TEST ANSWER complete solution questions and answers

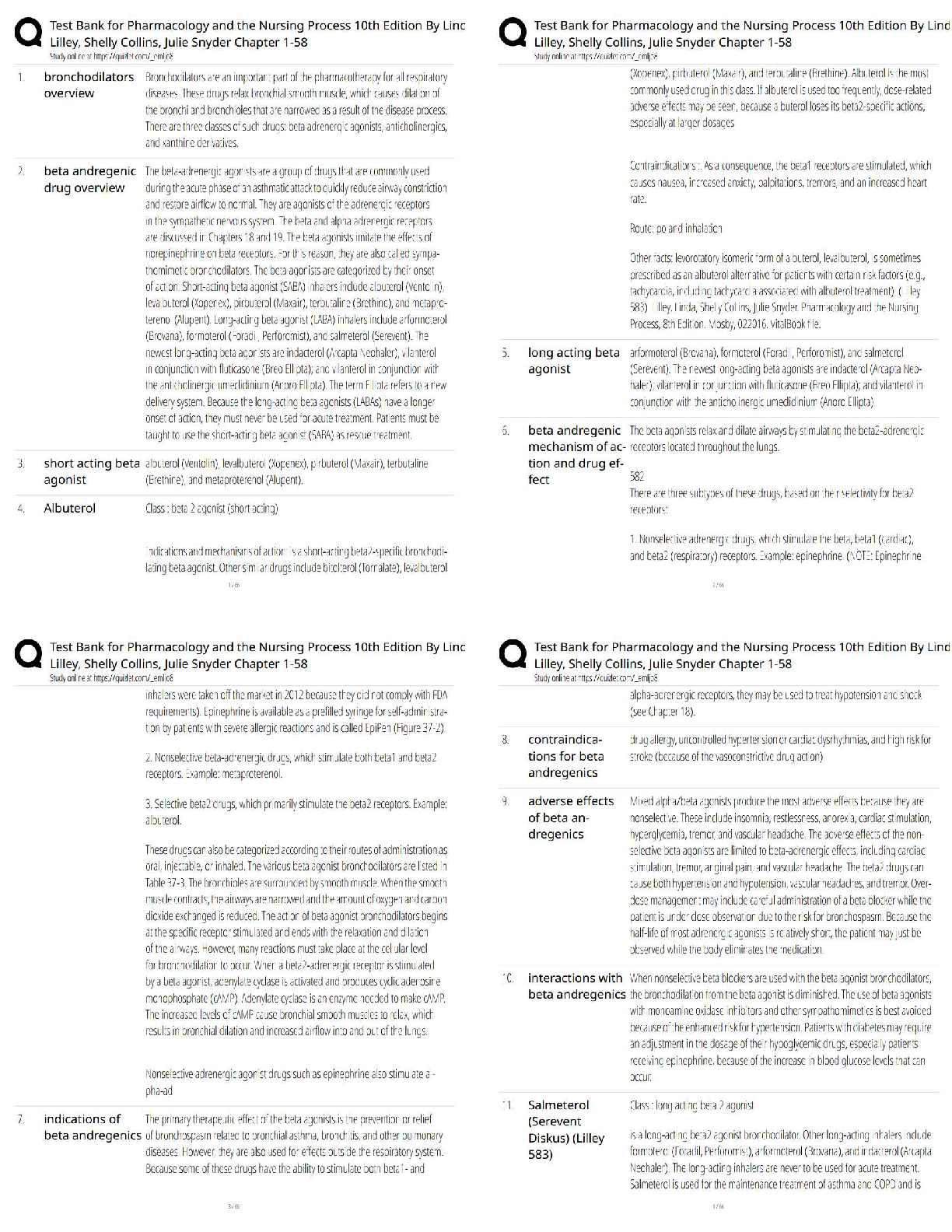

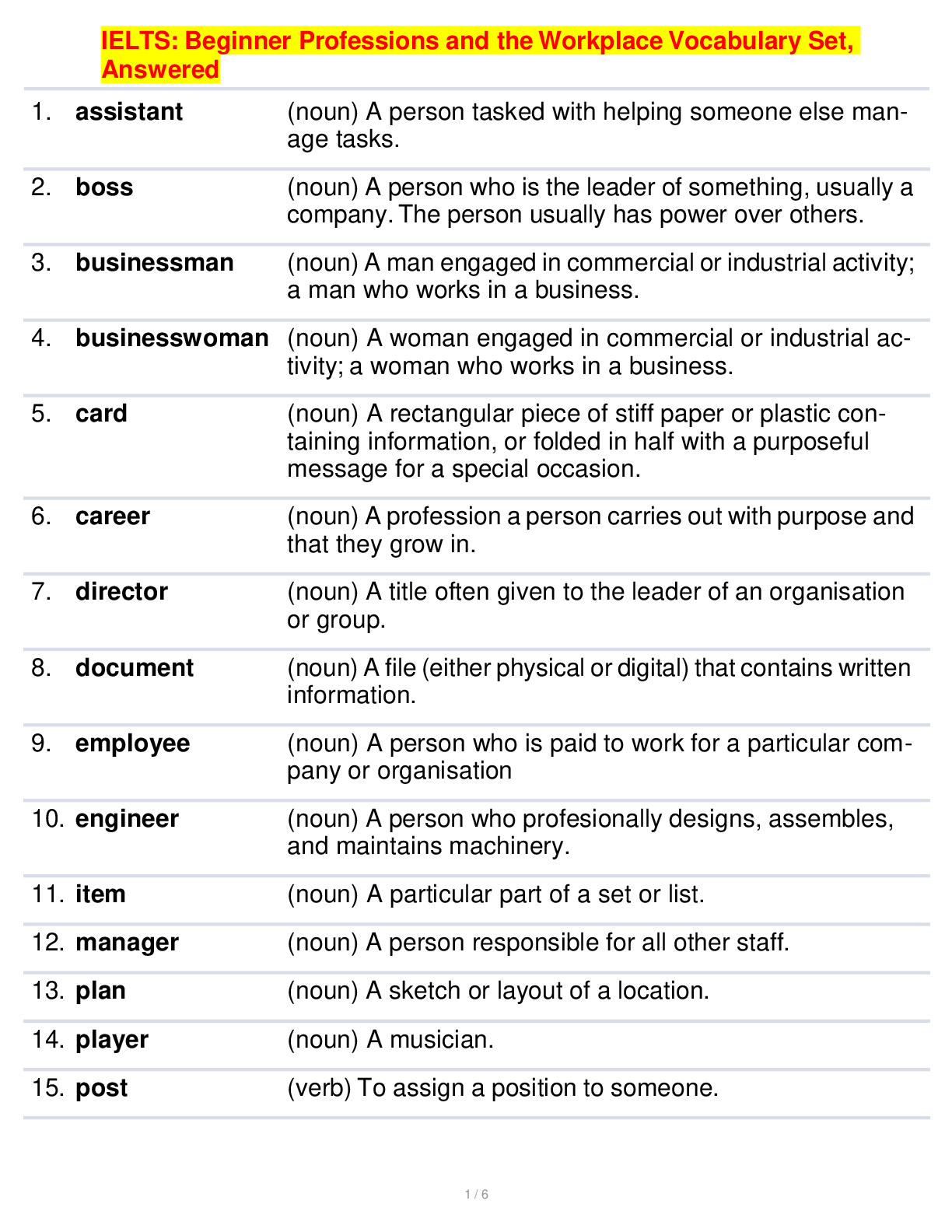

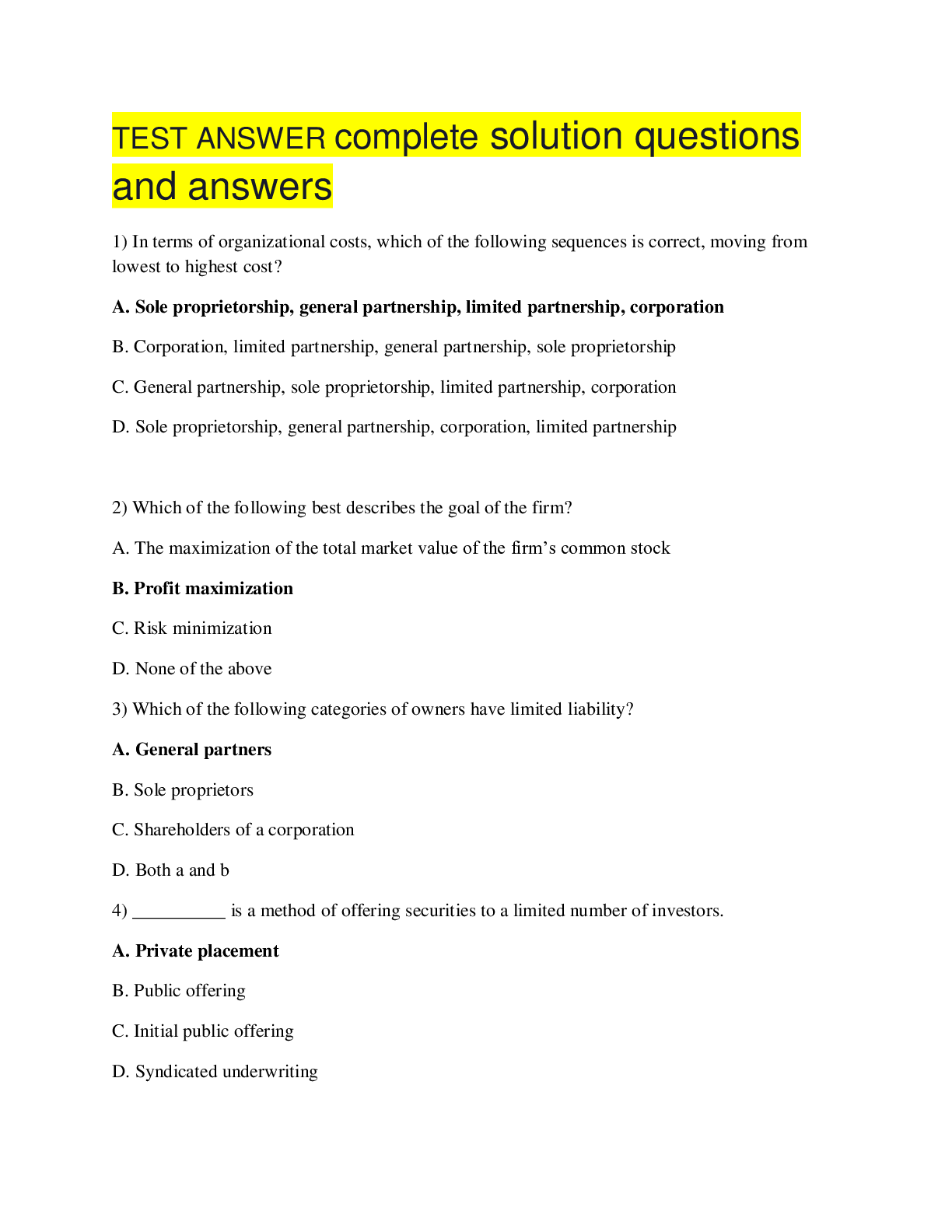

1) In terms of organizational costs, which of the following sequences is correct, moving from lowest to highest cost?

A. Sole proprietorship, general partnership, l

...

TEST ANSWER complete solution questions and answers

1) In terms of organizational costs, which of the following sequences is correct, moving from lowest to highest cost?

A. Sole proprietorship, general partnership, limited partnership, corporation

B. Corporation, limited partnership, general partnership, sole proprietorship

C. General partnership, sole proprietorship, limited partnership, corporation

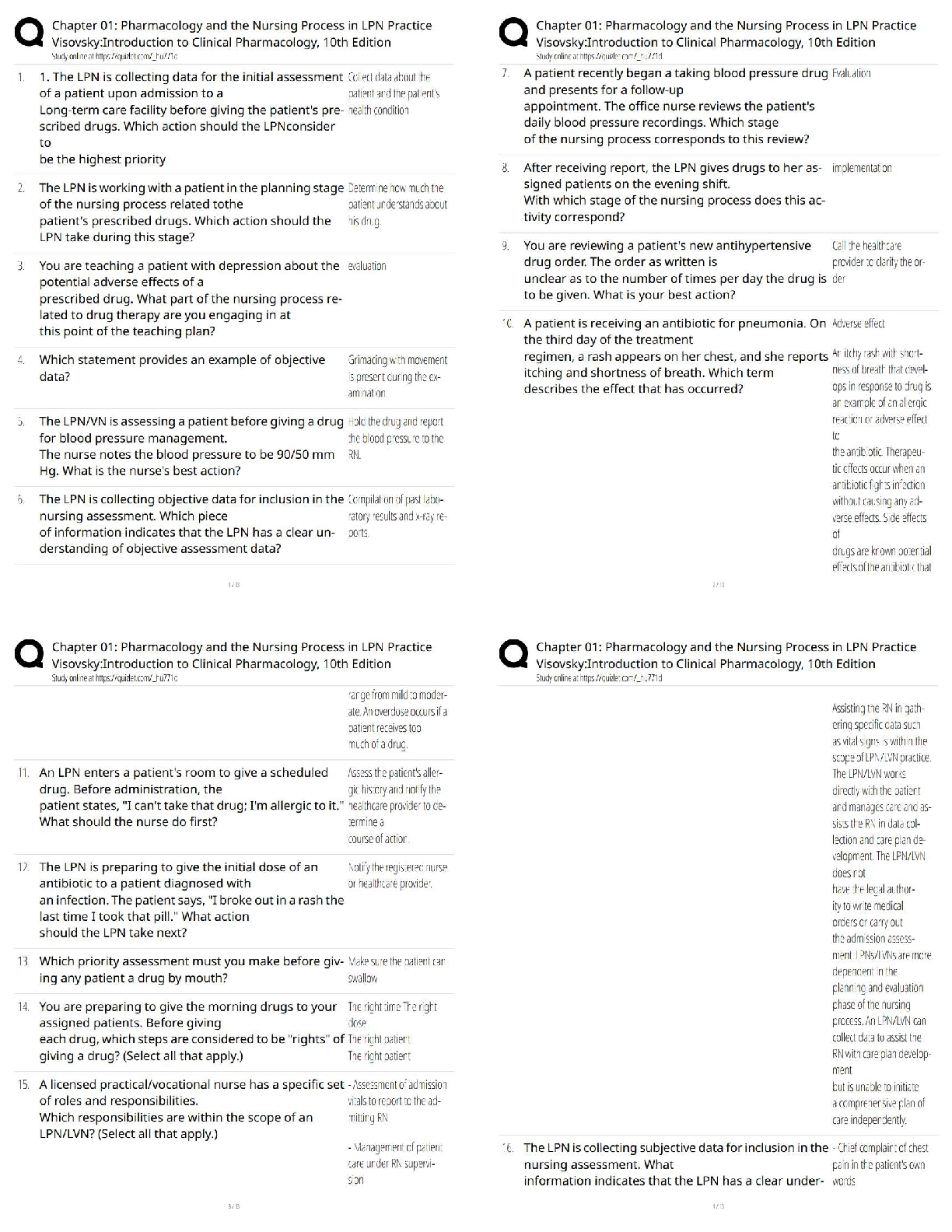

D. Sole proprietorship, general partnership, corporation, limited partnership

2) Which of the following best describes the goal of the firm?

A. The maximization of the total market value of the firm’s common stock

B. Profit maximization

C. Risk minimization

D. None of the above

3) Which of the following categories of owners have limited liability?

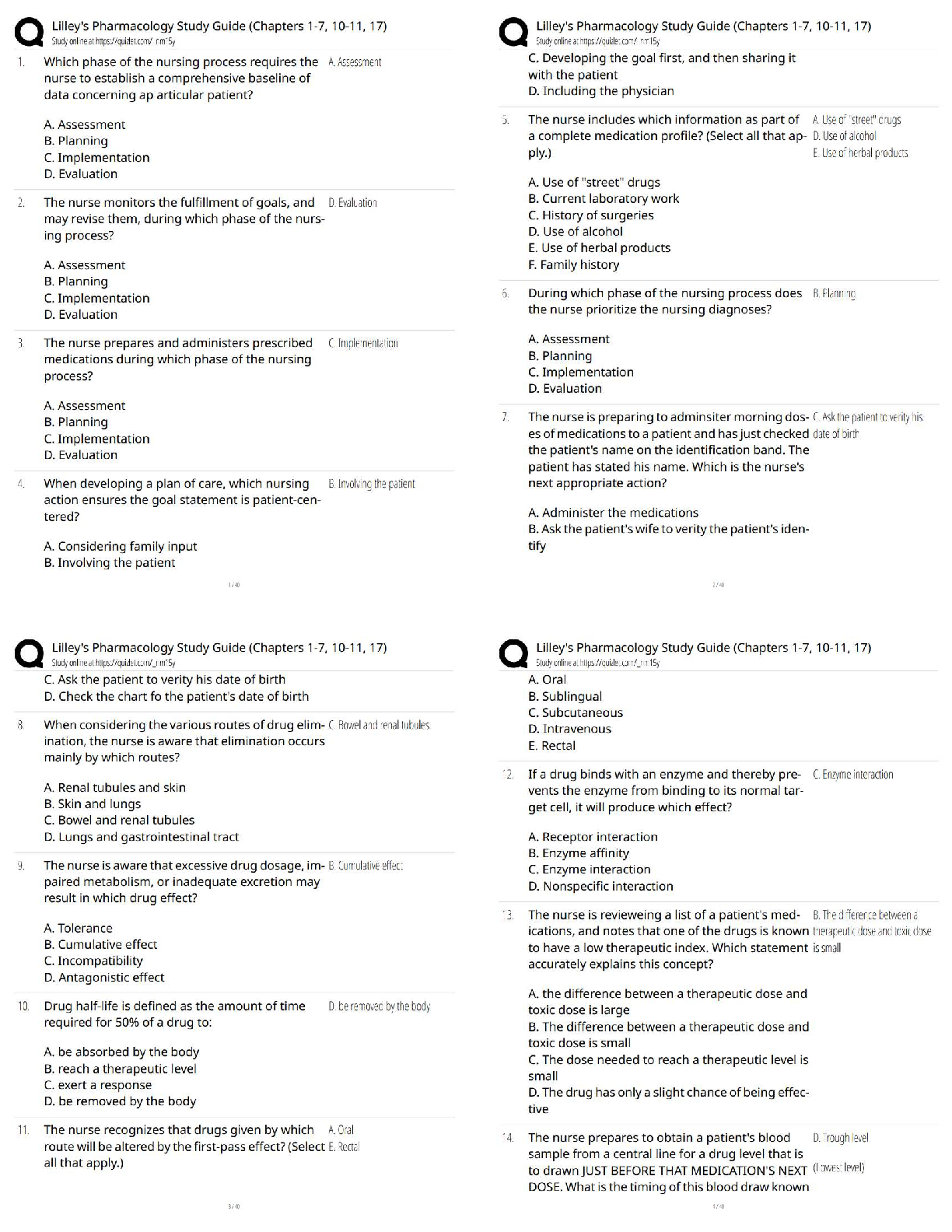

A. General partners

B. Sole proprietors

C. Shareholders of a corporation

D. Both a and b

4) __________ is a method of offering securities to a limited number of investors.

A. Private placement

B. Public offering

C. Initial public offering

D. Syndicated underwriting

5) When public corporations decide to raise cash in the capital markets, what type of financing vehicle is most favored?

A. Preferred stock

B. Common stock

C. Retained earnings

D. Corporate bonds

6) Which of the following does NOT involve underwriting by an investment banker?

A. Negotiated purchases

B. Syndicated purchases

C. Competitive bid purchases

D. Commission basis purchases

7) According to the agency problem, _________ represent the principals of a corporation.

A. managers

B. employees

C. shareholders

D. suppliers

8) Difficulty in finding profitable projects is due to:

A. opportunity costs.

B. ethical dilemmas.

C. social responsibility.

D. competitive markets.

9) Which of the following is NOT a principle of basic financial management?

A. Profit is king

B. Efficient capital markets

C. Risk/return tradeoff

D. Incremental cash flow counts

10) Which of the following financial ratios is the best measure of the operating effectiveness of a firm’s management?

A. Return on investment

B. Quick ratio

C. Current ratio

D. Gross profit margin

11) The accounting rate of return on stockholders’ investments is measured by:

A. realized rate of inflation.

B. operating income return on investment.

C. return on assets.

D. return on equity.

12) Marshall Networks, Inc. has a total asset turnover of 2.5% and a net profit margin of 3.5%. The firm has a return on equity of 17.5%. Calculate Marshall’s debt ratio.

A. 60%

B. 50%

C. 30%

D. 40%

Which of the following would increase the need for external equity? A. A reduction in corporate profits B. Inadequate investment opportunities C. A seasonal reduction in sales revenues D. A slow-down in economic growth

Edward Johnson decided to open up a Roth IRA. He will invest $1,800 per year for the next 35 years. Deposits to the Roth IRA will be made via a $150 payroll deduction at the end of each month. Assume that Edward will earn 8.75% over the life of the IRA. How much will he have at the end of 35 years? A. $363,000 B. $125,250 C. $414,405 D. $250,321

You have $10,000 to invest. You do not want to take any risk, so you will put the funds in a savings account at the local bank. Of the following choices, which one will produce the largest sum at the end of 22 years? A. An account that compounds interest quarterly B. An account that compounds interest annually C. An account that compounds interest monthly D. An account that compounds interest daily

1) The true owners of the corporation are the: A. holders of debt issues of the firm. B. preferred stockholders. C. common stockholders. D. board of directors of the firm.

2) In terms of organizational costs, which of the following sequences is correct, moving from lowest to highest cost? A. Corporation, limited partnership, general partnership, sole proprietorship B. General partnership, sole proprietorship, limited partnership, corporation C. Sole proprietorship, general partnership, limited partnership, corporation D. Sole proprietorship, general partnership, corporation, limited partnership

3) Which of the following best describes the goal of the firm? A. The maximization of the total market value of the firm’s common stock] B. Profit maximization C. Risk minimization D. None of the above

4) __________ is a method of offering securities to a limited number of investors. A. Public offering B. Initial public offering C. Private placement D. Syndicated underwriting

5) Money market instruments include: A. corporate bonds. B. bankers’ acceptances. C. preferred stock. D. common stock.

6) When public corporations decide to raise cash in the capital markets, what type of financing vehicle is most favored? A. Common stock B. Retained earnings C. Preferred stock D. Corporate bonds

7) According to the agency problem, _________ represent the principals of a corporation. A. employees B. shareholders C. managers D. suppliers

8) Difficulty in finding profitable projects is due to: A. ethical dilemmas. B. social responsibility. C. competitive markets. D. opportunity costs.

9) Which of the following is NOT a principle of basic financial management? A. Efficient capital markets B. Risk/return tradeoff C. Incremental cash flow counts D. Profit is king

10) Marshall Networks, Inc. has a total asset turnover of 2.5% and a net profit margin of 3.5%. The firm has a return on equity of 17.5%. Calculate Marshall’s debt ratio. A. 30% B. 40% C. 60% D. 50%

11) The accounting rate of return on stockholders’ investments is measured by: A. return on assets. B. return on equity. C. realized rate of inflation. D. operating income return on investment.

12) Which of the following financial ratios is the best measure of the operating effectiveness of a firm’s management? A. Current ratio B. Gross profit margin C. Return on investment D. Quick ratio

13) Northwest Bank pays a quoted annual (nominal) interest rate of 4.75%. However, it pays interest (compouned) daily using a 365-day year. What is the effective annual rate of return (APY)? A. 4.75% B. 5.02% C. 4.86% D. 3.61%

14) Suppose that you wish to save for your child's college education by opening up an educational IRA. You plan to deposit $100 per month into the IRA for the next 18 years. Assume that you will be able to earn 10%, compounded monthly, on your investment. How much will you have accumulated at the end of 18 years? A. $21,600 B. $54,719 C. $60,056 D. $85,920 E. $33,548

15) You have $10,000 to invest. You do not want to take any risk, so you will put the funds in a savings account at the local bank. Of the following choices, which one will produce the largest sum at the end of 22 years? A. An account that compounds interest annually B. An account that compounds interest daily C. An account that compounds interest monthly D. An account that compounds interest quarterly

16) The primary purpose of a cash budget is to: A. provide a detailed plan of future cash flows. B. determine the level of investment in current and fixed assets. C. determine accounts payable. D. determine the estimated income tax for the year.

17) Which of the following is NOT a basic function of a budget? A. Budgets compare historical costs of the firm with its current cost performance. B. Budgets indicate the need for future financing. C. Budgets provide the basis for corrective action when actual figures differ from the budgeted figures. D. Budgets allow for performance evaluation.

18) Which of the following statements about the percent-of-sales method of financial forecasting is true? A. It involves estimating the level of an expense, asset, or liability for a future period as a percent of the forecast for sales revenues. B. It is the least commonly used method of financial forecasting. C. It is a much more precise method of financial forecasting than a cash budget would be. D. It projects all liabilities as a fixed percentage of sales.

19) Which of the following is a non-cash expense? A. Packaging costs B. Depreciation expenses C. Interest expense D. Administrative salaries

20) A plant can remain operating when sales are depressed: A. in an effort to cover at least some of the variable cost. B. if the selling price per unit exceeds the variable cost per unit. C. to help the local economy. D. unless variable costs are zero when production is zero.

21) The break-even model enables the manager of a firm to: A. determine the quantity of output that must be sold to cover all operating costs. B. calculate the minimum price of common stock for certain situations. C. set appropriate equilibrium thresholds. D. determine the optimal amount of debt financing to use.

22) How long will it take $750 to double at 8% compounded annually? A. 9 years B. 6.5 years C. 48 months D. 12 years

23) Which of the following is the formula for compound value?

A.

FVn = P(1+i)n

B.

FVn = (1+i)/P

C.

FVn = P(1+i)-n

D.

FVn = P/(1+i)n

24) The present value of a single future sum:

A.

increases as the number of discount periods increas.

B.

is generally larger than the future sum.

C.

increases as the discount rate increases.

D.

depends upon the number of discount periods.

25) Which of the following is NOT considered a permanent source of financing?

A.

Corporate bonds

B.

Common stock

C.

Commercial paper

D.

Preferred stock

26) A toy manufacturer following the hedging principle will generally finance seasonal inventory build-up prior to the Christmas season with:

A.

common stock.

B.

selling equipment.

C.

preferred stock.

D.

trade credit.

27) Which of the following is considered to be a spontaneous source of financing?

A.

Operating leases

B.

Accounts receivable

C.

Accounts payable

D.

Inventory

28) We compute the profitability index of a capital-budgeting proposal by:

A.

multiplying the IRR by the cost of capital.

B.

dividing the present value of the annual after-tax cash flows by the cost of capital.

C.

multiplying the cash inflow by the IRR.

D.

dividing the present value of the annual after-tax cash flows by the cost of the project.

29) Your company is considering a project with the following cash flows: Initial outlay = $1,748.80 Cash flows Years 1–6 = $500 Compute the IRR on the project.

A.

18%

B.

9%

C.

24%

D.

11%

30) For the NPV criteria, a project is acceptable if the NPV is __________, while for the profitability index, a project is acceptable if the profitability index is __________.

A.

greater than one, greater than zero

B.

less than zero, greater than the required return

C.

greater than zero, less than one

D.

greater than zero, greater than one

31) You have been asked to analyze a capital investment proposal. The project’s cost is $2,775,000. Cash inflows are projected to be $925,000 in Year 1; $1,000,000 in Year 2; $1,000,000 in Year 3; $1,000,000 in Year 4; and $1,225,000 in Year 5. Assume that your firm discounts capital projects at 15.5%. What is the project’s MIRR?

A.

16.73%

B.

12.62%

C.

19.99%

D.

10.44%

32) Which of the following is considered to be a deficiency of the IRR?

A.

It fails to utilize the time value of money.

B.

It fails to properly rank capital projects.

C.

It is not useful in accounting for risk in capital budgeting.

D.

It could produce more than one rate of return.

33) Most firms use the payback period as a secondary capital-budgeting technique, which, in a sense, allows them to control for risk.

A.

True

B.

False

34) ABC Service can purchase a new assembler for $15,052 that will provide an annual net cash flow of $6,000 per year for five years. Calculate the NPV of the assembler if the required rate of return is 12%. (Round your answer to the nearest $1.)

A.

$7,621

B.

$1,056

C.

$6,577

D.

$4,568

35) The firm should accept independent projects if:

A.

the IRR is positive.

B.

the payback is less than the IRR.

C.

the NPV is greater than the discounted payback.

D.

the profitability index is greater than 1.0.

36) The NPV assumes cash flows are reinvested at the:

A.

IRR.

B.

NPV.

C.

real rate of return.

D.

cost of capital.

37) The average cost associated with each additional dollar of financing for investment projects is:

A.

the incremental return.

B.

the marginal cost of capital.

C.

risk-free rate.

D.

beta.

38) The most expensive source of capital is:

A.

preferred stock.

B.

new common stock.

C.

debt.

D.

retained earnings.

39) PepsiCo uses 30-year Treasury bonds to measure the risk-free rate because:

A.

these bonds are essentially free of business risk.

B.

they capture the long-term inflation expectations of investors associated with investments in long-term assets.

C.

these bonds are essentially free of interest rate risk.

D.

none of the above.

40) Shawhan Supply plans to maintain its optimal capital structure of 30% debt, 20% preferred stock, and 50% common stock far into the future. The required return on each component is: debt–10%; preferred stock–11%; and common stock–18%. Assuming a 40% marginal tax rate, what after-tax rate of return must Shawhan Supply earn on its investments if the value of the firm is to remain unchanged?

A.

18.0%

B.

13.0%

C.

10.0%

D.

14.2%

41) Bender and Co. is issuing a $1,000 par value bond that pays 9% interest annually. Investors are expected to pay $918 for the 10-year bond. Bender will have to pay $33 per bond in flotation costs. What is the cost of debt if the firm is in the 34% tax bracket?

A.

7.23%

B.

9.01%

C.

9.23%

D.

11.95%

42) The XYZ Company is planning a $50 million expansion. The expansion is to be financed by selling $20 million in new debt and $30 million in new common stock. The before-tax required rate of return on debt is 9%, and the required rate of return on equity is 14%. If the company is in the 40% tax bracket, what is the marginal cost of capital?

A.

14.0%

B.

9.0%

C.

10.6%

D.

11.5%

43) Zybeck Corp. projects operating income of $4 million next year. The firm’s income tax rate is 40%. Zybeck presently has 750,000 shares of common stock which have a market value of $10 per share, no preferred stock, and no debt. The firm is considering two alternatives to finance a new product: (a) the issuance of $6 million of 10% bonds, or (b) the issuance of 60,000 new shares of common stock. If Zybeck issues common stock this year, what will projected EPS be next year?

A.

$2.33

B.

$1.67

C.

$2.96

D.

$2.10

44) Lever Brothers has a debt ratio (debt to assets) of 40%. Management is wondering if its current capital structure is too conservative. Lever Brothers’s present EBIT is $3 million, and profits available to common shareholders are $1,560,000, with 342,857 shares of common stock outstanding. If the firm were to instead have a debt ratio of 60%, additional interest expense would cause profits available to stockholders to decline to $1,440,000, but only 228,571 common shares would be outstanding. What is the difference in EPS at a debt ratio of 60% versus 40%?

A.

$3.25

B.

$4.50

C.

$2.00

D.

$1.75

45) Lever Brothers has a debt ratio (debt to assets) of 20%. Management is wondering if its current capital structure is too conservative. Lever Brothers’s present EBIT is $3 million, and profits available to common shareholders are $1,680,000, with 457,143 shares of common stock outstanding. If the firm were to instead have a debt ratio of 40%, additional interest expense would cause profits available to stockholders to decline to $1,560,000, but only 342,857 common shares would be outstanding. What is the difference in EPS at a debt ratio of 40% versus 20%?

A.

$1.16

B.

$0.88

C.

$1.95

D.

$2.12

46) A bond sold simultaneously in several different foreign capital markets, but denominated in a currency different from the country in which the bond is issued, is called a(n):

A.

floating bond.

B.

Eurobond.

C.

international capital bond.

D.

world bond.

47) Which of the following statements about exchange rates is true?

A.

Exchange rates were fixed prior to establishing a floating-rate international currency system, and all countries set a specific parity rate for their currency relative either to the Canadian or to the U.S. dollar.

B.

Day-to-day fluctuations in exchange rates currently are caused by changes in parity rates.

C.

A floating-rate international currency system has been operating since 1973.

D.

All of the choices.

48) Capital markets in foreign countries:

A.

offer lower returns than those obtainable in the domestic capital markets.

B.

provide international diversification.

C.

in general are becoming less integrated due to the widespread availability of interest rate and currency swaps.

D.

all of the choices.

49) A spot transaction occurs when one currency is:

A.

exchanged for another currency at a specified price.

B.

traded for another at an agreed-upon future price.

C.

immediately exchanged for another currency.

D.

deposited in a foreign bank.

50) If the quote for a forward exchange contract is greater than the computed price, the forward contract is:

A.

a good buy.

B.

at equilibrium.

C.

undervalued.

D.

overvalued.

51) The interplay between interest rate differentials and exchange rates such that both adjust until the foreign exchange market and the money market reach equilibrium is called the:

A.

interest rate parity theory.

B.

arbitrage markets theory.

C.

balance of payments quantum theory.

D.

purchasing power parity theory.

52) One reason for international investment is to reduce:

A.

portfolio risk.

B.

beta risk.

C.

price-earnings (P/E) ratios.

D.

advantages in a foreign country.

53) An important (additional) consideration for a direct foreign investment is:

A.

political risk.

B.

maximizing the firm’s profits.

C.

attaining a high international P/E ratio.

D.

all of the above.

54) Buying and selling in more than one market to make a riskless profit is called:

A.

profit maximization.

B.

cannot be determined from the above information.

C.

arbitrage.

D.

international trading.

Which of the following is NOT a basic function of a budget?

A. Budgets compare historical costs of the firm with its current cost performance.

B. Budgets allow for performance evaluation.

C. Budgets indicate the need for future financing.

D. Budgets provide the basis for corrective action when actual figures differ from the budgeted figures.

17) Purchases of plant and equipment can be determined from the:

A. pro forma income statement.

B. use of ratio analysis.

C. current cash budget.

D. previous period's balance sheet.

18) All of the following are found in the cash budget EXCEPT:

A. cash disbursements.

B. new financing needed.

C. a net change in cash for the period.

D. inventory.

19) Which of the following is a non-cash expense?

A. Packaging costs

B. Administrative salaries

C. Depreciation expenses

D. Interest expense

20) A plant can remain operating when sales are depressed:

A. in an effort to cover at least some of the variable cost.

B. unless variable costs are zero when production is zero.

C. if the selling price per unit exceeds the variable cost per unit.

D. to help the local economy.

21) The break-even model enables the manager of a firm to:

A. determine the quantity of output that must be sold to cover all operating costs.

B. determine the optimal amount of debt financing to use.

C. calculate the minimum price of common stock for certain situations.

D. set appropriate equilibrium thresholds.

22) How long will it take $750 to double at 8% compounded annually?

A. 9 years

B. 12 years

C. 6.5 years

D. 48 months

24) If you have $20,000 in an account earning 8% annually, what constant amount could you withdraw each year and have nothing remaining at the end of five years?

A. $3,408.88

B. $3,525.62

C. $5,008.76

D. $2,465.78

25) Which of the following is NOT considered a permanent source of financing?

A. Preferred stock

B. Corporate bonds

C. Common stock

D. Commercial paper

26) Which of the following is considered to be a spontaneous source of financing?

A. Inventory

B. Operating leases

C. Accounts receivable

D. Accounts payable

27) A toy manufacturer following the hedging principle will generally finance seasonal inventory build-up prior to the Christmas season with:

A. trade credit.

B. common stock.

C. selling equipment.

D. preferred stock.

28) Compute the payback period for a project with the following cash flows, if the company's discount rate is 12%. Initial outlay = $450

Cash flows: Year 1 = $325

Year 2 = $ 65

Year 3 = $100

A. 2.88 years

B. 3.43 years

C. 3.17 years

D. 2.6 years

30) We compute the profitability index of a capital-budgeting proposal by:

A. dividing the present value of the annual after-tax cash flows by the cost of the project.

B. multiplying the IRR by the cost of capital.

C. dividing the present value of the annual after-tax cash flows by the cost of capital.

D. multiplying the cash inflow by the IRR.

31) You have been asked to analyze a capital investment proposal. The project's cost is $2,775,000. Cash inflows are projected to be $925,000 in Year 1; $1,000,000 in Year 2; $1,000,000 in Year 3; $1,000,000 in Year 4; and $1,225,000 in Year 5. Assume that your firm discounts capital projects at 15.5%. What is the project's MIRR?

A. 16.73%

B. 12.62%

C. 10.44%

D. 19.99%

32) Many firms today continue to use the payback method but employ the NPV or IRR methods as secondary decision methods of control for risk.

A. True

B. False

34) The NPV assumes cash flows are reinvested at the:

A. real rate of return.

B. IRR.

C. NPV.

D. cost of capital.

35) The firm should accept independent projects if:

A. the IRR is positive.

B. the payback is less than the IRR.

C. the profitability index is greater than 1.0.

D. the NPV is greater than the discounted payback.

36) ABC Service can purchase a new assembler for $15,052 that will provide an annual net cash flow of $6,000 per year for five years. Calculate the NPV of the assembler if the required rate of return is 12%. (Round your answer to the nearest $1.)

A. $7,621

B. $1,056

C. $4,568

D. $6,577

37) The marginal cost of preferred stock is equal to:

A. (1 - tax rate) times the preferred stock dividend divided by net price.

B. the preferred stock dividend divided by market price.

C. the preferred stock dividend divided by its par value.

D. the preferred stock dividend divided by the net market price.

38) The most expensive source of capital is:

A. debt.

B. preferred stock.

C. new common stock.

D. retained earnings.

39) The average cost associated with each additional dollar of financing for investment projects is:

A. risk-free rate.

B. the incremental return.

C. beta.

D. the marginal cost of capital.

40) J & B, Inc. has $5 million of debt outstanding with a coupon rate of 12%. Currently, the yield to maturity on these bonds is 14%. If the firm's tax rate is 40%, what is the cost of debt to J & B?

A. 8.4%

B. 12.0%

C. 5.6%

D. 14.0%

41) Bender and Co. is issuing a $1,000 par value bond that pays 9% interest annually. Investors are expected to pay $918 for the 10-year bond. Bender will have to pay $33 per bond in flotation costs. What is the cost of debt if the firm is in the 34% tax bracket?

A. 9.23%

B. 7.23%

C. 11.95%

D. 9.01%

42) Shawhan Supply plans to maintain its optimal capital structure of 30% debt, 20% preferred stock, and 50% common stock far into the future. The required return on each component is: debt–10%; preferred stock–11%; and common stock–18%. Assuming a 40% marginal tax rate, what after-tax rate of return must Shawhan Supply earn on its investments if the value of the firm is to remain unchanged?

A. 10.0%

B. 18.0%

C. 14.2%

D. 13.0%

43) Zybeck Corp. projects operating income of $4 million next year. The firm's income tax rate is 40%. Zybeck presently has 750,000 shares of common stock which have a market value of $10 per share, no preferred stock, and no debt. The firm is considering two alternatives to finance a new product: (a) the issuance of $6 million of 10% bonds, or (b) the issuance of 60,000 new shares of common stock. If Zybeck issues common stock this year, what will projected EPS be next year?

A. $2.33

B. $2.10

C. $1.67

D. $2.96

44) Castle Corp. generated $2 million in operating income from sales of $20 million during the latest fiscal year. The firm's interest expense was $500,000, and the corporate income tax rate was 40%. Investors require a rate of return of 18%. Using the dependence hypothesis approach to valuation, what is the market value of Castle?

A. $7.2 million

B. $9.6 million

C. $5.1 million

D. $8.3 million

E. $6.5 million

45) Farar, Inc. projects operating income of $4 million next year. The firm's income tax rate is 40%. Farar presently has 750,000 shares of common stock, no preferred stock, and no debt. The firm is considering the issuance of $6 million of 10% bonds to finance a new product that is not expected to generate an increase in income for two years. If Farar issues the bonds this year, what will projected EPS be next year?

A. $2.33

B. $1.53

C. $3.12

D. $1.98

E. $2.72

46) _________ risk is generally considered only a paper gain or loss.

A. Economic

B. Transaction

C. Financial

D. Translation

47) Which of the following statements about exchange rates is true?

A. Exchange rates were fixed prior to establishing a floating-rate international currency system, and all countries set a specific parity rate for their currency relative either to the Canadian or to the U.S. dollar.

B. Day-to-day fluctuations in exchange rates currently are caused by changes in parity rates.

C. A floating-rate international currency system has been operating since 1973.

D. All of the choices.

48) Capital markets in foreign countries:

A. offer lower returns than those obtainable in the domestic capital markets.

B. provide international diversification.

C. in general are becoming less integrated due to the widespread availability of interest rate and currency swaps.

D. all of the choices.

49) A spot transaction occurs when one currency is:

A. exchanged for another currency at a specified price.

B. deposited in a foreign bank.

C. traded for another at an agreed-upon future price.

D. immediately exchanged for another currency.

50) If the quote for a forward exchange contract is greater than the computed price, the forward contract is:

A. a good buy.

B. overvalued.

C. at equilibrium.

D. undervalued.

51) The interplay between interest rate differentials and exchange rates such that both adjust until the foreign exchange market and the money market reach equilibrium is called the:

A. interest rate parity theory.

B. purchasing power parity theory.

C. arbitrage markets theory.

D. balance of payments quantum theory.

52) Buying and selling in more than one market to make a riskless profit is called:

A. international trading.

B. profit maximization.

C. cannot be determined from the above information.

D. arbitrage.

53) An important (additional) consideration for a direct foreign investment is:

A. political risk.

B. maximizing the firm's profits.

C. attaining a high international P/E ratio.

D. all of the above.

54) The purchasing power parity theory states that currency exchange rates tend to vary ____________ with their respective purchasing powers in order to provide _________ purchasing powers.

A. inversely; greater

B. inversely; similar

C. directly; greater

D. directly; similar

1. Which of the following is a characteristic of an efficient market?

a. Small number of individuals.

b. Opportunities exist for investors to profit from publicly available information.

c. Security prices reflect fair value of the firm.

d. Immediate response occurs for new public information.

1. Diversification increases when _______ decreases.

a. variability

b. return

c. risk

d. a and c

e. all of the above

(I am not sure about this I thought it should just be volicity)

2. Corporations receive money from investors with:

a. initial public offerings.

b. seasoned new issues.

c. primary market transactions.

d. a and b.

e. all of the above.

3. Which of the following is true regarding an initial public offering?

a. The corporation gets proceeds from the investor.

b. Investors get proceeds from other investors.

c. The security is sold for the first time to the public.

d. Both a and c.

e. All of the above.

Table 1(Use this table for questions 5-8)

Smith Company Balance Sheet

Assets:

Cash and marketable securities $300,000

Accounts receivable 2,215,000

Inventories 1,837,500

Prepaid expenses 24,000

Total current assets $3,286,500

Fixed assets 2,700,000

Less: accumulated depreciation 1,087,500

Net fixed assets $1,612,500

Total assets $4,899,000

Liabilities:

Accounts payable $240,000

Notes payable 825,000

Accrued taxes 42,500

Total current liabilities $1,107,000

Long-term debt 975,000

Owner’s equity 2,817,000

Total liabilities and owner’s equity $4,899,000

Net sales (all credit) $6,375,000

Less: Cost of goods sold 4,312,500

Selling and administrative expense 1,387,500

Depreciation expense 135,000

Interest expense 127,000

Earnings before taxes $412,500

Income taxes 225,000

Net income $187,500

Common stock dividends $97,500

Change in retained earnings $90,000

4. Based on the information in Table 1, the current ratio is:

a. 2.97.

b. 1.46.

c. 2.11.

d. 2.23.

5. Based on the information in Table 1, the debt ratio is:

a. 0.70.

b. 0.20.

c. 0.74.

d. 0.42.

6. Based on the information in Table 1, the net profit margin is:

a. 4.61%

b. 2.94%.

c. 1.97%.

d. 5.33%.

7. Based on the information in Table 1, the inventory turnover ratio is:

a. 0.29 times.

b. 2.35 times.

c. 0.43 times.

d. 3.47 times.

8. Marshall Networks, Inc. has a total asset turnover of 2.5 and a net profit margin of 3.5%. The firm has a return on equity of 17.5%. Calculate Marshall’s debt ratio.

a. 30%

b. 40%

c. 50%

d. 60%

Use the following information and the percent-of-sales method to Answer questions 10 -12.

Below is the 2004 year-end balance sheet for Banner, Inc. Sales for 2004 were $1,600,000 and are expected to be $2,000,000 during 2005. In addition, we know that Banner plans to pay $90,000 in 2005 dividends and expects projected net income of 4% of sales. (For consistency with the Answer selections provided, round your forecast percentages to two decimals.)

Banner, Inc. Balance Sheet

December 31, 2004

Assets

Current assets $890,000

Net fixed assets 1,000,000

Total $1,890,000

Liabilities and Owners’ Equity

Accounts payable $160,000

Accrued expenses 100,000

Notes payable 700,000

Long-term debt 300,000

Total liabilities 1,260,000

Common stock (plus paid-in capital) 360,000

Retained earnings 270,000

Common equity 630,000

Total $1,890,000

9. Banner’s projected current assets for 2005 are:

a. $1,000,000.

b. $1,120,000.

c. $1,500,000.

d. $1,260,000.

10. Banner’s projected accounts payable balance for 2005 is:

a. $160,000.

b. $120,000.

c. $200,000.

d. $300,000.

11. Banner’s projected fixed assets for 2005 are:

a. $1,120,000.

b. $1,260,000.

c. $1,000,000.

d. $2,380,000.

13. What is the present value of $1,000 to be received 10 years from today? Assume that the investment pays 8.5% and it is compounded monthly (round to the nearest $1).

a. $893

b. $3,106

c. $429

d. $833

14. What is the present value of $12,500 to be received 10 years from today? Assume a discount rate of 8% compounded annually and round to the nearest $10.

a. $5,790

b. $11,574

c. $9,210

d. $17,010

15. The NPV method:

a. is consistent with the goal of shareholder wealth maximization.

b. recognizes the time value of money.

c. uses cash flows.

d. all of the above.

16. If the IRR is greater than the required rate of return, the:

a. present value of all the cash inflows will be greater than the initial outlay.

b. payback will be less than the life of the investment.

c. project should be rejected.

d. both a and b.

17. ABC Service can purchase a new assembler for $15,052 that will provide an annual net cash flow of $6,000 per year for five years. Calculate the NPV of the assembler if the required rate of return is 12%. (Round your answer to the nearest $1.)

a. $1,056

b. $4,568

c. $7,621

d. $6,577

18. Suppose you determine that the NPV of a project is $1,525,855. What does that mean?

a. In all cases, investing in this project would be better than investing in a project that has an NPV of $850,000.

b. The project would add value to the firm.

c. Under all conditions, the project’s payback would be less than the profitability index.

d. The project’s IRR would have to be less that the firm’s discount rate.

19. The IRR is:

a. the discount rate that makes the NPV positive.

b. the discount rate that equates the present value of the cash inflows with the cost of the project.

c. the discount rate that makes the NPV negative and the profitability index greater than one.

d. the rate of return that makes the NPV positive.

20. Crawfish Kitchen Inc. is planning to invest in one of three mutually exclusive projects. Projected cash flows for these ventures are as follows:

Which project is the most profitable according to the NPV Criteria if the discount rate for the firm is 14%?

a. Plan A

b. Plan B

c. Plan C

21. You are in charge of one division of Bigfella Conglomerate Inc. Your division is subject to capital rationing. Your division has four indivisible projects available, detailed as follows:

Project Initial Outlay IRR NPV

1 2 million 18% 2,500,000

3 1 million 10% 600,000

2 1 million 15% 950,000

4 3 million 9% 2,000,000

If you must select projects subject to a budget constraint of 5 million dollars, which set of projects should be accepted so as to maximize firm value?

a. Projects 1, 2, and 3

b. Project 1 only

c. Projects 1 and 4

d. Projects 2, 3, and 4

22. J & B, Inc. has $5 million of debt outstanding with a coupon rate of 12%. Currently, the yield to maturity on these bonds is 14%. If the firm’s tax rate is 40%, what is the cost of debt to J & B?

a. 12.0%

b. 14.0%

c. 8.4%

d. 5.6%

23. Shawhan Supply plans to maintain its optimal capital structure of 30% debt, 20% preferred stock, and 50% common stock far into the future. The required return on each component is: debt–10%; preferred stock–11%; and common stock–18%. Assuming a 40% marginal tax rate, what after-tax rate of return must Shawhan Supply earn on its investments if the value of the firm is to remain unchanged?

a. 18.0%

b. 13.0%

c. 10.0%

d. 14.2%

24. Bender and Co. is issuing a $1,000 par value bond that pays 9% interest annually. Investors are expected to pay $918 for the 10-year bond. Bender will have to pay $33 per bond in flotation costs. What is the cost of debt if the firm is in the 34% tax bracket?

a. 7.23%

b. 9.01%

c. 9.23%

d. 11.95%

25. Armadillo Mfg. Co. has a target capital structure of 50% debt and 50% equity. They are planning to invest in a project which will necessitate raising new capital. New debt will be issued at a before-tax yield of 12%, with a coupon rate of 10%. The equity will be provided by internally generated funds. No new outside equity will be issued. If the required rate of return on the firm’s stock is 15% and its marginal tax rate is 40%, compute the firm’s cost of capital.

a. 13.5%

b. 12.5%

c. 7.2%

d. 11.1%

26. A stock repurchase increases the:

a. retention ratio of earnings.

b. number of shares outstanding.

c. EPS.

d. both b and c.

27. The _______ is the federal agency primarily responsible for regulating the securities industry.

a. FTC

b. SEC

c. FRB

d. SCC

28. A firm’s business risk is influenced by the:

a. competitive position of the firm within the industry.

b. demand characteristics of the firm’s products.

c. financing structure of the firm.

d. both a and b.

e. all of the above.

29. Cost of capital is:

a. the coupon rate of debt.

b. a hurdle rate set by the board of directors.

c. the rate of return that must be earned on additional investment if firm value is to remain unchanged.

d. the average cost of the firm’s assets.

30. Given the following information, determine the risk-free rate.

Cost of equity = 12%

Beta = 1.50

Market risk premium = 3%

a. 8.0%

b. 7.5%

c. 7.0%

d. 6.5%

31. Which of the following relationships is true, regarding the costs of issuing the below securities?

a. Common stock > bonds > preferred stock

b. Preferred stock > common stock > bonds

c. Bonds > common stock > preferred stock

d. Common stock > preferred stock > bonds

Table 1 (Use this for questions 32-36)

Average selling price per unit $16.00

Variable cost per unit $11.00

Units sold 200,000

Fixed costs $800,000

Interest expense $ 50,000

32. Based on the data in Table 1, what is the break-even point in units produced and sold?

a. $130,000

b. $140,000

c. $150,000

d. $160,000

33. Based on the data contained in Table 1, what is the degree of operating leverage?

a. 1.00 times

b. 2.00 times

c. 3.00 times

d. 4.00 times

e. 5.00 times

34. Based on the data contained in Table 1, what is the contribution margin?

a. $5.00

b. $4.00

c. $3.00

d. $2.00

35. Based on the data contained in Table 1, what is the degree of financial leverage?

a. 3.33 times

b. 2.50 times

c. 1.50 times

d. 1.33 times

36. Based on the data contained in Table 1, what is the degree of combined leverage?

a. 6.33

b. 6.67

c. 7.33

d. 7.67

37. Fluctuations in EBIT result in:

a. fluctuations in EPS, which might be larger or smaller as financial leverage increases.

b. smaller fluctuations in EPS, the greater the degree of financial leverage.

c. greater fluctuations in EPS, the greater the degree of financial leverage.

d. equal fluctuations in EPS, the greater the degree of financial leverage.

38. A toy manufacturer following the hedging principle will generally finance seasonal inventory build-up prior to the Christmas season with:

a. common stock.

b. selling equipment.

c. trade credit.

d. preferred stock.

39. Accounts receivable and inventory self-liquidate through the __________ cycle.

a. spontaneous account

b. net working capital

c. cash conversion

d. sales-to-receivables collection

40. Given that short-term interest rates typically fluctuate more than long-term rates, interest rate risk is least for:

a. Treasury bills.

b. common stock.

c. long-term government bonds.

d. medium-term corporate bonds.

41. If you compare the yield of a municipal bond with that of a Treasury bond, what is the equivalent before-tax yield of a municipal bond yielding 6% per year for an investor in the 36% tax bracket (round to nearest .1%)?

a. 9.4%

b. 8.1%

c. 7.7%

d. 6.3%

42. Carrying cost on inventory includes:

a. the required rate of return on investment in total assets.

b. wages of warehouse employees.

c. cost associated with inventory shrinkage.

d. both b and c.

e. all of the above.

43. The TQM view argues that:

a. the costs of achieving higher quality are more than economists projected.

b. better quality products drive higher sales.

c. lost sales result from a poor-quality reputation.

d. both b and c.

e. all of the above.

44. A spot transaction occurs when one currency is:

a. deposited in a foreign bank.

b. immediately exchanged for another currency.

c. exchanged for another currency at a specified price.

d. traded for another at an agreed-upon future price.

45. Exchange rate risk:

a. arises from the fact that the spot exchange rate on a future date is a random variable.

b. applies only to certain types of international businesses.

c. has been phased out due to recent international legislation.

d. both a and b.

Use the following information to answer questions 46-47. Below is an excerpt from Table 22-1, The Globalization of Product and Financial Markets, that appears in your text. Values are foreign exchange rates reported in The Wall Street Journal.

U.S. $ equivalent Currency per U.S. $

Country Mon. Mon.

India (Rupee) 0.03137 31.88

Britain (Pound) 1.5615

30-day Forward 1.5609

90-day Forward 1.5605

180-day Forward 1.5603

Canada (Dollar) 0.7265 1.3765

30-day Forward 0.7256 1.3782

90-day Forward 0.7236 1.3820

180-day Forward 0.7196 1.3896

Sweden (Koruna) 0.18848 5.3055

30-day Forward 0.18829 5.3110

90-day Forward 0.18809 5.3167

180-day Forward 0.18795 5.3205

46. To buy one Indian Rupee you would need:

a. 3.137 cents.

b. 31.88 dollars.

c. 18.848 cents.

d. 5.3055 dollars.

47. The number of pounds you can purchase per U.S. dollar is:

a. 1.5609.

b. 0.6207.

c. 0.6404.

d. 1.5615.

48. Which of the following statements about a financial lease is generally true?

a. The entire lease payment is used as an income tax deduction.

b. Only the portion of the lease payment that reduces the principal may be used as an income tax deduction.

c. It has no income tax deductibility.

d. Only the portion of the lease payment that is applied to interest is tax-deductible.

49. Which of the following most likely would cause a lease to be classified as a capital lease?

a. The lease is for five or more years.

b. The lease is for $1 million or more.

c. The lease permits the lessee to purchase the equipment at the end of the lease for its fair market value.

d. The present value of the lease payments, calculated at the lessee’s typical rate of interest for a similar purchase loan, is more than the original purchase price of the equipment.

50. What price must a company typically pay to buy another company? The price will:

a. include some premium over the current market value of the target’s equity.

b. be the market value of the target’s equity.

c. be the book value of the target’s equity.

d. include some discount relative to the current market value of the target’s equity.

Finance 370 Final Exam

Instructor: Tim Gould

Ch 1, 3, 4,5,9,10,12,14,15,16,18,19,20,22,23,24

There are 50 questions worth 0.2 points each for a total possible of 10 points toward your class grade.

Please highlight the answer you want to give for each question in BOLD and yellow as follows:

a. All of the above.

1. Which of the following is a characteristic of an efficient market?

e. Small number of individuals.

f. Opportunities exist for investors to profit from publicly available information.

g. Security prices reflect fair value of the firm.

h. Immediate response occurs for new public information.

12. Diversification increases when ________ decreases.

f. variability

g. return

h. risk

i. a and c

j. all of the above

13. Corporations receive money from investors with:

f. initial public offerings.

g. seasoned new issues.

h. primary market transactions.

i. a and b.

j. all of the above.

14. Which of the following is true regarding an initial public offering?

f. The corporation gets proceeds from the investor.

g. Investors get proceeds from other investors.

h. The security is sold for the first time to the public.

i. Both a and c.

j. All of the above.

Table 1(Use this table for questions 5-8)

Smith Company Balance Sheet

Assets:

Cash and marketable securities $300,000

Accounts receivable 2,215,000

Inventories 1,837,500

Prepaid expenses 24,000

Total current assets $3,286,500

Fixed assets 2,700,000

Less: accumulated depreciation 1,087,500

Net fixed assets $1,612,500

Total assets $4,899,000

Liabilities:

Accounts payable $240,000

Notes payable 825,000

Accrued taxes 42,500

Total current liabilities $1,107,000

Long-term debt 975,000

Owner’s equity 2,817,000

Total liabilities and owner’s equity $4,899,000

Net sales (all credit) $6,375,000

Less: Cost of goods sold 4,312,500

Selling and administrative expense 1,387,500

Depreciation expense 135,000

Interest expense 127,000

Earnings before taxes $412,500

Income taxes 225,000

Net income $187,500

Common stock dividends $97,500

Change in retained earnings $90,000

15. Based on the information in Table 1, the current ratio is:

a. 2.97.

b. 1.46.

c. 2.11.

d. 2.23.

16. Based on the information in Table 1, the debt ratio is:

a. 0.70.

b. 0.20.

c. 0.74.

d. 0.42.

17. Based on the information in Table 1, the net profit margin is:

a. 4.61%

b. 2.94%.

c. 1.97%.

d. 5.33%.

18. Based on the information in Table 1, the inventory turnover ratio is:

a. 0.29 times.

b. 2.35 times.

c. 0.43 times.

d. 3.47 times.

19. Marshall Networks, Inc. has a total asset turnover of 2.5 and a net profit margin of 3.5%. The firm has a return on equity of 17.5%. Calculate Marshall’s debt ratio.

a. 30%

b. 40%

c. 50%

d. 60%

Use the following information and the percent-of-sales method to Answer questions 10 -12.

Below is the 2004 year-end balance sheet for Banner, Inc. Sales for 2004 were $1,600,000 and are expected to be $2,000,000 during 2005. In addition, we know that Banner plans to pay $90,000 in 2005 dividends and expects projected net income of 4% of sales. (For consistency with the Answer selections provided, round your forecast percentages to two decimals.)

Banner, Inc. Balance Sheet

December 31, 2004

Assets

Current assets $890,000

Net fixed assets 1,000,000

Total $1,890,000

Liabilities and Owners’ Equity

Accounts payable $160,000

Accrued expenses 100,000

Notes payable 700,000

Long-term debt 300,000

Total liabilities 1,260,000

Common stock (plus paid-in capital) 360,000

Retained earnings 270,000

Common equity 630,000

Total $1,890,000

20. Banner’s projected current assets for 2005 are:

a. $1,000,000.

b. $1,120,000.

c. $1,500,000.

d. $1,260,000.

21. Banner’s projected accounts payable balance for 2005 is:

a. $160,000.

b. $120,000.

c. $200,000.

d. $300,000.

22. Banner’s projected fixed assets for 2005 are:

a. $1,120,000.

b. $1,260,000.

c. $1,000,000.

d. $2,380,000.

13. What is the present value of $1,000 to be received 10 years from today? Assume that the investment pays 8.5% and it is compounded monthly (round to the nearest $1).

a. $893

b. $3,106

c. $429

d. $833

14. What is the present value of $12,500 to be received 10 years from today? Assume a discount rate of 8% compounded annually and round to the nearest $10.

a. $5,790

b. $11,574

c. $9,210

d. $17,010

15. The NPV method:

a. is consistent with the goal of shareholder wealth maximization.

b. recognizes the time value of money.

c. uses cash flows.

d. all of the above.

16. If the IRR is greater than the required rate of return, the:

a. present value of all the cash inflows will be greater than the initial outlay.

d. payback will be less than the life of the investment.

e. project should be rejected.

d. both a and b.

17. ABC Service can purchase a new assembler for $15,052 that will provide an annual net cash flow of $6,000 per year for five years. Calculate the NPV of the assembler if the required rate of return is 12%. (Round your answer to the nearest $1.)

a. $1,056

b. $4,568

c. $7,621

d. $6,577

18. Suppose you determine that the NPV of a project is $1,525,855. What does that mean?

a. In all cases, investing in this project would be better than investing in a project that has an NPV of $850,000.

b. The project would add value to the firm.

c. Under all conditions, the project’s payback would be less than the profitability index.

d. The project’s IRR would have to be less that the firm’s discount rate.

19. The IRR is:

a. the discount rate that makes the NPV positive.

b. the discount rate that equates the present value of the cash inflows with the cost of the project.

c. the discount rate that makes the NPV negative and the profitability index greater than one.

d. the rate of return that makes the NPV positive.

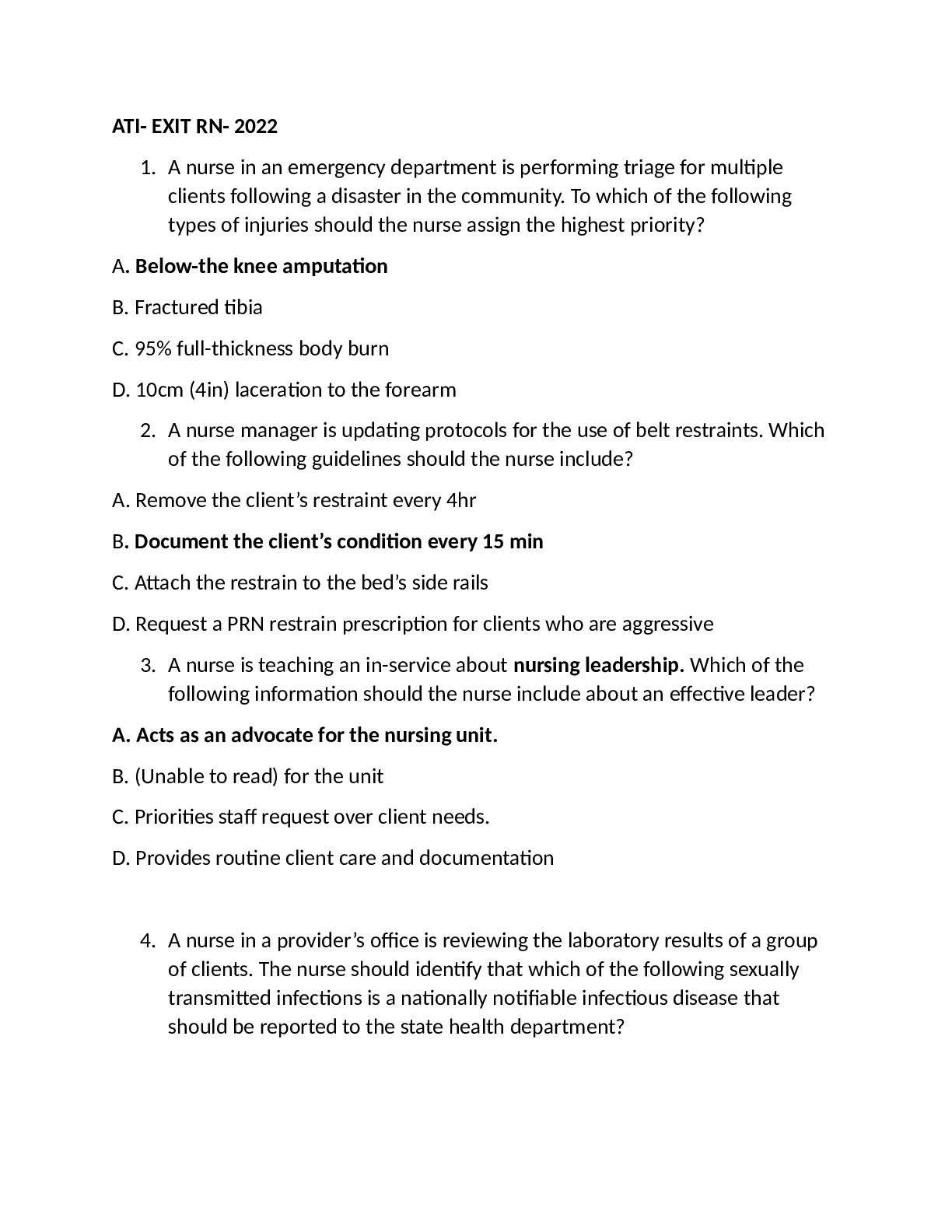

20. Crawfish Kitchen Inc. is planning to invest in one of three mutually exclusive projects. Projected cash flows for these ventures are as follows:

Which project is the most profitable according to the NPV Criteria if the discount rate for the firm is 14%?

a. Plan A

b. Plan B

c. Plan C

21. You are in charge of one division of Bigfella Conglomerate Inc. Your division is subject to capital rationing. Your division has four indivisible projects available, detailed as follows:

Project Initial Outlay IRR NPV

1 2 million 18% 2,500,000

3 1 million 10% 600,000

2 1 million 15% 950,000

4 3 million 9% 2,000,000

If you must select projects subject to a budget constraint of 5 million dollars, which set of projects should be accepted so as to maximize firm value?

a. Projects 1, 2, and 3

b. Project 1 only

c. Projects 1 and 4

d. Projects 2, 3, and 4

22. J & B, Inc. has $5 million of debt outstanding with a coupon rate of 12%. Currently, the yield to maturity on these bonds is 14%. If the firm’s tax rate is 40%, what is the cost of debt to J & B?

a. 12.0%

b. 14.0%

c. 8.4%

d. 5.6%

23. Shawhan Supply plans to maintain its optimal capital structure of 30% debt, 20% preferred stock, and 50% common stock far into the future. The required return on each component is: debt–10%; preferred stock–11%; and common stock–18%. Assuming a 40% marginal tax rate, what after-tax rate of return must Shawhan Supply earn on its investments if the value of the firm is to remain unchanged?

a. 18.0%

b. 13.0%

c. 10.0%

d. 14.2%

24. Bender and Co. is issuing a $1,000 par value bond that pays 9% interest annually. Investors are expected to pay $918 for the 10-year bond. Bender will have to pay $33 per bond in flotation costs. What is the cost of debt if the firm is in the 34% tax bracket?

a. 7.23%

b. 9.01%

c. 9.23%

d. 11.95%

25. Armadillo Mfg. Co. has a target capital structure of 50% debt and 50% equity. They are planning to invest in a project which will necessitate raising new capital. New debt will be issued at a before-tax yield of 12%, with a coupon rate of 10%. The equity will be provided by internally generated funds. No new outside equity will be issued. If the required rate of return on the firm’s stock is 15% and its marginal tax rate is 40%, compute the firm’s cost of capital.

a. 13.5%

b. 12.5%

c. 7.2%

d. 11.1%

26. Which of the following relationships is true, regarding the costs of issuing the below securities?

a. Common stock > bonds > preferred stock

b. Preferred stock > common stock > bonds

c. Bonds > common stock > preferred stock

d. Common stock > preferred stock > bonds

27. The _______ is the federal agency primarily responsible for regulating the securities industry.

a. FTC

b. SEC

c. FRB

d. SCC

28. A firm’s business risk is influenced by the:

a. competitive position of the firm within the industry.

b. demand characteristics of the firm’s products.

f. financing structure of the firm.

g. both a and b.

h. all of the above.

29. Cost of capital is:

a. the coupon rate of debt.

b. a hurdle rate set by the board of directors.

c. the rate of return that must be earned on additional investment if firm value is to remain unchanged.

d. the average cost of the firm’s assets.

30. Given the following information, determine the risk-free rate.

Cost of equity = 12%

Beta = 1.50

Market risk premium = 3%

a. 8.0%

b. 7.5%

c. 7.0%

d. 6.5%

31. Which of the following relationships is true, regarding the costs of issuing the below securities?

a. Common stock > bonds > preferred stock

b. Preferred stock > common stock > bonds

c. Bonds > common stock > preferred stock

d. Common stock > preferred stock > bonds

Table 1 (Use this for questions 32-36)

Average selling price per unit $16.00

Variable cost per unit $11.00

Units sold 200,000

Fixed costs $800,000

Interest expense $ 50,000

32. Based on the data in Table 1, what is the break-even point in units produced and sold?

a. $130,000

b. $140,000

c. $150,000

d. $160,000

33. Based on the data contained in Table 1, what is the degree of operating leverage?

a. 1.00 times

b. 2.00 times

c. 3.00 times

d. 4.00 times

e. 5.00 times

34. Based on the data contained in Table 1, what is the contribution margin?

a. $5.00

b. $4.00

c. $3.00

d. $2.00

35. Based on the data contained in Table 1, what is the degree of financial leverage?

a. 3.33 times

b. 2.50 times

c. 1.50 times

d. 1.33 times

36. Based on the data contained in Table 1, what is the degree of combined leverage?

a. 6.33

b. 6.67

c. 7.33

d. 7.67

37. Fluctuations in EBIT result in:

a. fluctuations in EPS, which might be larger or smaller as financial leverage increases.

b. smaller fluctuations in EPS, the greater the degree of financial leverage.

c. greater fluctuations in EPS, the greater the degree of financial leverage.

d. equal fluctuations in EPS, the greater the degree of financial leverage.

38. A toy manufacturer following the hedging principle will generally finance seasonal inventory build-up prior to the Christmas season with:

a. common stock.

b. selling equipment.

c. trade credit.

d. preferred stock.

39. Accounts receivable and inventory self-liquidate through the __________ cycle.

a. spontaneous account

b. net working capital

c. cash conversion

d. sales-to-receivables collection

40. Given that short-term interest rates typically fluctuate more than long-term rates, interest rate risk is least for:

a. Treasury bills.

b. common stock.

c. long-term government bonds.

d. medium-term corporate bonds.

41. If you compare the yield of a municipal bond with that of a Treasury bond, what is the equivalent before-tax yield of a municipal bond yielding 6% per year for an investor in the 36% tax bracket (round to nearest .1%)?

a. 9.4%

b. 8.1%

c. 7.7%

d. 6.3%

42. Carrying cost on inventory includes:

a. the required rate of return on investment in total assets.

b. wages of warehouse employees.

c. cost associated with inventory shrinkage.

d. both b and c.

e. all of the above.

43. The TQM view argues that:

a. the costs of achieving higher quality are more than economists projected.

b. better quality products drive higher sales.

c. lost sales result from a poor-quality reputation.

f. both b and c.

g. all of the above.

44. A spot transaction occurs when one currency is:

a. deposited in a foreign bank.

b. immediately exchanged for another currency.

c. exchanged for another currency at a specified price.

d. traded for another at an agreed-upon future price.

45. Exchange rate risk:

a. arises from the fact that the spot exchange rate on a future date is a random variable.

b. applies only to certain types of international businesses.

c. has been phased out due to recent international legislation.

d. both a and b.

Use the following information to answer questions 46-47. Below is an excerpt from Table 22-1, The Globalization of Product and Financial Markets, that appears in your text. Values are foreign exchange rates reported in The Wall Street Journal.

U.S. $ equivalent Currency per U.S. $

Country Mon. Mon.

India (Rupee) 0.03137 31.88

Britain (Pound) 1.5615

30-day Forward 1.5609

90-day Forward 1.5605

180-day Forward 1.5603

Canada (Dollar) 0.7265 1.3765

30-day Forward 0.7256 1.3782

90-day Forward 0.7236 1.3820

180-day Forward 0.7196 1.3896

Sweden (Koruna) 0.18848 5.3055

30-day Forward 0.18829 5.3110

90-day Forward 0.18809 5.3167

180-day Forward 0.18795 5.3205

46. To buy one Indian Rupee you would need:

a. 3.137 cents.

b. 31.88 dollars.

c. 18.848 cents.

d. 5.3055 dollars.

47. The number of pounds you can purchase per U.S. dollar is:

a. 1.5609.

b. 0.6207.

c. 0.6404.

d. 1.5615.

48. Which of the following statements about a financial lease is generally true?

a. The entire lease payment is used as an income tax deduction.

b. Only the portion of the lease payment that reduces the principal may be used as an income tax deduction.

c. It has no income tax deductibility.

d. Only the portion of the lease payment that is applied to interest is tax-deductible.

49. Which of the following most likely would cause a lease to be classified as a capital lease?

a. The lease is for five or more years.

b. The lease is for $1 million or more.

c. The lease permits the lessee to purchase the equipment at the end of the lease for its fair market value.

d. The present value of the lease payments, calculated at the lessee’s typical rate of interest for a similar purchase loan, is more than the original purchase price of the equipment.

50. What price must a company typically pay to buy another company? The price will:

a. include some premium over the current market value of the target’s equity.

b. be the market value of the target’s equity.

c. be the book value of the target’s equity.

d. include some discount relative to the current market value of the target’s equity.

This is the end of the exam. Please make sure you have answered all 50 questions with a bold and highlight of the answer you want for each question.

46) A bond sold simultaneously in several different foreign capital markets, but denominated in a currency different from the country in which the bond is issued, is called a(n): A. Eurobond. B. international capital bond. C. floating bond. D. world bond.

47) _________ risk is generally considered only a paper gain or loss. A. Translation B. Financial C. Economic D. Transaction

48) Capital markets in foreign countries: A. offer lower returns than those obtainable in the domestic capital markets. B. provide international diversification. C. in general are becoming less integrated due to the widespread availability of interest rate and currency swaps. D. all of the choices.

49) If the quote for a forward exchange contract is greater than the computed price, the forward contract is: A. undervalued. B. at equilibrium. C. a good buy. D. overvalued.

50) The interplay between interest rate differentials and exchange rates such that both adjust until the foreign exchange market and the money market reach equilibrium is called the: A. balance of payments quantum theory. B. arbitrage markets theory. C. interest rate parity theory. D. purchasing power parity theory.

51) A spot transaction occurs when one currency is: A. immediately exchanged for another currency. B. traded for another at an agreed-upon future price. C. exchanged for another currency at a specified price. D. deposited in a foreign bank.

52) The purchasing power parity theory states that currency exchange rates tend to vary ____________ with their respective purchasing powers in order to provide _________ purchasing powers. A. directly; similar B. directly; greater C. inversely; greater D. inversely; similar

53) One reason for international investment is to reduce: A. price-earnings (P/E) ratios. B. beta risk. C. advantages in a foreign country. D. portfolio risk.

54) An important (additional) consideration for a direct foreign investment is: A. political risk. B. maximizing the firm’s profits. C. attaining a high international P/E ratio. D. all of the above.

[Show More]

answers.png)