Chapter 5 HW

Document Content and Description Below

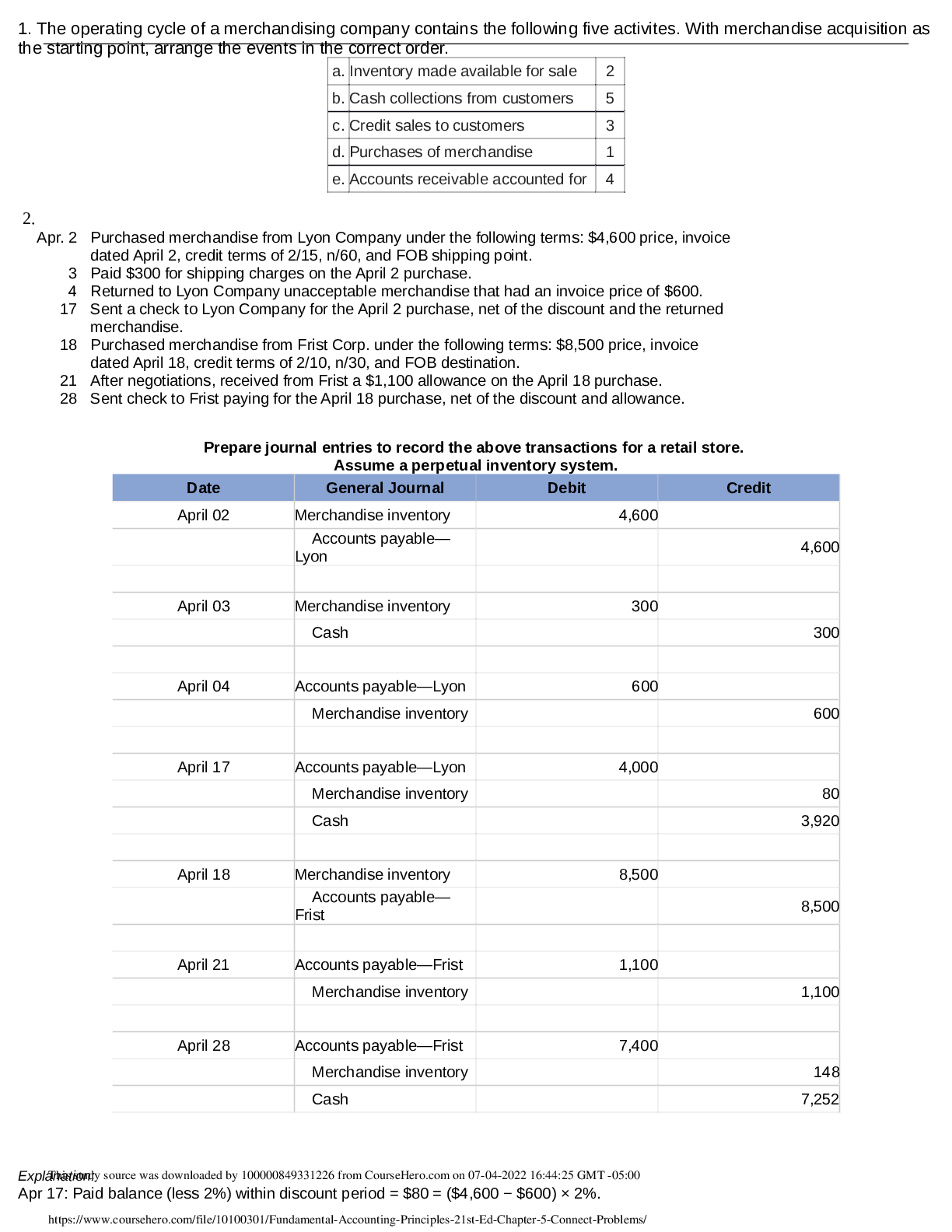

1. The operating cycle of a merchandising company contains the following five activities. With merchandise acquisition as

the starting point, arrange the events in the correct order.

a. Inventory ma

...

de available for sale 2

b. Cash collections from customers 5

c. Credit sales to customers 3

d. Purchases of merchandise 1

e. Accounts receivable accounted for 4

2.

Apr. 2 Purchased merchandise from Lyon Company under the following terms: $4,600 price, invoice

dated April 2, credit terms of 2/15, n/60, and FOB shipping point.

3 Paid $300 for shipping charges on the April 2 purchase.

4 Returned to Lyon Company unacceptable merchandise that had an invoice price of $600.

17 Sent a check to Lyon Company for the April 2 purchase, net of the discount and the returned

merchandise.

18 Purchased merchandise from Frist Corp. under the following terms: $8,500 price, invoice

dated April 18, credit terms of 2/10, n/30, and FOB destination.

21 After negotiations, received from Frist a $1,100 allowance on the April 18 purchase.

28 Sent check to Frist paying for the April 18 purchase, net of the discount and allowance.

Prepare journal entries to record the above transactions for a retail store.

Assume a perpetual inventory system.

Date General Journal Debit Credit

April 02 Merchandise inventory 4,600

Accounts payable—

Lyon 4,600

April 03 Merchandise inventory 300

Cash 300

April 04 Accounts payable—Lyon 600

Merchandise inventory 600

April 17 Accounts payable—Lyon 4,000

Merchandise inventory 80

Cash 3,920

April 18 Merchandise inventory 8,500

Accounts payable—

First 8,500

April 21 Accounts payable—Frist 1,100

Merchandise inventory 1,100

April 28 Accounts payable—Frist 7,400

Merchandise inventory 148

Cash 7,252

Explanation:

Apr 17: Paid balance (less 2%) within discount period = $80 = ($4,600 − $600) × 2%.

This study source was downloaded by 100000849331226 from CourseHero.com on 07-04-2022 16:44:25 GMT -05:00

https://www.coursehero.com/file/10100301/Fundamental-Accounting-Principles-21st-Ed-Chapter-5-Connect-Problems/Apr 28: Paid balance (less 2%) within discount period = $148 = ($8,500 − $1,100) × 2%

3.

Allied Parts was organized on May 1, 2013, and made its first purchase of merchandise on May 3. The

purchase was for 2,000 units at a price of $10 per unit. On May 5, Allied Parts sold 1,500 of the units for

$14 per unit to Baker Co. Terms of the sale were 2/10, n/60.

a. On May 7, Baker returns 200 units because they did not fit the customer's needs. Allied Parts restores

the units to its inventory.

b. On May 8, Baker discovers that 300 units are damaged but are still of some use and, therefore, keeps

the units. Allied Parts sends Baker a credit memorandum for $600 to compensate for the damage.

c. On May 15, Baker discovers that 100 units are the wrong color. Baker keeps 60 of these units

because Allied Parts sends a $120 credit memorandum to compensate. Baker returns the remaining

40 units to Allied Parts. Allied Parts restores the 40 returned units to its inventory.

Prepare entries for Allied Parts to record the May 5 sale and each of the above separate transactions a through c

using a perpetual inventory system.

Date General Journal Debit Credit

May 05 Accounts receivable 21,000

Sales 21,000

May 05 Cost of goods sold 15,000

Merchandise inventory 15,000

May 07 Sales returns and allowances 2,800

Accounts receivable 2,800

May 07 Merchandise inventory 2,000

Cost of goods sold 2,000

May 08 Sales returns and allowances 600

Accounts receivable 600

May 15 Sales returns and allowances 680

Accounts receivable 680

May 15 Merchandise inventory 400

Cost of goods sold 400

Explanation:

May 5: Sold merchandise on credit (1,500 × $14) = $21,000

May 5: To record cost of sale (1,500 × $10) = $15,000

May 7: Accepted a return from a customer (200 × $14) = $2,800

May 7: Returned merchandise to inventory (200 × $10) = $2,000

May 15: Accepted a return from a customer [$120 + (40 × $14)] = $680

May 15: Returned merchandise to inventory (40 × $10) = $400

The following list includes selected permanent accounts and all of the temporary accounts from December 31,

2013, unadjusted the trial balance of Emiko Co., a business owned by Kumi Emiko. Emiko Co. uses a perpetual inventory

system.

Debit Credit

Merchandise inventory $ 30,000

Prepaid selling expenses of 5,600

K. Emiko, Withdrawals 33,000

Sales $529,000

Sales returns and allowances 17,500

Sales discounts 5,000

Cost of goods sold 212,000

Sales salaries expense 48,000

Utilities expense 15,000

Selling expenses 36,000

Administrative expenses 105,000

[Show More]

Last updated: 3 years ago

Preview 1 out of 5 pages

.png)