Financial Accounting > EXAMs > ACC 202 WEEK 3 CNOW ASSIGNMENT. ASHFORD UNIVERSITY (All)

ACC 202 WEEK 3 CNOW ASSIGNMENT. ASHFORD UNIVERSITY

Document Content and Description Below

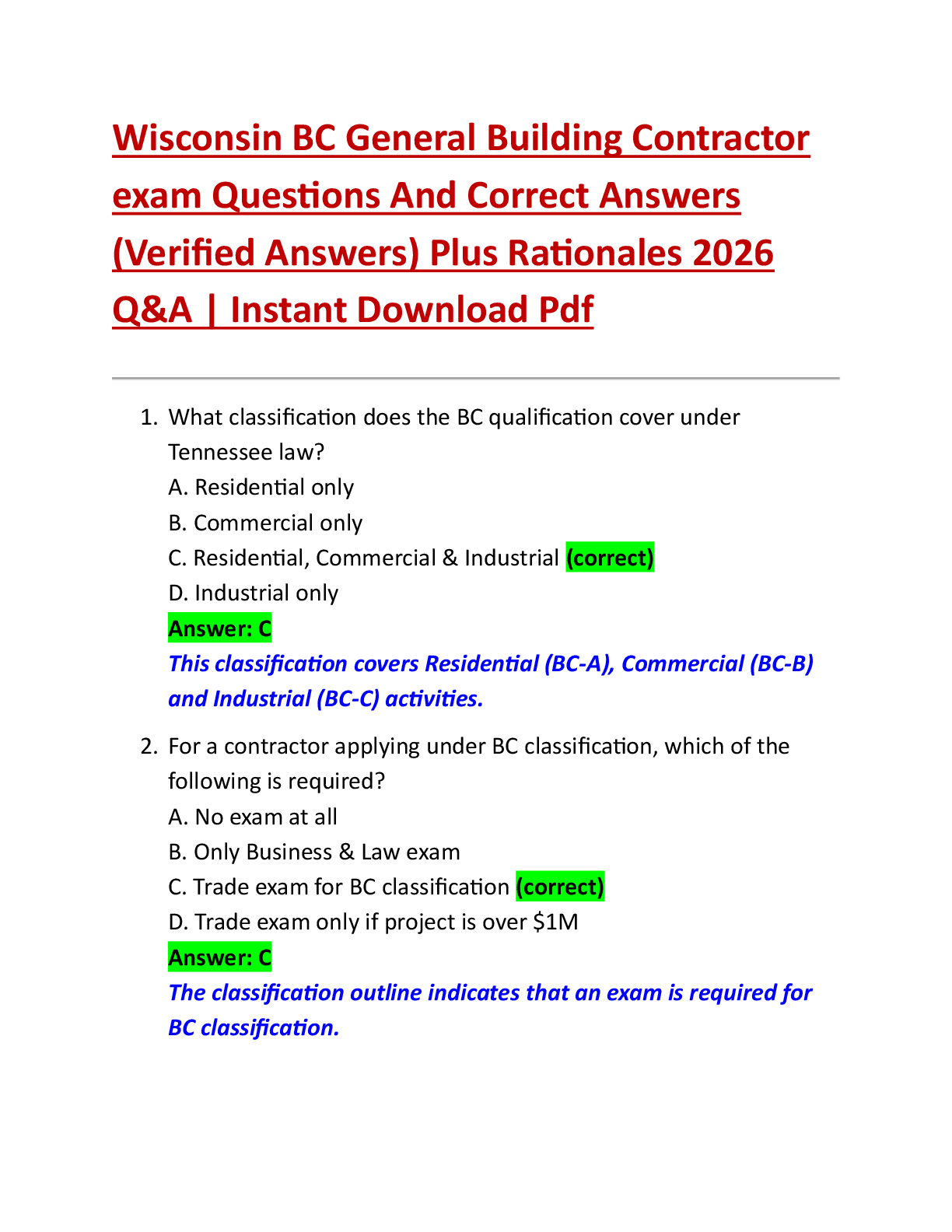

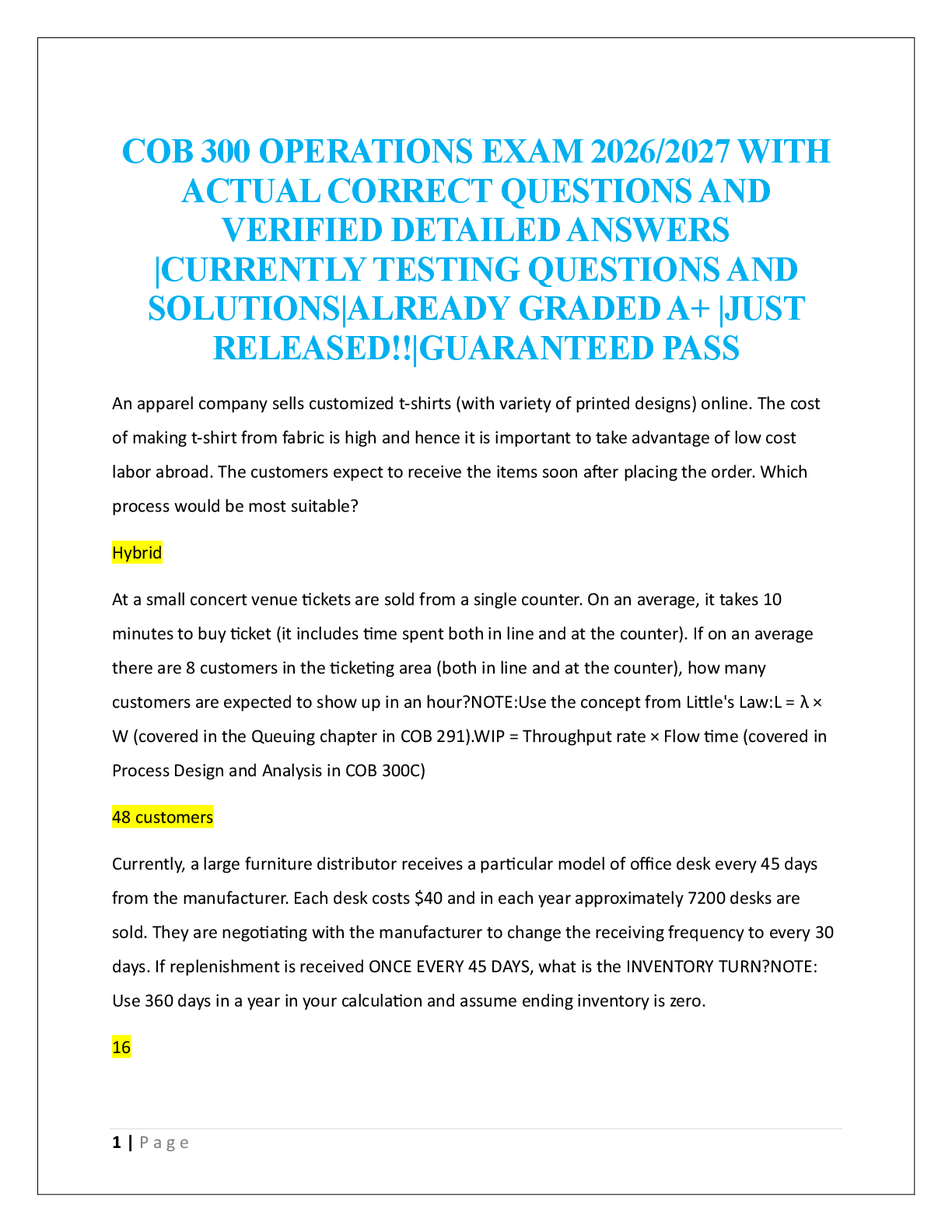

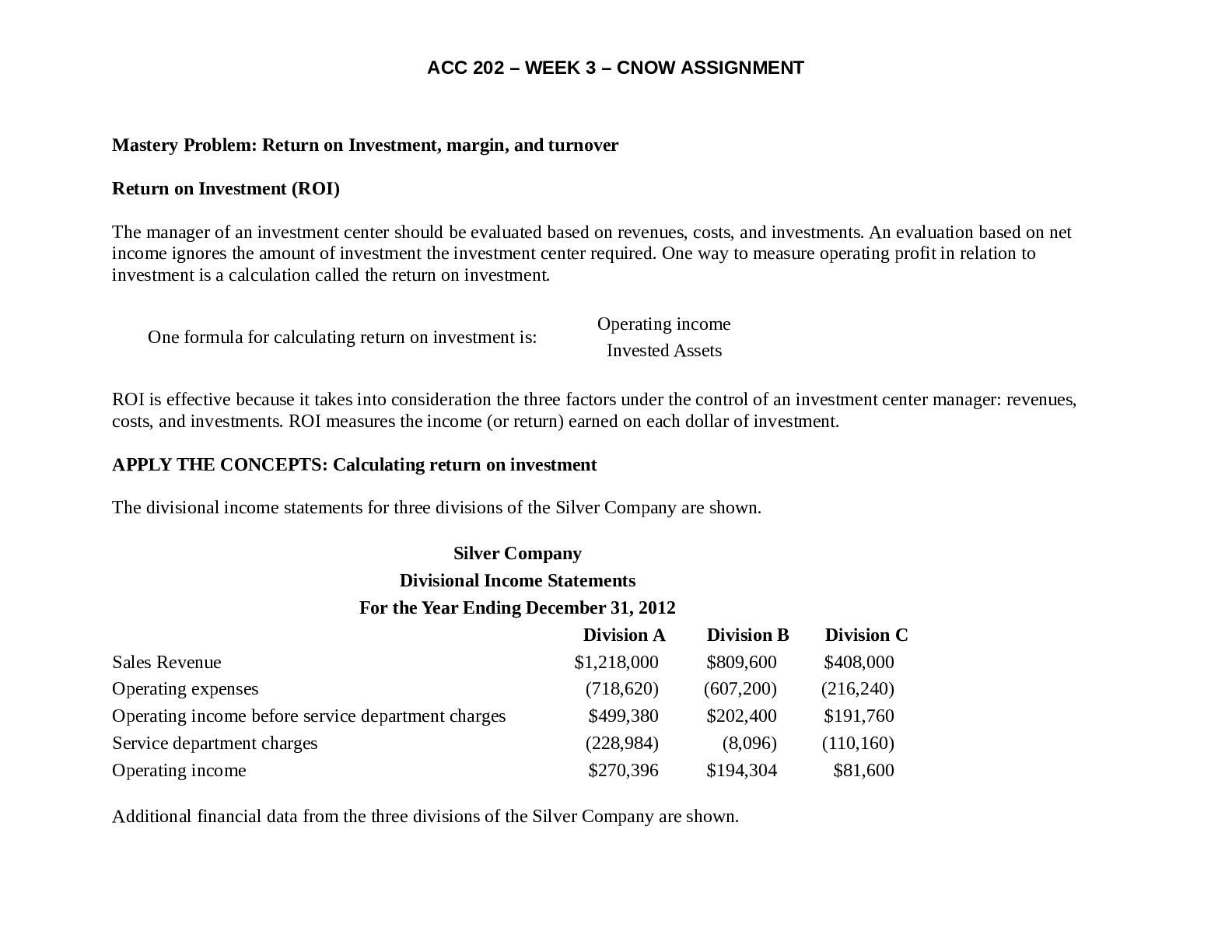

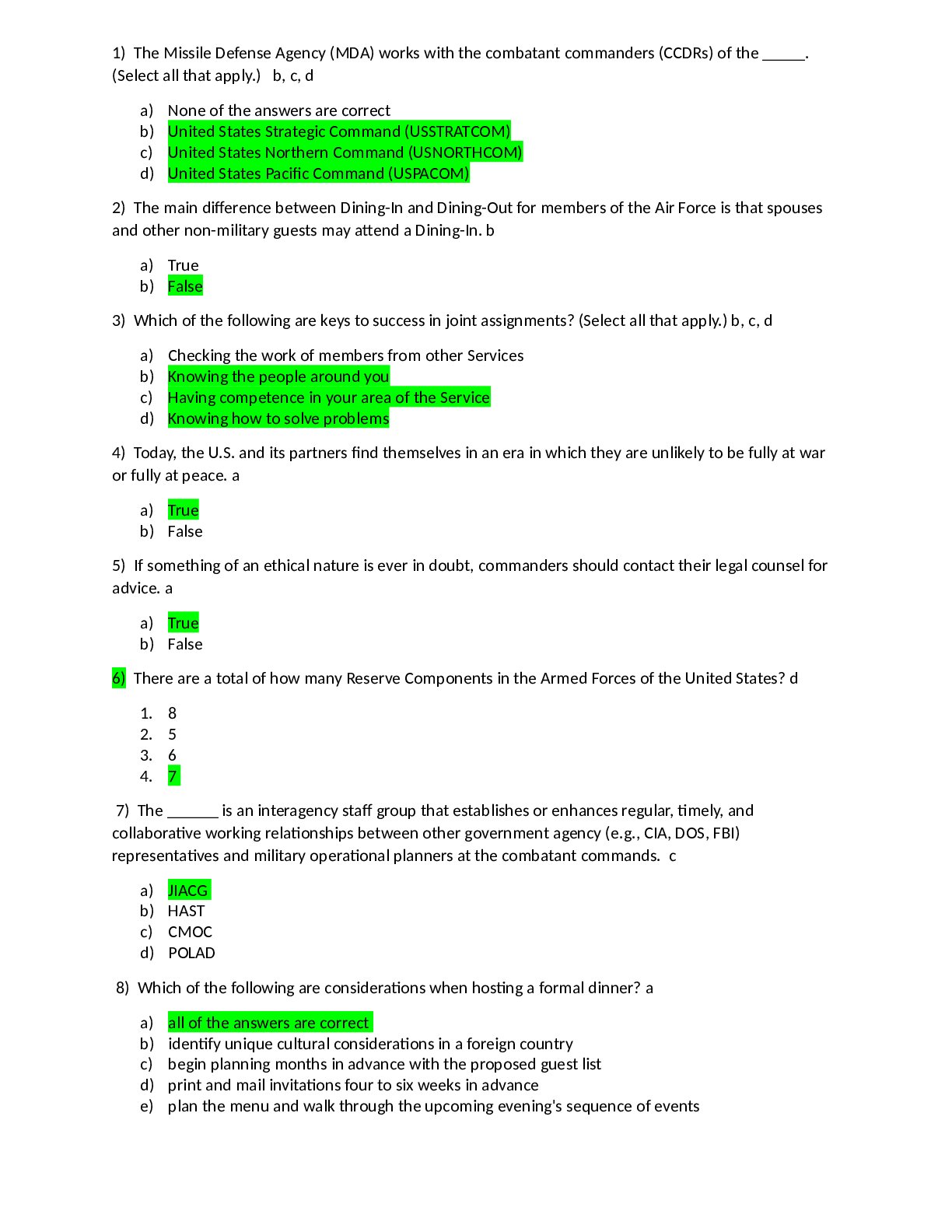

ACC 202 WEEK 3 CNOW ASSIGNMENT. ASHFORD UNIVERSITY.Mastery Problem: Return on Investment, margin, and turnover Return on Investment (ROI) The manager of an investment center should be evaluated ba ... sed on revenues, costs, and investments. An evaluation based on net income ignores the amount of investment the investment center required. One way to measure operating profit in relation to investment is a calculation called the return on investment. One formula for calculating return on investment is: Operating income Invested Assets ROI is effective because it takes into consideration the three factors under the control of an investment center manager: revenues, costs, and investments. ROI measures the income (or return) earned on each dollar of investment. APPLY THE CONCEPTS: Calculating return on investment The divisional income statements for three divisions of the Silver Company are shown. Silver Company Divisional Income Statements For the Year Ending December 31, 2012 Division A Division B Division C Sales Revenue $1,218,000 $809,600 $408,000 Operating expenses (718,620) (607,200) (216,240) Operating income before service department charges $499,380 $202,400 $191,760 Service department charges (228,984) (8,096) (110,160) Operating income $270,396 $194,304 $81,600 Additional financial data from the three divisions of the Silver Company are shown. ACC 202 – WEEK 3 – CNOW ASSIGNMENT Division A Division B Division C Invested assets $1,160,000 $704,000 $480,000 Calculate the return on investment for each division. If required, round the ROI to the nearest hundredth of a percent (for example, 16.943% would be rounded to 16.94%). Division A Division B Division C Return on investment fill in the blank a81881fbffc5fea_1 % fill in the blank a81881fbffc5fea_2 % fill in the blank a81881fbffc5fea_3 % Feedback Divide Operating income by Invested Assets and express it as a percentage, rounded to to two decimal places. Margin and Turnover One way to analyze the difference in return on investment for each division is to separate the return on investment formula into two calculations: margin and turnover. Margin shows the relationship between operating income and sales. It measures the profit earned for each dollar of sales, which is a measure of operating profitability . Turnover shows the relationship between sales and invested assets. It measures how many dollars of sales result from each dollar of invested assets, which is a measure of operating efficiency . The formulas for margin and turnover are: Margin = Operating income Sales Turnover = Sales Invested Assets Feedback The Margin is a measure of income per sales dollar [Show More]

Last updated: 3 years ago

Preview 1 out of 14 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$14.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jun 20, 2022

Number of pages

14

Written in

All

Additional information

This document has been written for:

Uploaded

Jun 20, 2022

Downloads

0

Views

88

.png)

.png)