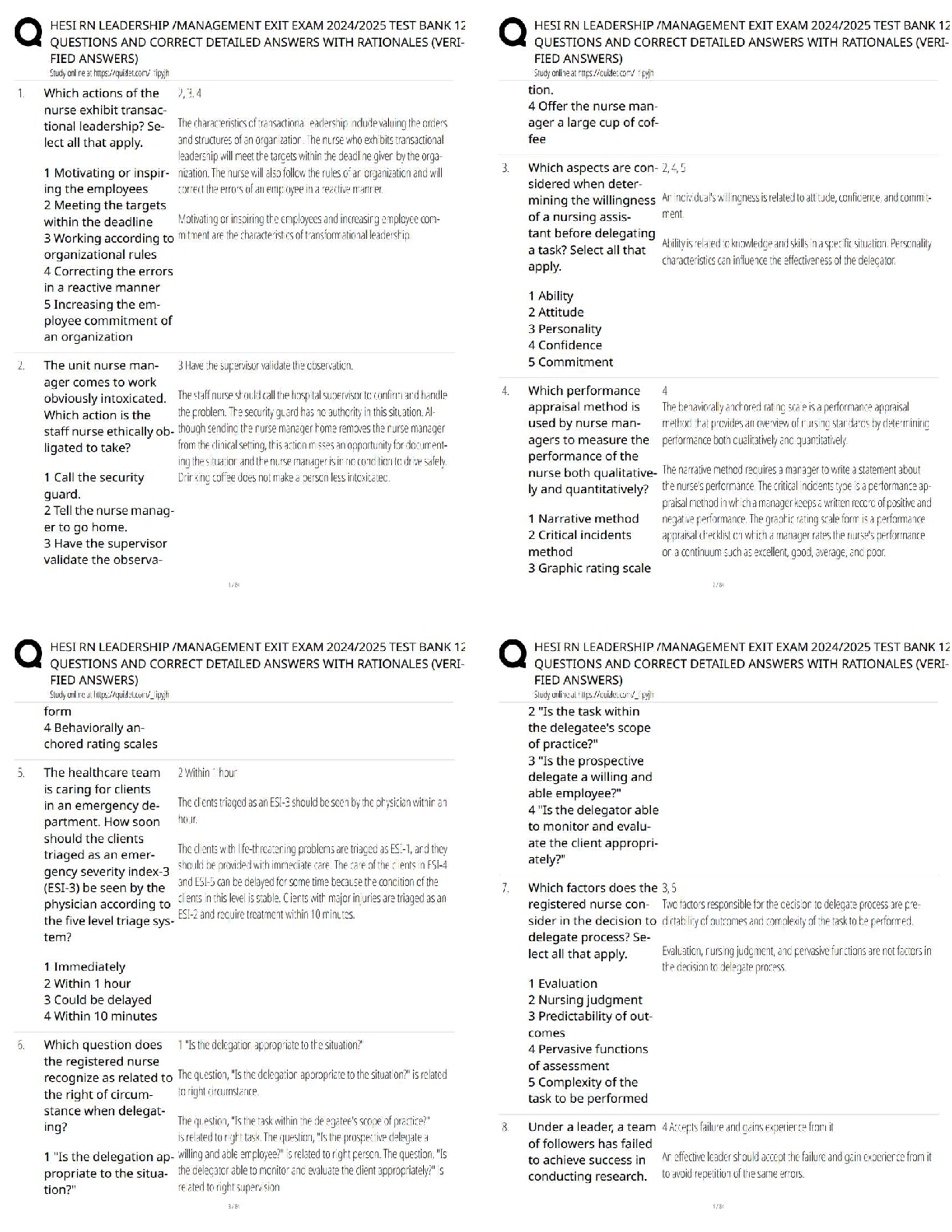

Microeconomics > QUESTIONS & ANSWERS > Sophia Micro Unit 4 Challenge 1 Questions and Answers Already Passed (All)

Sophia Micro Unit 4 Challenge 1 Questions and Answers Already Passed

Document Content and Description Below

When a tax is imposed, the resulting decrease in consumer and producer surplus is known as a ________. c.) deadweight loss Rent control is a type of __________ that lowers the price of rent below ... market value. This creates a __________ of affordable apartments, as more people want apartments at this price, and fewer landlords are willing and able to offer them. d.) price ceiling; shortage The minimum wage creates a __________ and is intended to increase the standard of living. But when it's set above equilibrium, the minimum wage can increase _______ by reducing the number of available jobs. c.) price floor; unemployment After doing some research, Patricia learned that the governments of some African countries were helping their farmers sell their cotton on the global market. The governments were offering financial assistance to any farmer who could produce over 100 pounds of cotton per year. What type of government intervention is this, and what would the result be in the global market for cotton? d.) This is a subsidy and supply will shift to the right. After the tax, what happens to price and quantity? b.) Consumers pay a higher price and consume fewer units. Sometimes when producers are not following specific practices, the government will impose a ______, which will require producers to pay the government and will decrease production of these types of goods. On a graph, this type of intervention would move the ________. This study source was downloaded by 100000831988016 from CourseHero.com on 06-22-2022 15:50:03 GMT -05:00 https://www.coursehero.com/file/69224478/Micro-Unit-4-Challange-1docx/ a.) tax; supply curve to the left To cover security fees and cost for new facilities, PMW Airlines has increased their ticket prices with additional tax charges. This tax on airline tickets reduced _________ since it raised prices and some people would purchase fewer. a.) consumer surplus Vanessa often smoked a couple of cigarettes to ease her stress. However, the tax per box of cigarettes in her state recently went up to $1.00. With this, Vanessa finally resolved to quit smoking for good. Looking at the effect of this tax on the market for cigarettes independent of the health impact, as a consumer, Vanessa would fall into the category of __________, since she could no longer afford to purchase cigarettes. a.) deadweight loss Robert often complained about the price of liquor but still purchased a bottle of wine every week. Which of the following statements is true? d.) The high taxes failed to modify consumer behavior. According to this Laffer curve, at which tax rate will the government maximize its revenue? d.) 50% According to this Laffer curve, should the government increase the tax rate from 40% to 60%? This study source was downloaded by 100000831988016 from CourseHero.com on 06-22-2022 15:50:03 GMT -05:00 https://www.coursehero.com/file/69224478/Micro-Unit-4-Challange-1docx/ a.) No, because the tax revenue is no longer maximized. According to the Laffer Curve, there is zero revenue collected by the government at tax rates of ___________. d.) 0% and 100% Which of the following is an example of a leading indicator? d.) Equity market performance If the number of building permits for new hou [Show More]

Last updated: 3 years ago

Preview 1 out of 4 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

Sophia Microeconomics & Macroeconomics Challenges Multiple Versions with Final Milestone Questions and Answers Already Passed

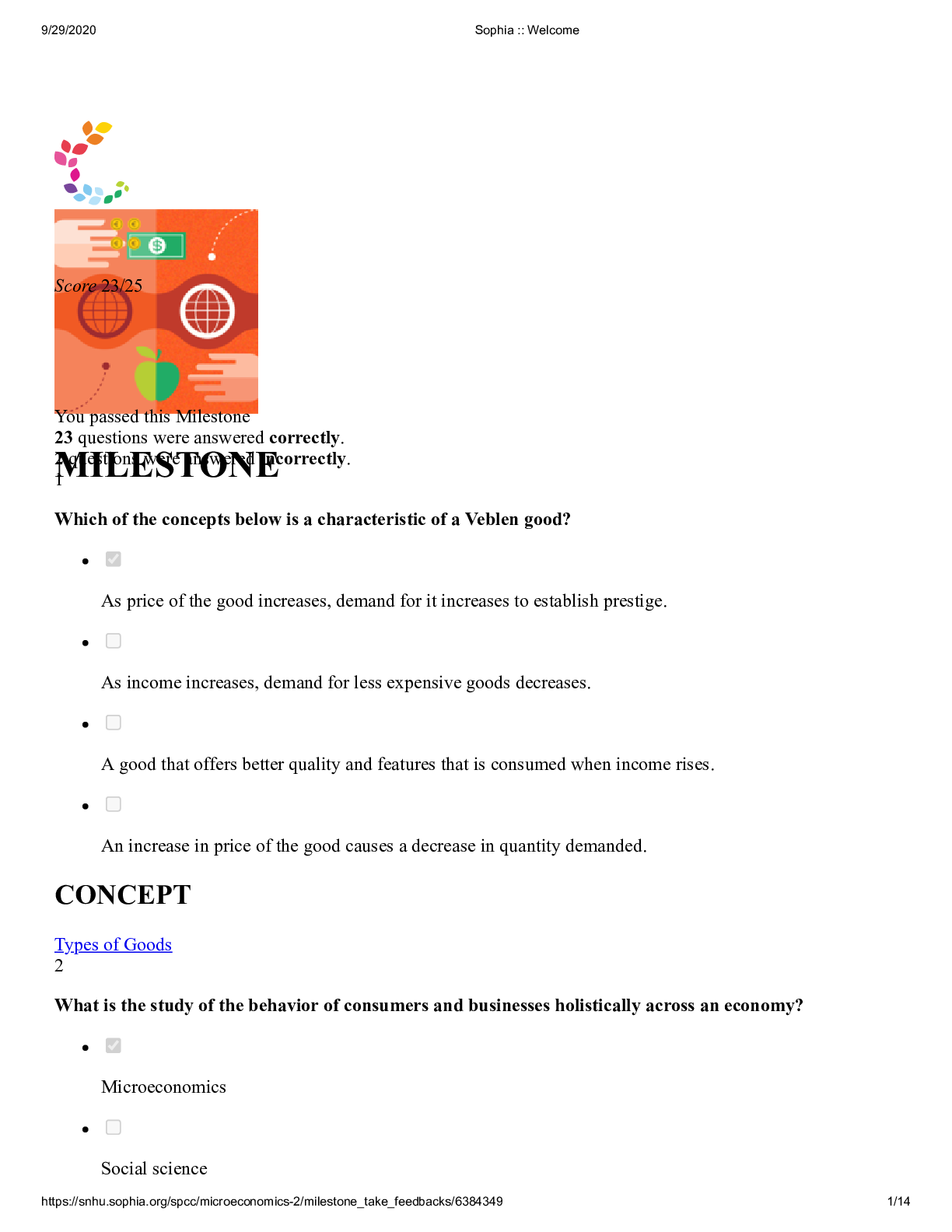

You passed this Milestone 23 questions were answered correctly. 2 questions were answered incorrectly. 1 Which of the concepts below is a characteristic of a Veblen good? As price of the good inc...

By Nutmegs 3 years ago

$30

19

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jun 22, 2022

Number of pages

4

Written in

All

Additional information

This document has been written for:

Uploaded

Jun 22, 2022

Downloads

0

Views

257

.png)