E-Commerce > QUESTIONS & ANSWERS > ECON 247 exam tested questions with answers new exam docs 2020 (All)

ECON 247 exam tested questions with answers new exam docs 2020

Document Content and Description Below

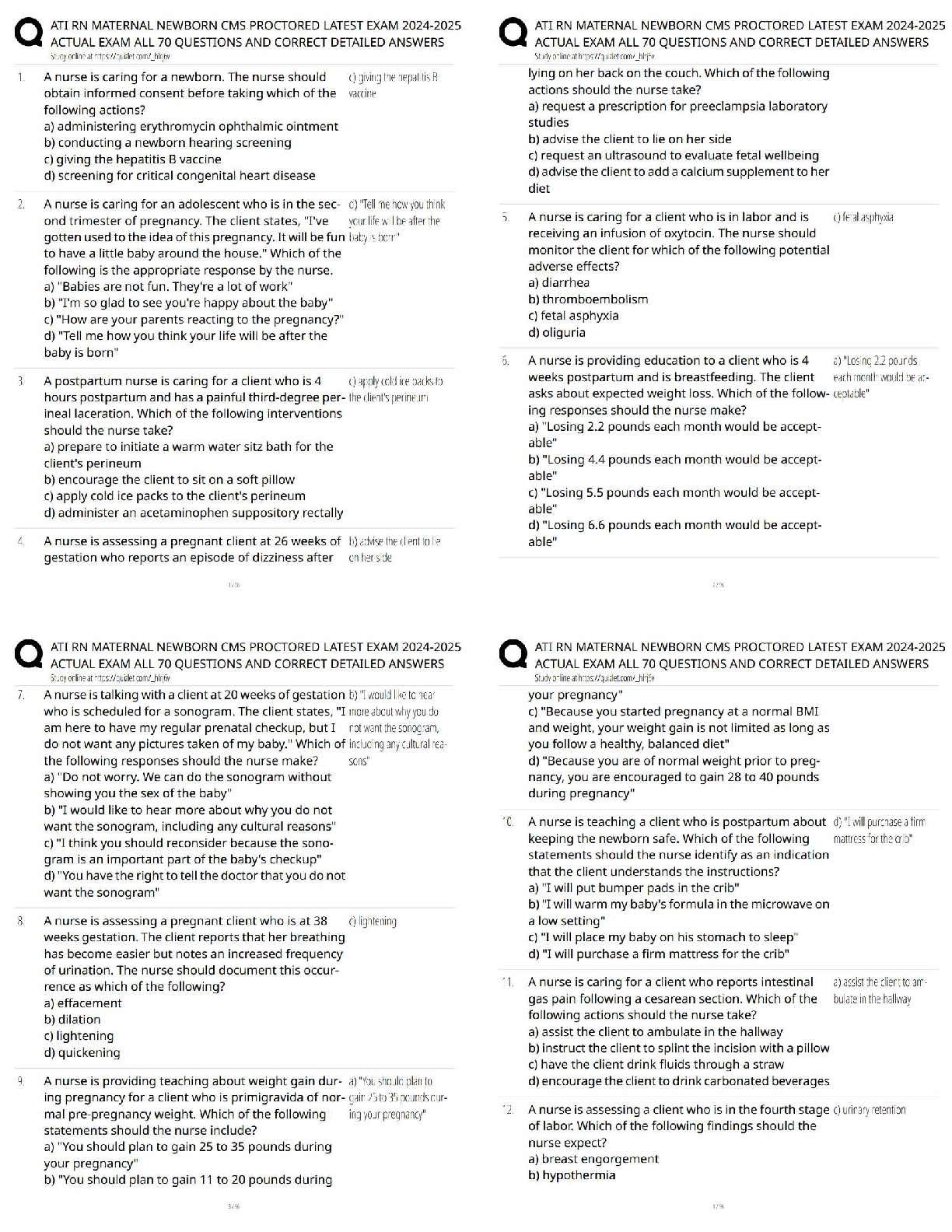

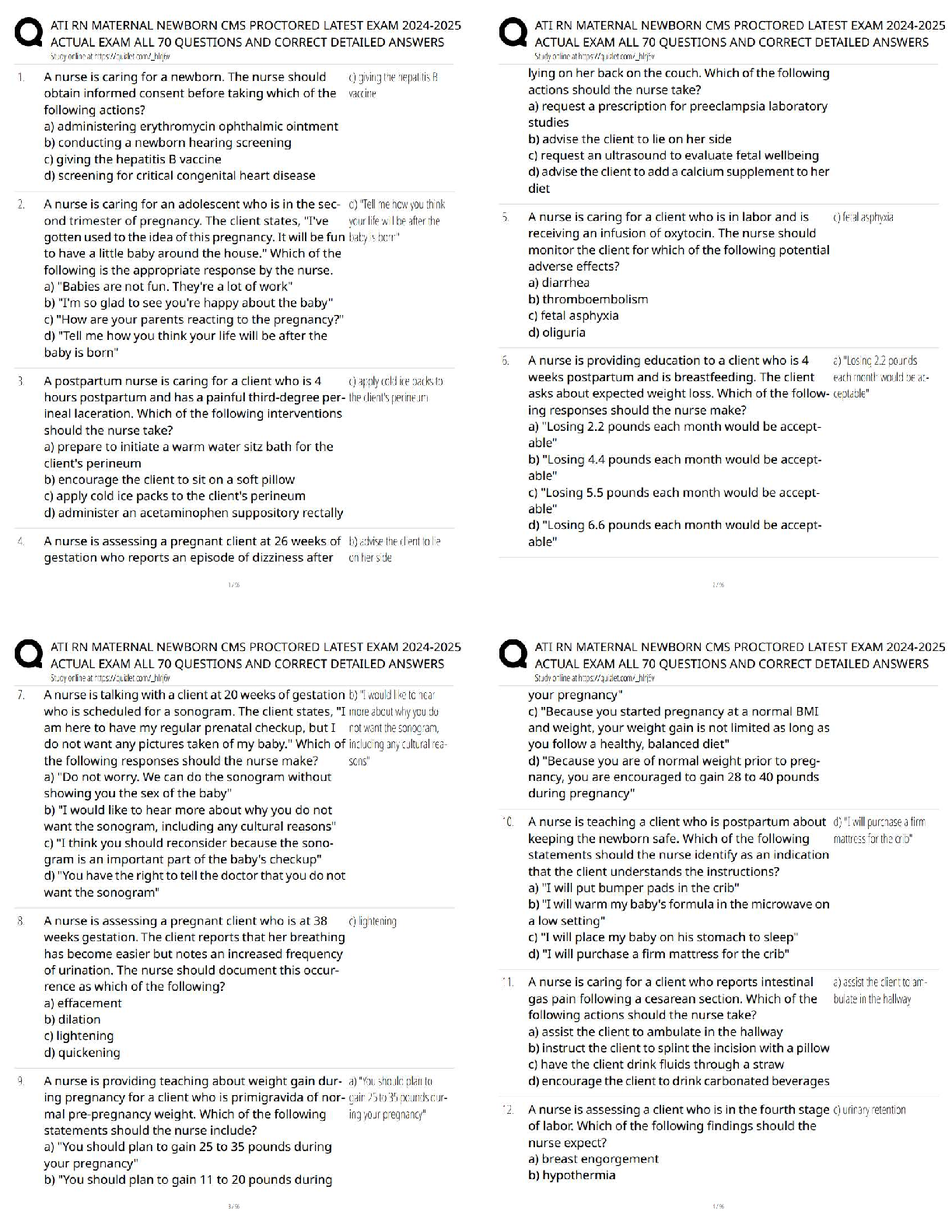

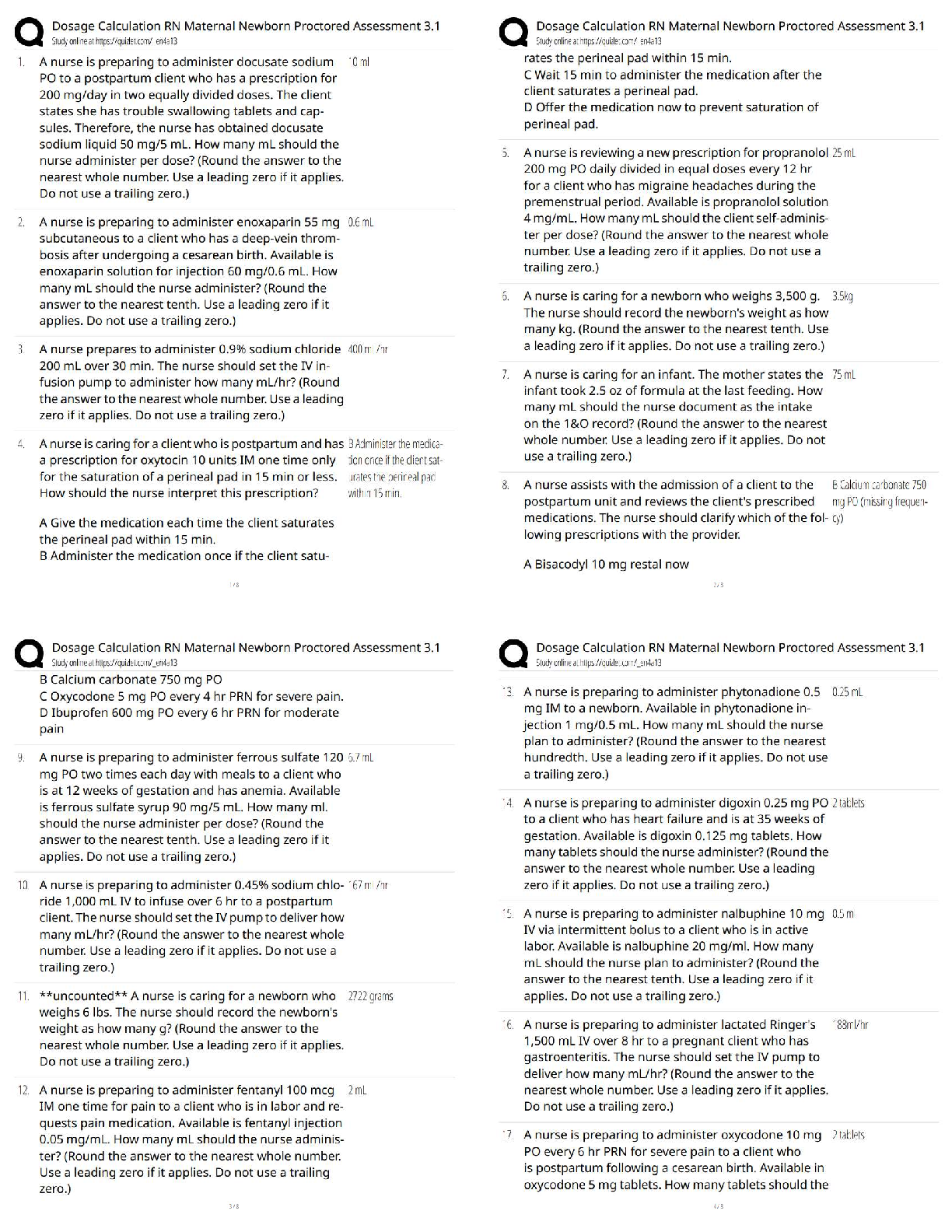

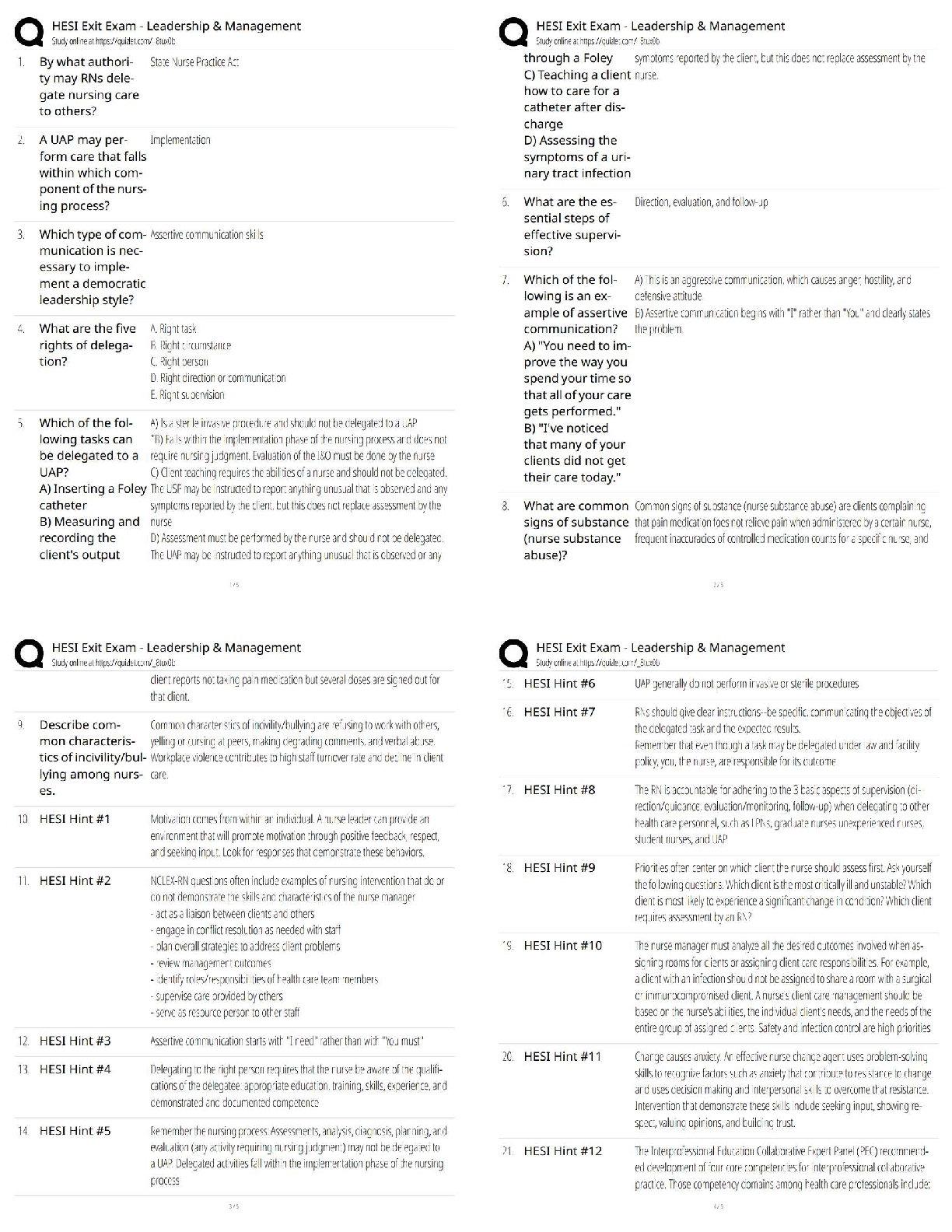

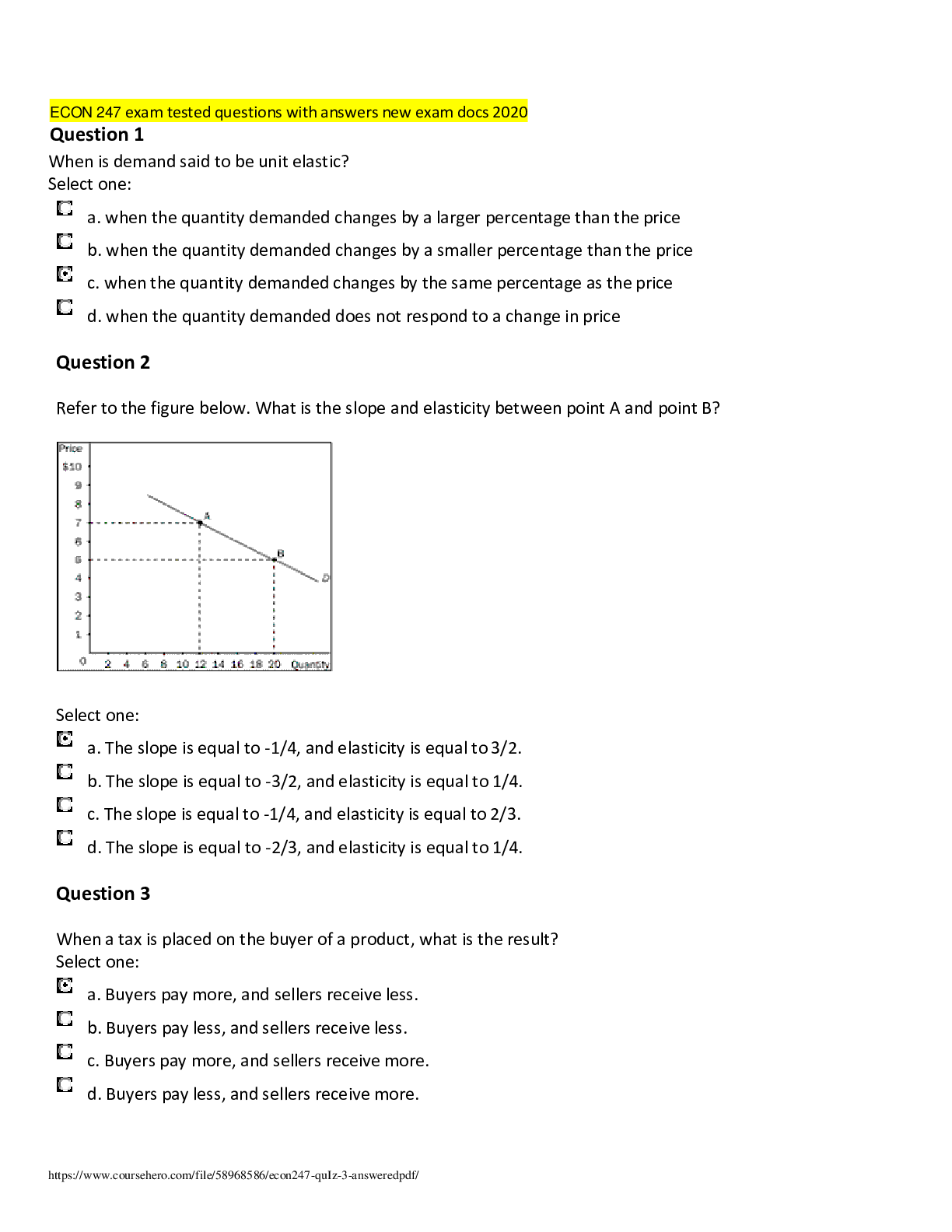

ECON 247 exam tested questions with answers new exam docs 2020 Question 1 When is demand said to be unit elastic? Select one: a. when the quantity demanded changes by a larger percentage than the ... price b. when the quantity demanded changes by a smaller percentage than the price c. when the quantity demanded changes by the same percentage as the price d. when the quantity demanded does not respond to a change in price Question 2 Refer to the figure below. What is the slope and elasticity between point A and point B? Select one: a. The slope is equal to -1/4, and elasticity is equal to 3/2. b. The slope is equal to -3/2, and elasticity is equal to 1/4. c. The slope is equal to -1/4, and elasticity is equal to 2/3. d. The slope is equal to -2/3, and elasticity is equal to 1/4. Question 3 When a tax is placed on the buyer of a product, what is the result? Select one: a. Buyers pay more, and sellers receive less. b. Buyers pay less, and sellers receive less. c. Buyers pay more, and sellers receive more. d. Buyers pay less, and sellers receive more. What effect does a tax on buyers of coffee have on the equilibrium price (for buyers) and quantity? Select one: a. It reduces the equilibrium price of coffee and reduces the equilibrium quantity. b. It increases the equilibrium price of coffee and reduces the equilibrium quantity. c. It increases the equilibrium price of coffee and increases the equilibrium quantity. d. It reduces the equilibrium price of coffee and increases the equilibrium quantity. Question 5 If a tax is imposed on the buyer of a product, the demand curve will shift Select one: a. upward by more than the amount of the tax. b. downward by less than the amount of the tax. c. upward by the amount of the tax. d. downward by the amount of the tax. Question 6 How does total revenue change as one moves down a linear demand curve? Select one: a. It first decreases and then increases. b. It first increases and then decreases. c. It increases. d. It decreases. Question 7 What is the main reason for using the midpoint method? Select one: a. It gives the same answer regardless of the direction of change. b. It rounds quantities to the nearest whole unit. c. It uses fewer numbers. d. It rounds prices to the nearest dollar. Refer to the figure below. Without the price ceiling in this market for gasoline, what will happen to the price when the supply curve shifts from S1 to S2? Select one: a. It will eventually move to P2 without government assistance. b. It will increase to P3, and the market will clear. c. It will increase to P3, but a shortage will still exist. d. It will remain at P1, and a shortage will still exist. Question 9 Suppose there is a 3% increase in the price of good X and a resulting 6% decrease in the quantity of X demanded. What is the price elasticity of demand for X? Select one: a. 0 b. 2 c. 6 d. infinite Question 10 How do most economists report the elasticity of demand? Select one: a. as the absolute value of the actual number b. as a dollar amount, since we are measuring the change in price c. as a negative number, since price and quantity demanded move in opposite directions d. as a percentage, since both the numerator and denominator are percentages Rent control is best characterized as Select one: a. the most effective way to provide affordable housing. b. the most efficient way to allocate housing. c. a common example of a price ceiling. d. a common example of a social problem solved by government regulation. Question 12 What is one disadvantage of government subsidies over price controls? Select one: a. Subsidies require higher taxes. b. Subsidies cause lower prices to suppliers. c. Subsidies cause disequilibrium in the market in which they are imposed. d. Subsidies cause unemployment. Question 13 What does the term tax incidence refer to? Select one: a. the division of the tax burden between sales taxes and income taxes b. the flat tax movement c. the 2008 reduction in the GST rate from 6% to 5% d. the division of the tax burden between buyers and sellers Question 14 If sellers respond substantially to changes in price, Select one: a. the supply curve will shift substantially when the price rises. b. the sellers are considered to be relatively price sensitive. c. the price elasticity of supply equals 1. d. the sellers are considered to be relatively price insensitive. A bakery would be willing to supply 500 bagels per day at a price of $0.50 each. At a price of $0.70, the bakery would be willing to supply 900. Using the midpoint method, what is the elasticity of supply for bagels? Select one: a. 0.58 b. 0.77 c. 1.24 d. 1.71 Question 16 The price elasticity of demand measures how responsive Select one: a. sellers are to a change in buyers' incomes. b. buyers are to a change in income. c. buyers are to a change in price. d. sellers are to a change in price. Question 17 If a 30% change in price causes a 10% change in quantity supplied, what do we know about the price elasticity of supply? Select one: a. It is 3, and supply is elastic. b. It is 1, and supply is unit elastic. c. It is 1/3, and supply is elastic. d. It is 1/3, and supply is inelastic. Question 18 When the local used bookstore prices economics books at $100 each, they generally sell 70 per month. If they lower the price to $70 each, they sell 90. Given this information, what is the elasticity of demand for economics books, and what action should the store take? Select one: a. 0.714; the store should lower prices to raise total revenue. b. 2.91; the store should lower prices to raise total revenue. c. 2.91; the store should raise prices to raise total revenue. d. 0.714; the store should raise prices to raise total revenue. If a 5% increase in price causes a 15% decrease in quantity demanded, what might be said about this product? Select one: a. It might be part of a broadly defined market. b. It has no close substitute. c. It might be a luxury. d. It might be in a short time horizon. Question 20 Which statement best describes a price ceiling? Select one: a. A price ceiling is a legal minimum on the price at which a good can be sold. b. A price ceiling occurs when the price in the market is temporarily above equilibrium. c. A price ceiling occurs when the price in the market is subsidized by the government. d. A price ceiling is a legal maximum on the price at which a good can be sold. Question 21 What does a tax placed on the seller of a good do to the price paid and received? Select one: a. It lowers the price buyers pay and raises the price sellers receive. b. It raises the price buyers pay and lowers the price sellers receive. c. It raises both the price buyers pay and the price sellers receive. d. It lowers both the price buyers pay and the price sellers receive. Question 22 Where is the initial effect of a tax on the buyers of a good? Select one: a. on the demand for that good b. on the equilibrium quantity of the good c. on the equilibrium price of the good d. on the supply of that good When studying how some event or policy affects a market, elasticity provides information on Select one: a. the direction and the efficiency of the effect on the market. b. the direction and the magnitude of the effect on the market. c. the magnitude and the efficiency of the effect on the market. d. the efficiency and the equity of the effect on the market. Question 24 What is a key determinant of the elasticity of supply? Select one: a. the number of firms in the market b. the ability of sellers to change the price of the good they produce c. the responsiveness of buyers to changes in sellers' prices d. the ability of sellers to change the amount of the good they produce Question 25 A price floor is binding when it is Select one: a. lower than the equilibrium market price. b. equal to the equilibrium market price. c. set by the government. d. higher than the equilibrium market price. Question 26 If two goods are substitutes, their cross-price elasticity of demand will be Select one: a. positive. b. negative. c. zero. d. one. What happens as elasticity of supply rises? Select one: a. The supply curve gets flatter. b. The quantity supplied falls. c. The supply curve gets steeper. d. The quantity supplied increases. Question 28 Moving up a linear demand curve, what happens to total revenue? Select one: a. It increases, then decreases. b. It decreases. c. It decreases, then increases. d. It increases. Question 29 What does the tax incidence depend on? Select one: a. the forces of supply and demand b. the size of the market c. whether the entire tax is levied on the buyers or the sellers d. the government regulations Question 30 What is the role of price controls in the market economy? Select one: a. Price controls are a tool used by business firms to fix prices. b. Price controls are used to make markets more efficient. c. Price controls are used by governments to reallocate resources more equitably. d. Price controls are nearly always effective in eliminating shortages. [Show More]

Last updated: 3 years ago

Preview 1 out of 8 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Dec 15, 2020

Number of pages

8

Written in

All

Additional information

This document has been written for:

Uploaded

Dec 15, 2020

Downloads

0

Views

164

answers.png)