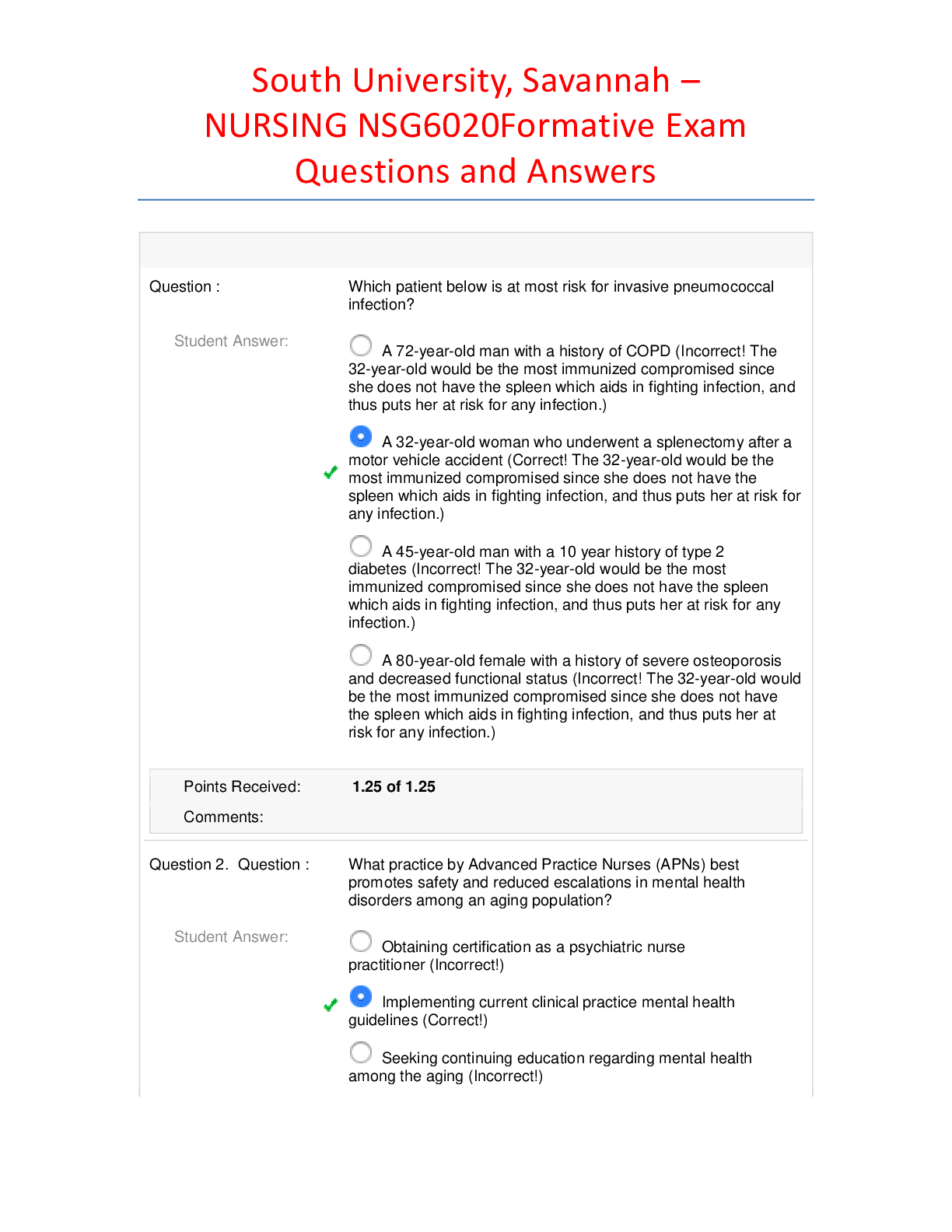

ECON 6100 Chapter 5 Investment Decisions Latest Exam, Questions and Answers.

Document Content and Description Below

ECON 6100 Chapter 5 Investment Decisions Latest Exam, Questions and Answers.1. The higher the interest rates a. the more value individuals place on future dollars b. the more value individua... ls place on current dollars c. individuals do not place any importance on either current or future dollars d. does not affect the investment strategy ANSWER: b TOPICS: Section 5.1 COMPOUNDING AND DISCOUNTING 2. A publisher is deciding whether or not to invest in a new printer. The printer would cost $500, and it would increase cash flows by $600 for the next two years. What is the present value of the cash flows from the investment? a. $1100 b. $541 c. $600 d. $1041 ANSWER: a TOPICS: Section 5.1 COMPOUNDING AND DISCOUNTING 3. A publisher is deciding whether or not to invest in a new printer. The printer would cost $900, and would increase the cash flows in year 1 by $500 and in year 3 by $800. Cash flows do not change in year 2. If the interest rate is 12%, what is the present value of the cash flows from the investment? a. $155.59 b. $1015.85 c. $1076.56 d. $346.78 ANSWER: b TOPICS: Section 5.1 COMPOUNDING AND DISCOUNTING 4. The lower the interest rates a. the more value individuals place on future dollars b. the less value individuals place on future dollars c. less investments will take place d. does not affect the investment strategy ANSWER: a TOPICS: Section 5.1 COMPOUNDING AND DISCOUNTING 5. If the annual interest rate is 0%, the net present value of receiving $550 in the next year is a. $550 b. $551 c. $549 d. $500 ANSWER: a TOPICS: Section 5.1 COMPOUNDING AND DISCOUNTING 6. If the annual interest rate is 10%, the net present value of receiving $550 in the next year is: a. $550 b. $551 c. $549 d. $500 ANSWER: a TOPICS: Section 5.1 COMPOUNDING AND DISCOUNTING 7. If the interest rate is 11%, $1500 received at the end of 12 years is worth how much today? a. 1500*(1+0.11)^12 b. 1500/(1 +0 .11)^12 c. 1500/(1 + 11)^12 d. 1500 ANSWER: b TOPICS: Section 5.1 COMPOUNDING AND DISCOUNTING 8. A cloth manufacturing firm is deciding whether or not to invest in new machinery. The machinery costs $45,000 and is expected to increase cash flows in the first year by $25,000 and in the second year by $30,000. The firm’s current fixed costs are $9,000 and current marginal costs are $15. The firm currently charges $18 per unit. If the interest rate is 5% then the present value of the cash flows is a. $6,020.41 b. $51,020.41 c. -$7,380.95 d. $10,000 ANSWER: b TOPICS: Section 5.1 COMPOUNDING AND DISCOUNTING 9. Lucy invested $10,000 at the rate of 12%. According to the rule of 72, it would take ______ years for her money to double a. 4 b. 5 c. 6 d. 7 ANSWER: c TOPICS: Section 5.1 COMPOUNDING AND DISCOUNTING 10. If GDP is expected to increase at a steady rate of 3% per year, how many years would it take for living standards to double? a. 10 b. 20 c. 24 d. 30 ANSWER: c TOPICS: Section 5.1 COMPOUNDING AND DISCOUNTING 11. The government is looking to double the living standards of its population in 18 years, what rate of GDP growth would it need to achieve that? a. 1% b. 2% c. 3% d. 4% ANSWER: d TOPICS: Section 5.1 COMPOUNDING AND DISCOUNTING [Show More]

Last updated: 2 years ago

Preview 1 out of 15 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$17.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Nov 23, 2020

Number of pages

15

Written in

Additional information

This document has been written for:

Uploaded

Nov 23, 2020

Downloads

0

Views

82

.png)

.png)

.png)