Financial Accounting > EXAMs > Coursera ACCOUNTING 101 Mastery Quiz 1 - 2. (All)

Coursera ACCOUNTING 101 Mastery Quiz 1 - 2.

Document Content and Description Below

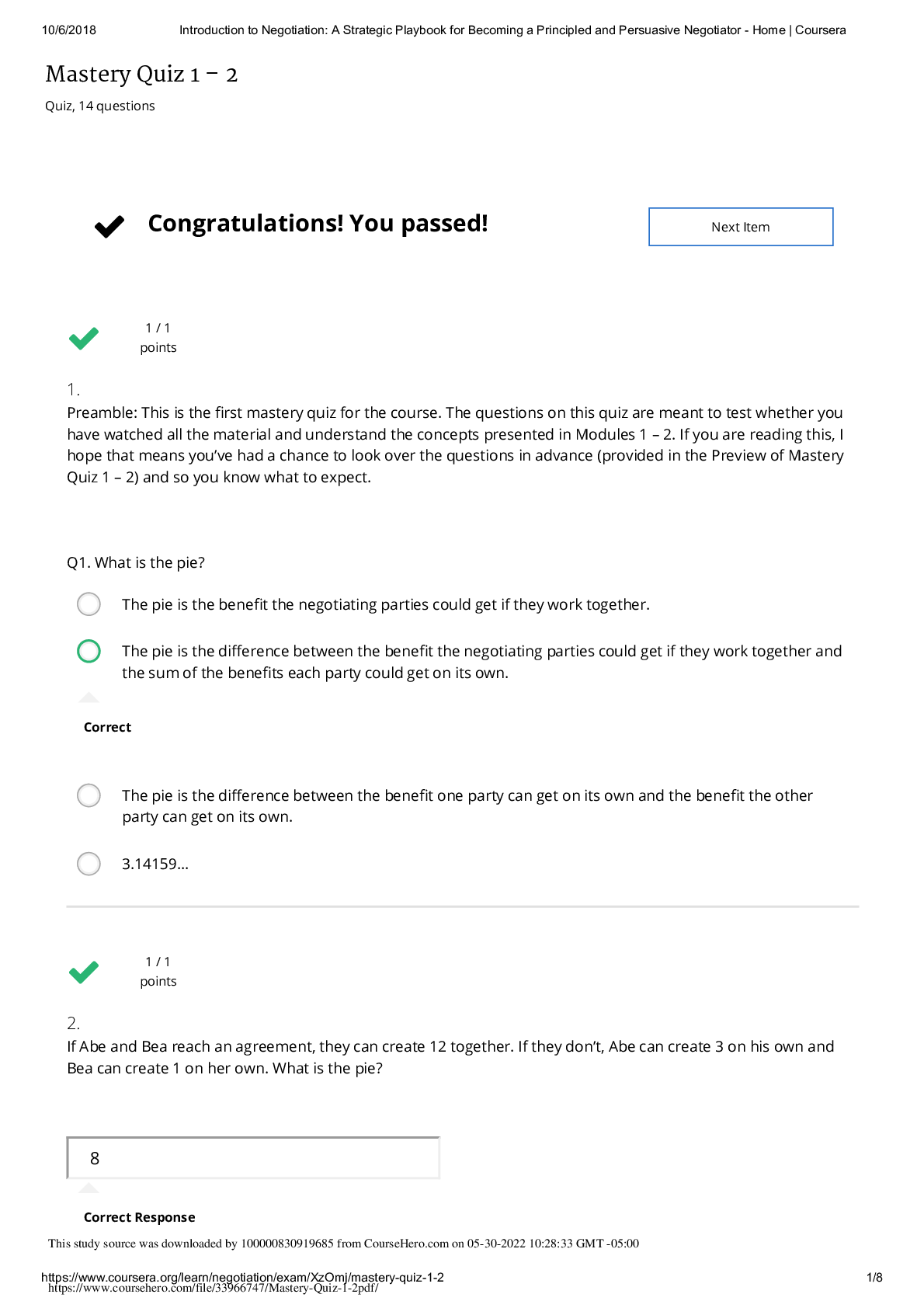

Preamble: This is the Òrst mastery quiz for the course. The questions on this quiz are meant to test whether you have watched all the material and understand the concepts presented in Modules 1 – ... 2. If you are reading this, I hope that means you’ve had a chance to look over the questions in advance (provided in the Preview of Mastery Quiz 1 – 2) and so you know what to expect. Q1. What is the pie? Correct points 1 / 1 The pie is the beneÒt the negotiating parties could get if they work together. The pie is the di×erence between the beneÒt the negotiating parties could get if they work together and the sum of the beneÒts each party could get on its own. The pie is the di×erence between the beneÒt one party can get on its own and the beneÒt the other party can get on its own. 3.14159… 2. If Abe and Bea reach an agreement, they can create 12 together. If they don’t, Abe can create 3 on his own and Bea can create 1 on her own. What is the pie? 8 Correct Response points 1 / 1 Mastery Quiz 1 – 2 Quiz, 14 questions That’s right. The pie is how much more the two parties can create by working together compared to what they can create without an agreement. Therefore the pie is 12 - (3 + 1) = 8. 3. In the above scenario, how much should Abe get (in total)? 4. Andrea and Beth are dining at a Òne restaurant. There is a bottle of 2009 Grgich Hills Chardonnay on the menu and the price is $100. To keep things simple, albeit unrealistic, assume the restaurant only sells whole bottles and this is the only wine they carry. Andrea would be willing to pay $110 to drink the whole bottle. Andrea would be willing to pay $90 to drink half the bottle. Beth would be willing to pay $80 to drink the whole bottle. Beth would be willing to pay $50 to drink half the bottle. They would like to share a bottle if it makes sense to do so (and if they can agree on how to divide the costs). To see if it makes sense, what is the pie, in dollars? Note: In the past, nearly 90% of learners got this question wrong on the Òrst try. To help you get into the 10%, please take a moment to think through the potential beneÒt from reaching an agreement and what each party would do absent a deal. 30 If they don’t reach an agreement, Andrea will get $10 and Beth will get nothing. If they do reach an agreement, they will jointly have created $40 of surplus ($90 + $50 – $100). Thus the pie is $30. 5. In the question above, how much should Andrea pay, in dollars, if they split the pie? 65 Correct Response If they split it evenly, each side will end up with $15 of the pie. Thus Beth pays $50 – $15 = $35 and Andrea pays $90 – ($15 + $10) = $65. Note Andrea starts with the $10 of value that she can create on her own. 6. Recall that if Aegean and Baltic share the cost of a new software program, Aegean will beneÒt $100 while Baltic beneÒts $200. If the software costs $100 total, how much should Aegean pay, in dollars? 50 If the software costs $100, the net beneÒt they would receive together is $200. If they work on their own, Aegean will not buy the software since the cost ($100) cancels out its beneÒt ($100). Baltic will buy the software for a net beneÒt of $200 - $100 = $100. Therefore the pie, or the di×erence between working together and working separately, is $200 - $100 = $100. The pie should be divided equally: $50/$50. Aegean and Baltic will each pay $50. Here it is in tabular form: Aegean Baltic Total Net BeneÒt: Together ------- ------ 200 Net BeneÒt: On Their Own 0 100 100 Pie ------- ------ 100 Total beneÒt each side gets when they split the pie 50 150 200 How much each pays 50 50 200 7. What is the Shapley Value? Well done. For each party in the group, it is the amount of pie created by that party joining others in the group, averaged across all possible orderings in which parties join the group. For each party in the group, it is half of the amount of pie created by that party joining others in the group, averaged across all possible orderings in which parties join the group. For each party in the group, it is the maximum portion of the pie created by that party joining the group, across all possible orderings in which parties join the group. 8. In the Planet–Gazette merger, the Gazette was twice as big as the Planet. If the Planet were the same size as the Gazette, how much more of the pie would you expect the Planet to get? Correct The pie gets split in half, not because the Planet and Gazette are equal in size, but because the cooperation of both parties is needed to complete the merger and create the pie. No more 50% more 100% more 9. Recall in the Planet–Gazette merger case, the increased productivity from the Gazette’s know-how was worth $1 million to the Planet. Imagine the Planet could hire a consultant to improve its productivity up to the same level as the Gazette. The cost of the consultant would be $200,000. Of course, with the merger, there is no need for the consultant. When the Planet has the ability to hire a consultant, how much more money should the Planet get in the merger? The same amount as before $200,000 more $300,000 more Mastery Quiz 1 – 2 Quiz, 14 questions The Planet can get $800k of the savings without any help from the Gazette. The reason to do the merger is to save an additional $200k. The Planet should get half this amount. Thus the total going to the Planet is $800k + $100k = $900k, which is $400k more than the $500k they were getting. $400,000 more $500,000 more 10. Consider a potential merger between two hypothetical beer companies. Prior to the merger, the Òrst, Ann Hy, is worth $150 billion and the second, Czar Bosch, is worth $100 billion. If they merge, they will gain $30 billion in increased value from reduced costs and additional sales (in present discounted value). Thus the combined value of the new entity (called Ann Hy-Czar Bosch) would be $280 billion. How much more could Czar Bosch hope to get by using the theory of the pie instead of proportional division? Correct That's right. Under proportional division, Czar Bosch would likely get an amount proportional to their market cap, 40% (2/5th) of the $30 billion, or $12 billion. If they split the pie, then Czar Bosch would get $15 billion, or $3 billion more. 0 $1.3 billion $3 billion $5 billion $10 billion $10.7 billion 11. Consider an Ultimatum Game where the pie is $100. You are the receiver. What reserve price, in dollars, maximizes your expected payout? points Your reserve price doesn’t change what the other side will o×er. Thus anything you turn down is like throwing money away. You may choose to do so out of spite or to enforce a social norm, but doing so will lower your expected payout. 12. In an Ultimatum Game where the pie is $100, would you rather be: Correct Remember the old adage: It is better to give than to receive. You would rather be the one making the o×er since that person should get more than half of the pie. The advantage of being the one receiving the o×er is you can guarantee yourself some money by saying yes to everything. the person making the o×er the person receiving the o×er 13. You should propose proportional division if it beneÒts you. Correct If a proportional split leads you to get more than half the pie and the other side is willing to agree, then go ahead. points 1 / 1 Abe and Bea each have some money to invest in a CD (CertiÒcate of Deposit). Abe has $5,000 and Bea has $20,000. Both are interested in making a 6-month investment at Synchrony Bank. The CD rates for Synchrony Bank (as of July 8, 2015) are as listed below. With 0.41% interest, Abe would get $5,010 in six months. With 0.50% interest, Bea would get $20,050 at the end of six months. If they pool their funds, they will be able to purchase a $25,000 CD, which pays a higher interest rate. The 0.60% interest will return $25,075 at the end of six months. Obviously, Abe gets back his $5,000 principle, and Bea gets back her $20,000 principle. How should the $75 interest be divided between the two of them? Correct If they don’t pool their funds, then Abe will only earn $10 of interest and Bea will earn $50. By coming together, they can earn $75, which is an extra $15 of interest. The two should spit this evenly, $7.50 and $7.50. Thus Abe would get $17.50 and Bea would get $57.50. Note that this increases Abe’s e×ective interest rate from 0.41% to 0.7%, which is more than what Bea is getting. The reason is that Bea is not able to increase her payout from 0.50% to 0.60% without Abe’s cooperation. Were Bea able to Ònd someone else with $5,000 to invest with her, then she would likely get much more of the gain. Divide up the interest according to the amount invested. Since Bea has 80% of the funds, she should get 80% of the interest, or $60 in total. This is the same as both parties getting 0.60% interest on their funds. Divide the interest in two, so each gets $37.50. Abe gets $17.50 and Bea gets $57.50. [Show More]

Last updated: 3 years ago

Preview 1 out of 8 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

May 30, 2022

Number of pages

8

Written in

All

Additional information

This document has been written for:

Uploaded

May 30, 2022

Downloads

0

Views

51