Business > QUESTIONS & ANSWERS > [Solved] Estate Plan Scenerio |Rated A+ (All)

[Solved] Estate Plan Scenerio |Rated A+

Document Content and Description Below

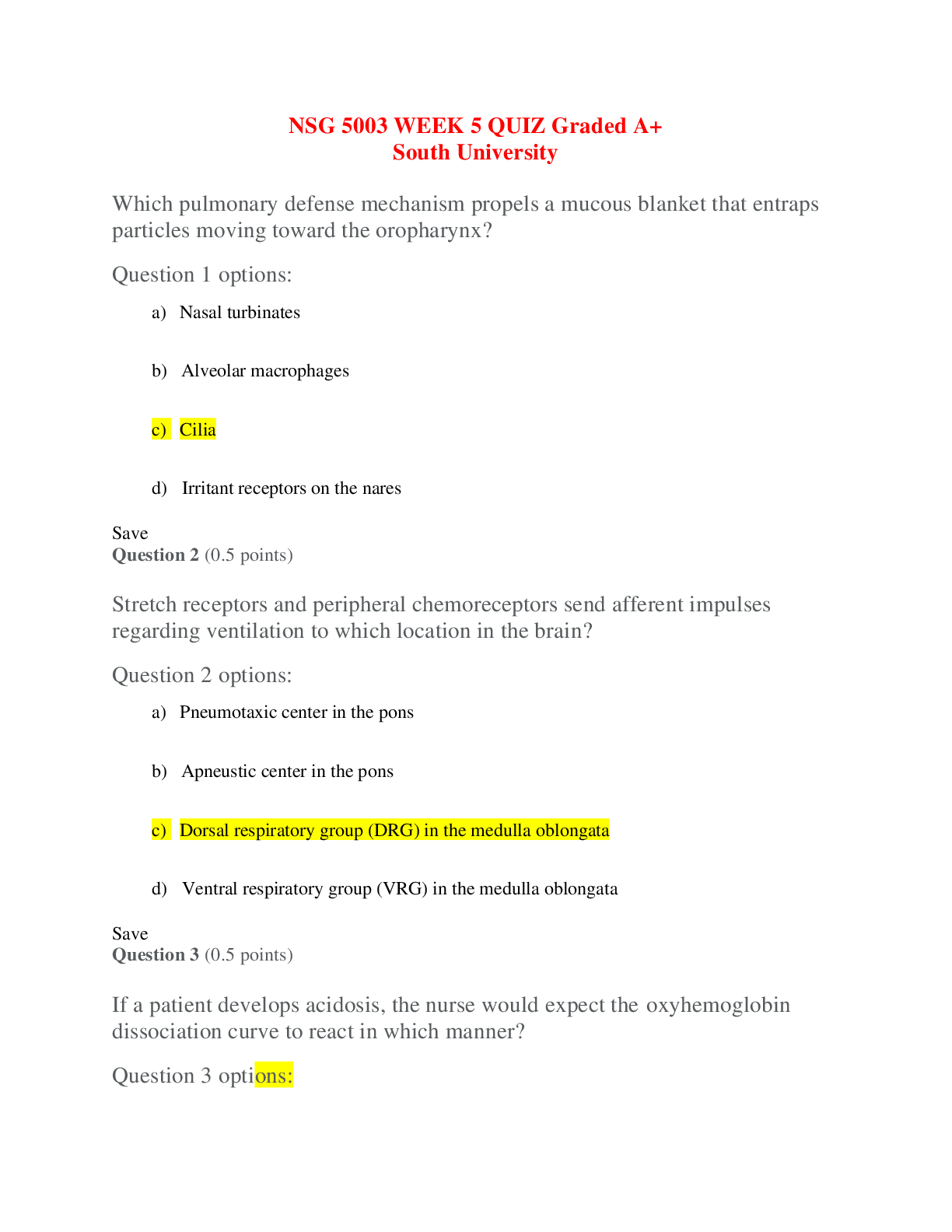

Estate Plan Answer the following questions. Assume the facts given in the fact pattern and that the 2012 estate and gift tax rates and annual exclusion apply to all transfers in the current and pre ... vious years. (Numbers are rounded for convenience.) 1. Which of the following transfer mechanisms would be appropriate for the transfer of Fresh Veggies to James and Elizabeth assuming Kathi and Darrin did not want to make an outright gift of the company to them? 1. Private Annuity. 2. SCIN. 3. Family Limited Partnership. 4. QPRT. (a) 1 only. (b) 3 only. (c) 1 and 2. (d) 1, 2, 3 and 4. 2. If Darrin died today, which of the following statements is true regarding the transfers made in his will? (a) Kathi will receive Darrin’s interest in the Investment Portfolio. (b) Elizabeth will receive the proceeds of the life insurance policy. (c) James will receive the yacht in place of the house boat. (d) Marie may potentially receive Vacation Home 1 as Lynn’s rightful heir. 3. Assuming Darrin died today, calculate his gross estate. (a) $5,525,000. (b) $7,525,000. (c) $8,025,000. (d) $8,372,760. 4. Assuming Darrin died today, calculate his probate estate. (a) $5,525,000. (b) $7,525,000. (c) $8,025,000. (d) $8,380,320. 5. Assuming Darrin died today, calculate the marital deduction available for transfers to Kathi (remember this is a net amount). (a) $4,425,000. (b) $4,539,500. (c) $5,425,500. (d) $6,375,000. 6. Assume that Darrin died today and the estate tax due was $702,591 and Keith is appointed executor. Unfortunately, Keith forgot to file an Estate Tax Return (Form 706) and pay the estate tax due until 45 days after the return’s due date. How much is the failure-to-file penalty? (a) $7,026. (b) $63,233. (c) $70,259. (d) $77,285. 7. Assume Kathi and Darrin wanted to establish college funds for each of the grandchildren. Which of the following statements would be true? (a) An irrevocable trust would be a completed gift for gift tax and estate tax purposes. (b) The transfers would not be subject to GSTT, regardless of to whom the money is paid, because the payments were made for education. (c) If Darrin and Kathi found out about Marie and wanted to establish a fund for her as well, then the transfer to Marie would be subject to GSTT. (d) An appropriate planning technique for both Elizabeth and James’ family would be to place the assets into 2 family trusts, 1 for Elizabeth’s children (with Elizabeth and Scott as joint trustees) and 1 for James’ children (with Catherine as the trustee). 8. Which of the following statements regarding the transfer to Andrew 5 years ago is correct? (a) Andrew is a skip person because he is more than 37½ years younger than Darrin, thus the transfer results in a taxable termination. (b) The transfer will qualify for the GSTT annual exclusion. (c) Assuming 2011 rates apply to this transfer, the GSTT will be 35% of $8,000,000. (d) The only tax consequence for this transfer will be GSTT due. 9. Assuming Kathi died today, which of the following statements is true? (a) Kathi’s assets would avoid probate. (b) State intestacy law would dictate who received Kathi’s assets. (c) All of Kathi’s community property assets would transfer to Darrin because of the implied right of survivorship. (d) Kathi’s gross estate would include the life insurance policy on Darrin. 10. Assuming Darrin died today, which of the following statements regarding a valid disclaimer is correct? (a) Assume Darrin left Elizabeth his interest in the Yacht. If Elizabeth disclaims her property then the transfer will be subject to GSTT. (b) If James disclaimed his property, the property would transfer to Kathi. (c) If Kathi wanted to disclaim a portion of the property, she must do so by the due date of the estate tax return plus extensions. (d) In order for the disclaimer to be valid it must be in writing or witnessed by 3 nonrelated individuals if the disclaimer is oral. 11. Assume Kathi died today and left Vacation Home 2 to Elizabeth. What would Elizabeth’s adjusted basis be in Vacation Home 2? (a) $30,000. (b) $200,000. (c) $250,000. (d) $500,000. 12. Assume Kathi died today and left her share of the personal residence to Darrin. What would Darrin’s adjusted basis be in the personal residence? (a) $300,000. (b) $600,000. (c) $1,050,000. (d) $1,500,000. 13. Kathi and Darrin are considering making a charitable contribution to the Boys and Girls Club of America and want the grandchildren to receive income from the property for an extended period. Which of the following charitable devices may be appropriate to meet their objectives? 1. Charitable Remainder Annuity Trust. 2. Charitable Remainder Unitrust Trust. 3. Pooled Income Fund. 4. Charitable Lead Trust. (a) 1 only. (b) 1, 2, and 3. (c) 2, 3, and 4. (d) 1, 2, 3, and 4. 14. Which of the following types of clauses appear in Darrin’s will? 1. Specific Bequests. 2. Survivorship Clause. 3. No-contest clause. 4. Simultaneous death clause. (a) 1 only. (b) 2 and 3. (c) 1 and 2. (d) 1, 2, 3, and 4. 15. Assume Darrin died today and Keith is appointed as executor. Of the following, which is not an available election Keith can make before he files Darrin’s estate tax return? (a) Electing the QTIP election on property passing to Kathi. (b) Utilizing the annual exclusion against testamentary transfers. (c) Selection of the income tax year end for Darrin. (d) Deducting the expenses of administering Darrin’s estate on the estate tax return (Form 706). 16. Assume Darrin died in 2011. Which filing status can Kathi use on her 2011 income tax return? (a) Single. (b) Head of Household. (c) Married Filing Jointly. (d) Qualifying Widow. 17. Assume Darrin died in 2011. Which filing status can Kathi use on her 2012 income tax return? (a) Single. (b) Head of Household. (c) Married Filing Jointly. (d) Qualifying Widow. 18. Assume Darrin died today, Keith is appointed executor, and the estate does not have sufficient cash to pay the required taxes or expenses. Of the following statements, which is not true regarding selling an estate’s assets to generate cash? (a) The estate may have income tax consequences. (b) The assets may not be sold at full, realizable fair market value. (c) Any losses on the sale of the assets are deductible as losses on the estate tax return. (d) Any selling expenses are deductible on the estate tax return. 19. Assume Darrin dies today and Keith is appointed executor. Keith is considering electing the alternate valuation date. Which of the following statements does not correctly reflect the rules applicable to the alternate valuation date? (a) The general rule is the election covers all assets included in the gross estate and cannot be applied to only a portion of the property. (b) Assets disposed of within 6 months of decedent’s death must be valued on the date of disposition. (c) The election can be made even though an estate tax return does not have to be filed. (d) The election must decrease the value of the gross estate and decrease the estate tax liability. 20. Assume Darrin transfers ownership of the life insurance policy on his life to an Irrevocable Life Insurance Trust (ILIT) and retains the right to borrow against the policy. Assume Darrin dies 5 years later. Which of the following is correct regarding the treatment of the proceeds of the life insurance policy? (a) The proceeds will be included in Darrin’s federal gross estate if he has any outstanding loans against the life insurance policy. (b) The proceeds will be included in Darrin’s federal gross estate if Darrin continued paying the policy premiums after the life insurance policy was transferred to the ILIT. (c) The proceeds will never be included in Darrin’s federal gross estate. (d) The proceeds will always be included in Darrin’s federal gross estate. [Show More]

Last updated: 3 years ago

Preview 1 out of 11 pages

![Preview image of [Solved] Estate Plan Scenerio |Rated A+ document](https://scholarfriends.com/storage/Estate-scenario (2).png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$15.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Nov 06, 2020

Number of pages

11

Written in

All

Additional information

This document has been written for:

Uploaded

Nov 06, 2020

Downloads

0

Views

61

.png)