Finance > QUESTIONS & ANSWERS > FIN515 MANAGERIAL FINANCE MIDTERM EXAM POSSIBLE QUESTIONS WITH ANSWERS DOCS UPDATED WOTKING SOLN (All)

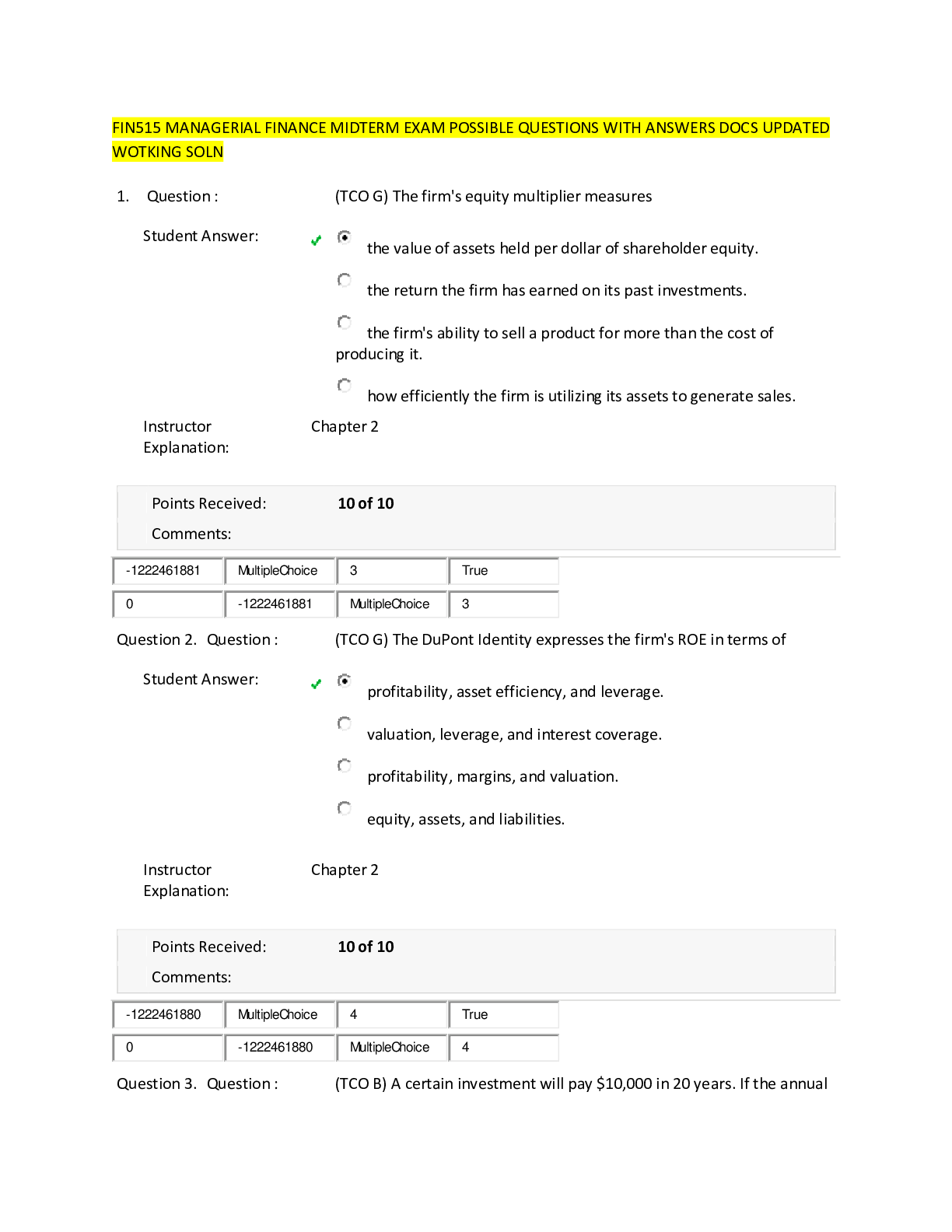

FIN515 MANAGERIAL FINANCE MIDTERM EXAM POSSIBLE QUESTIONS WITH ANSWERS DOCS UPDATED WOTKING SOLN

Document Content and Description Below

FIN515 MANAGERIAL FINANCE MIDTERM EXAM POSSIBLE QUESTIONS WITH ANSWERS DOCS UPDATED WOTKING SOLN 1. Question : (TCO G) The firm's equity multiplier measures Question 2. ... Question : (TCO G) The DuPont Identity expresses the firm's ROE in terms of Question 3. Question : (TCO B) A certain investment will pay $10,000 in 20 years. If the annual return on comparable investments is 8%, what is this investment currently worth? Show your work. Question 4. Question : (TCO B) You take out a 5 year car loan for $20,000. The loan has a 5% annual interest rate. The payments are made monthly. What are the monthly payments? Show your work. Question 5. Question : (TCO B) Someone leases a car with the following terms: monthly payment, five year term, 5% annual interest rate, initial value of the lease is $35,000, and value at the end of the lease is $10,000. What are the monthly payments? Show your work. Question 6. Question : (TCO B) An accident victim has received a structured settlement. According to the terms of the agreement, the victim will receive $10,000 per year at the end of each year for the next 15 years. Additionally, the victim will receive $20,000 in 10 years. The victim believes they could get 7% annually on an investment they could make if they had all the money now. What would the money be worth to them if they could get it now? Show your work. Question 7. Question : (TCO F) A project requires an initial cash outlay of $60,000 and has expected cash inflows of $15,000 annually for 8 years. The cost of capital is 10%. What is the project’s NPV? Show your work. Question 8. Question : (TCO F) A project requires an initial cash outlay of $95,000 and has expected cash inflows of $20,000 annually for 9 years. The cost of capital is 10%. What is the project’s payback period? Show your work. Question 9. Question : (TCO F) A project requires an initial cash outlay of $40,000 and has expected cash inflows of $12,000 annually for 7 years. The cost of capital is 10%. What is the project’s IRR? Show your work. Question 10. Question : (TCO F) A project requires an initial cash outlay of $95,000 and has expected cash inflows of $20,000 annually for 9 years. The cost of capital is 10%. What is the project’s discounted payback period? Show your work. Question 11. Question : (TCO F) Company A has the opportunity to do any, none, or all of the projects for which the net cash flows per year are shown below. The projects are not mutually exclusive. The company has a cost of capital of 15%. Which should the company do and why? You must use at least two capital budgeting methods. Show your work. Explain your answer thoroughly. A B C 0 -300 -100 -300 1 100 -100 100 2 100 100 100 3 100 100 100 4 100 100 100 5 100 100 100 6 100 100 -100 7 -300 -200 0 [Show More]

Last updated: 3 years ago

Preview 1 out of 6 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Nov 09, 2020

Number of pages

6

Written in

All

Additional information

This document has been written for:

Uploaded

Nov 09, 2020

Downloads

0

Views

98

answers.png)