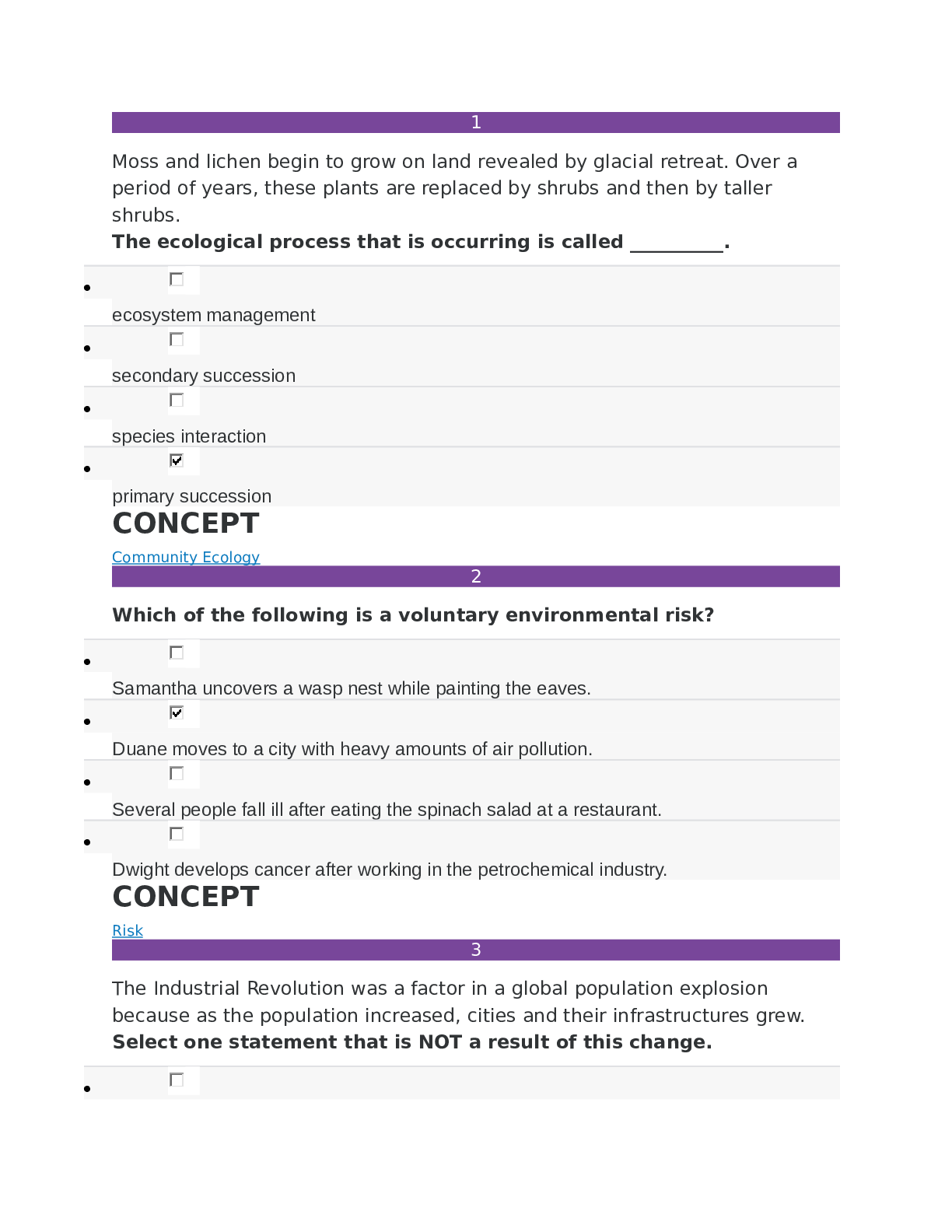

Environmental Science Final Milestone .docx. graded A+

$ 7

eBook (EPUB) The Pandemic Information Gap The Brutal Economics of COVID-19 By Joshua Gans

$ 29

Defence Acquisition University CLM 023 AbilityOne | 100% Correct Answers

.png)

.png)

.png)