RPSGT DOMAIN 1 CLINICAL OVERVIEW MEDICATIONS PRACTICE QUIZZES Q & A 2024

$ 11

NUR 112 / NUR112Preeclampsia-Eclampsia Case Study UNFOLDING Reasoning

$ 10

NURSING 112023 Comprehensive Review For The NCLEX-RN Examination, 5Edition Questions With Rationales New Update 2022/2023

$ 10

Test Bank for Leddy & Pepper's Professional Nursing 9th Edition Hood

$ 12

AHIP Module 2 QUESTIONS AND ANSWERS

$ 5

SBE-310 Week 7 Part 3 – Entrepreneur Research Paper

$ 10

HURST REVIEW NCLEX-RN Readiness Exam 1 - Questions, Answered and well detailed Rationales

$ 25

RPSGT DOMAIN 1 CLINICAL OVERVIEW SLEEP DISORDERS PRACTICE QUIZZES Q & A 2024

$ 10

Solution Manual For Consumer Behavior 8th Edition by Wayne D. Hoyer, Deborah J. MacInnis, Rik Pieters

$ 17.5

DOC600_Module_4_CASE.docx Trident University Module 4 Case Business Research Process DO

$ 10

University of the PeopleEDUC 5710EDUC 5710 Written Assignment Unit7

$ 7

NOCTI HORTICULTURE PRACTICE EXAM QUESTIONS AND CORRECT ANSWERS (VERIFIED ANSWERS) PLUS RATIONALES 2025

$ 15

ISA Certified Arborist - Test Questions and Answers 2024 / 2025 | 100% Verified Answers

$ 15.5

Instructor Manual for Principles of Taxation for Business and Investment Planning 2026 (2025 Release) By Sally Jones, Shelley Rhoades-Catanach

$ 30

HESI CAT NURSING EXAM 2026–2027: ULTIMATE COMPUTERIZED ADAPTIVE TESTING STUDY PACK WITH FULL PRACTICE TESTS AND ANSWER KEYS

$ 17.5

.png)

NRS-451VN Week 2 Topic 2: Discussion Question 2

$ 11.5

MOCK PAPER CHEMISTRY PAPER 2 - Element Chemistry Learning Centre Limited

$ 4

COMMON ELECTRICIAN LICENSING EXAM QUESTIONS AND ANSWERS RATED A.

$ 14

NURS 1102 Passpoint- Antepartum Study Guide

$ 25

AST 113 ASTRONOMY Lab 8

$ 9

.png)

NRS-434V Week 4 Discussion Question 1:/RATED A/COMPLETE

$ 12.5

NSG6101 Week 6 Knowledge Check 2020/ Satisfaction Guaranteed

$ 10

NURSING 101 Swift River Answers

$ 24

GCSE (9-1) Business J204/02 Business 2. operations, finance and influences on business Question Paper

$ 5.5

SUPPLY CHAIN RECOVERY

$ 27

NURS 6501 / NURS6501: Advanced Pathophysiology - Chapter 23 Study Notes (Latest Update) Walden University

$ 6

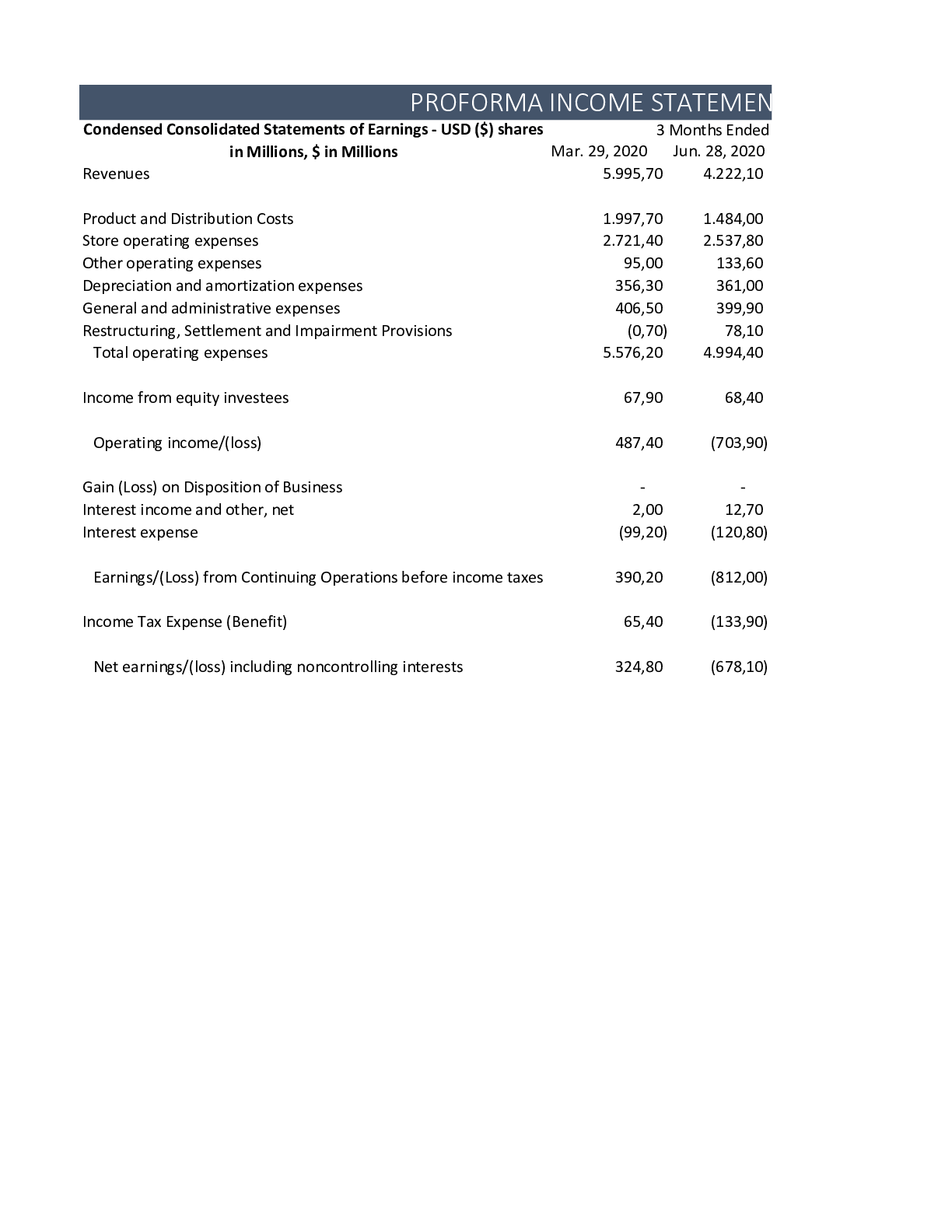

BUS 629 Week 1 Assignment Financial Forecasting

$ 4.5

HSCO 502 Test 1 ; Liberty University answers complete solutions; Latest 2019/20.

$ 5

NUR2488 / NUR 2488: Mental Health Nursing Module 2 Summary Notes (Latest Update) Rasmussen

$ 6

Charlie Snow Age: 6 years Diagnosis: Anaphylaxis| Feedback Log & Score 96% — Charlie Snow SUNY Canton - NURS 101 Charlie.

$ 8

NSG 3023 Chapter 30 QUIZ | COMPLETE GUIDE

$ 11.5

Alpha Phi Alpha risk management Questions Complete And 100% Correct Answers

$ 9.5

NUR 2092 PRACTICE EXAM QUESTIONS (LATEST UPDATE)

$ 13

NSG6101 Week 10 Knowledge Check {Latest Solved Solution}

$ 7

ATI Maternal Newborn Proctored Exam 2020 / 2021 | ATI Maternal Newborn Proctored Exam 1 & 2

$ 15

NR 500 Week 2 Complete Discussions

$ 16

.png)

What does the EOQ formula tell us

$ 7

Solutions Manual For Accounting for Decision Making and Control 8e Jerold Zimmerman All Chapters

$ 16.5

RN Comprehensive Predictor 2019 Form B.

$ 14.5

NR 511 hypothyroidism Study Guide 2021 Chamberlain University

$ 15

NR 224 Final Exam Key Concepts

$ 9.5

LU GOVT 480 DB1