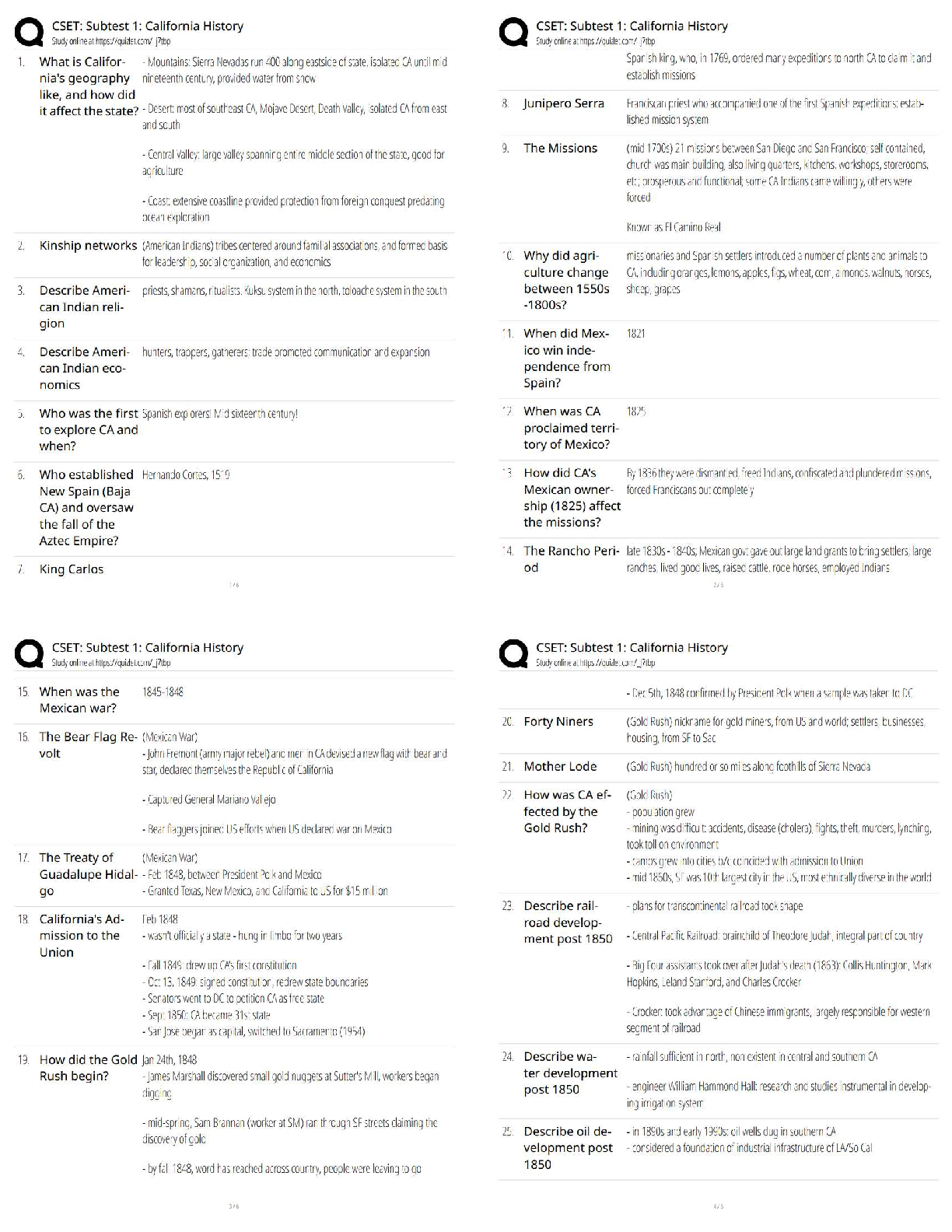

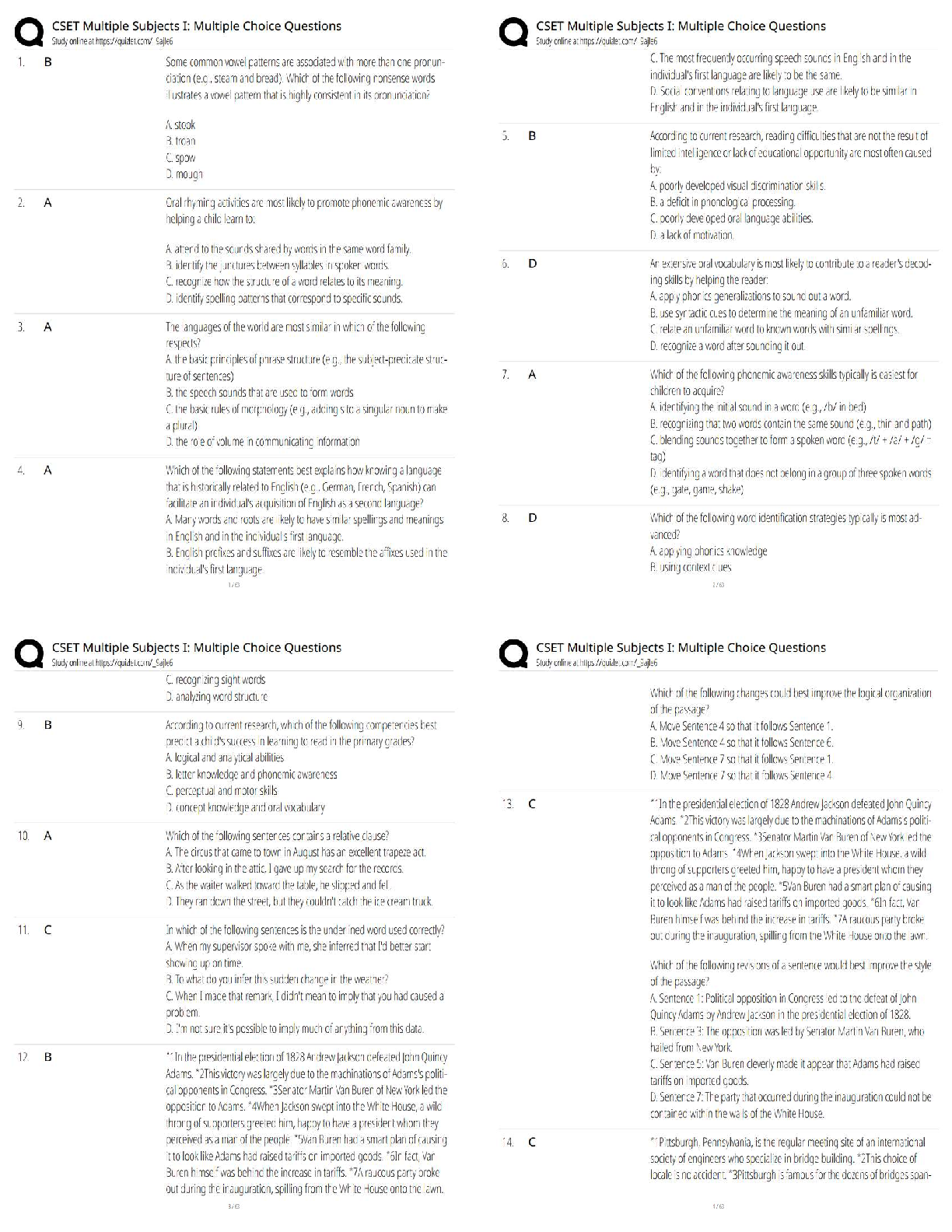

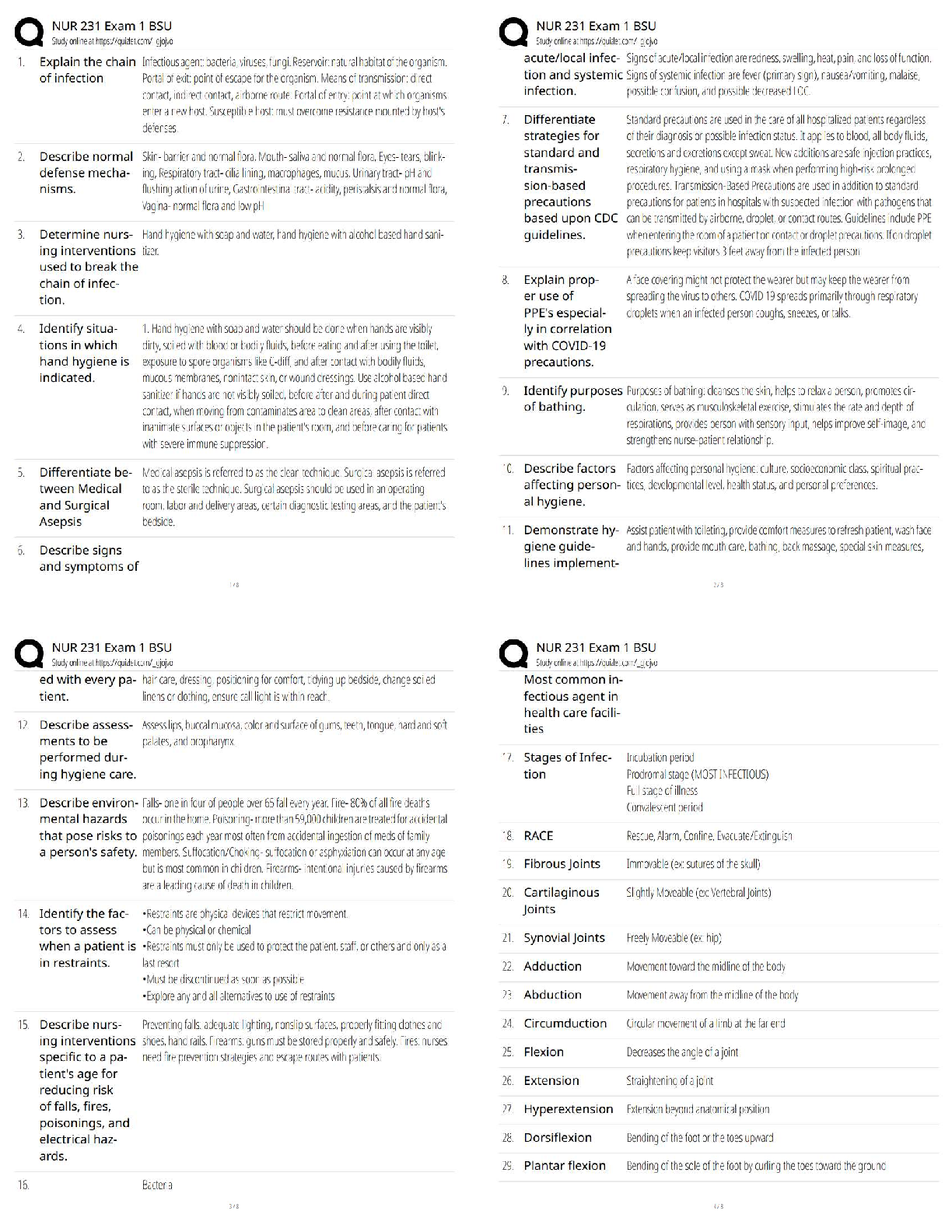

Accounting > QUESTIONS & ANSWERS > ACCT 212 Week 3 Homework.DeVry University, Chicago ACCT 212 212 . (All)

ACCT 212 Week 3 Homework.DeVry University, Chicago ACCT 212 212 .

Document Content and Description Below

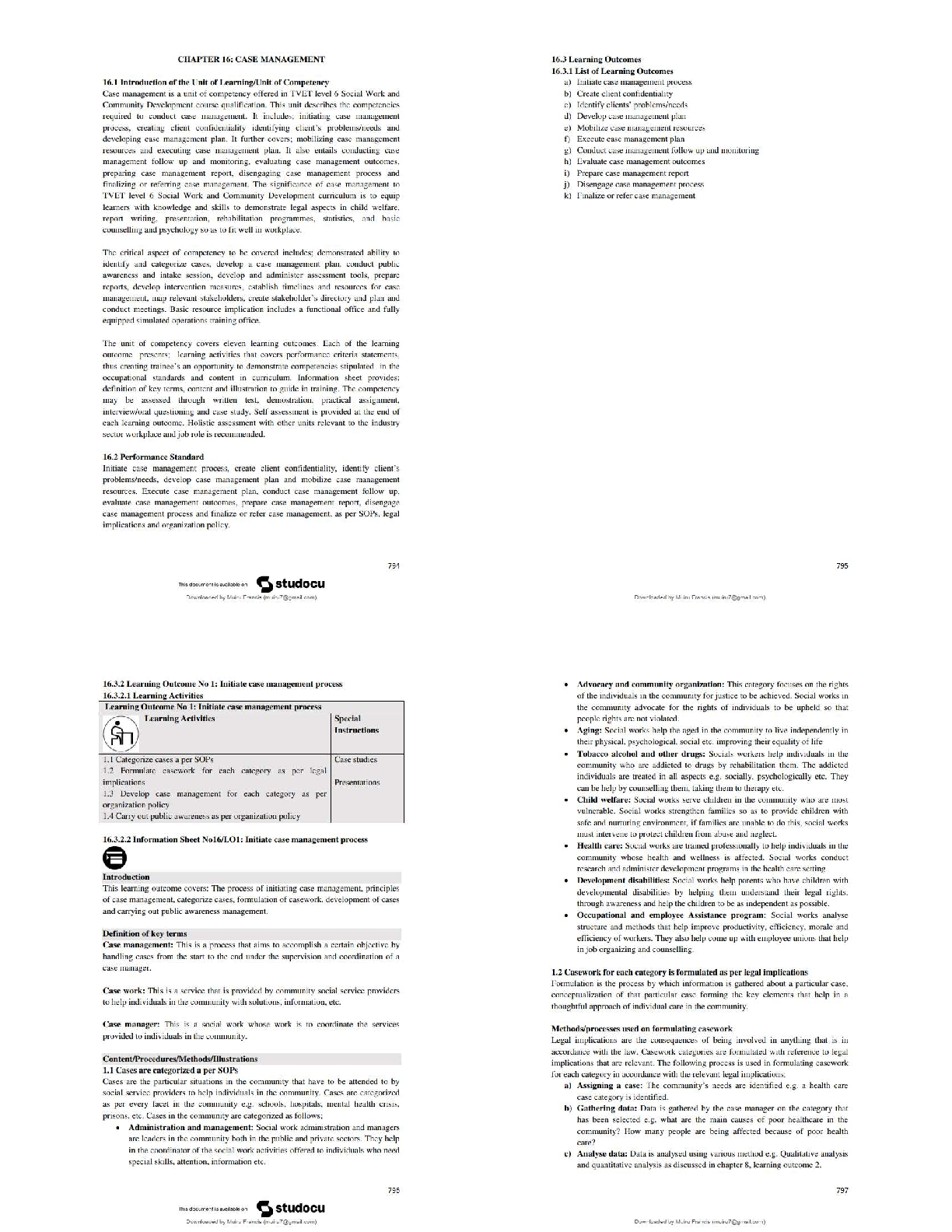

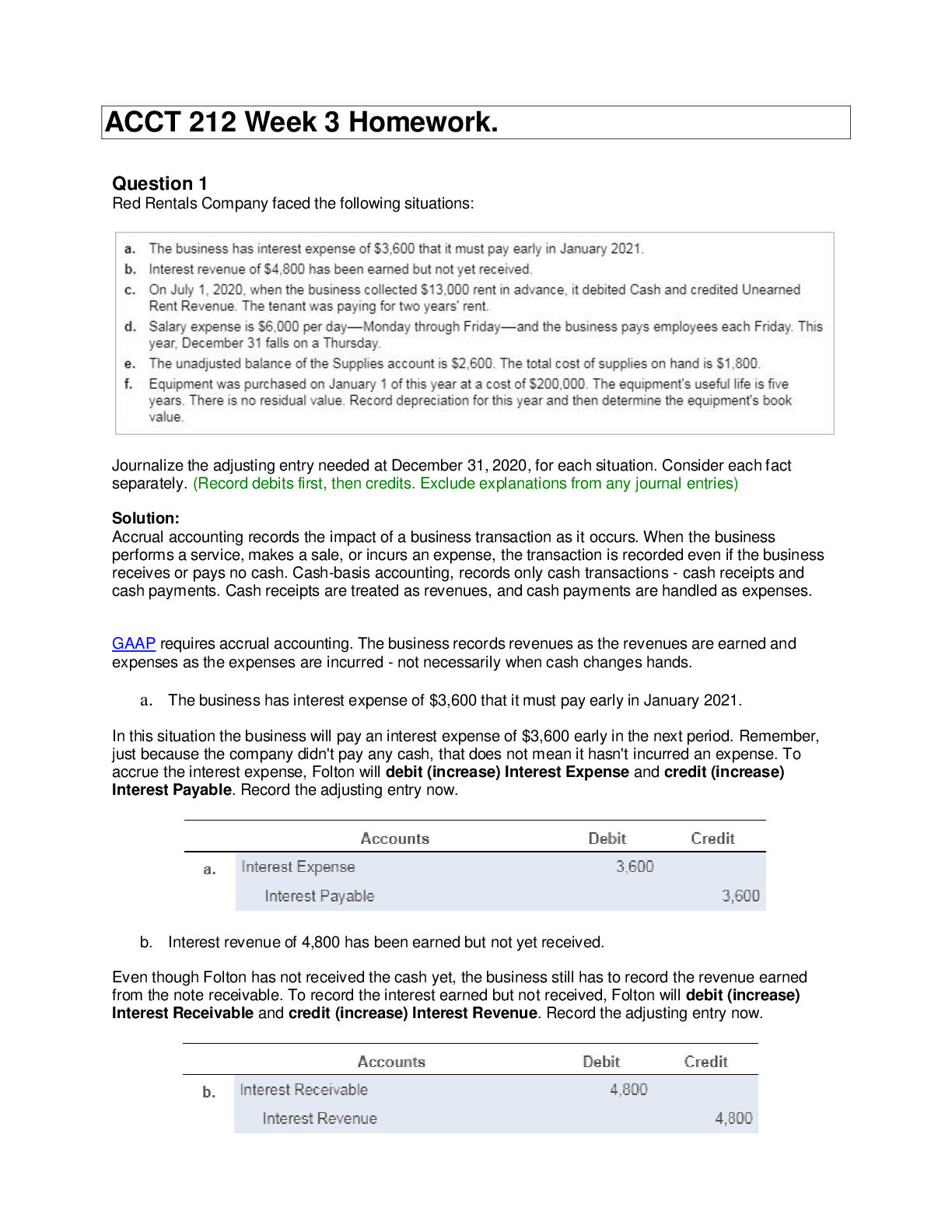

Journalize the adjusting entry needed at December 31, 2020, for each situation. Consider each fact separately. (Record debits first, then credits. Exclude explanations from any journal entries) Solu ... tion: Accrual accounting records the impact of a business transaction as it occurs. When the business performs a service, makes a sale, or incurs an expense, the transaction is recorded even if the business receives or pays no cash. Cash-basis accounting, records only cash transactions - cash receipts and cash payments. Cash receipts are treated as revenues, and cash payments are handled as expenses. GAAP requires accrual accounting. The business records revenues as the revenues are earned and expenses as the expenses are incurred - not necessarily when cash changes hands. a. The business has interest expense of $3,600 that it must pay early in January 2021. In this situation the business will pay an interest expense of $3,600 early in the next period. Remember, just because the company didn't pay any cash, that does not mean it hasn't incurred an expense. To accrue the interest expense, Folton will debit (increase) Interest Expense and credit (increase) Interest Payable. Record the adjusting entry now. b. Interest revenue of 4,800 has been earned but not yet received. Even though Folton has not received the cash yet, the business still has to record the revenue earned from the note receivable. To record the interest earned but not received, Folton will debit (increase) Interest Receivable and credit (increase) Interest Revenue. Record the adjusting entry now. [Show More]

Last updated: 3 years ago

Preview 1 out of 12 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 23, 2022

Number of pages

12

Written in

All

Additional information

This document has been written for:

Uploaded

Aug 23, 2022

Downloads

0

Views

76

.png)

.png)

.png)

.png)

.png)

.png)

.png)