Economics > QUESTIONS & ANSWERS > econ247 exam copy questions with answers all correct 2020 docs liberty university (All)

econ247 exam copy questions with answers all correct 2020 docs liberty university

Document Content and Description Below

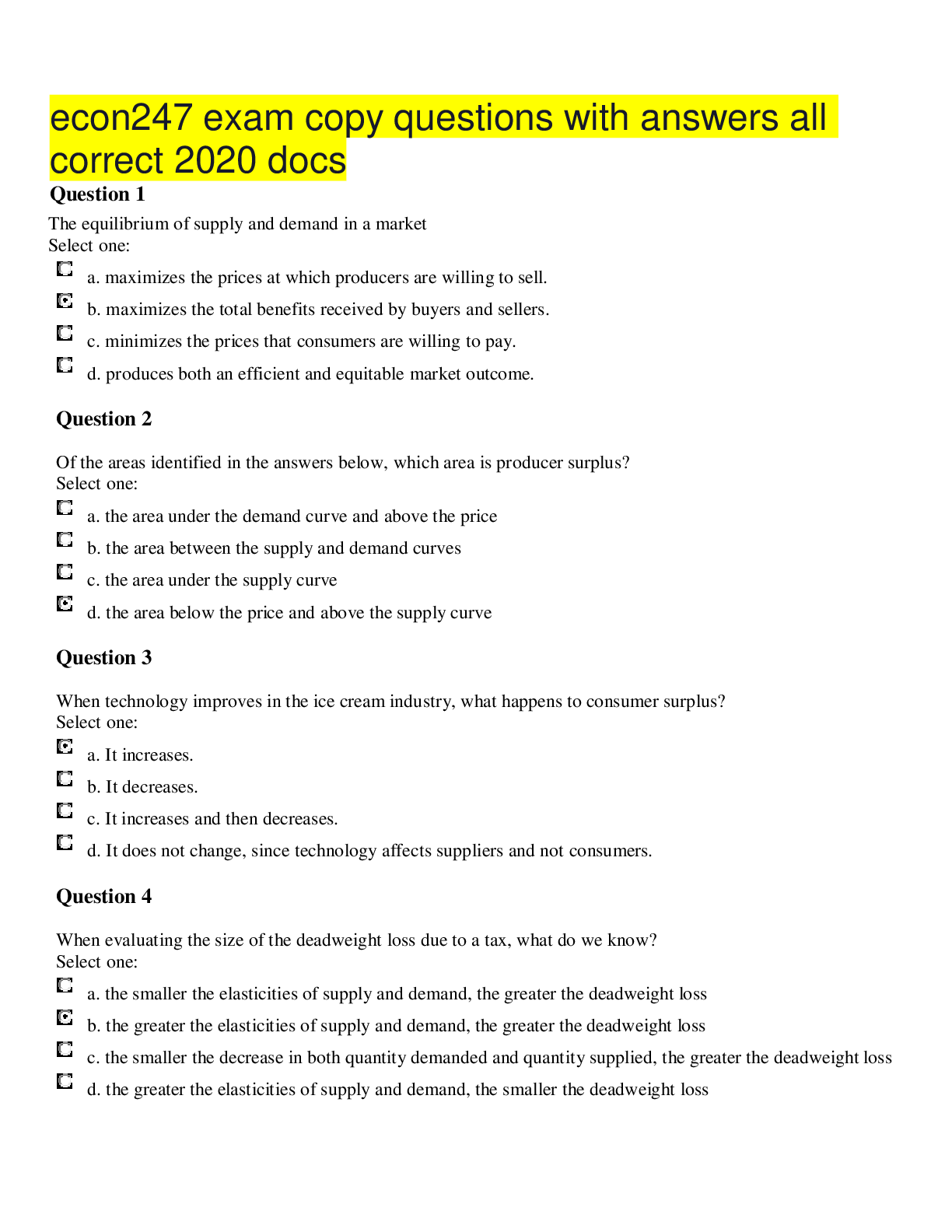

econ247 exam copy questions with answers all correct 2020 docs Question 1 The equilibrium of supply and demand in a market Select one: a. maximizes the prices at which producers are willing to se ... ll. b. maximizes the total benefits received by buyers and sellers. c. minimizes the prices that consumers are willing to pay. d. produces both an efficient and equitable market outcome. Question 2 Of the areas identified in the answers below, which area is producer surplus? Select one: a. the area under the demand curve and above the price b. the area between the supply and demand curves c. the area under the supply curve d. the area below the price and above the supply curve Question 3 When technology improves in the ice cream industry, what happens to consumer surplus? Select one: a. It increases. b. It decreases. c. It increases and then decreases. d. It does not change, since technology affects suppliers and not consumers. Question 4 When evaluating the size of the deadweight loss due to a tax, what do we know? Select one: a. the smaller the elasticities of supply and demand, the greater the deadweight loss b. the greater the elasticities of supply and demand, the greater the deadweight loss c. the smaller the decrease in both quantity demanded and quantity supplied, the greater the deadweight loss d. the greater the elasticities of supply and demand, the smaller the deadweight loss What happens as elasticities of supply and demand increase? Select one: a. the deadweight loss from a tax becomes smaller b. the deadweight loss from a tax becomes greater c. tax on a market becomes less intrusive d. the distribution of a tax between buyers and sellers becomes more equitable Question 6 Which area identified in the answers below represents the total surplus in a market? Select one: a. the total area under the price and up to the point of equilibrium b. the total area under the demand curve and above the price c. the total area between the demand and supply curves up to the point of equilibrium d. the total area above the supply curve and up to the equilibrium price Question 7 Critics of free trade sometimes argue that allowing imports from foreign countries costs jobs domestically. What would an economist argue? Select one: a. Foreign competition may cause unemployment in import-competing industries, but the increase in producer surplus due to free trade is more valuable than the lost jobs. b. Foreign competition may cause unemployment in import-competing industries, but the increase in the variety of goods consumers can choose from is more valuable than the lost jobs. c. Foreign competition may cause unemployment in import-competing industries, but the effect is temporary because other industries, especially exporting industries, will be expanding. d. Foreign competition may cause unemployment in import-competing industries, but the increase in consumer surplus due to free trade is more valuable than the lost jobs. What does willingness to pay measure? Select one: a. the amount a buyer is willing to pay for a good minus the amount the buyer actually pays for it b. the maximum amount that a buyer will pay for a good c. the maximum amount a buyer is willing to pay for a good minus the minimum amount a seller is willing to accept for the good d. the amount a seller actually receives for a good minus the minimum amount the seller is willing to accept for the good Question 9 When Ford and General Motors import automobile parts from Mexico at prices below those they must pay in Canada, who is worse off? Select one: a. Mexican consumers, as a group b. Canadian companies that manufacture automobile parts c. workers who assemble Ford and General Motors vehicles d. Canadian consumers, as a group Question 10 Inefficiency exists in any economy when a good Select one: a. is not being produced by the highest-cost producer. b. is not distributed fairly among buyers. c. is not being consumed by the buyers who value it most highly. d. is being consumed by the buyers who value it most highly. Refer to the figure below. Without trade, what would producer surplus be? Select one: a. $3600 b. $7200 c. $24 d. $300 Refer to the figure below. What price do sellers receive after the tax? Select one: a. 12 b. 8 c. 4 d. 6 Question 13 Cost is a measure of Select one: a. the seller's willingness to buy. b. the producer's shortage. c. the seller's willingness to sell. d. the seller's producer surplus. What should be used to analyze economic well-being in an economy? Select one: a. producer and consumer surplus b. demand and supply c. government spending and tax revenue d. equilibrium price and quantity Question 15 Refer to the figure below. Without trade, what would the producer surplus be? Select one: a. $210 b. $245 c. $450 d. $490 Question 16 Australia is an importer of computer chips and is also a price taker in the chip market. The world price of these computer chips is $25. If Australia imposes a $5 tariff on chips, who will lose and/or gain? Select one: a. Consumers and producers will both lose. b. Consumers will lose, and producers will gain. c. Consumers and producers will both gain. d. Consumers will gain, and producers will lose. To correctly analyze the welfare effects of free trade on an economy, economists must assume Select one: a. that the country has an absolute advantage in the product. b. that the country has a comparative advantage in the product. c. that the country is the only producer of the product. d. that the country is a price taker. Question 18 As the size of a tax increases, what will happen to tax revenue? Select one: a. It will increase. b. It will increase and then decrease. c. It will remain the same. d. It will decrease. Question 19 If a tax is imposed on the buyer of a product, what is the effect on the demand curve? Select one: a. It shifts downward by less than the amount of the tax. b. It shifts upward by the amount of the tax. c. It shifts downward by the amount of the tax. d. It shifts upward by more than the amount of the tax. Question 20 The total surplus in a market is Select one: a. the total value to buyers of the goods less the total costs to sellers of providing those goods. b. greater than consumer surplus plus producer surplus. c. less than consumer surplus plus producer surplus. d. the total costs to sellers of providing the goods less the total value to buyers of the goods. What is welfare economics? Select one: a. the study of how the allocation of resources affects economic well-being b. the study of welfare programs in Canada c. the study of the well-being of unfortunate people d. the study of the effect of income redistribution on work effort Question 22 What can be said if Canada exports cars to France and imports cheese from Switzerland? Select one: a. Canada has a comparative advantage in producing cheese, and Switzerland has a comparative advantage in producing cars. b. Canada and France would both be better off if they both produce cars. c. Canada has a comparative advantage in producing cars, and Switzerland has a comparative advantage in producing cheese. d. Canada and France would both be better off if they both produce cheese. Question 23 Refer to the figure below. What occurs at the world price? Select one: a. Both domestic producers and consumers are better off. b. The domestic quantity demanded is less than the domestic quantity supplied. c. The demand curve is perfectly inelastic. d. The domestic quantity demanded is greater than the domestic quantity supplied. Question 24 What is the effect of a tariff on the market price? Select one: a. It keeps the price of the exported good the same as the world price. b. It raises the price of the imported good above the world price. c. It lowers the price of the exported good below the world price. d. It lowers the price of the imported good below the world price. Question 25 What does the Laffer curve do? Select one: a. It relates income to unemployment. b. It relates income tax rates to total income taxes collected. c. It relates tax rates to deadweight welfare losses. d. It relates government welfare payments to the birth rate. Question 26 What does deadweight loss represent? Select one: a. the reduction in producer surplus when a tax is placed on buyers b. the decline in government revenue when taxes are reduced in a market c. the loss of profit to businesses when a tax is imposed d. the reduction in total surplus that results from a tax Question 27 What will a tariff and an import quota do to the quantity of imports and the domestic price? Select one: a. increase the quantity of imports and raise the domestic price b. reduce the quantity of imports and lower the domestic price c. reduce the quantity of imports and raise the domestic price d. increase the quantity of imports and lower the domestic price Question 28 Refer to the figure below. When the price falls from 8 to 6, which area represents the increase in consumer surplus to existing buyers? Select one: a. ABD b. ACF c. BCED d. DEF Question 29 When a good is taxed, how does this affect buyers and sellers? Select one: a. Both buyers and sellers are better off. b. Buyers are worse off, and sellers are better off. c. Both buyers and sellers are worse off. d. Sellers are worse off, and buyers are better off. Question 30 Total surplus with a tax is equal to Select one: a. consumer surplus plus producer surplus. b. consumer surplus minus producer surplus. c. consumer surplus plus producer surplus, plus tax revenue. d. consumer surplus minus tax revenue, plus producer surplus. [Show More]

Last updated: 3 years ago

Preview 1 out of 11 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Dec 14, 2020

Number of pages

11

Written in

All

Additional information

This document has been written for:

Uploaded

Dec 14, 2020

Downloads

0

Views

114

answers.png)