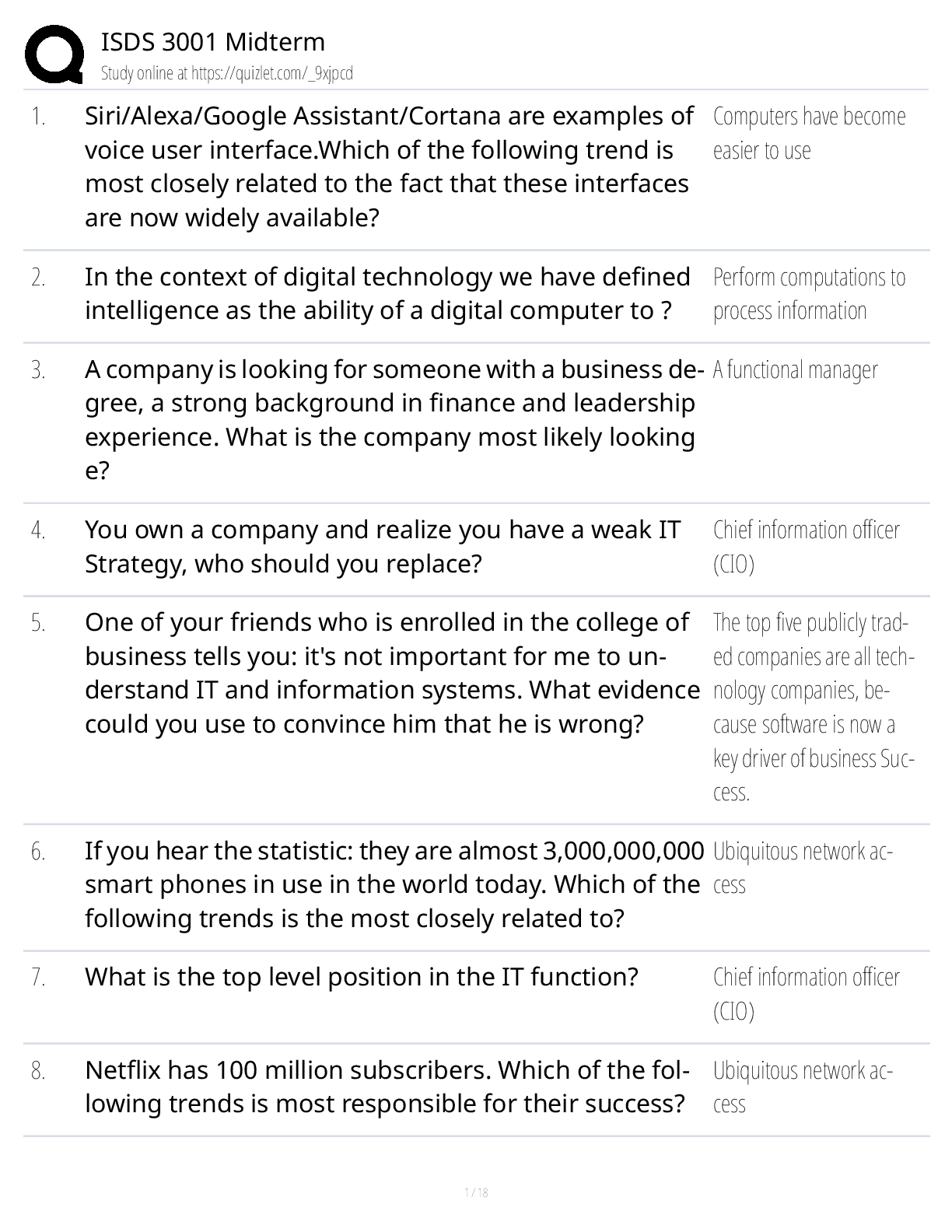

WGU C214 Concepts Only Multi Choice Version (Answered)

$ 12

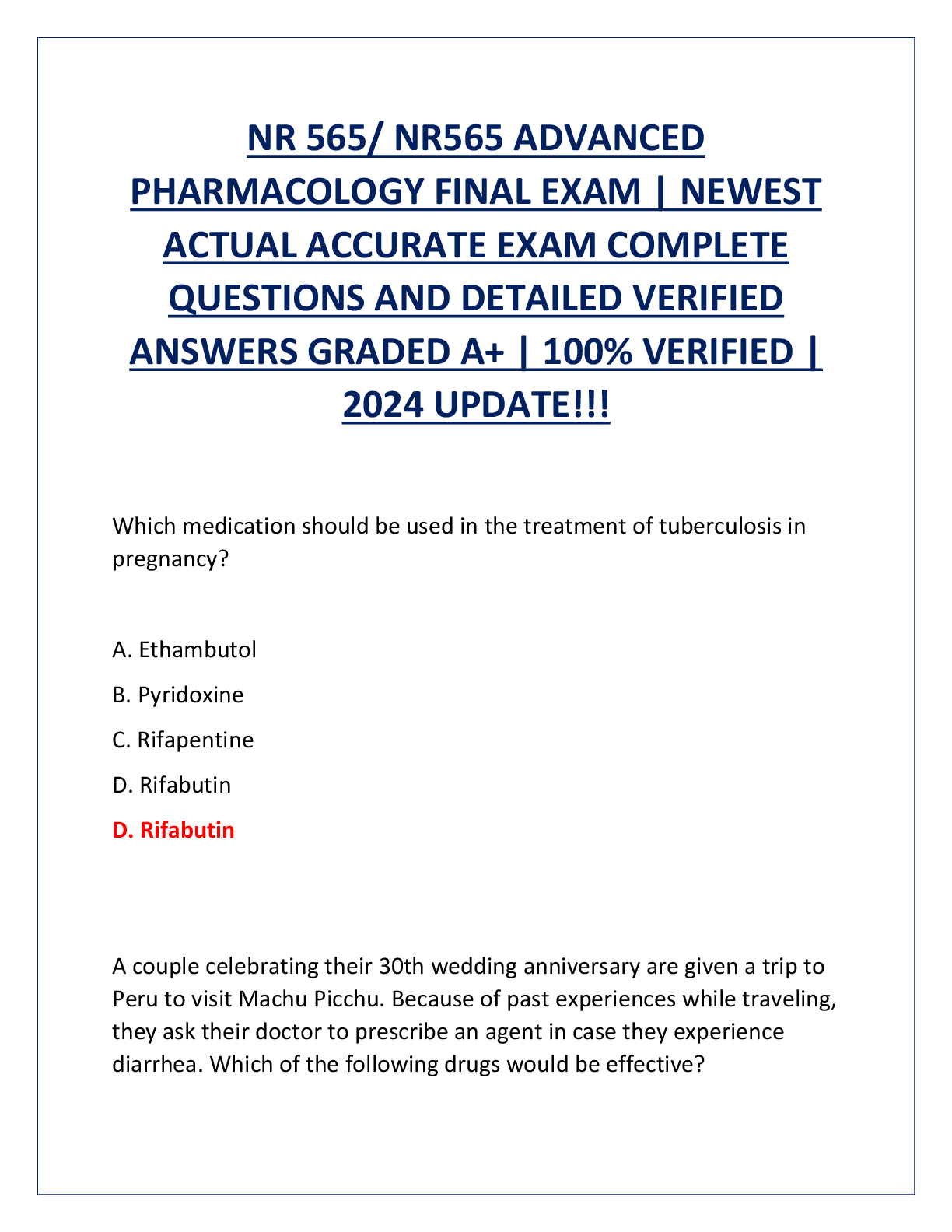

NR 565/ NR565 ADVANCED PHARMACOLOGY FINAL EXAM | NEWEST ACTUAL ACCURATE EXAM COMPLETE QUESTIONS AND DETAILED VERIFIED ANSWERS GRADED A+ | 100% VERIFIED | 2024 UPDATE!!!

$ 9

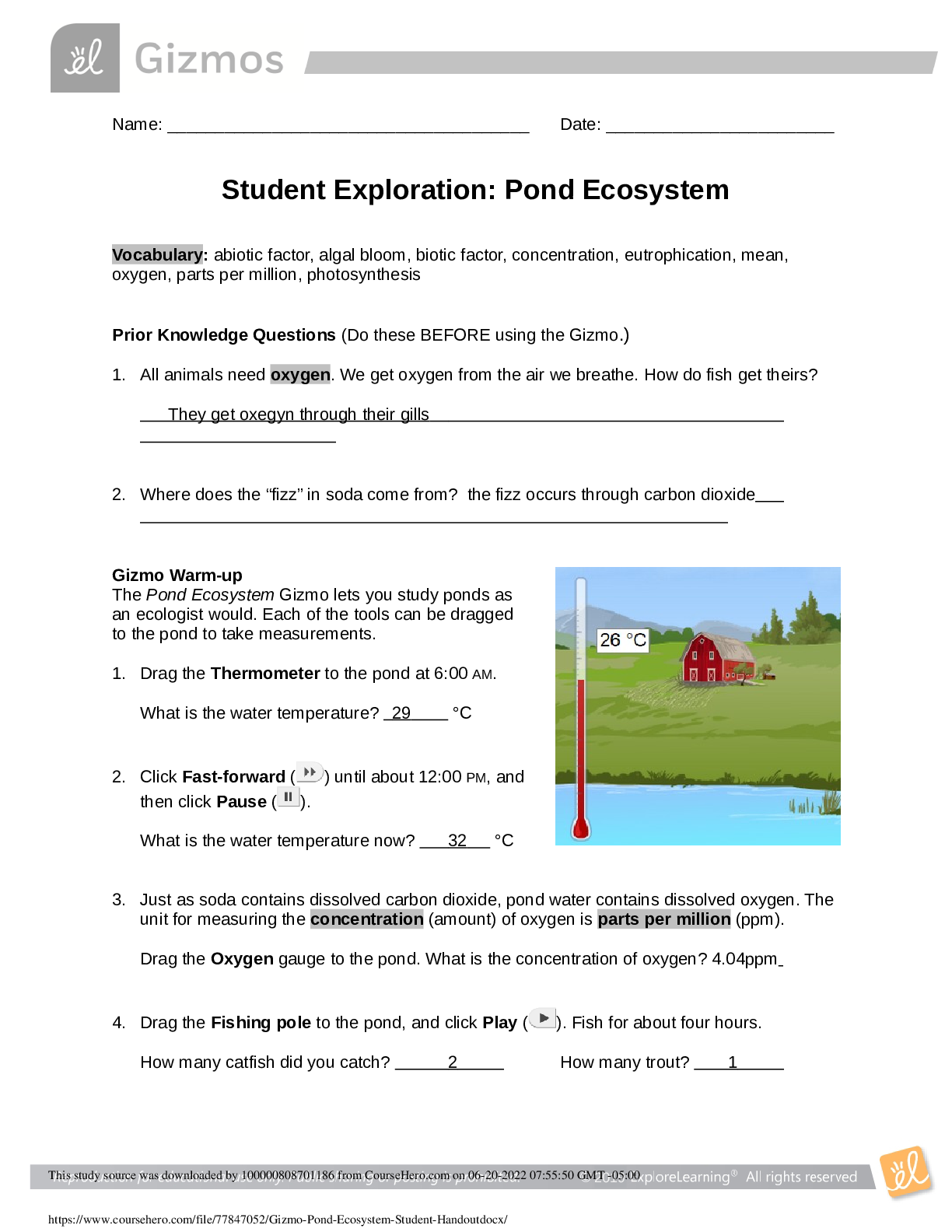

Gizmo Pond Ecosystem Student Exploration QUESTION and ANSWERS [ALL CORRECT SOLUTIONS]

$ 7

Pearson Edexcel International Advanced Level In A Level Chemistry WCH14 Paper 01: Rates, Equilibria and Further Organic Chemistry. Mark Scheme (Results) January 2022

$ 4

.png)

Elevator Mechanic Questions and Answers Graded A+

$ 11

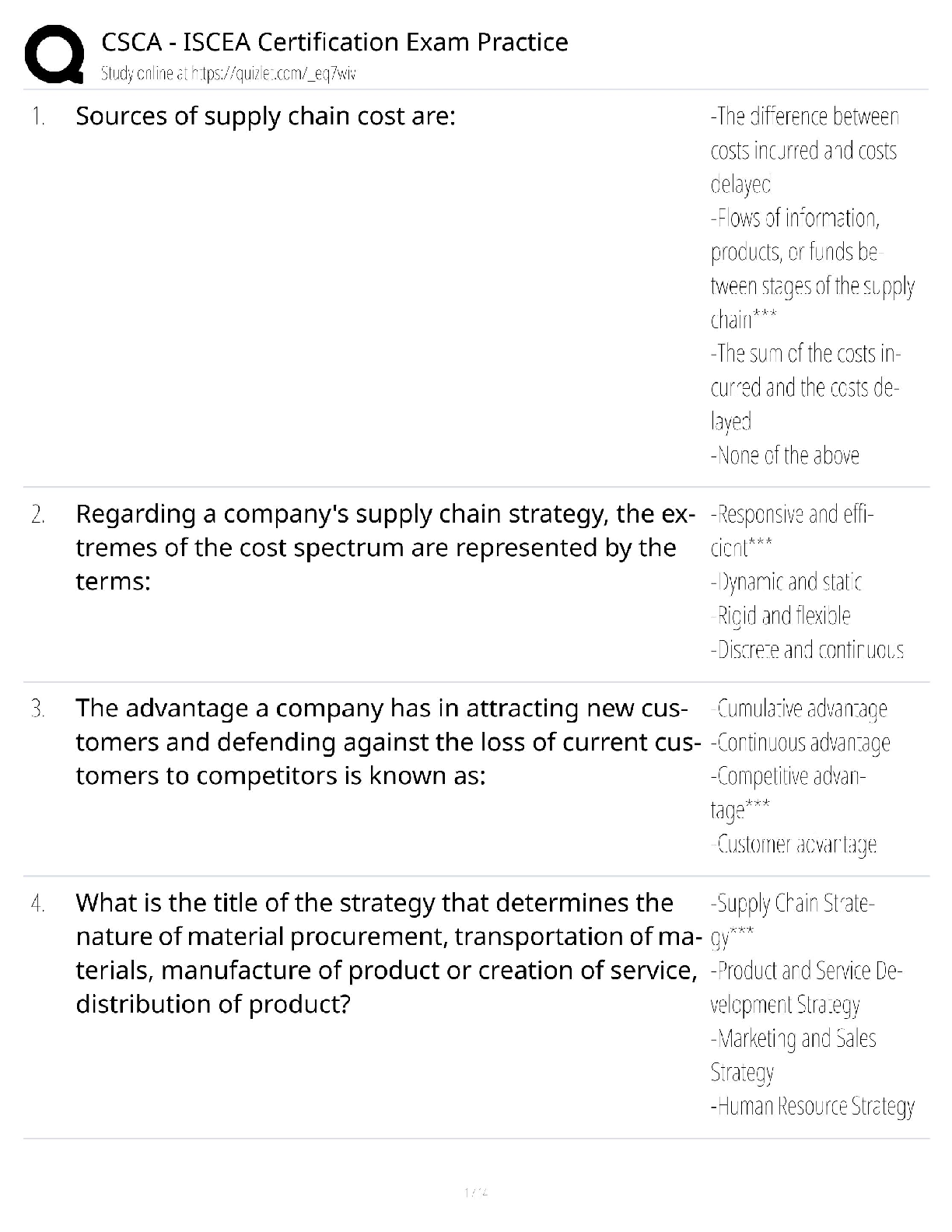

CSCA - ISCEA Certification / Practice Exam & Study Guide / 2025 Update / Score 100%

$ 18.5

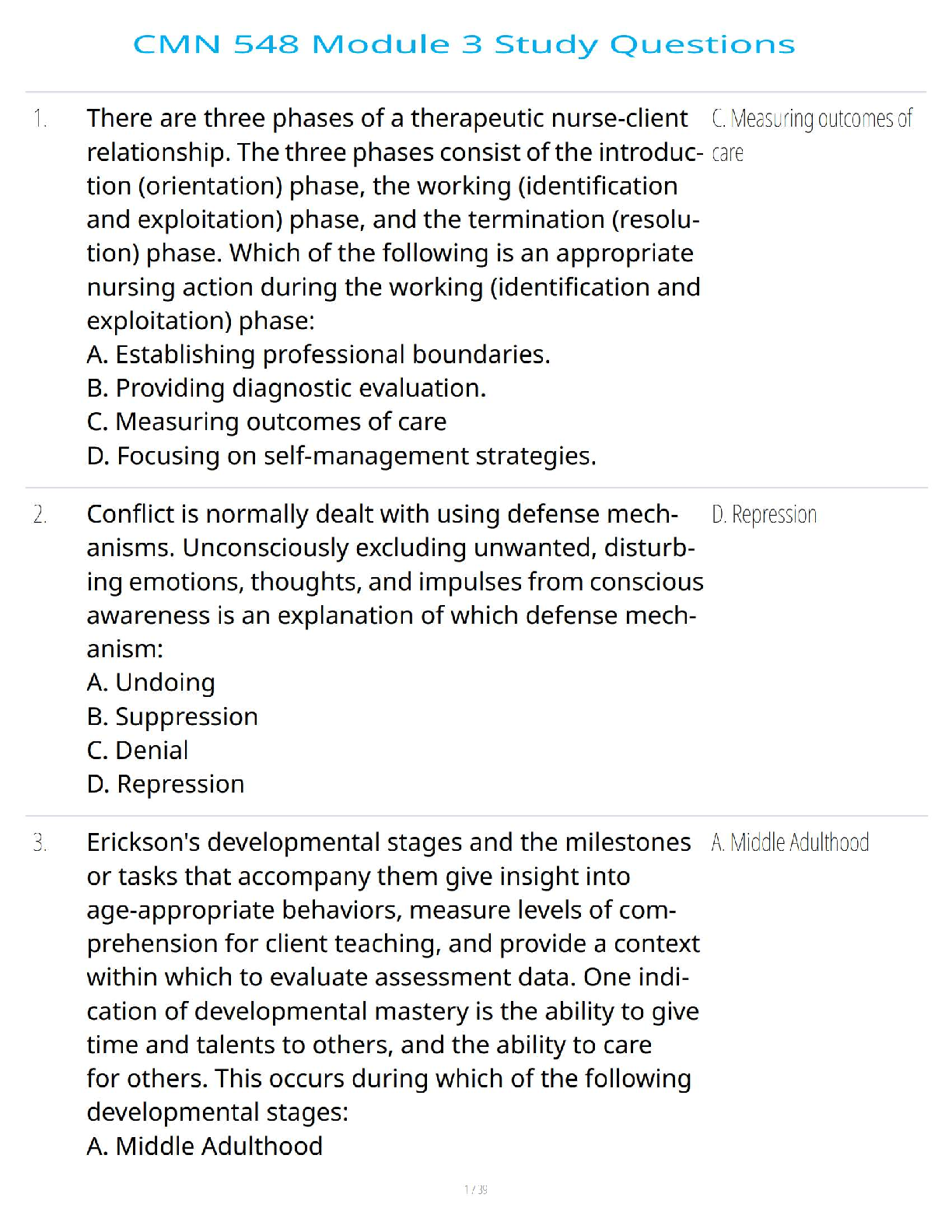

🧠 CMN 548 – Module 3 Study Questions | Psychiatric-Mental Health Nurse Practitioner | Chamberlain University | Verified Concepts and Clinical Reasoning | 2025–2026 Edition

$ 16

Test Bank For Discovering Statistics, 3rd Edition By Daniel Larose

$ 20

Citizenship J270/01: Citizenship in perspective General Certificate of Secondary Education QUESTION PAPER for November 2020

$ 6.5

STT 200 Final Exam_Practice Exam_SOLUTIONS

$ 9

MED SURG 206 Comprehensive Foundation NCLEX Questions And Answers( All Answers Are Correct)100%

$ 16

Mark Klimek Test taking strategies. Best Lecture Notes.

$ 9.5

CASE SOLUTIONS for Introduction to Human Resource Management 2nd Edition by Paul Banfield, Rebecca Kay

$ 22

Pearson Edexcel Level 1 /Level 2 GCSE (9-1 ) Time 50 minutes Paper reference 1 RAO/4B Religious Studies A PAPER 4: Area of Study 4 —Textual Studies Option 4B —The Qur'an

$ 7

.png)

PREP U CHAPTER 25-31. with accurate answers.

$ 20

Mark Scheme (Provisional) Summer 2021 Pearson Edexcel International GCSE In Science (Single Award) (4SS0) Paper 1C/ Graded A+

$ 10

Pearson Edexcel WCH12/01 I AS/A Level Chemistry International Advanced Subsidiary/Advanced Level UNIT 2: Energetics, Group Chemistry, Halogenoalkanes and Alcohols QP Jan 2022

$ 4

AHIP Practice Test Questions with Answers

$ 6

Maternal PN ATI

$ 35.5

Pearson Edexcel IAL WPS02/01 A Level Psychology International Advanced Level PAPER 2: Biological Psychology, Learning Theories and Development. QP Jan 2022

$ 9

HESI A2 Vocabulary Mastery – 250+ Practice Questions for Exam Success

$ 35.5

(ASU) CSE 575 Statistical Machine Learning - Knowledge Assessment Review 20242025

$ 10

BIOD 151 MODUL 1 EXAM QUESTIONS WITH 100% CORRECT ANSWERS PORTAGE LEARNING (GRADED A+)

$ 19

Solutions Manual for Introduction to Electrochemical Science and Engineering, 2nd Edition By Serguei Lvov

$ 29

BIO 235 MIDTERM 1 STUDY NOTES - Athabasca University

$ 15

BIOD 171 M6: Module 6 Exam

$ 7

.png)

Pearson Edexcel Level 3 GCE 8EC0/01 2022 Economics A Advanced Subsidiary PAPER 1: Introduction to Markets and Market Failure

$ 10

Computer Science H446/02: Algorithms and programming Advanced GCE QUESTION PAPER

$ 6.5

MN 553 Final Purdue Global University 2023

$ 15

INTERMEDIATE ACCOUNTING 1 CASH AND CASH EQUIVALENTS- Complete Notes, Defitions and Financial Calculation Guidelines

$ 6

Bio 319 Midterm Exam review sheet

$ 12

AP Computer Science Principles EXAM Quizlet Questionand Answer 2023

$ 10

International Business Management

$ 13

.png)

University of Cincinnati, Main Campus CHEM 111 Chem21Labs exp 1

$ 9

VSIM Nursing (NUR4545): Vsim Amelia Sung Pre/Pro-Test, Answered-

$ 8.5

Nurse Practitioner Certification Examination and Practice Preparation, 5th Edition

$ 20

OCR AS Level Latin H043/01 Language JUNE 2022

$ 7

University of South Africa TLI 4801 LITIGATION SKILLS FOR SOUTH AFRICAN LAWYERS

$ 15

Shadow Health-ABDOMINAL -RESULTS- Lab-Objective Complete

$ 14

ummary D182 Task 2 Professional Growth Plan.docx Running head: OHM2 Task Two: Developing a Professional Growth Plan D182 MSCIN Program, Western Governor s University D182, The Reflective Practitioner, Task 2 Introduction I am a first-grade teacher in a s

$ 10

.png)

PK0-004 Project+ BEST STUDY GUIDE 2021/2022

$ 10

.png)

OCR Interchange October 2021 A Level Physics/ H556/01 Modelling physics

$ 6

Humanitarian Assistance Response Training (HART) Pretest Exam Questions and Correct Answers (Complete Solution) Graded A+ 2023

$ 7

.png)

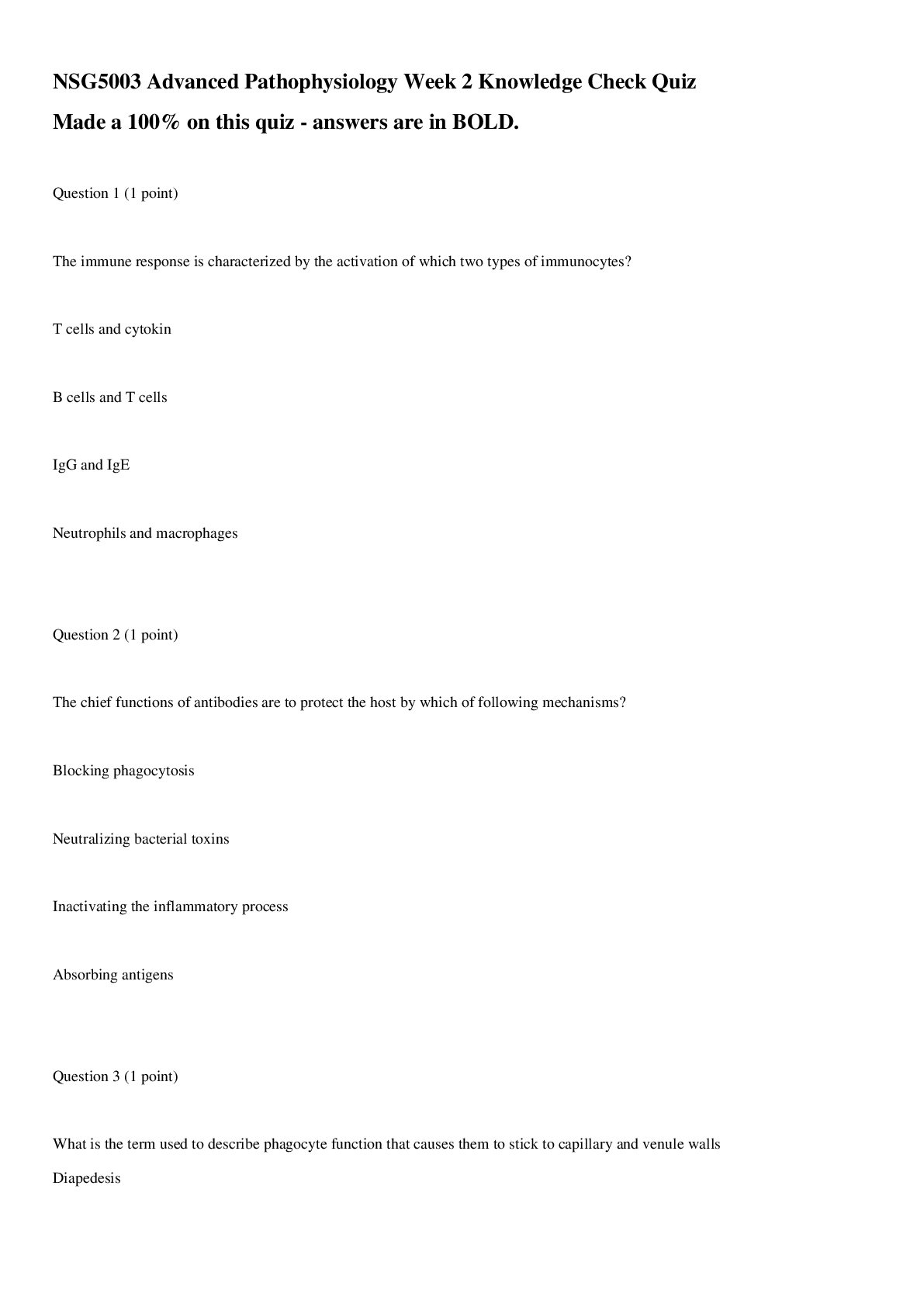

Walden University NURS 6501 Quiz 2

$ 14

GCSE (9–1) Religious Studies (Short Course) J125/01: Religion, philosophy and ethics in the modern world General Certificate of Secondary Education Mark Scheme for November 2020

$ 5

eBook (EPUB) Fundamentals of Craniofacial Malformations, Vol. 3, Surgical Atlas 1st Edition by Ulrich Meyer, Richard A Hopper

$ 30

Thio's Deviant Behavior, 13th Edition by Jim Taylor 2025. All Chapters 1-15 | Test Bank

$ 19

Solution and Answer Guide Essentials of Pharmacology for Health Professions, 9th Edition by Bruce Colbert, Adam James, Elizabeth Katrancha All Chapters

$ 19

.png)

Project_Management_Competency_1_Practice_Milestone. RATED A

$ 7

.png)

Pearson Edexcel Level 3 GCE 8PS0/02 2022 Psychology Advanced Subsidiary PAPER 2: Biological Psychology and Learning Theories

$ 10

Psychology Making Sense of Data 1010

$ 7.5

(Capella) HIM4620 Data Management in Health Information Systems Comprehensive Midterm Exam Guide Q & A 2024

$ 12

TDCJ OVERVIEW- LATEST UPDATE

$ 13.5

GLO-BUS Decisions & Reports years 6/ GLOBUS Decisions & Reports years; Latest 2019/20 Complete Guide, Already Graded A.

$ 8

8251-BASIC ELECTRICAL AND ELECTRONICS ENGINEERING: Q&A

$ 7

NUR 2063 Final REVISED Final Exam Study Guide Patho Spring 2020,100% CORRECT

$ 16

AVSC 3330 Exam | Questions and Answers

$ 13

IAAI CFI Exam Testbank & Study Guide (2025/2026) – Verified Questions & Detailed Answers | Certified Fire Investigator Prep

$ 23.5

Network Security | 90 Questions And Answers

$ 10

PSYC 280 Biological psychology - Simon Fraser University. PSYC 280 Final Exam Notes on: Homeostasis, Sleeping and Waking, Sensory Processing, Hearing, The Visual System, Emotions, Mood Disorders, Memory AND Learning and Language and Hemispheric Asymmetry

$ 9.5

Transcript Comprehensive Assessment _ Completed _ Shadow Health

$ 10.5

KILLER TEAS V PRACTICE TEST-SCIENCE PART I Questions And Answers (2022 – 2023) GRADED A+

$ 13

Massachusetts Chiropractic Jurisprudence 2025 EXAM QUESTIONS WITH ACCURATE VERIFIED ANSWERS

$ 3

APM Service Now | 100 Questions with 100% Correct Answers

$ 8

OB MATERNITY HESI EXAM /HESI MATERNITY OB EXAM VERSION A, B, C AND PRACTICE EXAM 2025 NEWEST EXAM COMPLETE 600 QUESTIONS WITH DETAILED VERIFIED ANSWERS (100% CORRECT ANSWERS) /A+ STUDY MATERIAL //CURRENTLY TESTING

$ 8.5

NURSING QUALITY CONTROL FINAL EXAM MODULE 1 QNS & ANS 20232024

$ 10

2023 COURSE OF DRUGS ELABORATIONS OF ANTIHELMINTHIC DRUGS

$ 6

.png)

EDEXCEL Mark Scheme (Results) November 2021 Pearson Edexcel GCE In Biology A Salters Nuffield (9BN0) Paper 2: Energy, Exercise and Coordination./

$ 12.5

MDC 3 Final Exam Blueprint Filled out

$ 30

CDL General Knowledge 2022 Questions And Answers With Complete Solution Rated A.

$ 10

FDNYC G60 Practice Exam Latest Update Already Passed

$ 10

Study_Guide_ATI_maternity_ ATTEMPT 95% SCORE

$ 8.5

Solution Manual For Intermediate Accounting IFRS 4th Edition by Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield Chapter 1-24

$ 10

Biology Syllabus

$ 10.5

Counterintelligence Awareness Questions and Answers Latest Updated 2022 Already Passed

$ 3

OCR A LEVEL JUNE 2022 FURTHER MATHS B -MECHANICS MOJOR - ANSWER BOOKLET

$ 3

NGN ATI PN Management Exam

$ 16

Computer Science H446/01: Computer systems Advanced GCE Question Paper

.png)