Accounting > QUESTIONS & ANSWERS > Chapter 2 Practice Midterm.San Francisco State UniversitySchool name ACCT 305. (All)

Chapter 2 Practice Midterm.San Francisco State UniversitySchool name ACCT 305.

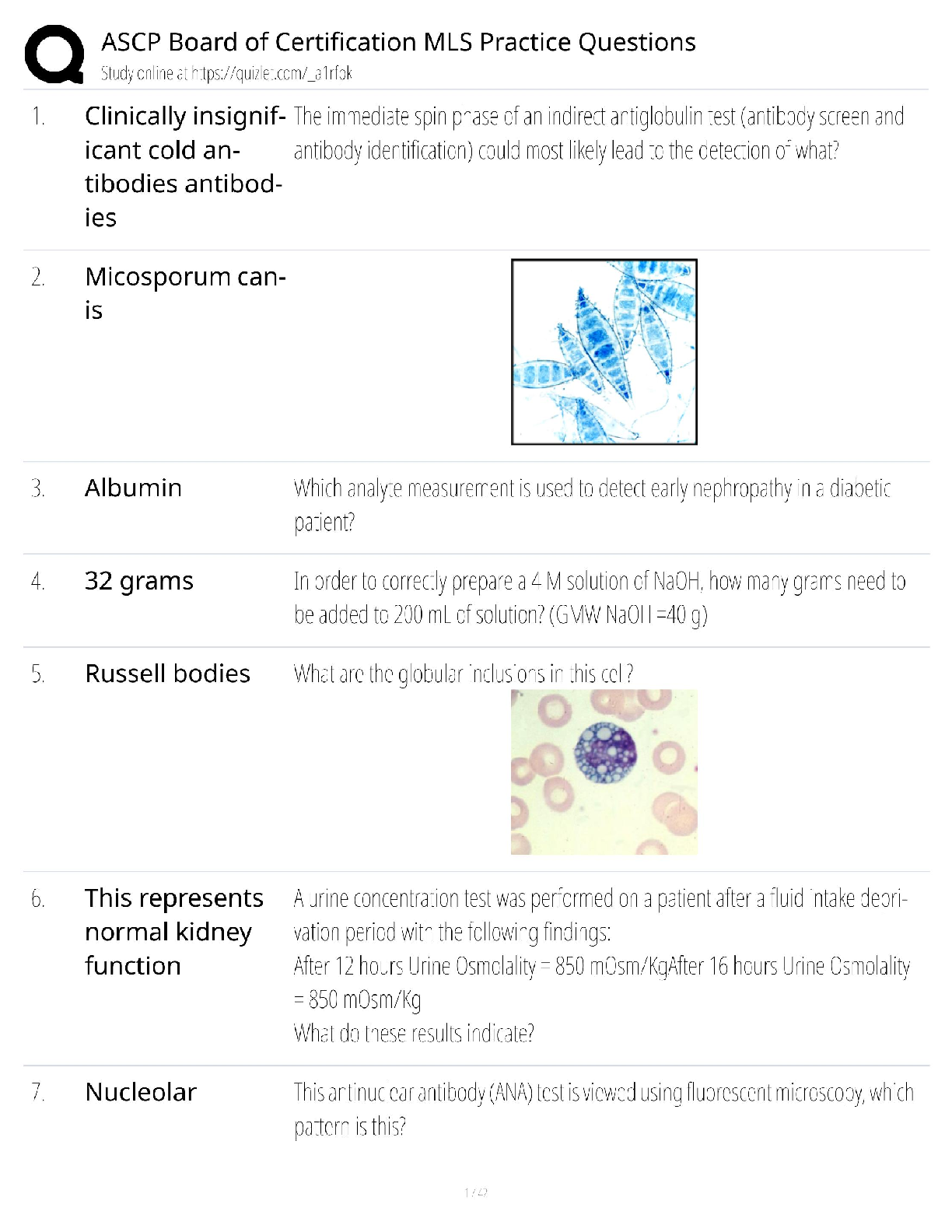

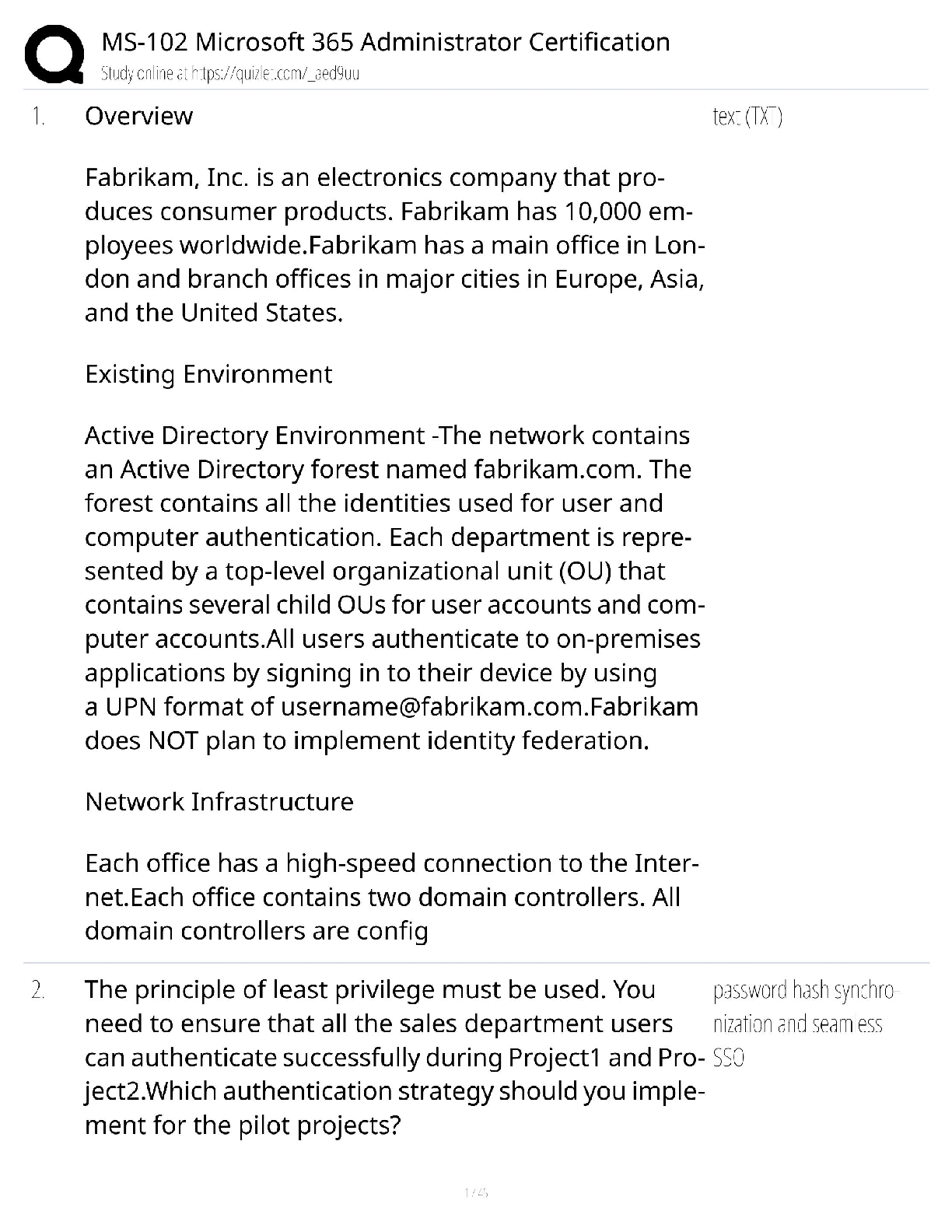

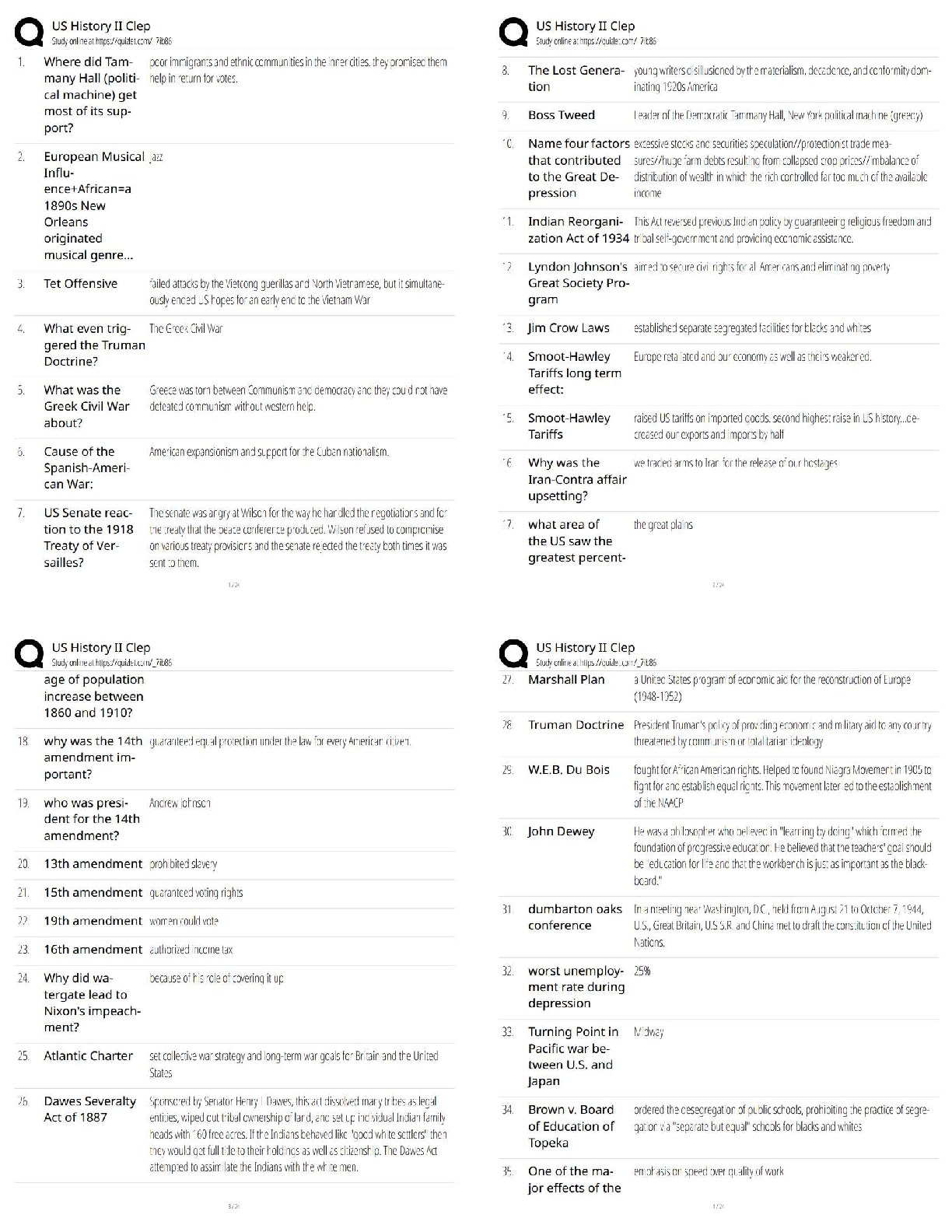

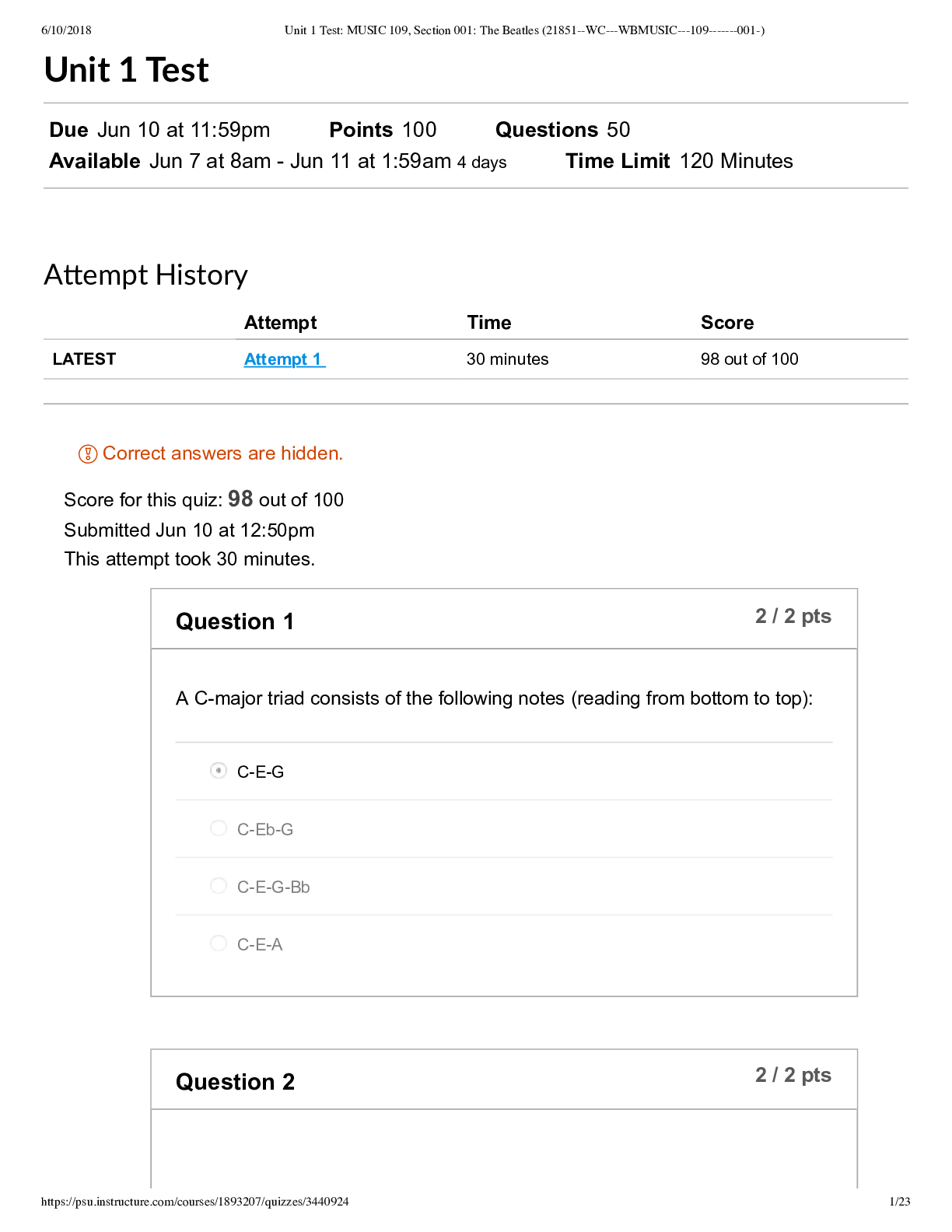

Document Content and Description Below

40. Which of the following would most likely be included as part of manufacturing overhead in the production of a wooden table? A) The amount paid to the individual who stains the table. B) The com ... mission paid to the salesperson who sold the table. C) The cost of glue used in the table. D) The cost of the wood used in the table. Answer: C 41. Property taxes on a manufacturing facility are classified as: Conversion cost Period cost A ) Yes No B) Yes Yes C) No Yes D ) No No EX. Mortgage liability 3.6k Interest exp 400 Cash 4k 1m/50 = $20k/yr MOH 20k (instead of depreciation exp) Acc Depreciation 20k To pay property taxes: MOH 6k Cash 6k 39. The property taxes on a factory building would be an example of: Prime Cost Conversion Cost A ) No Yes B) Yes No C) Yes Yes D ) No No Answer: A 59. Which of the following costs, if expressed on a per unit basis, would be expected to decrease as the level of production and sales increases? A) Sales commissions. B) Fixed manufacturing overhead. C) Variable manufacturing overhead. D) Direct materials. Answer: B 61. Which of the following is an example of a cost that is variable with respect to the number of units produced? A) Rent on the administrative office building. B) Rent on the factory building. C) Direct labor cost, where the direct labor workforce is adjusted to the actual production of the period. D) Salaries of top marketing executives. Answer: C 64. A sunk cost is: A) a cost which may be saved by not adopting an alternative. B) a cost which may be shifted to the future with little or no effect on current operations. C) a cost which cannot be avoided because it has already been incurred. D) a cost which does not entail any dollar outlay but which is relevant to the decision-making process. Answer: C 70. The following costs were incurred in April: Direct materials........................ $18,000 Direct labor.............................. $21,000 Manufacturing overhead.......... $33,000 Selling expenses...................... $14,000 Administrative expenses.......... $19,000 Conversion costs during the month totaled: A) $39,000 B) $54,000 C) $105,000 D) $51,000 Answer: B Feedback: Conversion cost = Direct labor + Manufacturing overhead = $21,000 + $33,000 = $54,000 [Show More]

Last updated: 3 years ago

Preview 1 out of 28 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$15.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 23, 2022

Number of pages

28

Written in

All

Additional information

This document has been written for:

Uploaded

Aug 23, 2022

Downloads

0

Views

147

.png)

.png)

.png)

.png)

.png)

.png)

.png)