ACCT105 8.docx ACCT105: Accounting Week 8 Paper American Military University ACCT105:

$ 10

.png)

Maternal & Child Health Nursing: Care of the Childbearing & Childrearing Family 8th Edition Test Bank / Instant Test Bank For Maternal & Child Health Nursing: Care of the Childbearing & Childrearing Family 8th Edition Authors: JoAnne Silbert-Flagg, Pillit

$ 10

HESI CAT Exam Questions & Answers, Rated 100%

$ 17.5

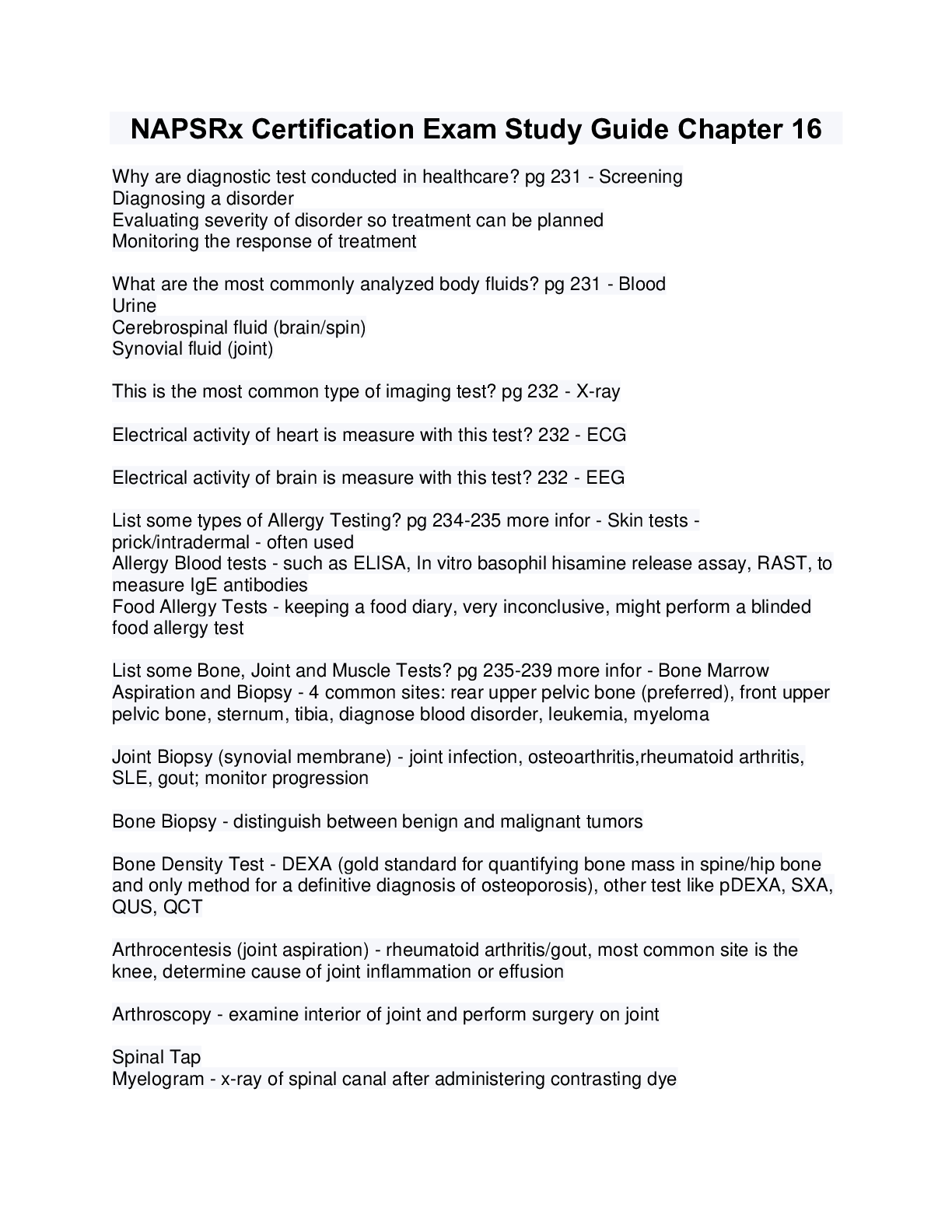

NAPSRx Certification Exam Study Guide Chapter 16

$ 10

WGU C214 Financial Management OA Study Set

$ 9.5

Denise G.png)

Denise G. Anderson, Sarah N. Salm, Deborah P. Allen - Nester’s Microbiology_ A Human Perspective-McGraw-Hill (2015)

$ 7.5

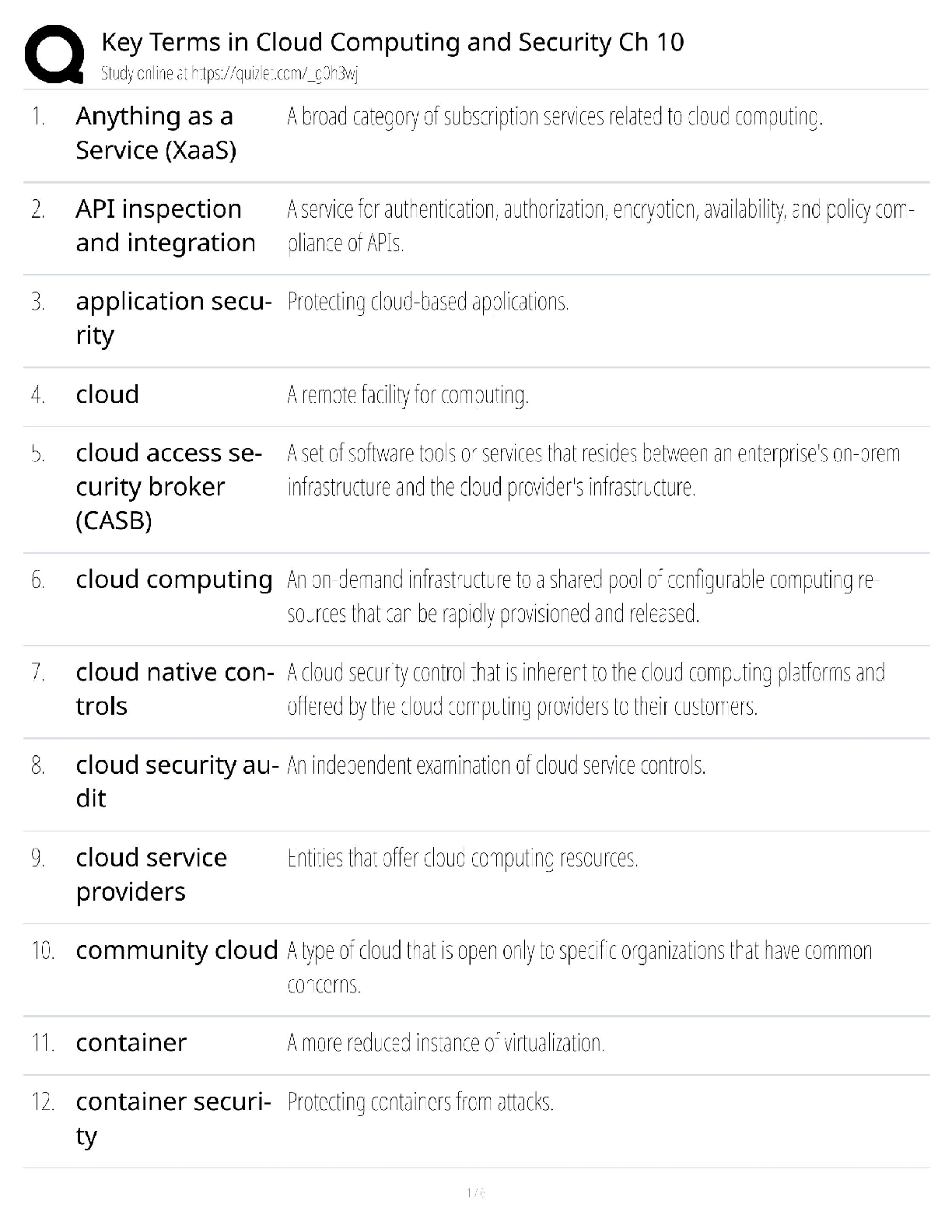

Cloud Security Key Terms (Ch10) / 2025 CompTIA Security+ & CCSP Guide / AWS-Azure-GCP Glossary / Score 100%

$ 5.5

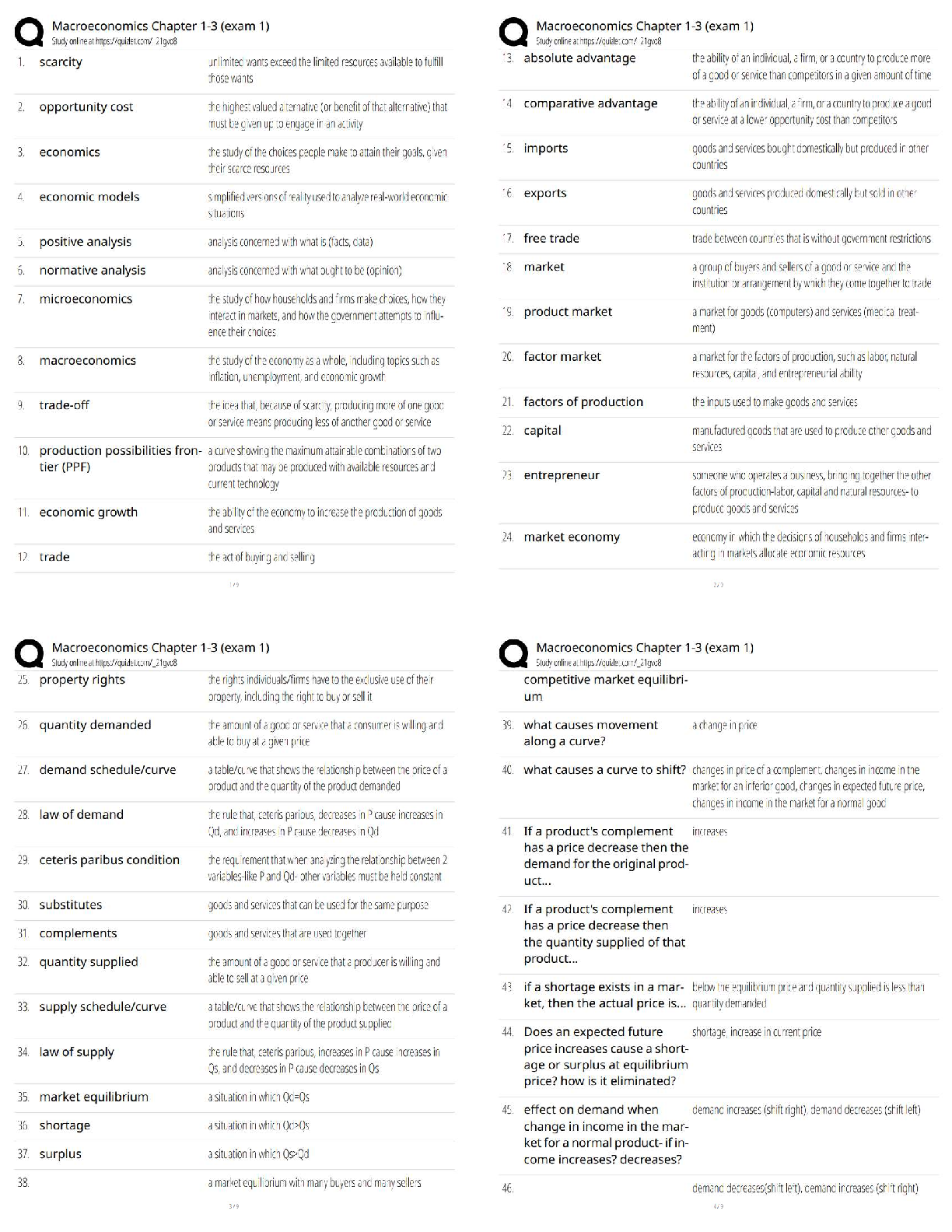

Macroeconomics Chapters 1–3 Exam 1 / Multiple Choice Test Bank / Intro Macroeconomics / Study Guide & Practice Questions / 2025 Update / Score 100%

$ 11.5

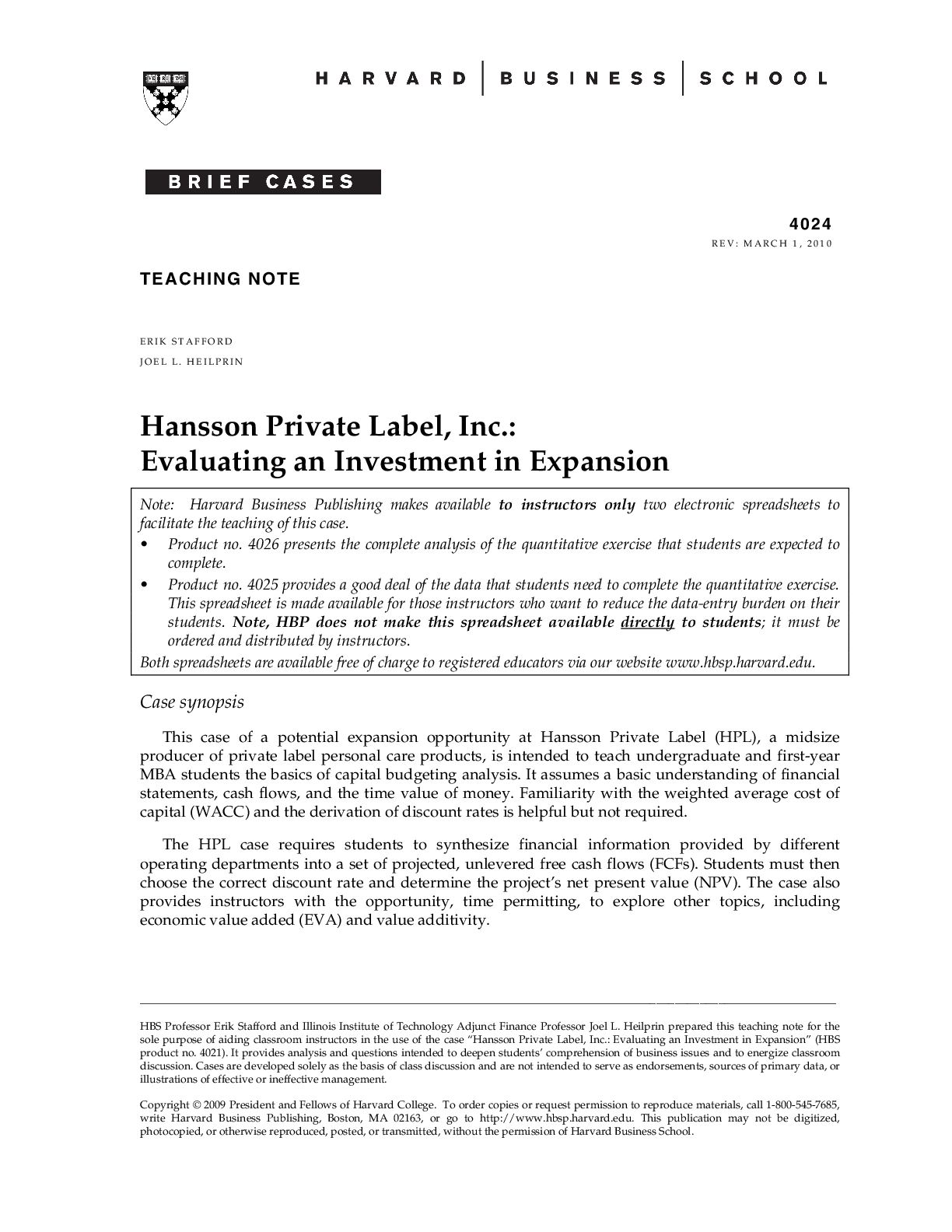

Case Solutions/ Notes for Hansson Private Label, Inc.: Evaluating an Investment in Expansion by Erik Stafford, Joel L. Heilprin, Jeffrey DeVolder

$ 15

.png)

WGU C836 MULTI/COMPREHENSIVE FINAL EXAM REVIEW (LATEST VERSION 2022)