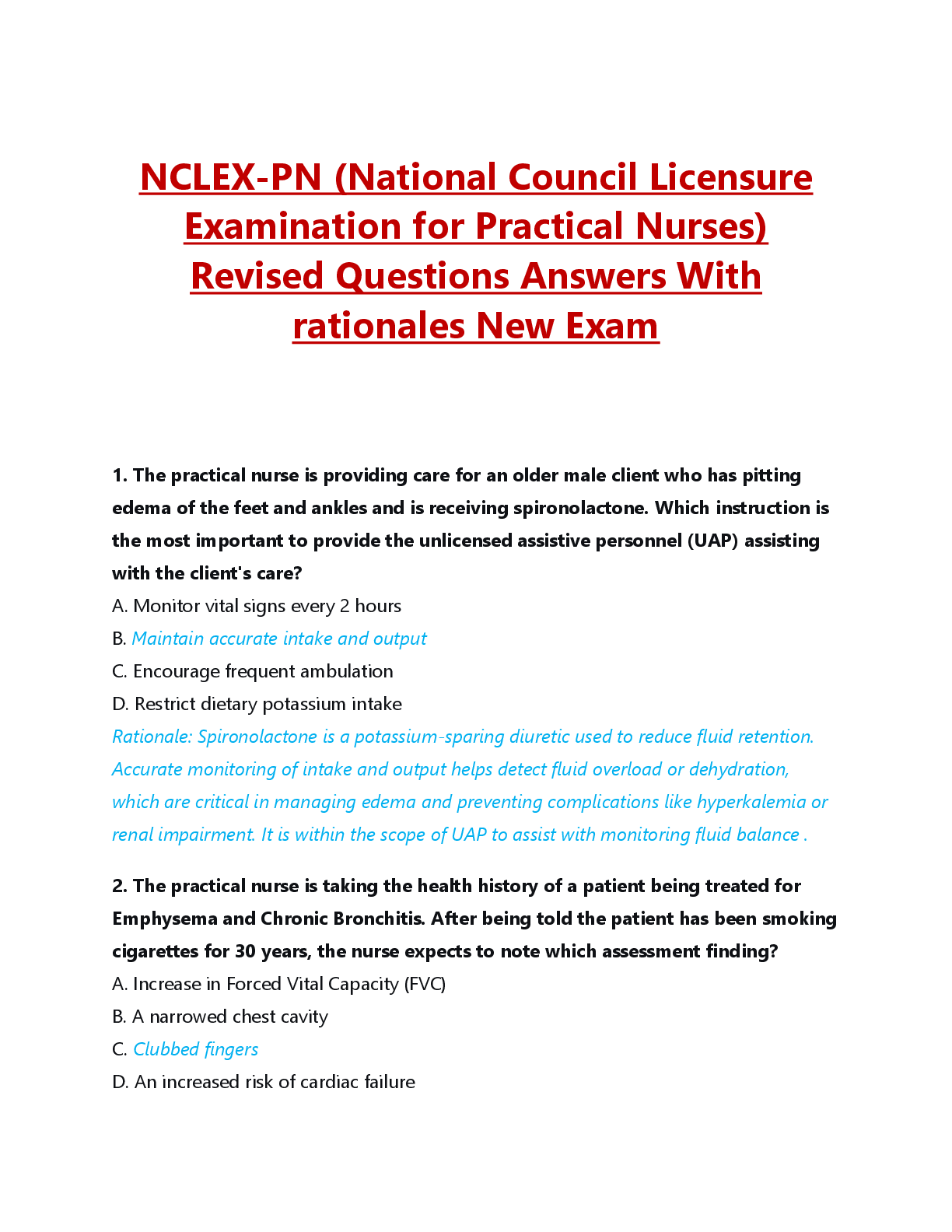

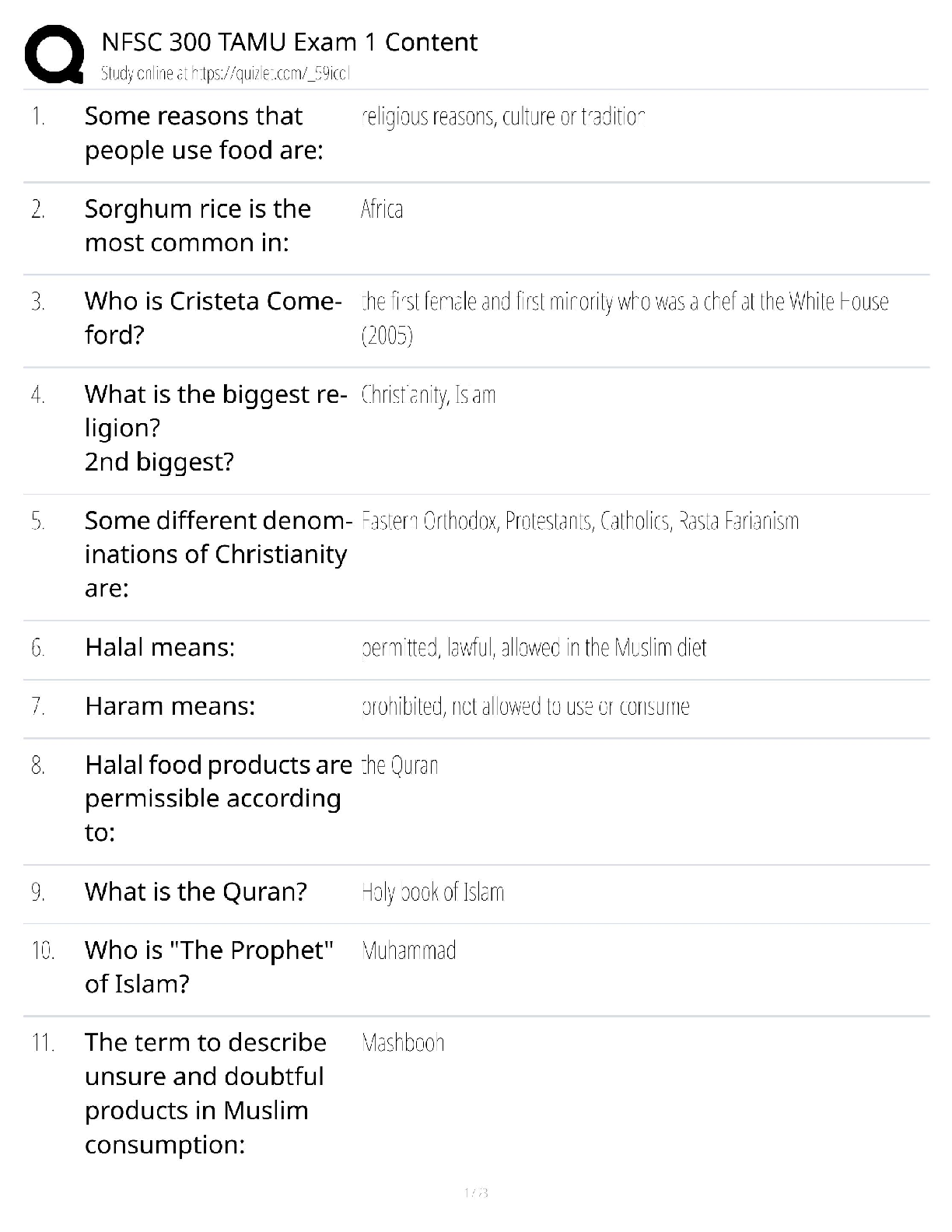

NFSC 300 TAMU Exam 1 / Texas A&M Nutrition Science / 2025 Study Guide / Score 100% / Test Bank

$ 26.5

AQA GCSE HISTORY America, 1920–1973: Opportunity and inequality 2021 ASSESSMENT MATERIALS QP

$ 7.5

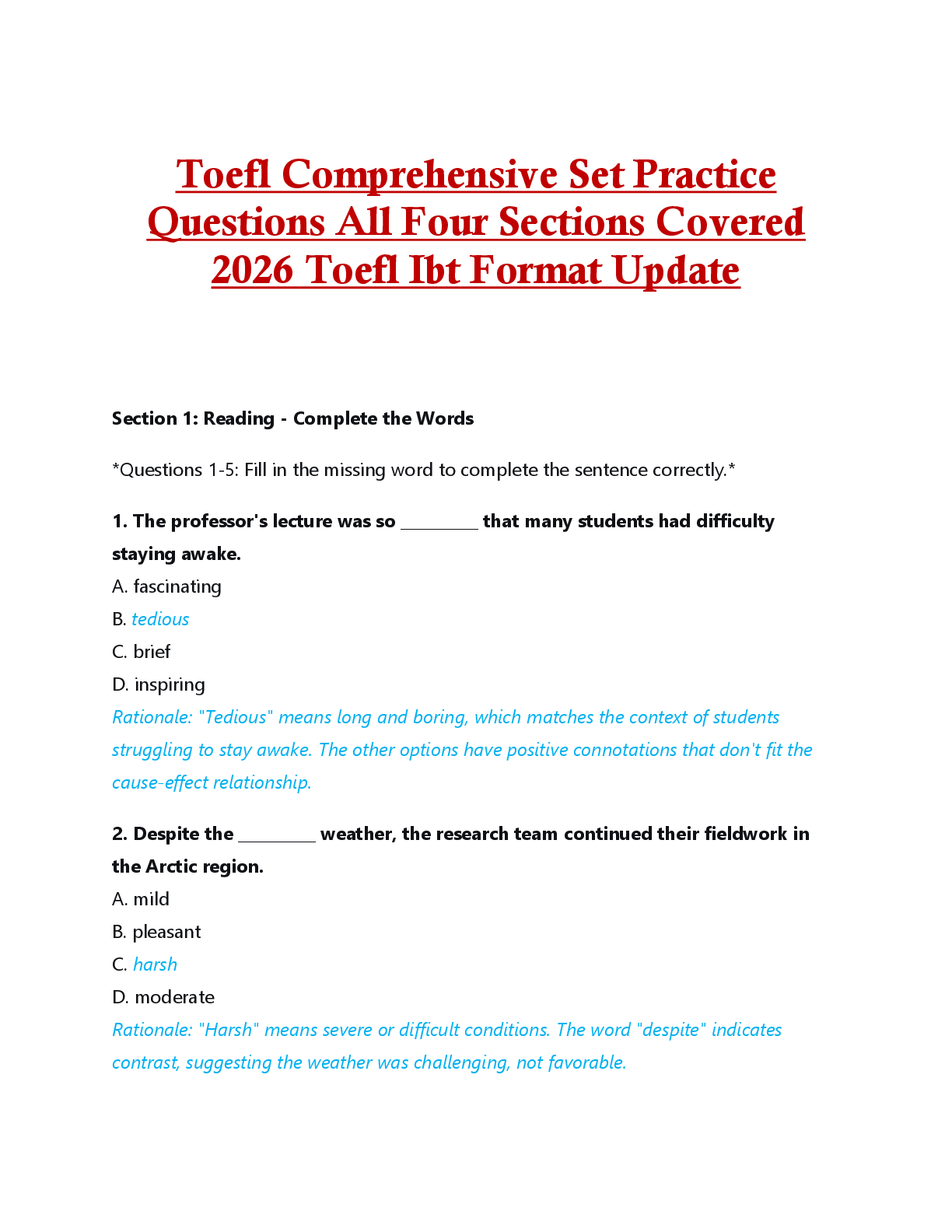

ATI - NURSING FUNDAMENTALS STUDY GUIDE-UPDATED 2022

$ 10

OCR AS Level Biology A H020-01 Breadth in biology MAY 2024 Combined Question Paper and Mark Scheme

$ 15.5

DOSAGE CALCULATION DIMENSIONAL ANALYSIS CBT REVIEW EXAM Q & A 2024

$ 12

Health Assessment Exam 2 study guide.

$ 7.5

OCR AS Level Biology A H020-01 Breadth in biology MAY 2024 Combined Question Paper and Mark Scheme

$ 16

OCR AS Level Biology A H020-01 Breadth in biology MAY 2024 Combined Question Paper and Mark Scheme

$ 15.5

ATI-RN Assessment Level 1: Practice A 100 Questions with 100% Correct Answers

$ 11

GCSE COMPUTER SCIENCE 8520/2 Paper 2 Written Assessment Mark scheme June 2020 Version: 1.0 Fina

$ 10

NOCTI RADIO AND TELEVISION BROADCASTING PRACTICE EXAM QUESTIONS AND CORRECT ANSWERS (VERIFIED ANSWERS) PLUS RATIONALES 2025

$ 15

WGU c170 The Most Important SQL Commands(SQL study guide)

.png)

.png)

.png)