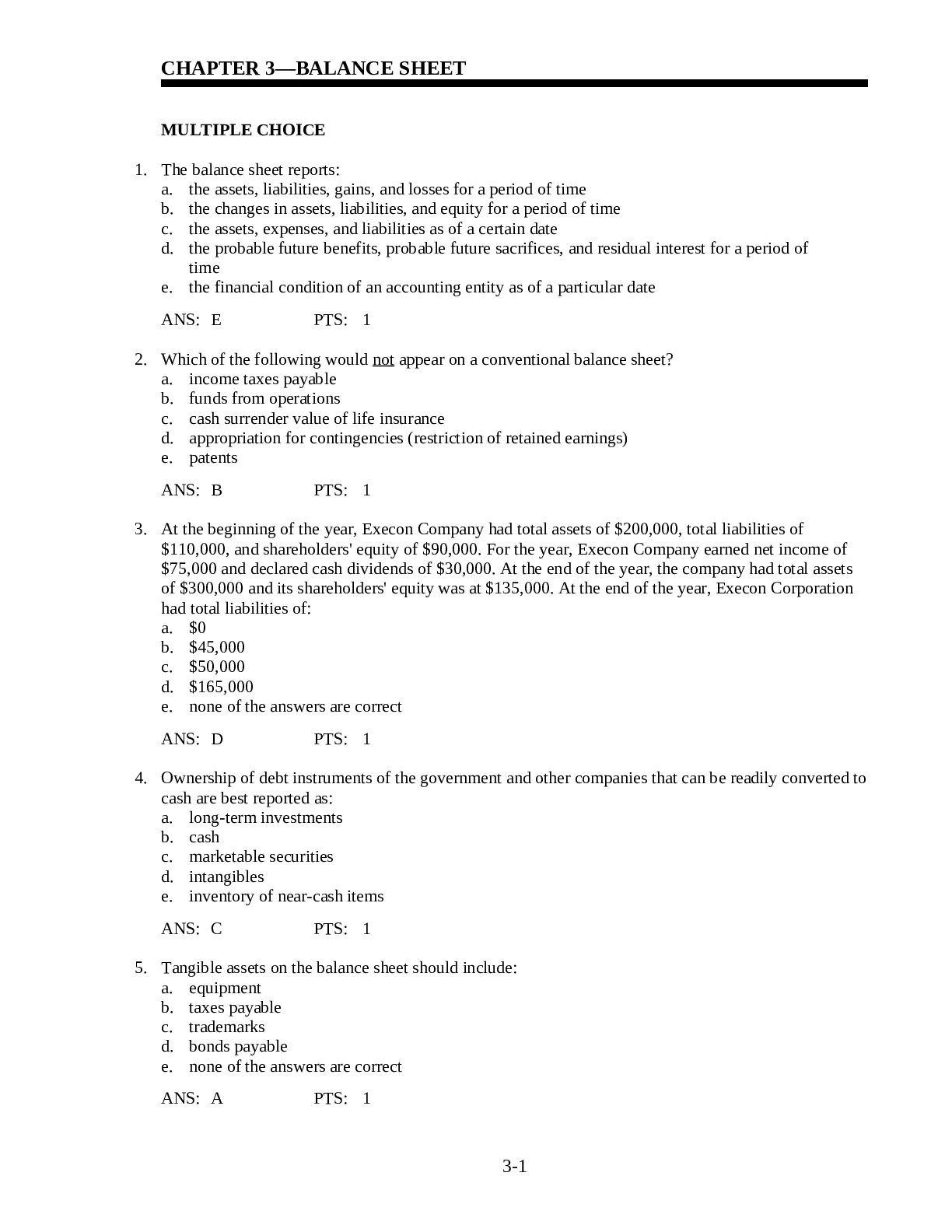

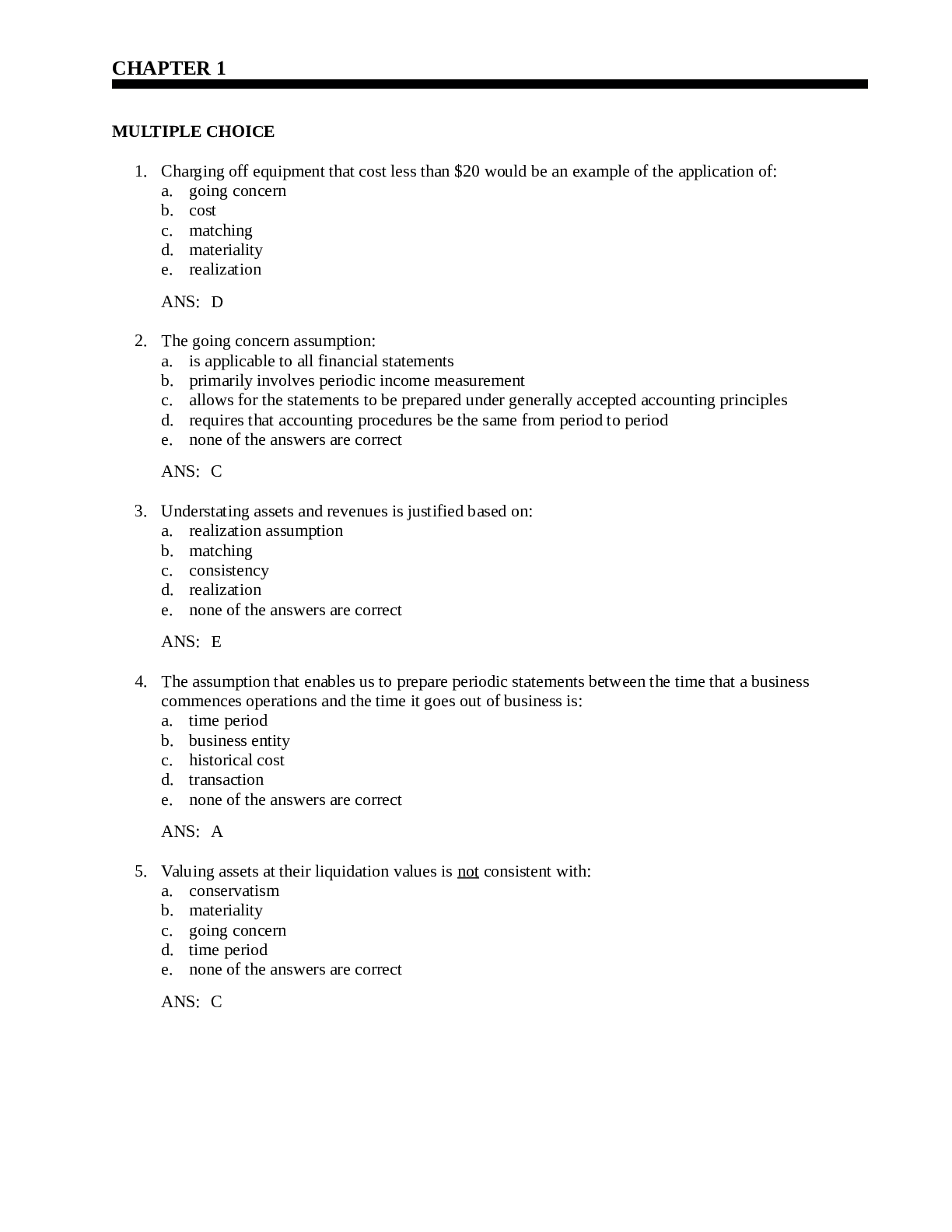

Multiple Choice Questions 1. Which of the following best describes the current ratio? A. debt ratio B. operating performance ratio C. liquidity ratio D. efficiency ratio 2. Which of the followin... g is not likely to be used to measure a company's liquidity? A. Working capital B. Financial leverage C. Current ratio D. Acid-test (quick) ratio 3. Which of the following is likely to be used to measure a company's solvency? A. Net operating profit margin B. Current ratio C. Financial leverage D. Cash to current liabilities ratio 4. Which of the following items would not typically be included in the components of the current ratio? A. Inventory B. Accounts payable C. Capitalized software development costs D. Deferred charges 10-1 Chapter 10 - Credit Analysis 5. Imagine FASB passes a new rule that required the capitalization of R&D. The effect for a drug company would be to: A. Increase its current ratio B. Decrease debt/equity ratio C. Decrease working capital D. Improve asset turnover 6. Selling accounts receivable increases which of the following? A. current ratio B. accounts receivable turnover C. debt/equity D. effective tax rate 7. Which of the following is not likely to be the cause of a company's a low accounts receivable turnover? A. Poor collection efforts B. Low price of product C. Customers in financial distress D. Delays in customer payments 8. Which of the following is not a measure of a company's a solvency? A. Debt to equity ratio B. Equity to assets ratio C. Sales to assets ratio D. Debt to assets ratio [Show More]

Last updated: 2 years ago

Preview 1 out of 37 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$15.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 27, 2022

Number of pages

37

Written in

Additional information

This document has been written for:

Uploaded

Apr 27, 2022

Downloads

0

Views

120

.png)

.png)