Business > QUESTIONS & ANSWERS > PROBLEM SET 4 ANSWERS GRADED A+ SOLUTION DOCS 2020 (All)

PROBLEM SET 4 ANSWERS GRADED A+ SOLUTION DOCS 2020

Document Content and Description Below

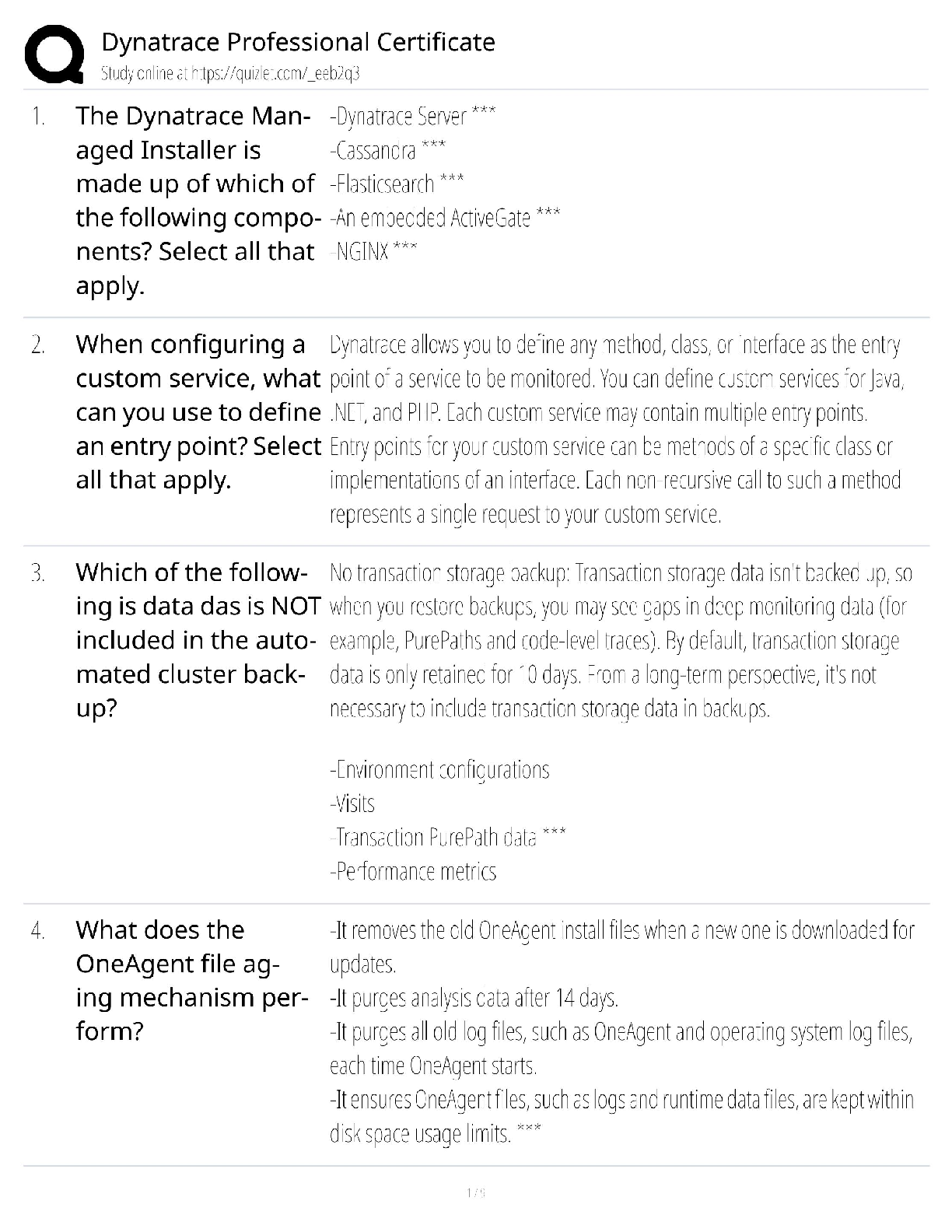

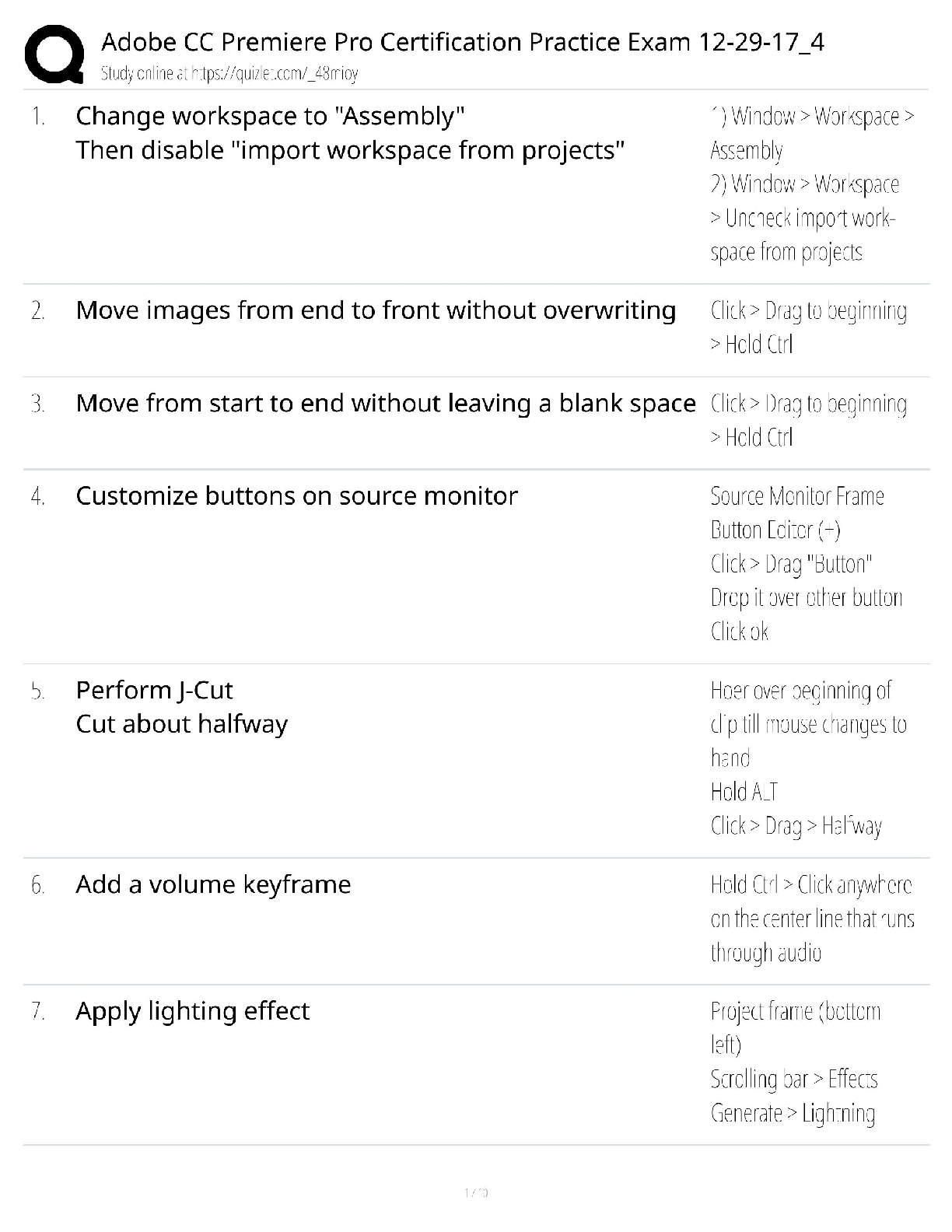

PROBLEM SET 4 ANSWERS GRADED A+ SOLUTION DOCS 2020 1) Explain the difference between a budget deficit and the national debt. 2) Use the Marginal Income Tax Rates in Figure 15.6 (see p. 463) to co ... mpute the following: a. ■ The tax due on $100,000 is: ■ The tax due on $200,000 is: ■ The tax due on $500,000 is: b. Average tax rates are calculated by dividing the total tax bill by the total taxable income. ■ The average tax rate on $100,000 is ■ The average tax rate on $200,000 ■ The average tax rate on $500,000 3) Greece, Ireland, Portugal, and Spain all went through national budget difficulties in recent years. Use the data below to answer questions regarding the sovereign debts of these nationals (All data comes from the OECD and is in billions of current US dollars.). a. Compute the debt-to-GDP ratio for all four nations in both 2000 and 2010. b. Compute the average yearly budget deficit for each of the nations over this period. c. In your judgment, which of the four nations was in the worse fiscal shape in 2010? Use your computations from above to justify your answer. 4) Explain the differences between typical demand side fiscal policy and supply side fiscal policy. For each of the following fiscal policy proposals, determine whether the primary focus is on aggregate demand or aggregate supply or both. a. A $1,000 per person tax reduction: b. A 5% reduction in all tax rates: c. Pell grants: d. Government-sponsored prizes for new scientific discoveries: e. Increasing unemployment compensation: 5) Fill in the blanks in the table below. Assume that the MPC is constant over everyone in the economy. MPC Spending multiplier Change in Government Spending Change in Income 10 100 2.5 -500 0.5 300 0.2 1000 [Show More]

Last updated: 3 years ago

Preview 1 out of 3 pages

answers.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Dec 01, 2020

Number of pages

3

Written in

All

Additional information

This document has been written for:

Uploaded

Dec 01, 2020

Downloads

0

Views

144

answers.png)